OMB Approval No. 3245-0205

Expiration Date: 8/31/2016

8(a) ANNUAL UPDATE

Under 15 United States Code (U.S.C.) § 636(j)(10), each Program Participant is required to submit a business plan to SBA as condition of participation and to review that plan with the Agency annually. As a part of this effort, SBA collects information on the “8(a) Annual Update” to ensure eligibility for participation in the 8(a) Business Development Program according to the requirements listed in 13 Code of Federal Regulations (C.F.R) § 124.112.

Form 1450 with Attachments A and B can be accessed electronically for completion, modification and submission. The form can be found by accessing the following: http://www.sba.gov/sites/defualt/files/forms_1450.pdf. In addition, a hard copy of the certification page within Form 1450 containing a “wet signature” of the President, Partner or proprietor must be submitted to SBA. This document should be sent to the assigned Business Opportunity Specialist located at the serving District office.

REVIEW YOUR RESPONSES CAREFULLY. BY SIGNING ON PAGE 5 BELOW, YOU ARE CERTIFYING TO THE ACCURACY AND TRUTHFULNESS OF THIS INFORMATION. FALSE STATEMENTS ARE SUBJECT TO CRIMINAL AND/OR CIVIL PROSECUTION.

All information collected will be protected to the extent permitted by law, including the Freedom of Information Act, (5 U.S.C. 522), Privacy Act (5 U.S.C. 555a) and the Right to Financial Privacy Act of 1978 (12 U.S.C. 3401).

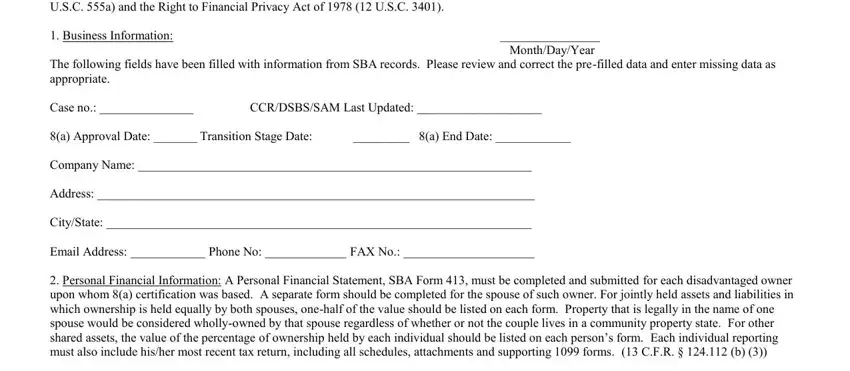

1. Business Information: |

________________ |

|

Month/Day/Year |

The following fields have been filled with information from SBA records. Please review and correct the pre-filled data and enter missing data as appropriate.

|

|

|

Case no.: _______________ |

CCR/DSBS/SAM Last Updated: ____________________ |

8(a) Approval Date: _______ Transition Stage Date: |

_________ 8(a) End Date: ____________ |

Company Name: _______________________________________________________________

Address: ______________________________________________________________________

City/State: ____________________________________________________________________

Email Address: ____________ Phone No: _____________ FAX No.: _____________________

2.Personal Financial Information: A Personal Financial Statement, SBA Form 413, must be completed and submitted for each disadvantaged owner upon whom 8(a) certification was based. A separate form should be completed for the spouse of such owner. For jointly held assets and liabilities in which ownership is held equally by both spouses, one-half of the value should be listed on each form. Property that is legally in the name of one spouse would be considered wholly-owned by that spouse regardless of whether or not the couple lives in a community property state. For other shared assets, the value of the percentage of ownership held by each individual should be listed on each person’s form. Each individual reporting must also include his/her most recent tax return, including all schedules, attachments and supporting 1099 forms. (13 C.F.R. § 124.112 (b) (3))

3.Annual Compensation Data: A record of all payments, compensation and distributions (including loans, advances, salaries and dividends) should be made by the Participant to each of its owners, officers or directors, or to any person or entity affiliated with such individuals. Please complete Attachment A, “Individual/Entity Compensation Worksheet.” (13 C.F.R. § 124.112(b)(5))

4.Transferred Assets: A record must be completed from each individual claiming disadvantaged status regarding the transfer of assets for less than fair market value to any immediate family member or to any trust where the beneficiary is an immediate family member, within two years of the date of the this annual review. The record must provide the name of the recipient(s) and family relationship, and the difference between the fair market value of the asset transferred and the value received by the disadvantaged individual. (13 C.F.R. § 124.112 (b) (4))

