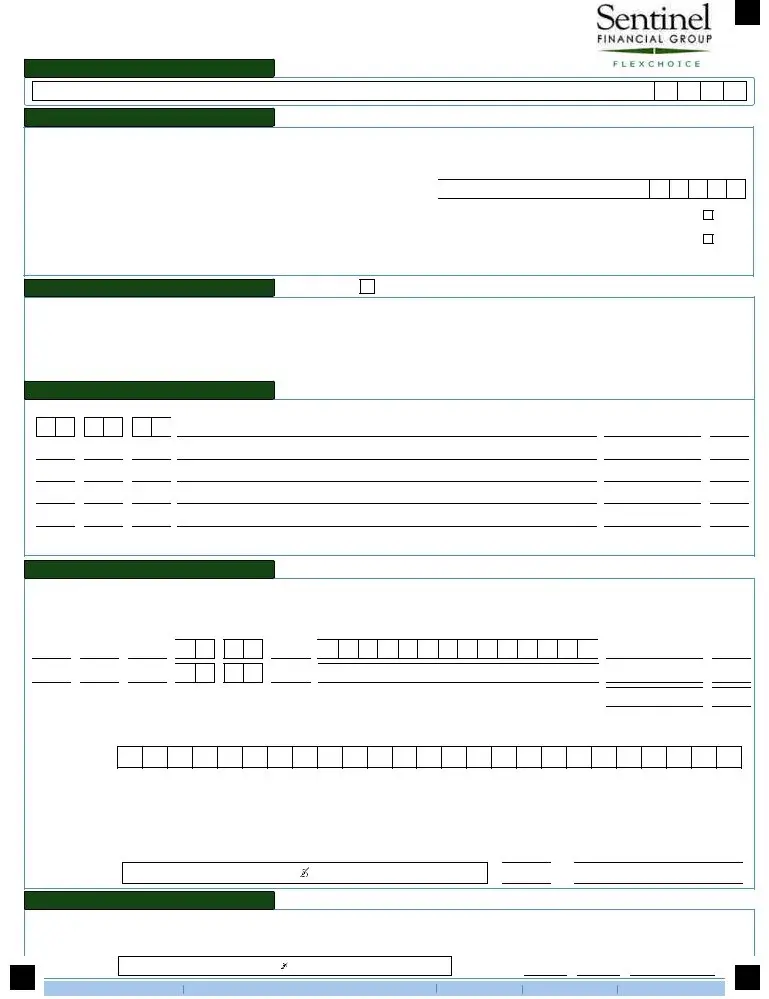

Understanding the intricacies of submitting a claim for reimbursement through Sentinel Benefits can seem daunting at first glance, but with the right guidance, it becomes a straightforward process. At its core, the Sentinel Benefits Reimbursement Claim Form serves as a vital tool for individuals wishing to claim expenses under their Healthcare and Dependent Care Flexible Spending Accounts. It necessitates detailed employee information, including social security numbers and contact details, along with clear instructions on how to fill out the form properly. For claims to be processed efficiently, it's imperative to attach all necessary documentation, such as evidence of the expense incurred, in the order listed on the form. Importantly, it's noted that receipts, rather than cancelled checks or credit card receipts, serve as valid documentation. With designated sections for both healthcare and dependent care claims, the form not only outlines the types of expenses eligible for reimbursement but also emphasizes the importance of validation, including the service provider's details and the date of service. Moreover, it highlights certain restrictions, like the annual deferral limits for dependent care expenses and the ineligibility of certain costs, offering a comprehensive guide to maximize one's benefits. To facilitate a smooth claim process, Sentinel also provides additional tips such as opting for direct deposit for quicker reimbursements and maintaining personal copies of all submissions for records. Thus, understanding how to meticulously complete and submit this form can significantly enhance the reimbursement experience for participants.

| Question | Answer |

|---|---|

| Form Name | Sentinel Benefits Reimbursement Claim Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sample fsa claim form word format, sentinel benefits dependent care reimbursement form, sentinel benefits claim reimbursement form, sentinel benefits reimbursement form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare and Dependent Care Flexible Spending Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

52040 |

|

|

|

|

|

|

|

Reimbursement Claim Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT CLEARLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

INSTRUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are submitting debit card verification receipts. |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

Home

Office

IMPORTANT INFORMATION: KEEP A COPY OF THIS FORM AND RECEIPTS FOR YOUR RECORDS (Please see page 2 for additional information.)

1.Please complete the appropriate section for each account you are submitting claims (i.e. Dependent Care Account/Healthcare Account).

2.Attach the documentation in the order in which you have the expenses listed.

3.The documentation must contain the date(s) of service, expense/purchase incurred and the name of the service provider.

HEALTHCARE CLAIM INFORMATION

4.Cancelled checks and credit card receipts are not a valid form of documentation.

5.The form must be signed and dated in order to be processed and approved.

6.Please fax or mail the form with receipts to the address below.

.

Date of Service |

Service Provider/Description of Service (i.e. |

Amount Requested |

MM. DD . YY

.

.

.

. .

.

.

.

.

. .

.

.

.

.

. .

.

.

.

.

. .

.

.

.

