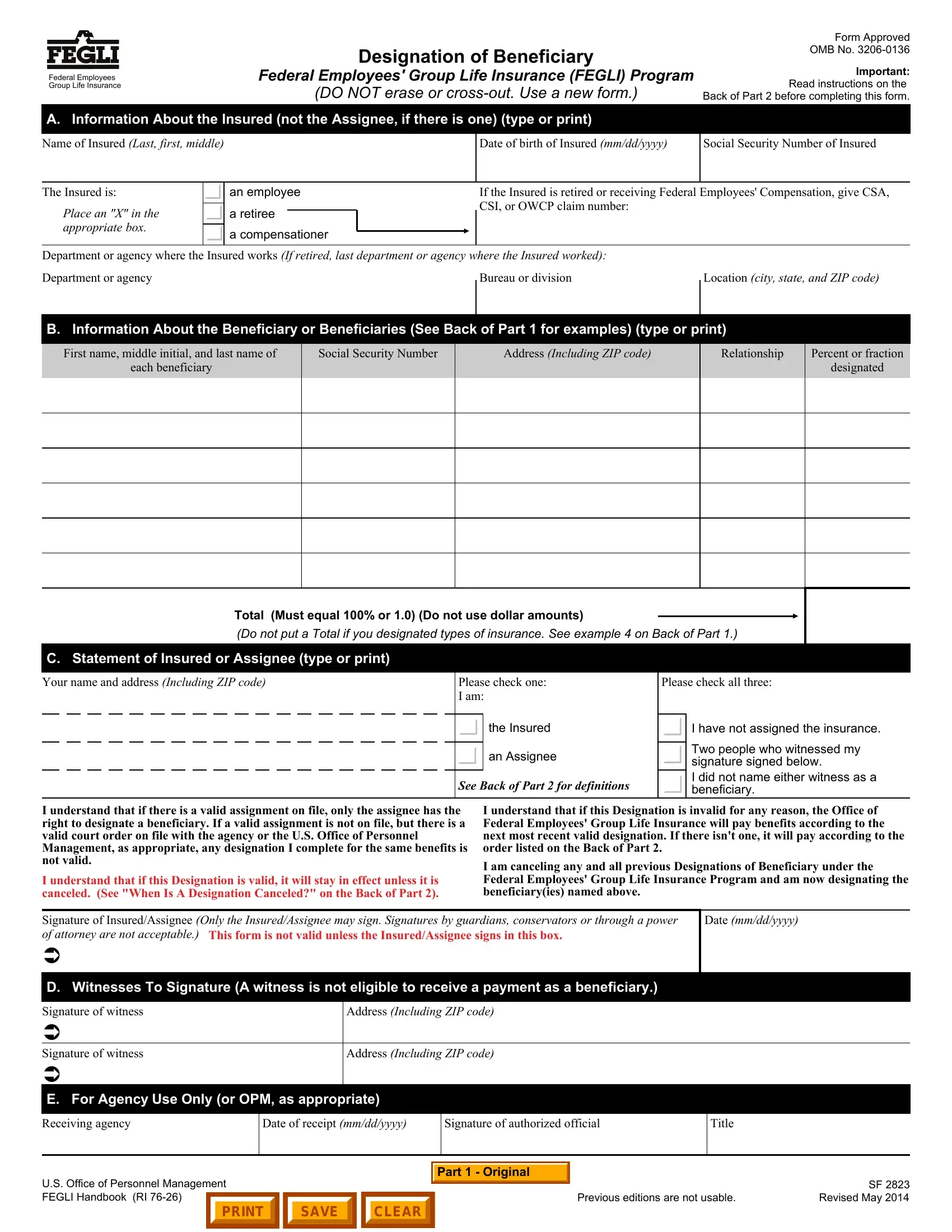

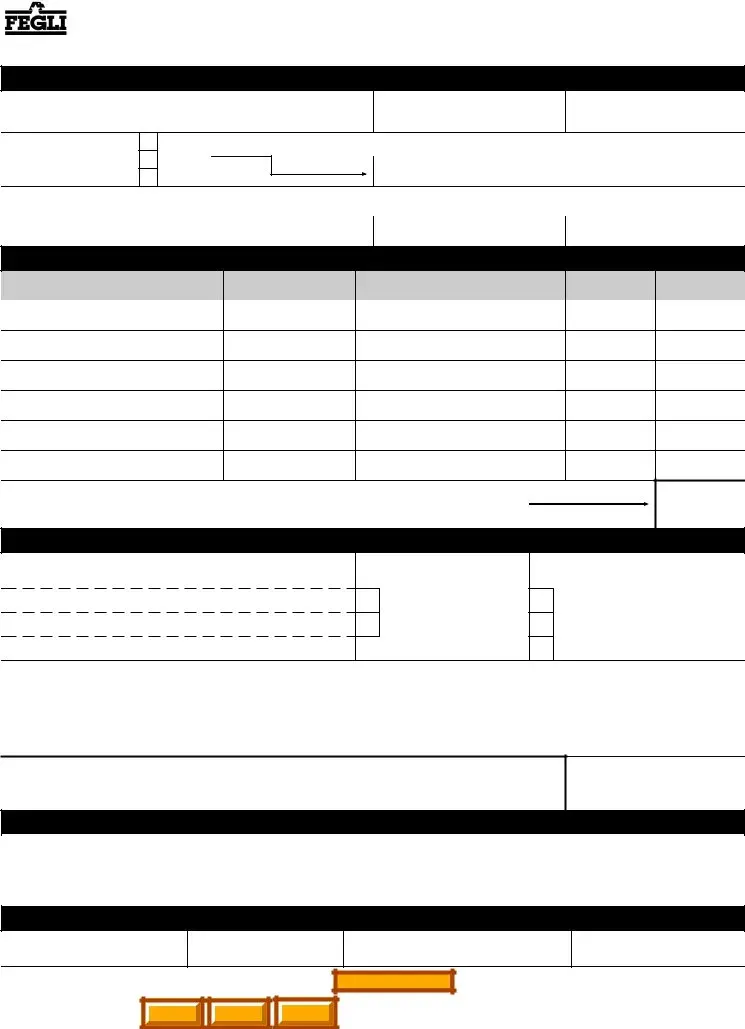

Who receives benefits when the Insured dies? By law, the Office of Federal Employees' Group Life Insurance (OFEGLI) pays benefits in this order:

If the Insured assigned ownership of his/her insurance (usually by filing an RI 76-10, Assignment of Life Insurance), OFEGLI will pay:

First, to the beneficiary(ies) the assignee(s) validly designated; Second, if none, to the assignee(s).

If the Insured did not assign ownership and there is a valid court order (see Part 870 of title 5, Code of Federal Regulations) on file with the agency or OPM, as appropriate, OFEGLI will pay benefits according to the court order.

If the Insured did not assign ownership and there is no valid court order on file with the agency or OPM, as appropriate, then OFEGLI will pay:

First, to the beneficiary(ies) the Insured validly designated; Second, if none, to the Insured's widow or widower;

Third, if none of the above, to the Insured's child or children in equal shares, and the descendants of any deceased children (a court will usually have to appoint a guardian to receive payment for a minor child); Fourth, if none of the above, to the Insured's parents in equal shares, or the entire amount to the surviving parent;

Fifth, if none of the above, to the court-appointed executor or administrator of the Insured's estate;

Sixth, if none of the above, to the Insured's other next of kin entitled under the laws of the State where the Insured lived.

Do I have to designate a beneficiary? No. But if you want OFEGLI to pay differently than listed above and you have not assigned the life insurance and there is no valid court order on file with the agency or OPM, as appropriate, you need to designate a beneficiary.

What if one of the beneficiaries dies or is disqualified for any reason? Unless you indicate otherwise on your designation of beneficiary, OFEGLI will distribute that beneficiary's share equally among the surviving beneficiaries, or entirely to the sole survivor.