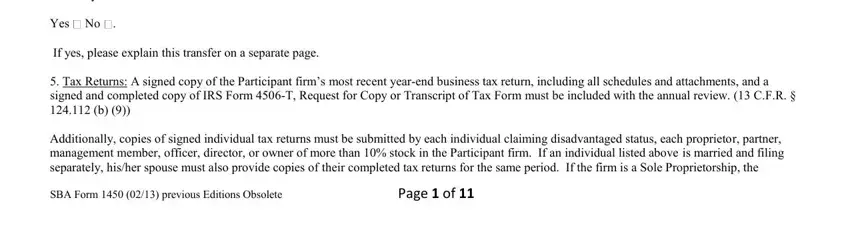

Have any assets been transferred since the last annual review:

Yes No .

If yes, please explain this transfer on a separate page.

5.Tax Returns: A signed copy of the Participant firm’s most recent year-end business tax return, including all schedules and attachments, and a signed and completed copy of IRS Form 4506-T, Request for Copy or Transcript of Tax Form must be included with the annual review. (13 C.F.R. § 124.112 (b) (9))

Additionally, copies of signed individual tax returns must be submitted by each individual claiming disadvantaged status, each proprietor, partner, management member, officer, director, or owner of more than 10% stock in the Participant firm. If an individual listed above is married and filing separately, his/her spouse must also provide copies of their completed tax returns for the same period. If the firm is a Sole Proprietorship, the

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 1 of 11 |

Participant must include the owner’s Schedule C. If an individual listed above is married and filing separately, his/her spouse must also provide copies of completed tax returns for the same period as well as a signed and completed Form 4506-T. The spouse should only complete blocks 5, 6, 6a and 9 on Form 4506-T.

6.Business Structure/Ownership changes: Have there been any changes in the Partnership Agreement, Articles of Incorporation, By-Laws or stock issues since the Participant firm was certified for the 8(a) Business Development program and which have not been previously reported to SBA?

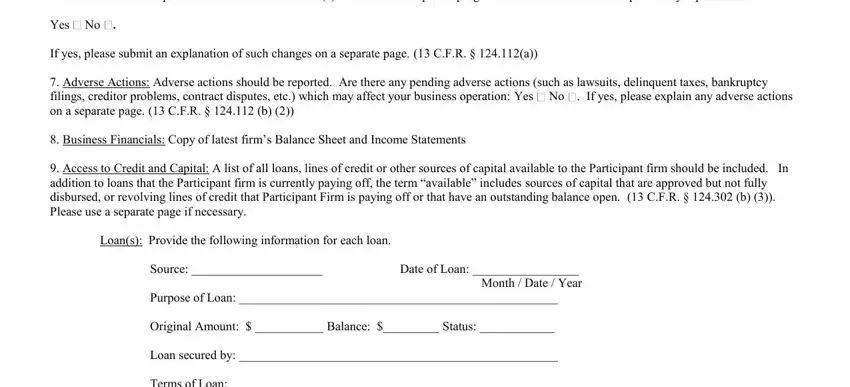

Yes No .

If yes, please submit an explanation of such changes on a separate page. (13 C.F.R. § 124.112(a))

7. Adverse Actions: Adverse actions should be reported. Are there any pending adverse actions (such as lawsuits, delinquent taxes, bankruptcy

filings, creditor problems, contract disputes, etc.) which may affect your business operation: Yes No . If yes, please explain any adverse actions on a separate page. (13 C.F.R. § 124.112 (b) (2))

8.Business Financials: Copy of latest firm’s Balance Sheet and Income Statements

9.Access to Credit and Capital: A list of all loans, lines of credit or other sources of capital available to the Participant firm should be included. In addition to loans that the Participant firm is currently paying off, the term “available” includes sources of capital that are approved but not fully disbursed, or revolving lines of credit that Participant Firm is paying off or that have an outstanding balance open. (13 C.F.R. § 124.302 (b) (3)). Please use a separate page if necessary.

Loan(s): Provide the following information for each loan.

