sf 2818 can be completed with ease. Simply try FormsPal PDF editor to complete the job fast. Our tool is continually developing to give the very best user experience attainable, and that's thanks to our commitment to constant enhancement and listening closely to customer opinions. To begin your journey, take these basic steps:

Step 1: Press the "Get Form" button above. It's going to open up our pdf tool so you could begin completing your form.

Step 2: After you access the PDF editor, you will get the document ready to be filled in. Other than filling out various fields, it's also possible to do many other actions with the form, particularly putting on any words, modifying the original text, adding images, signing the PDF, and much more.

With regards to the blanks of this precise PDF, here is what you should do:

1. Whenever completing the sf 2818, be sure to incorporate all of the important fields in the relevant section. This will help facilitate the work, allowing for your information to be processed quickly and accurately.

2. Right after performing the previous step, go to the next part and fill out the necessary particulars in these blank fields - What is the Extra Benefit The, What if I dont want Basic, Will I have accidental death and, What do I pay As an annuitant you, What if I want to change my, and SF Instructions page of.

3. This third step should be fairly simple, How many multiples of Option B, the years of service immediately, all service during which those, Will my Option B andor Option C, cid, What is Full Reduction This means, Option A is free starting on the, What do I pay for Options B and C, For Full Reduction multiples, What if I want to change my, and SF Instructions page of Revised - each one of these fields has to be completed here.

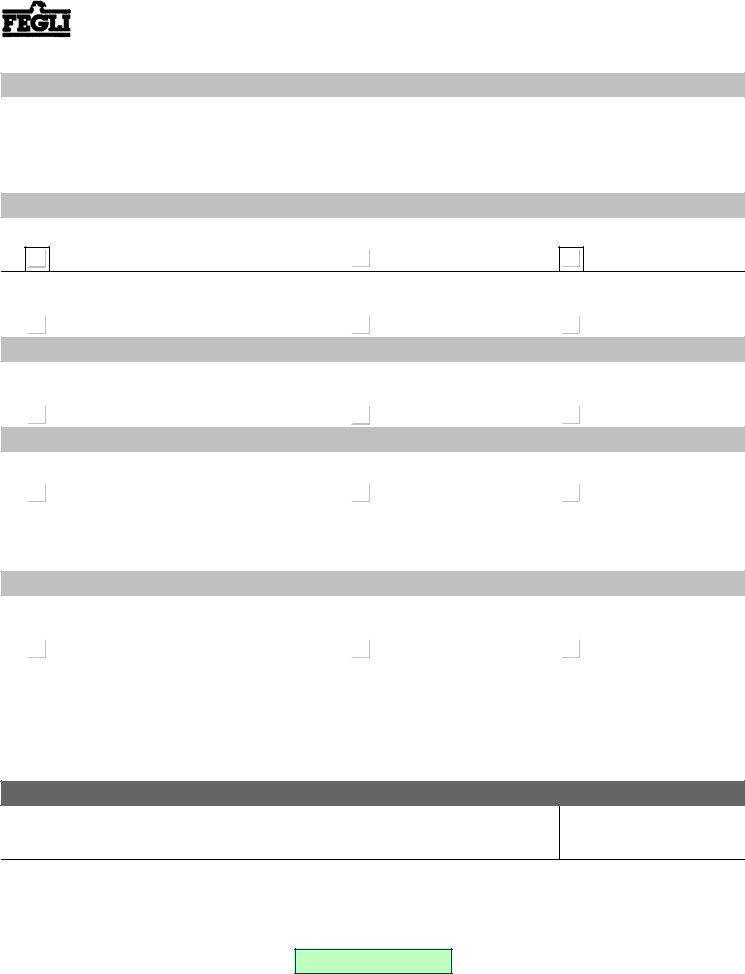

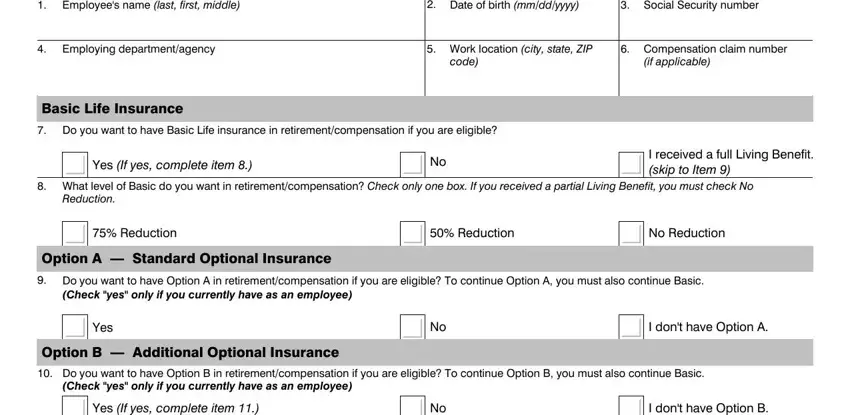

4. The next part needs your details in the subsequent parts: Identifying Information Employees, Employing departmentagency, Date of birth mmddyyyy, Social Security number, Work location city state ZIP, Compensation claim number, code, if applicable, Basic Life Insurance Do you want, Yes If yes complete item, I received a full Living Benefit, What level of Basic do you want, Reduction, Reduction, and Reduction. Make sure you fill in all requested details to move onward.

People generally get some things incorrect when filling in Employing departmentagency in this part. You should read twice everything you enter here.

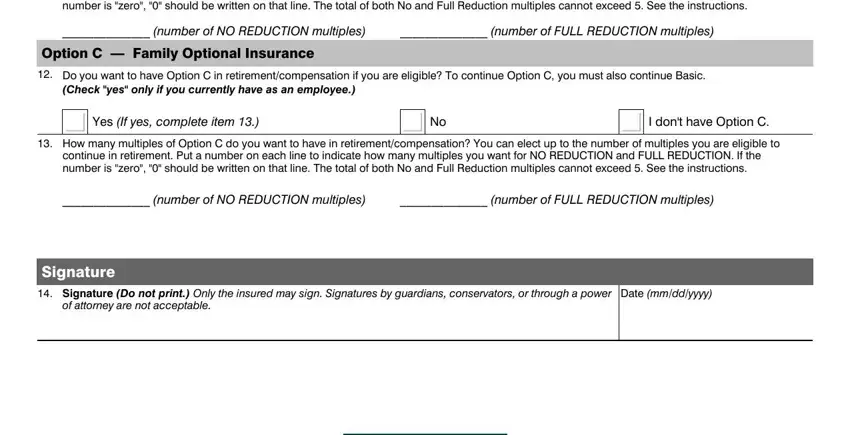

5. Now, this last subsection is what you will have to wrap up before finalizing the document. The blanks at this point include the following: continue in retirement Put a, number of NO REDUCTION multiples, number of FULL REDUCTION multiples, Option C Family Optional Insurance, Do you want to have Option C in, Check yes only if you currently, Yes If yes complete item, I dont have Option C, How many multiples of Option C do, continue in retirement Put a, number of NO REDUCTION multiples, number of FULL REDUCTION multiples, Signature Signature Do not print, and of attorney are not acceptable.

Step 3: Prior to moving forward, double-check that all blank fields are filled in properly. When you’re satisfied with it, press “Done." Acquire your sf 2818 as soon as you join for a free trial. Quickly use the pdf document within your FormsPal account page, together with any modifications and changes automatically synced! We do not sell or share the information that you enter whenever filling out forms at FormsPal.