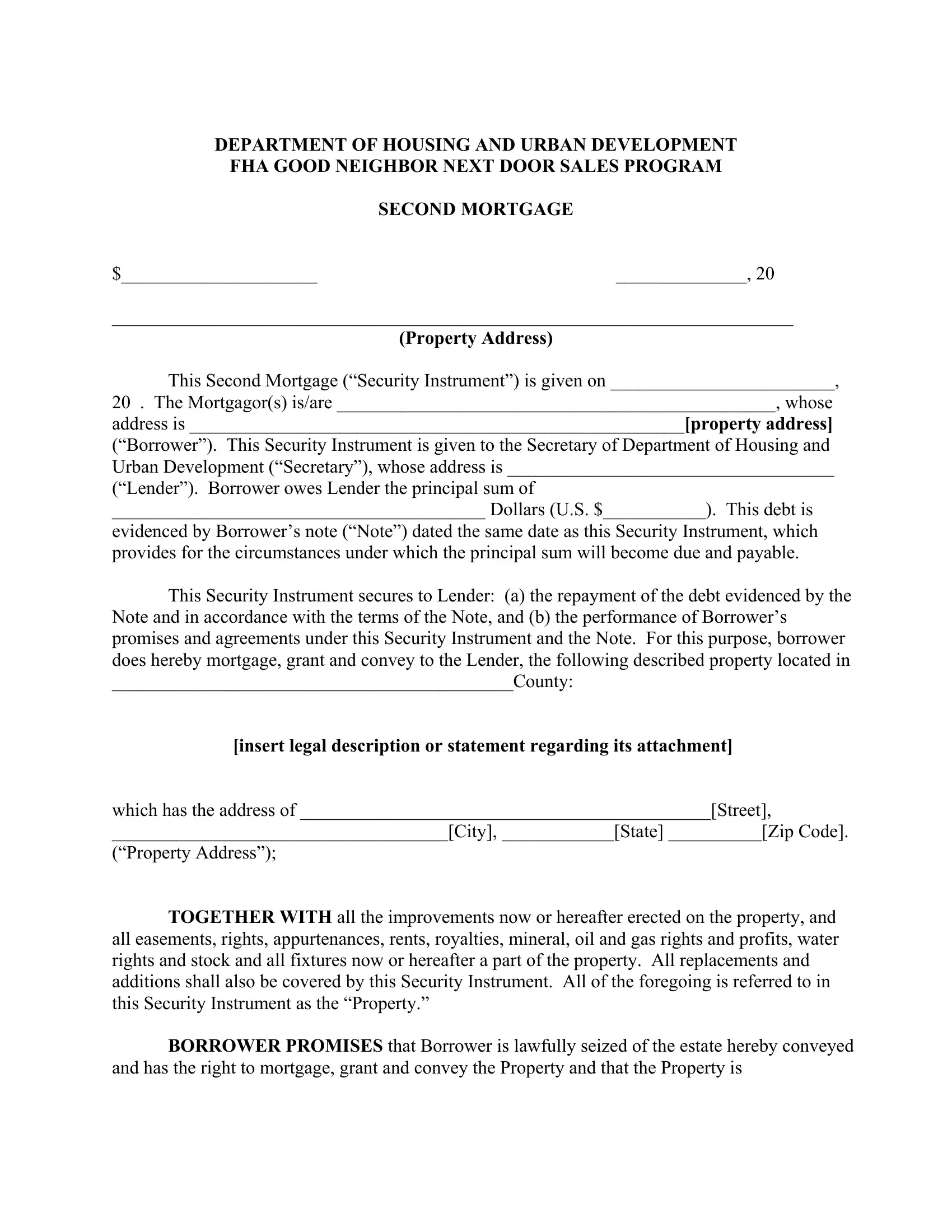

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

FHA GOOD NEIGHBOR NEXT DOOR SALES PROGRAM

SECOND MORTGAGE

$___________________________________, 20

_________________________________________________________________________

(Property Address)

This Second Mortgage (“Security Instrument”) is given on ________________________,

20. The Mortgagor(s) is/are _______________________________________________, whose address is _____________________________________________________[property address] (“Borrower”). This Security Instrument is given to the Secretary of Department of Housing and Urban Development (“Secretary”), whose address is ___________________________________

(“Lender”). Borrower owes Lender the principal sum of

________________________________________ Dollars (U.S. $___________). This debt is evidenced by Borrower’s note (“Note”) dated the same date as this Security Instrument, which provides for the circumstances under which the principal sum will become due and payable.

This Security Instrument secures to Lender: (a) the repayment of the debt evidenced by the Note and in accordance with the terms of the Note, and (b) the performance of Borrower’s promises and agreements under this Security Instrument and the Note. For this purpose, borrower does hereby mortgage, grant and convey to the Lender, the following described property located in

___________________________________________County:

[insert legal description or statement regarding its attachment]

which has the address of ____________________________________________[Street],

____________________________________[City], ____________[State] __________[Zip Code].

(“Property Address”);

TOGETHER WITH all the improvements now or hereafter erected on the property, and all easements, rights, appurtenances, rents, royalties, mineral, oil and gas rights and profits, water rights and stock and all fixtures now or hereafter a part of the property. All replacements and additions shall also be covered by this Security Instrument. All of the foregoing is referred to in this Security Instrument as the “Property.”

BORROWER PROMISES that Borrower is lawfully seized of the estate hereby conveyed and has the right to mortgage, grant and convey the Property and that the Property is

unencumbered, except for encumbrances of record. Borrower warrants and will defend generally the title to the Property against all claims and demands, subject to any encumbrances or record.

1.Payment of Principal and Interest. Borrower shall pay, when due and payable, the principal sum of the debt evidenced by the Note and according to the terms of the Note.

2.Occupancy. Borrower shall own and occupy, establish and use the Property as Borrower’s sole residence and shall continue to occupy the Property as Borrower’s sole residence for at least 36 (thirty-six) months, beginning on ________________________[insert date of commencement of Owner-occupant period – thirty (30), ninety (90) or one hundred eighty (180) days after closing] and ending on __________________________________[36 (thirty-six) months after date of commencement].

3.Fees. Lender may collect fees and charges authorized by the Note.

4.Grounds for Acceleration of Debt. Lender may require immediate payment in full of all sums secured by this Security Instrument as evidenced by the Note after any default by the Borrower occurs as described in paragraph 5 of Note.

5.Foreclosure Procedure. [For illustration only. Needs adaptation, per the instruction relating to paragraph 18 of the model mortgage form in appendix II of HUD handbook 4165.1 REV-2.] If lender requires immediate payment in full under Paragraph 4 above, Lender may invoke the power of sale and any other remedies permitted by applicable law. Lender shall be entitled to collect all expenses incurred in pursuing the remedies provided in the paragraph 5, including but not limited to, reasonable attorney’s fees and cost of title evidence.

If lender invokes the power of sale, Lender shall give notice to borrower in the manner provided in paragraph 7 below. Lender shall publish and post the notice of sale, and the Property shall be sold in the manner prescribed by applicable law. Lender or its designee may purchase the property at any sale. The proceeds of the sale shall be applied in the following order: (a) to all expenses of the sale, including but not limited to, reasonable attorney’s fees; (b) to all sums secured by this Security Instrument as evidenced by the Note; and (c) any excess to the person or persons legally entitled to it.

[The following language is mandatory in all cases.] If the Lender’s interest in this Security Instrument is held by the Secretary and the Secretary requires immediate payment in full under Paragraph 4, the Secretary may invoke the nonjudicial power of sale provided in the Single Family Mortgage Foreclosure Act of 1994 (“Act) (12 U.S.C.3751 et seq.) by requesting a foreclosure commissioner designated under the Act to commence foreclosure and to sell the Property as provided in the Act. Nothing in the preceding sentence shall deprive the Secretary of any rights otherwise available to a Lender under this Paragraph 5 or applicable law.

6.Joint and Several Liability; Co- Signers. Borrower’s promises and agreements shall be joint and several. Any borrower who is not a law enforcement officer, teacher or firefighter/emergency medical technician who co-signs this Security Instrument, but does not execute the Note is: (a) co-signing this Security Instrument only to mortgage, grant and convey that Borrower’s interest in the Property under the terms of this Security Instrument; (b) not personally obligated to pay the sums secured by the Security Instrument as evidenced by the Note;

(c)not obligated to live in the Property as his or her sole residence for three years; and (d) agrees that Lender and any other Borrower may agree to make any accommodations with regard to the terms of this Security Instrument or the Note without that Borrower’s consent

7.Notices. Any notice that must be given to Borrower under this Security Instrument will be given by delivering it or by mailing it by first class mail to Borrower at the Property address above.

Any notice that may be given to the Lender under this Security Instrument will be given by mailing it first class mail to the Lender at the address stated above or at a different address, if Borrower is given notice of that different address.

8.Governing Law; Severability. This Security Instrument shall be governed by Federal Law. In the event that any provision or clause of this Security Instrument or the Note conflicts with applicable law, such conflict shall not affect other provision of this Security Instrument or the Note which can be given effect without the conflicting provision. To this end, the provisions of this Security Instrument and the Note are declared to be severable.

9.Borrower’s Copy. Borrower shall be given one conformed copy of this Security Instrument.

BY SIGNING BELOW, borrower accepts and agrees to the terms of this Security Instrument.

Witness: |

Borrowers: |

__________________________________ |

_________________________________ |

__________________________________ |

_________________________________ |