Source: _____________________Date of Loan: _________________

Month / Date / Year

Purpose of Loan: ___________________________________________________

Original Amount: $ ___________ Balance: $_________ Status: ____________

Loan secured by: ___________________________________________________

Terms of Loan: _____________________________________________________

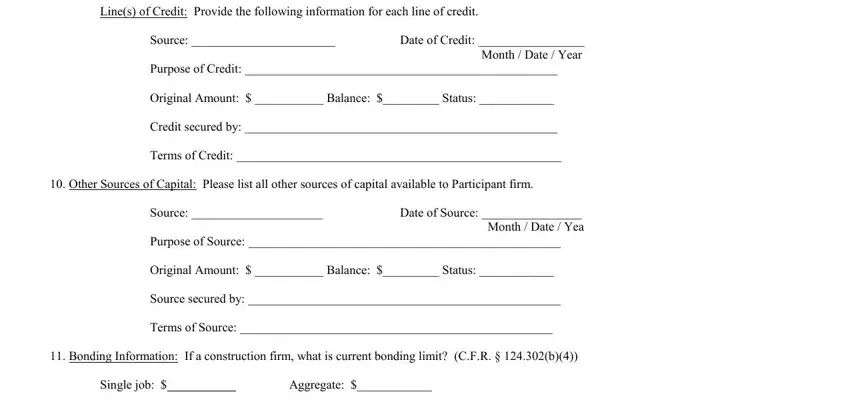

Line(s) of Credit: Provide the following information for each line of credit.

Source: _______________________Date of Credit: _________________

Month / Date / Year

Purpose of Credit: __________________________________________________

Original Amount: $ ___________ Balance: $_________ Status: ____________

Credit secured by: __________________________________________________

Terms of Credit: ____________________________________________________

10. Other Sources of Capital: Please list all other sources of capital available to Participant firm.

Source: _____________________Date of Source: ________________

Month / Date / Yea

Purpose of Source: __________________________________________________

Original Amount: $ ___________ Balance: $_________ Status: ____________

Source secured by: __________________________________________________

Terms of Source: __________________________________________________

11. Bonding Information: If a construction firm, what is current bonding limit? (C.F.R. § 124.302(b)(4))

Single job: $___________ |

|

Aggregate: $____________ |

Individual Surety: ________ |

Corporate Treasury Listed Surety: ____________________ |

Is SBA guaranty required? |

Yes |

No Sometimes |

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 2 of 11 |

12.Business Activity Report: On a separate sheet of paper provide a report of all non-8(a) contracts that the Participant firm performed, including all options and modifications to previously awarded contracts executed during the fiscal year. Indicate below total of all non-8(a) revenue and 8(a) revenue earned during the program year. (13 C.F.R. § 124.509(c)(ii))

This report will be made for the program year starting on ____________ and ending on

_____________. |

Month/ Date/ Year |

|

|

|

|

|

Month/ Date/ Year |

|

|

|

Non-8(a) sales: |

$ _____________ |

( |

%) |

8(a) sales |

$ _____________ |

( |

%) |

Total sales (program year) $ _____________ |

(100 |

%) |

How many competitive solicitations (private, Federal, state or local) have your responded to within the last program year?

Commercial: _______ |

Local government: _______ |

State government: _______ |

Federal Non-8(a): _______ Federal 8(a): _______ |

Total: _______ |

Please explain on a separate sheet of paper the efforts made by your firm to pursue non-8(a) sales during the last program year.

Include a report on attachment C for each 8(a) contract performed during the year explaining how the performance of work requirements are being met (or were met) for the contract. (13 C.F.R. § 124.112(b)(8). (Include this information for each 8(a) contract that the Participant firm performed as the prime contractor and that the Participant firm performed as part of a joint venture, as referenced in question #15 below.)

13. Number of Employees: Please indicate how many employees you have?

Full Time: _______ |

Part Time: _______ as of ______________. |

|

Month/ Date/ Year |

14.Mentor/Protégé: For the program or fiscal year being reviewed, were you a participant in an SBA-approved or any approved mentor/protégé agreement? (13 C.F.R. § 124.520)

Yes No

If yes, please complete Attachment B, “Mentor/Protégé Worksheet.”

15. Joint Venture: For the program or fiscal year being reviewed, were you a participant in a joint venture (JV) agreement? (C.F.R. § 124.513)

Yes No

For each joint venture agreement, indicate the following: (Use separate sheet if needed.)

JV PartnerJV Name Award Date Prime Contract #

____________________ __________________ ______________ ______________________

____________________ __________________ ______________ ______________________

15.Taxes: Indicated taxes your firm paid for fiscal year ending _______ by jurisdiction: Federal: $ ______________

State: $ ________________

Local: $ _______________

17.Contract Forecast: Each Participant must annually forecast its needs for contract awards for the next program year. The forecast must include the aggregate dollar value of 8(a) contracts broken down by soled source and competitive opportunities where possible; the aggregate dollar value of non-8(a) contracts; the types of contract opportunities identified by product or service. (13 C.F.R. § 124.403(b))

|

8(a) Forecast |

Non-8(a) Forecast |

Sole-Source |

$ ___________________ |

$ ___________________ |

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 3 of 11 |

Competitive |

$ ___________________ |

$ ___________________ |

Total |

$ ___________________ |

$ ___________________ |

Total Forecast to include 8(a) and Non-8(a) Forecasts: $ _________________

Briefly identify the types of contract opportunities that you plan to seek. Use a separate sheet if needed.

________________________________________________________________________________________________________________________

TRANSITION MANAGEMENT PLAN

Beginning in the first year of the transitional stage of program participation (years 5 through 9) each Participant must annually submit a transition management strategy to be incorporated into its business plan. This transition management strategy must describe the following: (13 C.F.R. § 124.403(c))

1.How you plan to meet the applicable non-8(a) business activity targets, imposed by 13C.F.R. § 124.509 during the transitional stage of participation. (13 C.F.R. § 403(c)(1))

2.Indicate the specific steps you intend to take to continue business growth and promote profitable business operations after the expiration of your program term. (13 C.F.R. § 124.403(c)(2))

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 4 of 11 |

CERTIFICATIONS

BY SIGNING BELOW, THE PARTICIPANT FIRM CERTIFIES THAT IT HAS REVIEWED THE RELEVANT REGULATIONS AND THAT IT REMAINS ELIGIBLE FOR THE 8(A) BUSINESS DEVELOPMENT PROGRAM. FIRMS OWNED BY INDIAN TRIBES, ALASKA NATIVE CORPORATIONS (ANCS), NATIVE HAWAIIAN ORGANIZATIONS (NHOS) OR COMMUNITY DEVELOPMENT CORPORATIONS (CDCS) ARE SUBJECT TO THE 8(A) PROGRAM ELIGIBILITY REQUIREMENTS AS SET FORTH IN 13 C.F.R. § 124.101 – 124.108 TO THE EXTENT THAT THESE REGULATIONS ARE NOT INCONSISTENT WITH 13 C.F.R. § 124.109, 124.110 AND 124.111. FIRMS NOT OWNED BY INDIAN TRIBES, ANCS, NHOS, OR CDCS ARE SUBJECT TO THE ELIGIBILITY REQUIREMENTS OF 13 C.F.R. § 124.101 THROUGH § 124.108.

BY SIGNING BELOW, THE PARTICIPANT FIRM CERTIFIES THAT THERE HAVE BEEN NO CHANGES TO ANY INFORMATION SUBMITTED IN ITS APPLICATION FOR ADMISSION, OR IN CONNECTION WITH ITS APPLICATION FOR ADMISSION, THAT MAY AFFECT THE FIRM’S ELIGIBILITY TO PARTICIPATE IN THE 8(A) PROGRAM. IF, AFTER BEING ADMITTED TO THE PROGRAM, THE PARTICIPANT FIRM PROVIDED SUPPLEMENTAL INFORMATION TO SBA REGARDING SUCH CHANGES AND SBA HAS PROVIDED WRITTEN NOTICE THAT THE CHANGES DO NOT AFFECT PROGRAM ELIGIBILITY, THE PARTICIPANT FIRM ALSO CERTIFIES THAT THERE HAVE BEEN NO SUBSEQUENT CHANGES TO THE SUPPLEMENTAL INFORMATION. ANY QUESTIONS REGARDING THE PARTICIPANT FIRM’S CONTINUING ELIGIBILITY SHOULD BE DIRECTED TO THE SERVICING SBA OFFICE.

BY SIGNING BELOW, I CERTIFY THAT ALL INFORMATION SUBMITTED IN THIS 8(A) ANNUAL UPDATE, ATTACHMENTS, AND THE PERSONAL FINANCIAL STATEMENT IS TRUE, CORRECT AND ACCURATE. I UNDERSTAND THAT FALSE STATEMENTS CAN BE SUBJECT TO PROSECUTION UNDER 18 U.S.C. § 1001 AND OTHER STATUTES, CAN SUBJECT ME OR MY COMPANY TO TREBLE DAMAGES UNDER THE FALSE CLAIMS ACT, 31 U.S.C. §§ 3729–3733 OR SUSPENSION OR DEBARMENT, AND CAN RESULT IN THE TERMINATION OF MY COMPANY FROM THE 8(A) PROGRAM.

