The notion supporting our PDF editor was to allow it to be as simple to use as possible. You will find the general process of managing sba form 1368 pdf simple as soon as you adhere to the next steps.

Step 1: The very first step would be to choose the orange "Get Form Now" button.

Step 2: At this point, you're on the document editing page. You can add text, edit existing information, highlight specific words or phrases, put crosses or checks, add images, sign the document, erase unneeded fields, etc.

Enter the appropriate information in each part to create the PDF sba form 1368 pdf

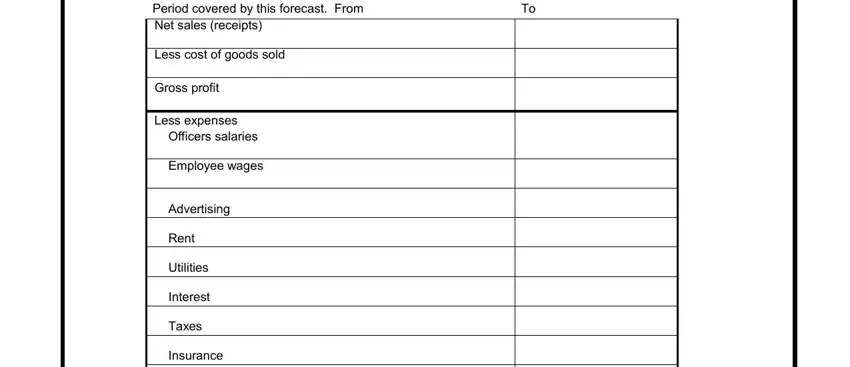

Enter the requested data in the space Period covered by this forecast, Less cost of goods sold, Gross profit, Less expenses, Officers salaries, Employee wages, Advertising, Rent, Utilities, Interest, Taxes, and Insurance.

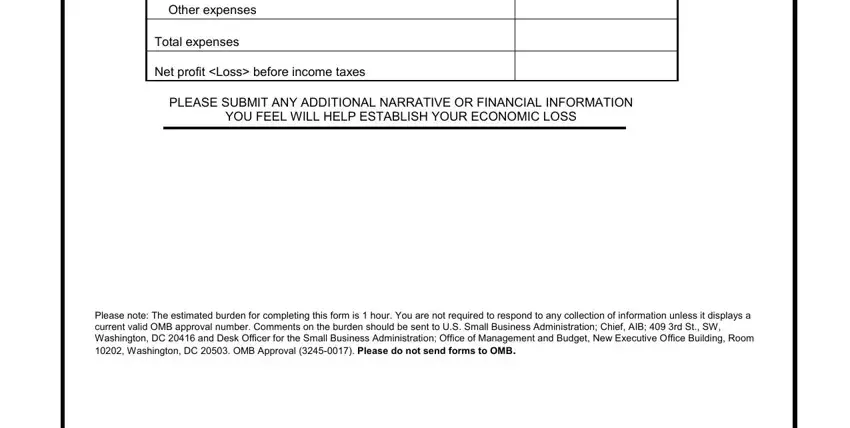

You may be requested for specific necessary data to be able to complete the Other expenses, Total expenses, Net profit Loss before income taxes, PLEASE SUBMIT ANY ADDITIONAL, and Please note The estimated burden area.

Step 3: As you press the Done button, your finished document may be exported to all of your gadgets or to electronic mail given by you.

Step 4: Be sure to remain away from future issues by creating minimally 2 duplicates of your document.