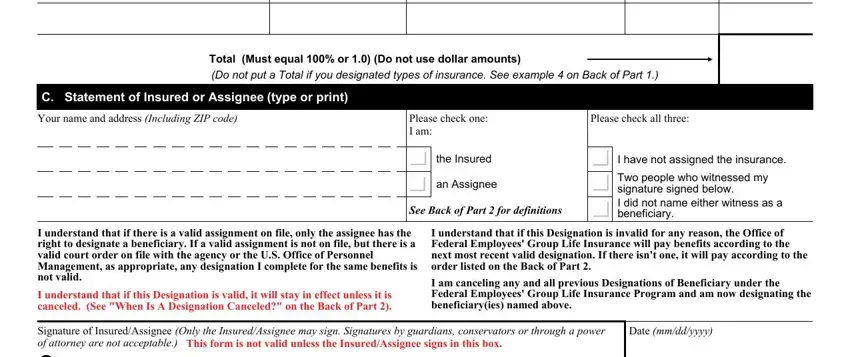

What if none of the beneficiaries is living when the Insured dies? OFEGLI will pay the benefits according to the order of precedence listed above.

Can I cancel or change this designation at any time? Yes, you may cancel or change your designation at any time, without the knowledge of or consent of the beneficiary(ies), unless you assigned the insurance or there is a valid court order on file with the agency or OPM, as appropriate.

Is a change or cancellation of beneficiary in my last will or testament valid?

It is valid only if you sign your will, two people who witnessed your signature sign your will, and your agency (or OPM, for retirees or insured compensationers) receives your will before the Insured's death.

What if I don't know a beneficiary's social security number? If you don't know the number, leave it blank. But having the number helps speed up the payment of benefits.

Can a witness receive benefits as a designated beneficiary? No.

Who can I name as a beneficiary? You may name any person, firm, corporation or legal entity (except an agency of the Federal or District of Columbia government).

Can I use a common disaster clause? Yes. A common disaster clause is a statement that says that a designated beneficiary is entitled to the benefits only if he/she survives the Insured by a specified minimum number of days. The number of days cannot exceed 30. You can name a contingent beneficiary. If you don't name a

contingent and your beneficiary does not live long enough to qualify, OFEGLI will pay according to the order listed in the first column.

Can I designate a trust? Yes. See examples 5 and 6 on the Back of Part 1. Those examples name a contingent beneficiary in case the trust is not valid. You don't have to name a contingent beneficiary unless you want to. If the trust is not valid, and you do not name a contingent, OFEGLI will pay according to the order listed in the first column. The trust designation should include the name of the grantor, the trust name (if different), the name(s) of the trustees, and the date the trust was signed.

When is a designation canceled? A designation of beneficiary is automatically canceled 31 days after the Insured stops being insured. It is also canceled if either the Insured or assignee assigns the insurance or if the Insured or assignee submits another valid designation.

What if the Insured elected a full living benefit? Then there is no Basic left. So if you want to designate different types of insurance to different beneficiaries (see example 4 on the Back of Part 1), you should only list Option A and Option B.

Who can sign this form? The Insured or Assignee (if applicable) must sign this form. The signature of a guardian, conservator or other fiduciary (including, but not limited to, those acting according to a Power of Attorney or a Durable Power of Attorney) is not acceptable.

What if I erase or cross out something on this form? You should complete another form. Erasures, cross-outs and alterations cause a delay in the payment of benefits and may make the entire designation invalid.

What if I need more room? Write "See Attached" in Part B of the form. Use a blank sheet. Print your name, date of birth and social security number at the top of the attachment. List the information required in Part B for each beneficiary. Sign the form and attachment. Have the same two people witness both of your signatures and sign the form and attachment.

Where can I get more information? The FEGLI Handbook (RI 76-26) and FEGLI Booklet (FE 76-21 or FE 76-20 for Postal employees) contain more information. You can read them at www.opm.gov/healthcare-insurance/life-insurance.

Where should I send this form? Send it to the Insured's employing agency if the Insured:

is an employee; or

has been receiving compensation payments from the Office of Workers' Compensation Programs for less than 12 months and is still on the agency's rolls as an employee.

Send it to the Office of Personnel Management, Retirement Operations Center, P.O. Box 45, Boyers, PA 16017-0045 if the Insured:

is a retiree; or

is receiving compensation payments from the Office of Workers' Compensation Programs and is not still employed or has been receiving compensation payments for at least 12 months.

The agency or OPM will note receipt in section E of the form and return a copy to you as evidence that it received and filed the original.

PROPERLY COMPLETED DESIGNATIONS ARE NOT VALID UNLESS THE APPROPRIATE OFFICE LISTED ABOVE RECEIVES THEM BEFORE THE INSURED'S DEATH.