________________________________________ |

__________________ |

Signature of President, Partner or Proprietor |

Date |

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 5 of 11 |

Attachment A

INDIVIDUAL/ENTITY COMPENSATION WORKSHEET

Annual Compensation Data: For the previous annual year, describe below all payments, compensation and distributions (including loans, advances, salaries and dividends) made by the Participant (1) to each of its owners, officers directors, and stock holders owning 10% or more of the Participant Firm’s stock or (2) to any person or entity affiliated with such individuals. The term “entity affiliated with such individuals” includes, without limitation, all companies or organizations of which an owner, officer or director of the Participant Firm is a officer, partner or director or holds a 10 percent or greater ownership interest. Compensation includes, without limitation, all payments and distributions, including loans, advances, salaries and dividends. Each individual reporting must include a signed and dated copy of their most recent tax return, including all schedules and attachments. In addition, all supporting 1099 forms must be provided. If a filing extension has been requested, provide a copy of IRS Form 4868, Individual Extension Request and a copy of most recently signed and dated tax return. Tax information provided may be verified with IRS. (13 C.F.R. § 124.112(3)(b)(5))

Provide the following information for each payment, compensation, or distribution made to an owner, officer, director, or shareholder owning more than 10% of the Participant Firm’s stock:

Name of person receiving payment/compensation/distribution: |

_________________ Title: _________________ |

Ownership %: of Participant firm _________________ |

|

|

Nature of Payments: |

|

|

Salary: $ ______________ |

|

|

Bonus: $ ______________ |

|

|

Advances: $ ___________ |

|

|

Dividends: $ ___________ |

|

|

Distributions: $ -------------- |

|

|

Other compensation (please specify): $ _______________________________________ |

|

Total Payments/Compensation/Distributions for period of ____________ through ____________ |

$_______________ |

Month/ Date / Year |

Month/Date/ Year |

Loan(s): Has the participant firm made any outstanding loan(s) to any owner, officer, director, and shareholder owning more than 10% of the Participant Firm’s stock? Yes No

If yes, please provide the following information for each loan. (Use a separate sheet if needed.)

Loan Source: ______________ Date of Loan: ______________ Status: __________________

Month/ Date/Year

Original Amount: $ ______________ Balance: $ _____________ Secured by: _____________

Terms:_____________________ |

Purpose of Loan: _____________________ |

Provide the following information for each payment made to an affiliated entity (i.e., a company or organization of which an owner, officer or director of the Participant Firm is a officer, partner or director or holds a 10 percent or greater ownership interest)

Name of entity receiving payment: |

_________________ |

Total dollar value of payments made during the annual year:

Purpose(s) of payments – if payment was made in connection with services or goods provided to the Participant firm, describe the nature of the services or goods provided:

Which owner, officer, partner or director of the Participant Firm is affiliated with this entity? _________________

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 6 of 11 |

How in the Participant Firm’s owner, officer, partner or director affiliated with this entity: _________________

Has the Participant firm made any loans to this entity? Yes __ No __

If yes, please provide the following information for each loan. (Use a separate sheet if needed.)

Date of Loan: ______________ Status: __________________

Month/ Date/Year

Original Amount: $ ______________ Balance: $ _____________ Secured by: _____________

Terms: _____________________ |

Purpose of Loan: _____________________ |

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 7 of 11 |

Attachment B

MENTOR-PROTÉGÉ WORKSHEET

Your firm participated in or continues to participate in any approved mentor/protégé agreement with whom:

___________________________________________________

Date this agreement was approved: ___________Period of agreement:______________

Is this firm the mentor or the protégé? NOTE: If your firm is a protégé, your firm’s Mentor must complete the information and sign below as indicated below.

Questions for Protégés

If your firm is the protégé, the following information must be provided: (13 C.F.R. § 124.520(g)(i)-(v))

(i)List all technical and/or management assistance provided by the mentor to the protégé.

