You can certainly get forms applying our PDF editor. Changing the ftb schedule 540 form is not difficult if you keep up with these actions:

Step 1: At first, pick the orange "Get form now" button.

Step 2: You're now on the document editing page. You may edit, add information, highlight particular words or phrases, put crosses or checks, and insert images.

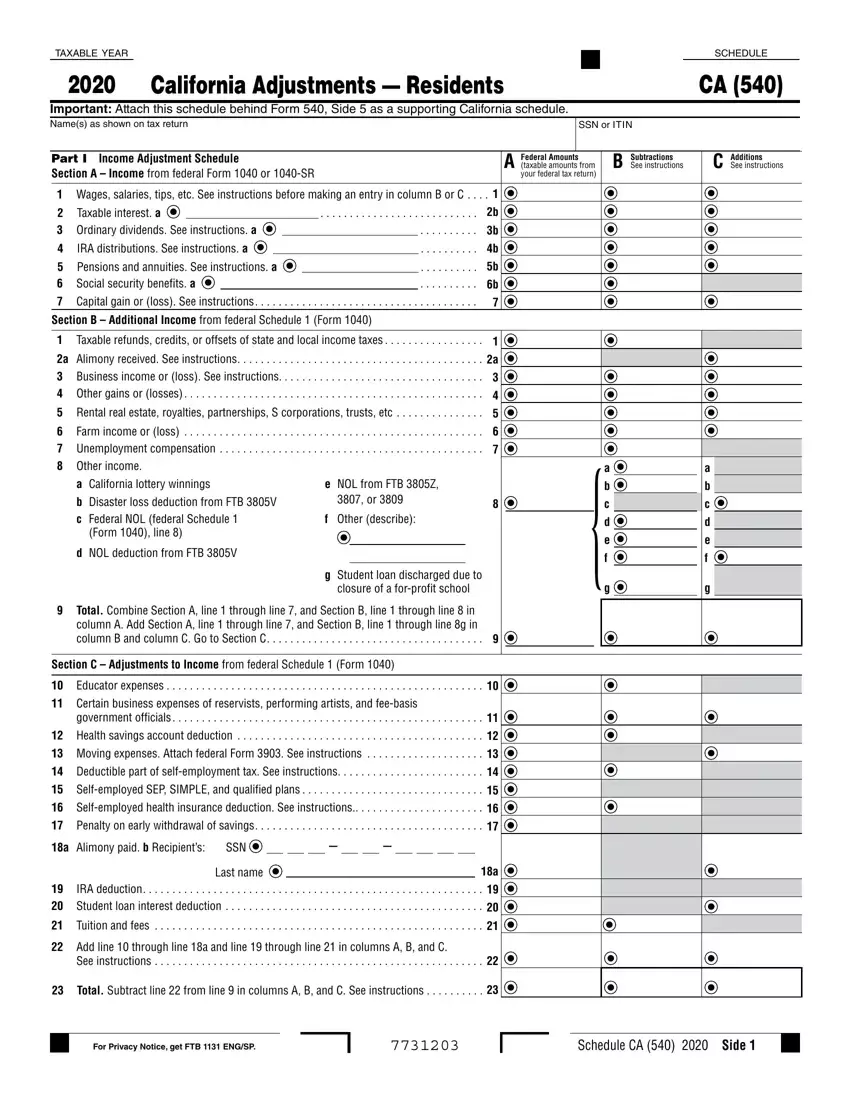

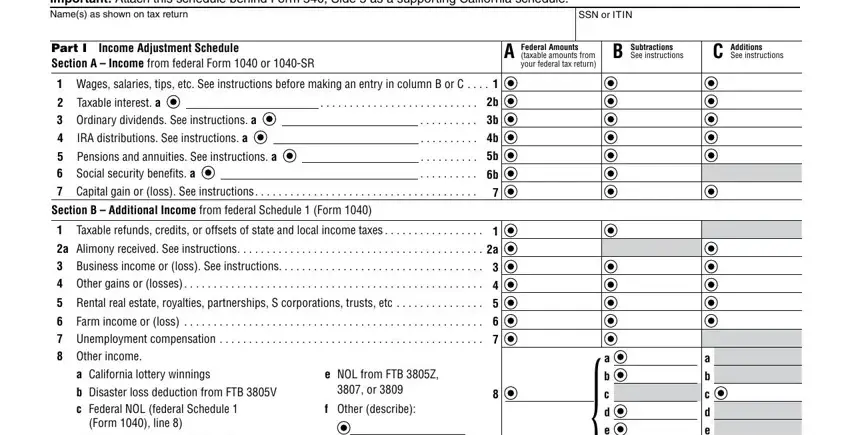

Fill out the ftb schedule 540 PDF by providing the text necessary for each individual section.

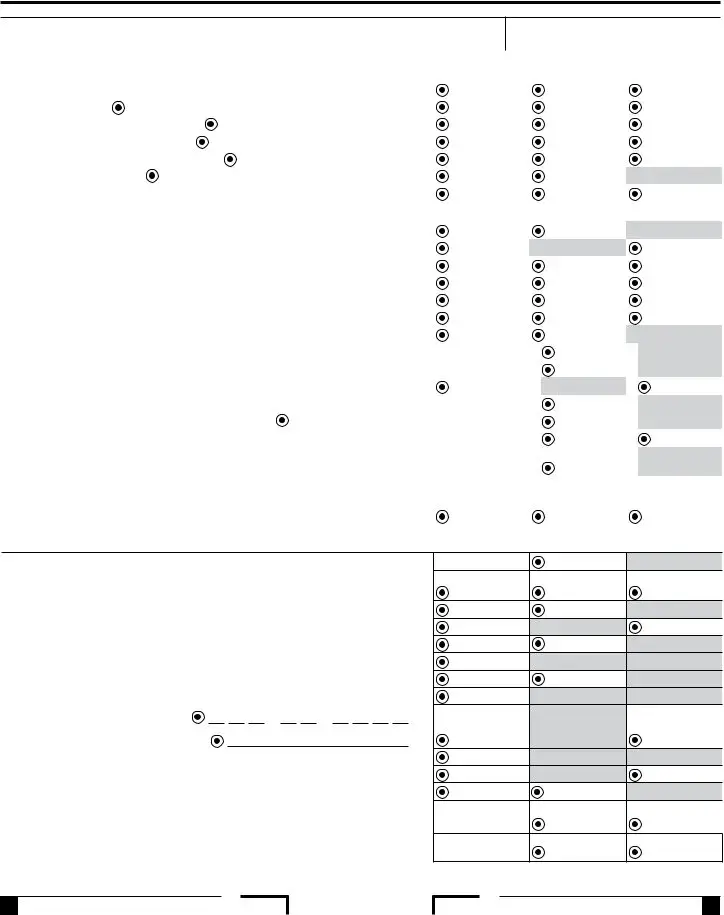

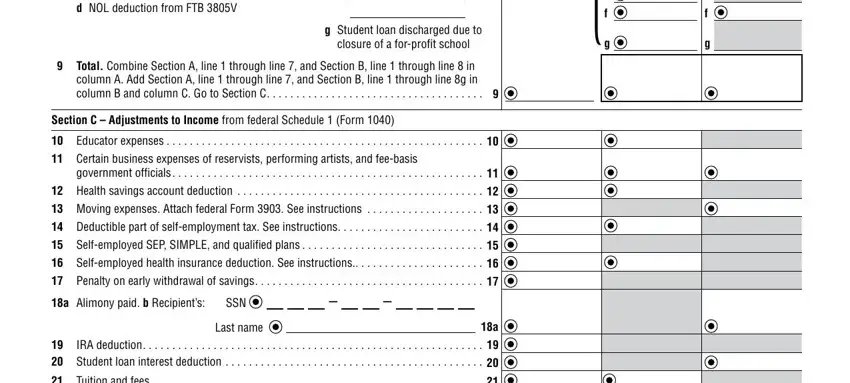

Jot down the details in d NOL deduction from FTB V, g Student loan discharged due to, Total Combine Section A line, Section C Adjustments to Income, Educator expenses, Certain business expenses of, government officials, Health savings account deduction, Moving expenses Attach federal, Deductible part of selfemployment, Selfemployed SEP SIMPLE and, Selfemployed health insurance, Penalty on early withdrawal of, a Alimony paid b Recipients SSN, and Last name.

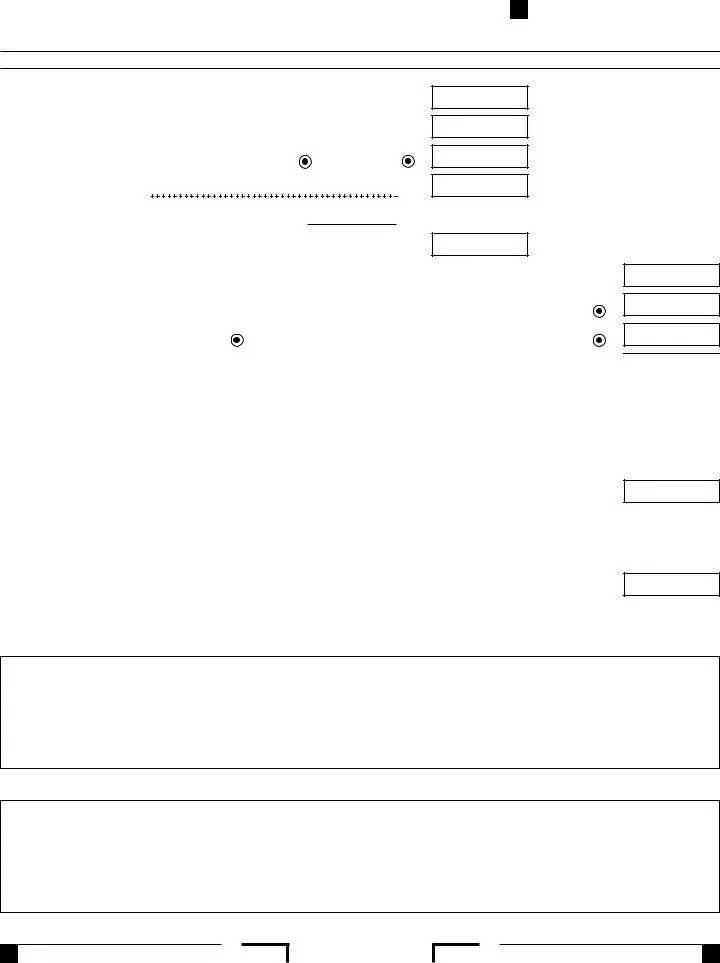

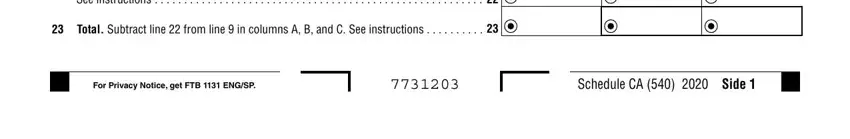

In the See instructions, Total Subtract line from line, For Privacy Notice get FTB ENGSP, and Schedule CA Side box, describe the key data.

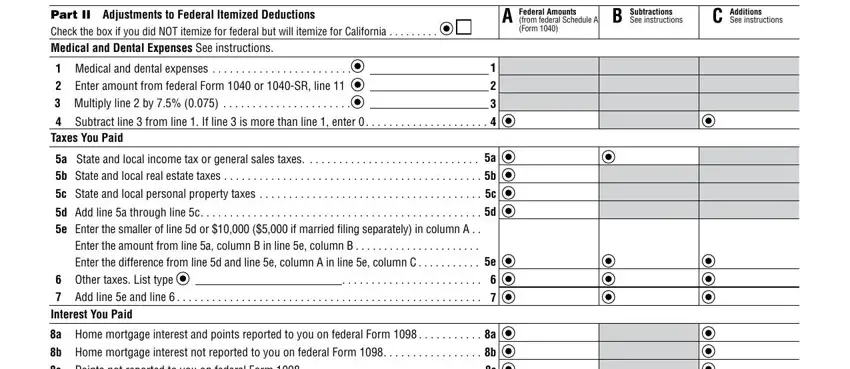

Inside of box A Federal Amounts, from federal Schedule A Form, B Subtractions, See instructions, C Additions, See instructions, Part II Adjustments to Federal, Medical and dental expenses, Subtract line from line If line, a State and local income tax or, c State and local personal, d Add line a through line c, a Home mortgage interest and, b Home mortgage interest not, and c Points not reported to you on, identify the rights and obligations.

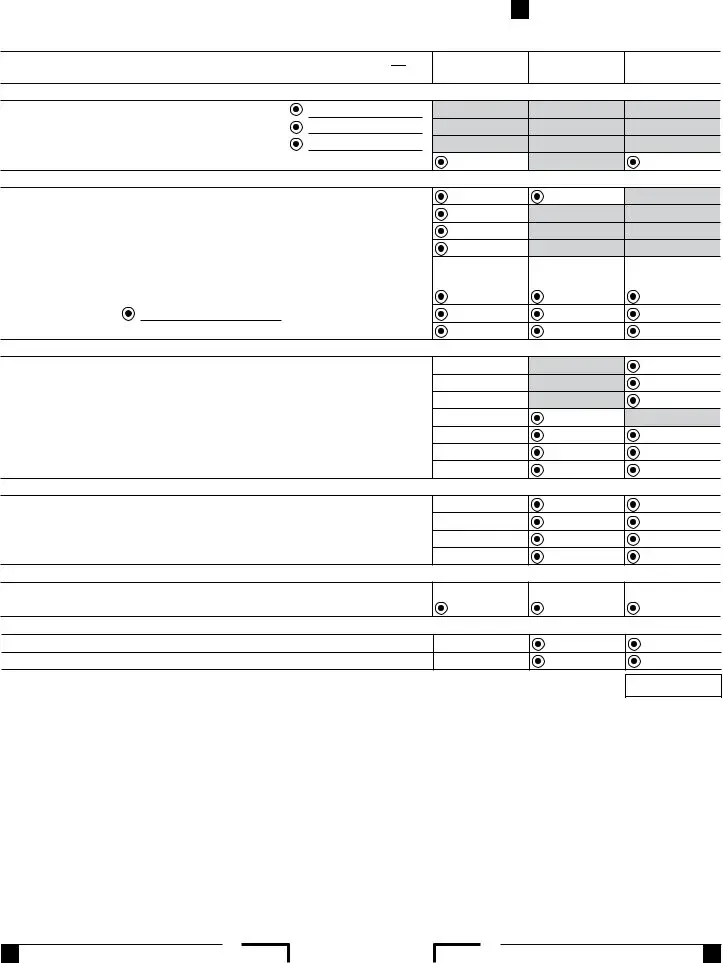

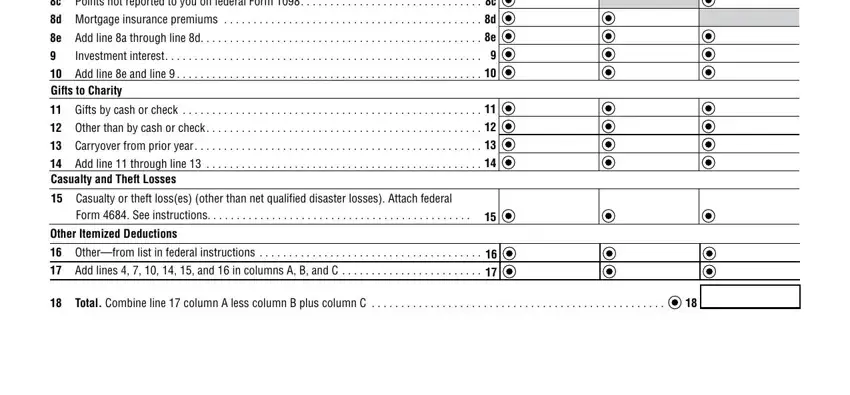

Complete the form by analyzing all these sections: c Points not reported to you on, d Mortgage insurance premiums, e Add line a through line d, Investment interest, Add line e and line, Gifts by cash or check, Other than by cash or check, Carryover from prior year, Add line through line, Casualty or theft losses other, Form See instructions, Other Itemized Deductions, Otherfrom list in federal, Add lines and in columns A, and Total Combine line column A less.

Step 3: Choose the button "Done". The PDF document can be transferred. You will be able obtain it to your pc or send it by email.

Step 4: You may create duplicates of your form tostay clear of all of the potential future issues. You need not worry, we don't distribute or track your information.