Dealing with PDF files online can be a breeze using our PDF editor. You can fill out indiana sc40 here and try out many other functions available. Our editor is continually evolving to give the best user experience attainable, and that is because of our commitment to continual development and listening closely to comments from users. Here is what you'd have to do to get started:

Step 1: Just click on the "Get Form Button" above on this webpage to access our pdf form editor. There you will find all that is required to work with your document.

Step 2: With the help of this online PDF file editor, you'll be able to accomplish more than just fill out blank form fields. Try each of the features and make your forms appear sublime with customized text put in, or tweak the file's original content to perfection - all supported by the capability to incorporate your personal images and sign it off.

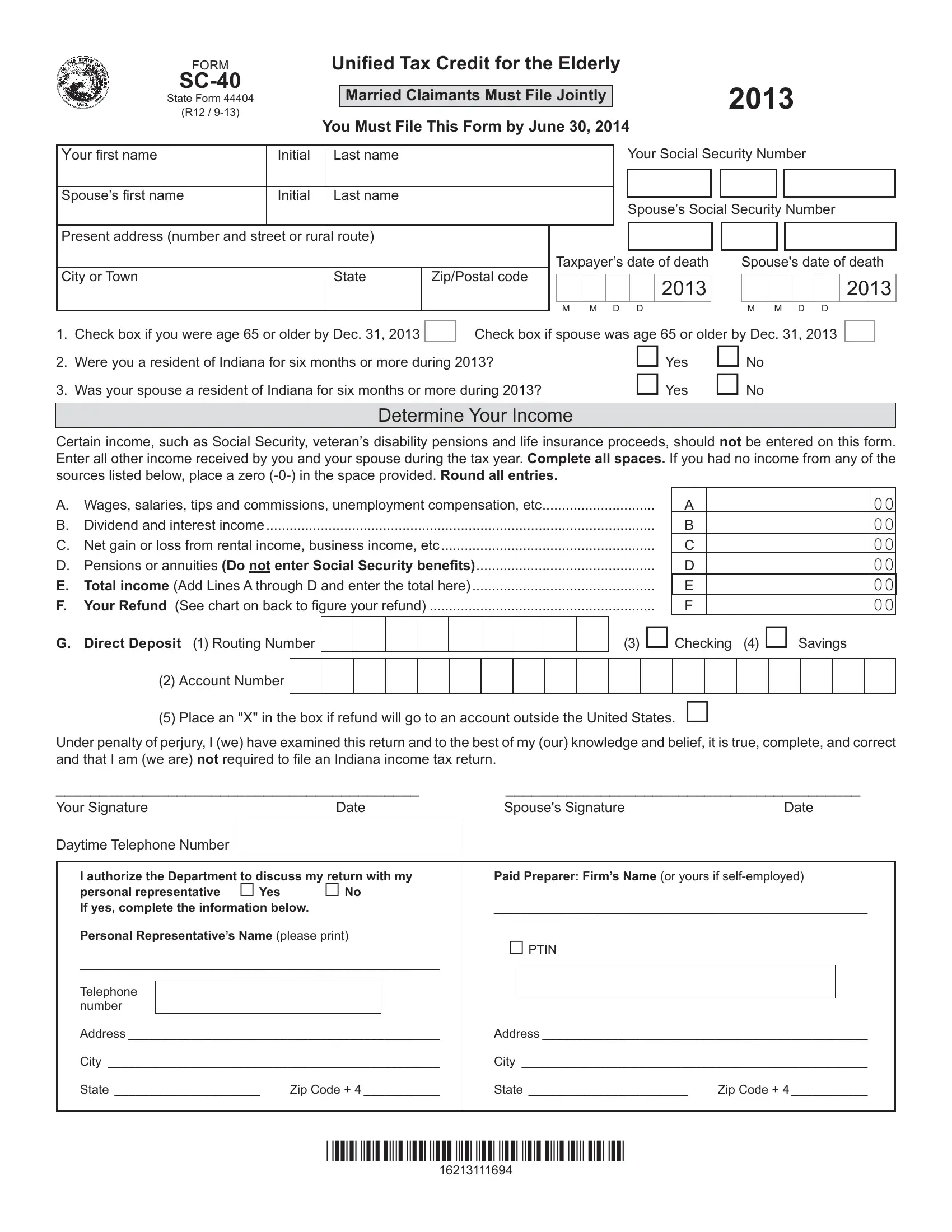

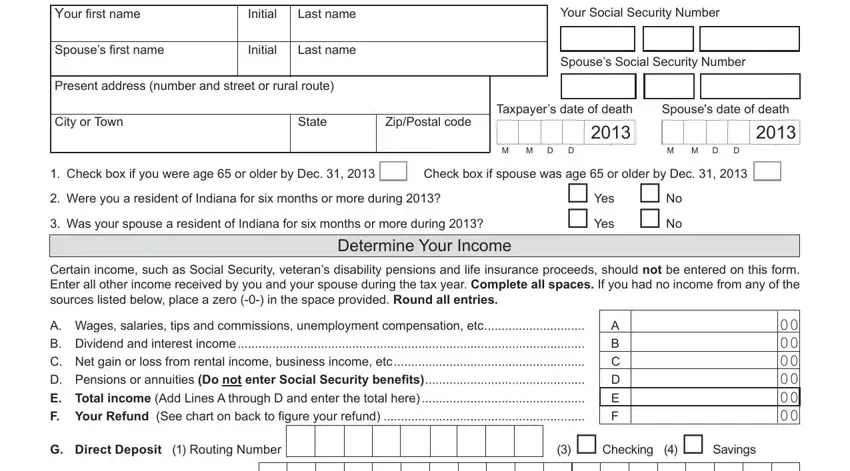

In order to complete this PDF document, be sure to enter the necessary information in each blank:

1. Start completing the indiana sc40 with a selection of necessary blanks. Get all the information you need and make certain nothing is overlooked!

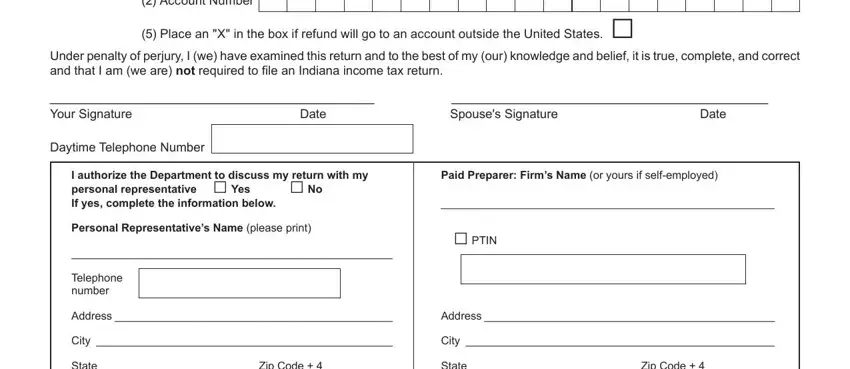

2. Immediately after the last section is done, go to type in the suitable details in these: Account Number, Place an X in the box if refund, Under penalty of perjury I we have, Your Signature, Date, Daytime Telephone Number, I authorize the Department to, personal representative Yes, If yes complete the information, Spouses Signature, Date, Paid Preparer Firms Name or yours, Personal Representatives Name, PTIN, and Telephone number.

You can certainly make an error when completing your Place an X in the box if refund, therefore you'll want to take a second look prior to when you send it in.

Step 3: Right after taking another look at the filled out blanks, click "Done" and you are all set! Join FormsPal right now and easily gain access to indiana sc40, prepared for download. All modifications made by you are saved , enabling you to customize the form later on when required. At FormsPal.com, we strive to be sure that all of your details are kept protected.