(ii) List all loans to and/or equity investments made by the mentor to the protégé;

(iii) List all subcontracts awarded to the protégé by the mentor and the value of each subcontract;

(iv)List all federal contracts awarded to the mentor/protégé relationship as a joint venture (designating each as an 8(a), small business set- aside, or unrestricted procurement), the value of each contract, and the percentage of revenue accruing to each party to the joint venture:

(v)Provide a narrative 1) detailing all contracts it has performed in conjunction with its mentor; and 2) describing the success such assistance has had in addressing the developmental needs of the protégé and addressing any problems encountered (13 C.F.R. § 124.112(b)(6); 124.520(v));:

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 8 of 11 |

(vi) Provide a list of the mentoring services the protégé received by category and hours. (13 C.F.R. § 124.520(g)(2)

_____________________________________________________________________________

The protégé must also provide the following: (13C.F.R. § 124.520(g)(3)

The protégé must annually certify to SBA whether there has been any change in the terms of the mentor-protégé agreement. If there were no changes, please state so, or if there were changes, please indicate.

To be completed by the Mentor:

If your firm is a Mentor, are there any pending adverse actions (such as lawsuits, delinquent taxes, bankruptcy filings, creditor problems, contract disputes, suspension/debarment from federal contracting of the firm, etc.) which may affect your business operation, good character, and/or favorable financial position?: 13 C.F.R. § 124.520(b)(4) Yes ___ No ____

If yes, please explain below or on a separate page if needed.

BY SIGNING BELOW, I CERTIFY THAT ALL INFORMATION SUBMITTED IN THIS MENTOR/PROTÉGÉ WORKSHEET AND ANY ATTACHMENTS IS TRUE, CORRECT AND ACCURATE. I UNDERSTAND THAT FALSE STATEMENTS CAN BE SUBJECT TO PROSECUTION UNDER 18 U.S.C. § 1001 AND OTHER STATUTES, CAN SUBJECT ME OR MY COMPANY TO TREBLE DAMAGES UNDER THE FALSE CLAIMS ACT, 31 U.S.C. §§ 3729–3733 OR SUSPENSION OR DEBARMENT, AND CAN RESULT IN THE TERMINATION OF MY COMPANY FROM THE 8(A) PROGRAM.

For the Protégé |

|

________________________________________ |

__________________ |

Signature of President, Partner or Proprietor |

Date |

For the Mentor: |

|

________________________________________ |

__________________ |

Signature of President, Officer or Authorized Official |

Date |

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 9 of 11 |

Attachment C

8(a) CONTRACTS ANNUAL PERFORMANCE

Provide the following information for all 8(a) contracts the Participant Firm worked on during the past annual year:

Contract Number and date contract was signed

NAICS

Code

Assigned

to

Contract

Percentage of Contract

Work Performed By

8(a) Participant

(Exclude Work

Performed by non-8(a) Joint Venture Partners)

Percentage of

Contract Work

Performed by

Subcontractors

Name of any

Subcontractor

Performing More than

10% of the Contract

Work (indicate

percentage performed)

Provide the following information for any 8(a) contract performed as a joint venture:

Name of Other Firm(s) Partnering in

the Joint Venture. If any of these firms are 8(a) firms, indicate this by adding “[8(a)]” after the firm’s name

Percentage of Contract

Work Performed by

Joint Venture

Percentage of Contract Work

Performed by Non 8(a)

Partner in Joint Venture

For all of the above 8(a) contracts performed as a joint venture, were all of the above 8(a) contracts performed under a Joint Venture Agreement Approved by SBA? Yes __ No __

If no, identify all relevant 8(a) contracts ___________________________________________________________________

For all of the above 8(a) contracts performed as a joint venture, were all of the above contracts performed under a Mentor Protégé Agreement Approved by SBA? Yes __ No __

If no, identify all relevant 8(a) contracts ___________________________________________________________________

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 10 of 11 |

For all of the above 8(a) contracts performed as a joint venture, did the joint venture subcontract any contract work to the non-8(a) partner in the joint venture or any company that is affiliated With the non-8(a) partner? Yes__ No __ [Note: See the Guidance on Affiliation in 13 C.F.R. § 121.103.]

If yes, identify all relevant 8(a) contracts ___________________________________________________________________

For all of the above 8(a) contracts performed as a joint venture, provide a narrative description below how the percentage of work requirement was met: ______________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

PLEASE NOTE: The estimate burden for completing this form is 2 hours. You are not required to respond to any collection of information unless it displays a currently valid OMB approval number. Comments on the burden should be sent to U.S. Small Business Administration, Chief AIB, 409 3rd St., S.W., Washington, D.C. 20416 and Desk Officer of the U.S. Small Business Administration, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, D.C. 20503. OMB Approval 3245-0205. PLEASE DO NOT SEND FORMS TO OMB.

SBA Form 1450 (02/13) previous Editions Obsolete |

Page 11 of 11 |