Using PDF files online is actually a piece of cake with our PDF editor. Anyone can fill out sba form 4 application for business loan here in a matter of minutes. Our development team is relentlessly endeavoring to enhance the tool and enable it to be much easier for users with its cutting-edge functions. Discover an endlessly progressive experience today - take a look at and uncover new opportunities along the way! With a few simple steps, you can start your PDF editing:

Step 1: Press the "Get Form" button above on this webpage to access our PDF tool.

Step 2: After you access the PDF editor, you will see the form made ready to be filled out. Besides filling in different fields, you could also do some other actions with the PDF, specifically adding custom text, changing the initial text, adding illustrations or photos, affixing your signature to the document, and more.

It really is an easy task to complete the form following this practical tutorial! Here is what you need to do:

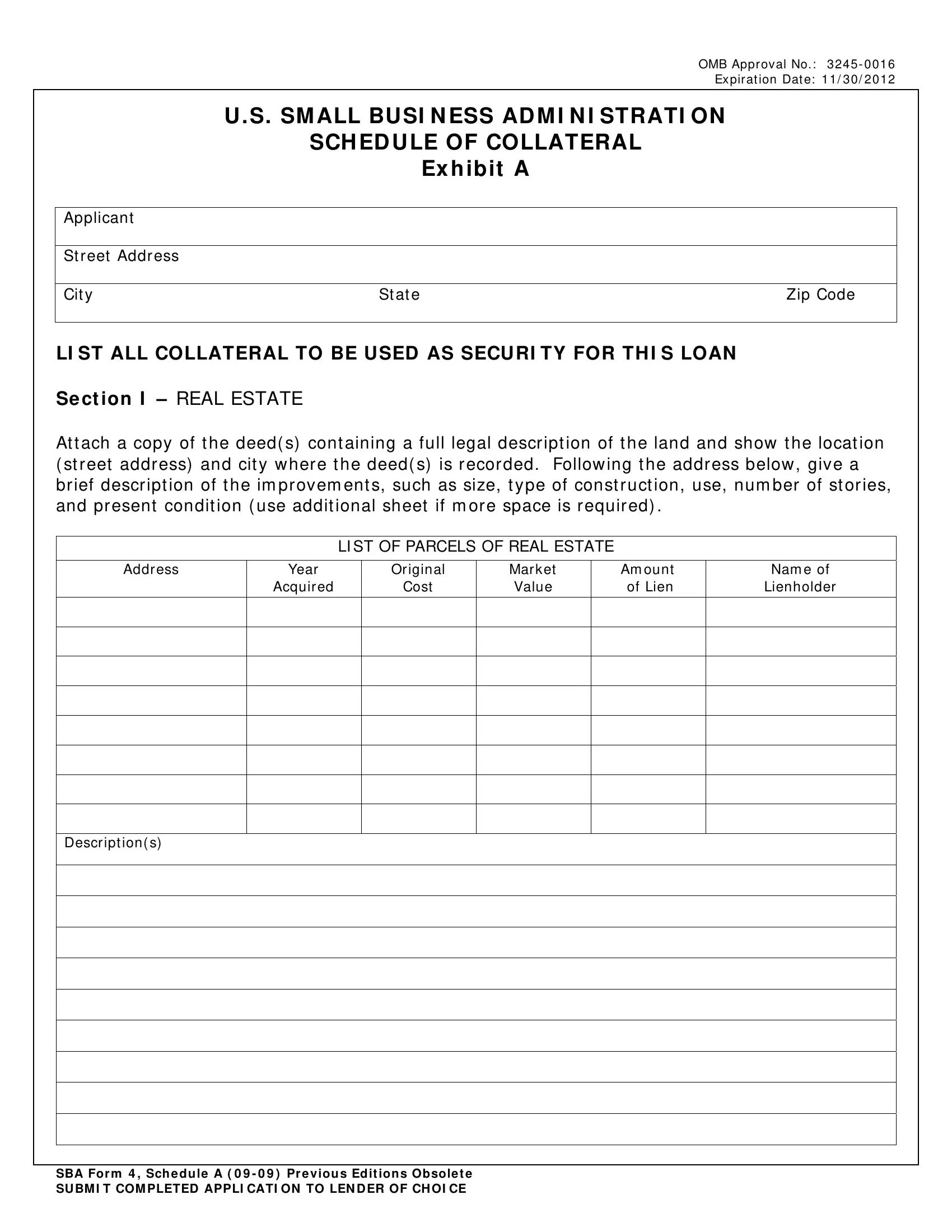

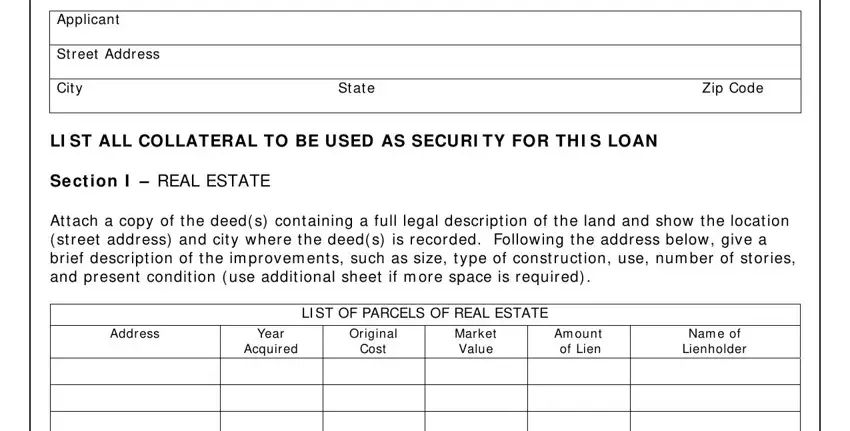

1. First of all, once filling out the sba form 4 application for business loan, start with the section that includes the subsequent fields:

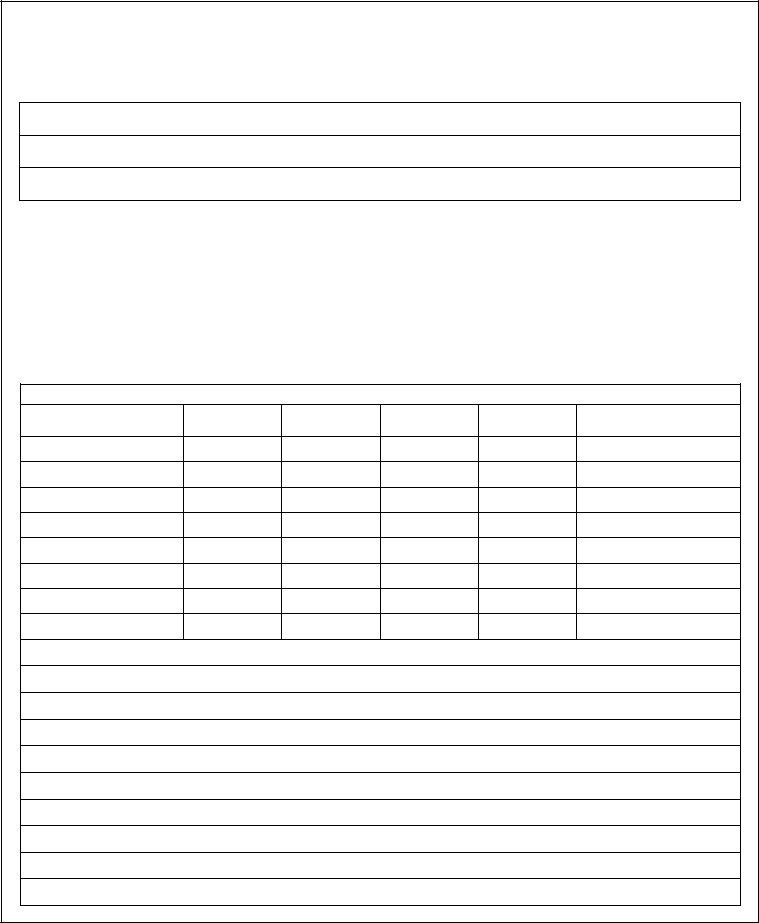

2. Once your current task is complete, take the next step – fill out all of these fields - Descript ion s with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. In this stage, examine SBA For m Sch e du le A. All these need to be completed with greatest awareness of detail.

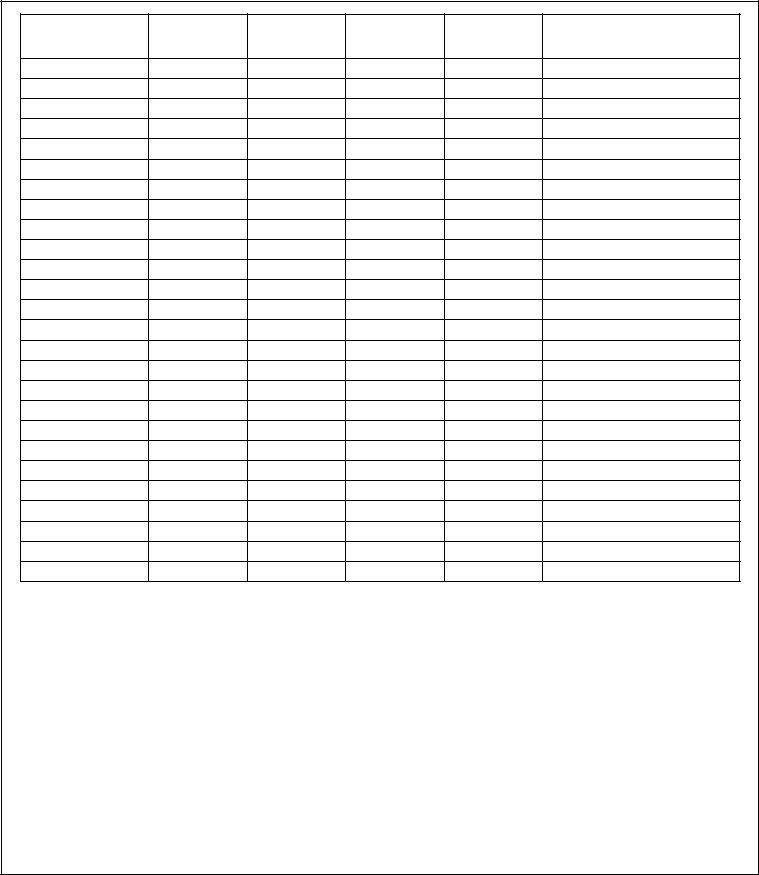

4. Filling in Descript ion Show Manufact urer is key in the fourth form section - make certain that you devote some time and take a close look at each field!

Always be really mindful when completing Descript ion Show Manufact urer and Descript ion Show Manufact urer, as this is the section where many people make a few mistakes.

5. Because you reach the end of your document, you will find just a few more things to undertake. Mainly, Descript ion Show Manufact urer, All inform at ion cont ained, Dat e, and Dat e must be filled out.

Step 3: Once you have glanced through the details in the file's blank fields, click on "Done" to finalize your form at FormsPal. Download the sba form 4 application for business loan when you subscribe to a 7-day free trial. Easily get access to the pdf document inside your personal account page, along with any modifications and changes automatically saved! With FormsPal, you can easily complete forms without needing to worry about personal information leaks or data entries getting distributed. Our protected platform helps to ensure that your private information is kept safely.