Total Reimbursement Requested |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPENDENT CARE CLAIM INFORMATION

Please provide a statement from the Dependent Care Provider listing the following information. If no statement is provided, complete the Certification information below.

a. Begin and end dates of service |

c. Provider's signature |

b. Description of charges |

d. Tax ID# or Social Security# of Provider |

Start Date

MMDDYY

.

. .

.

.

.

.

.

MM

.

.

End Date

DDYY

.

.

Dependent's Name |

Amount Requested |

.

.

.

.

Total Reimbursement Requested

.

.

Dependent Care Provider's Certification of Services Rendered (in lieu of a printed statement from Provider)

I, the signer below, certify that the services listed above were rendered by me and the charges incurred have been paid.

Provider of Service

Dependent Care Provider's Company Name |

|

Signee's Name |

|

|

|

|

|

|

|

|

|

Address, City, State |

|

|

|

|

|

|

|

|

Tax ID (Required)

Provider's Signature

CERTIFICATION

-

-

I request payment from my reimbursement account for the expenses itemized above. I certify that I have not previously requested reimbursement under this plan or from any other source for these expenses. I also certify that the total dependent care expenses (if any) for which I am requesting this plan year do not exceed the lesser of my or my spouses earned income for the year.

I further certify that I have met all of the requirements for eligible healthcare and dependent care expenses as described on the second page of this form. I understand that reimbursement expenses cannot be claimed on my personal income tax return.

Signature

Date

.

.

.

.

Sentinel Financial Group

55 Walkers Brook Drive, P.O. Box 5005 Reading, MA 01867 Tel:

Fax:

www.sentinelgroup.com

Draft

ADDITIONAL INFORMATION REGARDING REIMBURSEMENTS

HEALTHCARE ELIGIBLE EXPENSE INFORMATION

In general, an employee may be reimbursed for a healthcare expense which qualifies as a deduction on the federal income tax return, but which has not or will not be reimbursed by any other source and has not been or will not be deducted on the employee's income tax return. Some examples of eligible expenses include

More information about Healthcare Expenses, including eligible

Required Supporting Documentation

The following supporting documentation must be attached to this form:

Expenses covered by your Healthcare plan - medical, dental and vision expenses covered by your Healthcare plans must be submitted under that plan first. Attach a copy of the Explanation of Benefits statement to claim amounts not paid by your Healthcare Plan.

For all other expenses, attach bills that clearly state:

Date service was rendered or purchased

Date service was rendered or purchased

Description of service or item

Description of service or item

Name of provider of service

Name of provider of service

Amount charged

Amount charged

Name of the person receiving the service

Name of the person receiving the service

Proof of Purchase

Proof of Purchase

Dental Care

Receipts related to Dental claims must include a description of the service provided. Cosmetic services are not eligible for reimbursement.

DEPENDENT CARE ELIGIBLE EXPENSES

In general, the following rules apply to dependent care expenses:

No participant shall be allowed to defer more than $5,000, if married filing jointly, or $2,500 if married filing separately. The maximum that can be deferred under this program shall be the lesser of $5,000 or the earned income of the participant's spouse.

No participant shall be allowed to defer more than $5,000, if married filing jointly, or $2,500 if married filing separately. The maximum that can be deferred under this program shall be the lesser of $5,000 or the earned income of the participant's spouse.

Overnight camp and kindergarten are not eligible expenses.

Overnight camp and kindergarten are not eligible expenses.

The expenses must be employment related expenses for the care of a dependent of the employee who's entitled to a dependent deduction under the Internal Revenue Code section 151(e), or a dependent who is physically or mentally incapable of caring for himself or herself.

The expenses must be employment related expenses for the care of a dependent of the employee who's entitled to a dependent deduction under the Internal Revenue Code section 151(e), or a dependent who is physically or mentally incapable of caring for himself or herself.

Payments cannot be made to a person who is claimed as a dependent by the employee.

Payments cannot be made to a person who is claimed as a dependent by the employee.

If the services are provided by a Dependent Care center which provides care for more than six individuals, the center must comply with state and local laws.

If the services are provided by a Dependent Care center which provides care for more than six individuals, the center must comply with state and local laws.

Dependent Care expenses are reimbursed when payroll contributions are received and processed on our administration system.

Dependent Care expenses are reimbursed when payroll contributions are received and processed on our administration system.

Dependent Care Claim Checklist

1.Complete the requested information on the front of this form.

2.Have the Caregiver sign the front of this form.

3.Attach a cancelled check or receipt from the caregiver if one exists.

4.Provide the Tax ID# or Social Security Number of the Service Provider.

NOTE: DIRECT DEPOSIT IS THE QUICKEST WAY TO RECEIVE YOUR REIMBURSEMENT

Reimbursements will be faster if you have signed up for direct deposit. To request direct deposit, simply go to our website www.sentinelgroup.com, click on "customer service" and then click on "forms." Complete the FlexChoice Direct Deposit form and send it directly to Sentinel Benefits.

In an effort to provide you with faster notification of processed claims, we will send you an

Claims faxed in good order by 5:00 PM ET on Wednesday will be processed by Friday. (Holidays may impact this schedule.) Reimbursement checks are mailed via US Postal Service.

Sentinel Financial Group 55 Walkers Brook Drive, Suite 100, P.O. Box 5005 Reading, MA 01867 Tel: