When using the online PDF editor by FormsPal, you can easily complete or change form sfn 41263 for 2019 right here and now. To have our editor on the cutting edge of efficiency, we work to integrate user-driven capabilities and improvements on a regular basis. We are always looking for suggestions - play a pivotal part in remolding PDF editing. This is what you'll need to do to begin:

Step 1: Open the form in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: As soon as you access the tool, you will get the document all set to be filled out. Besides filling out various fields, you could also do other actions with the Document, such as adding any text, modifying the original textual content, adding illustrations or photos, affixing your signature to the document, and a lot more.

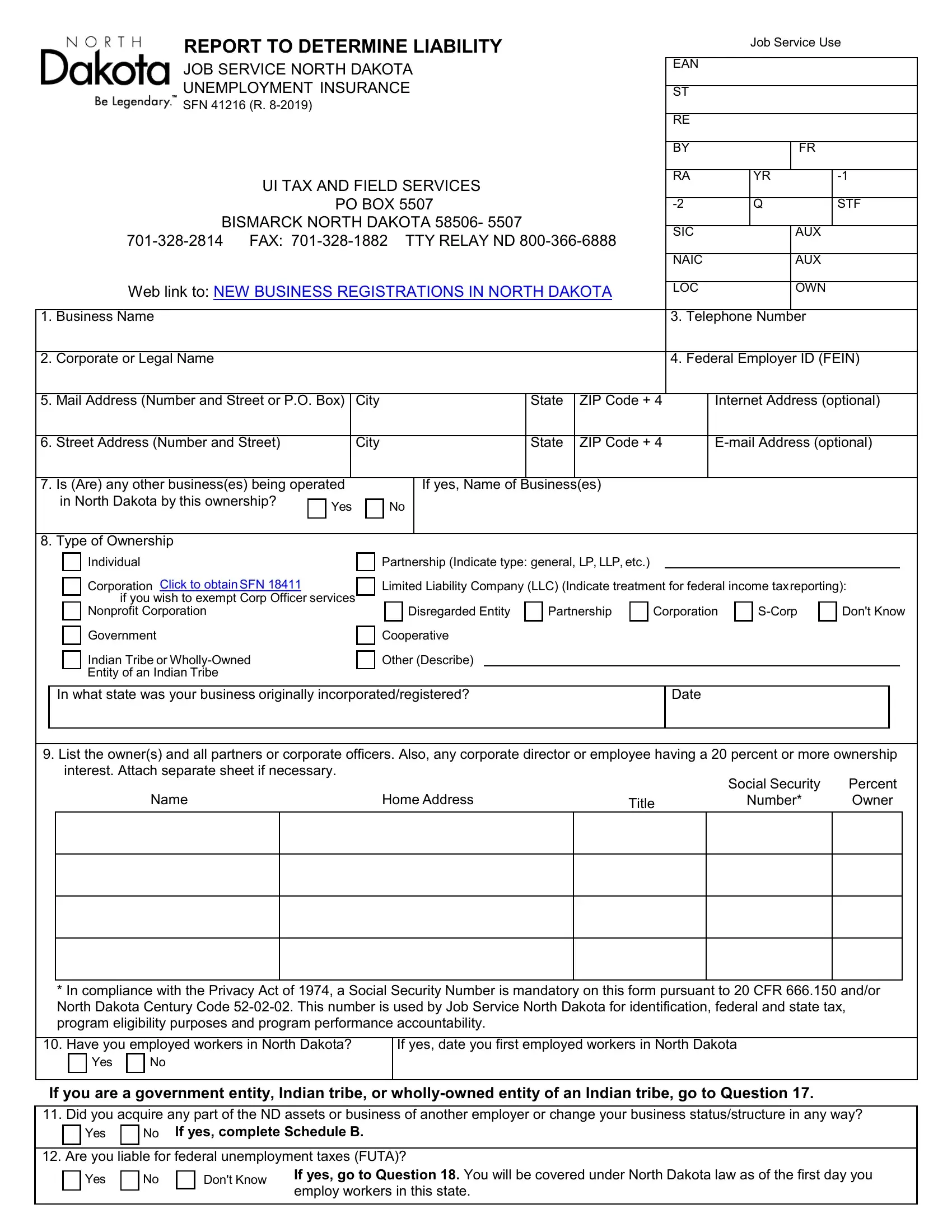

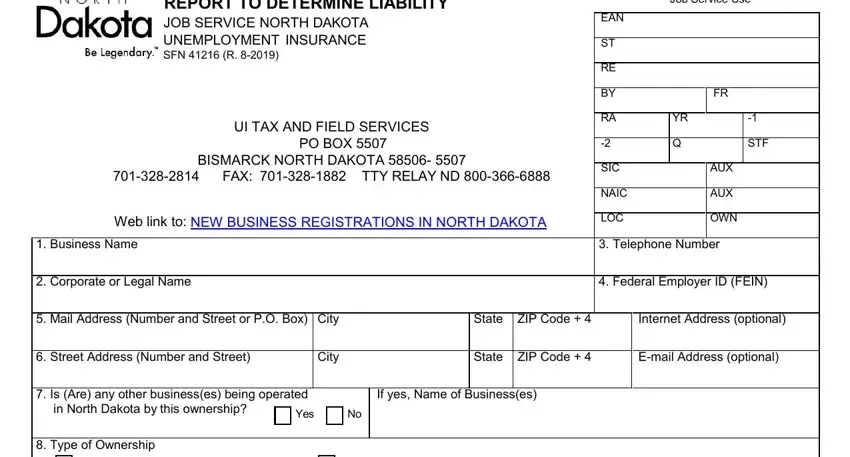

When it comes to fields of this precise PDF, here's what you want to do:

1. Complete your form sfn 41263 for 2019 with a group of necessary blanks. Consider all of the required information and make certain there's nothing overlooked!

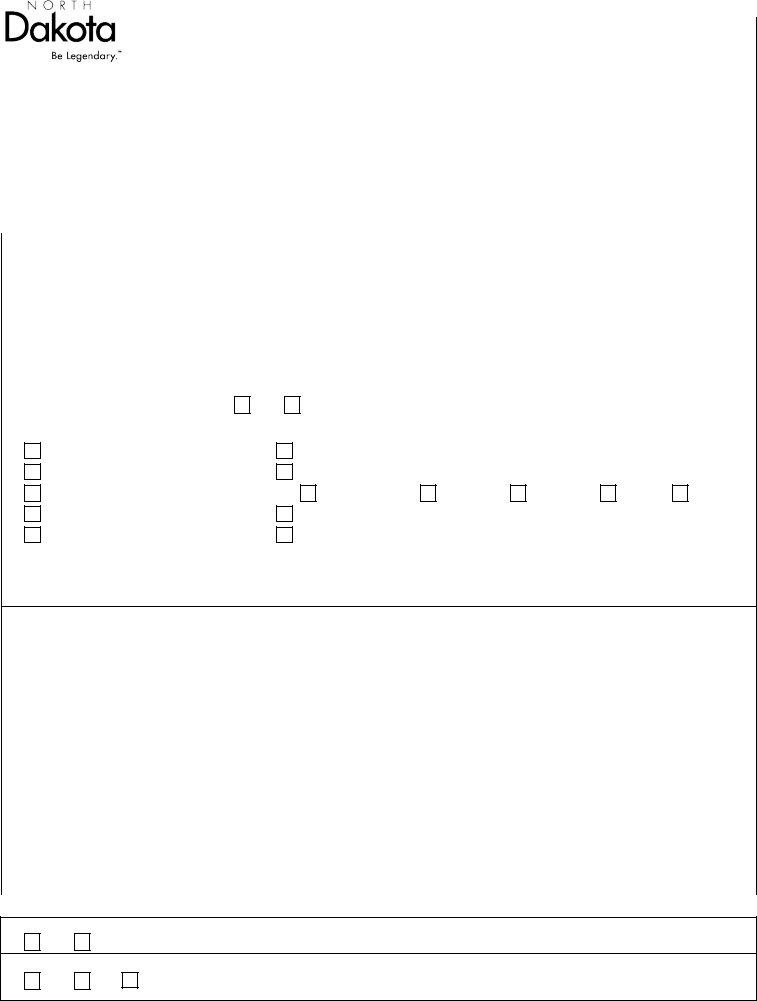

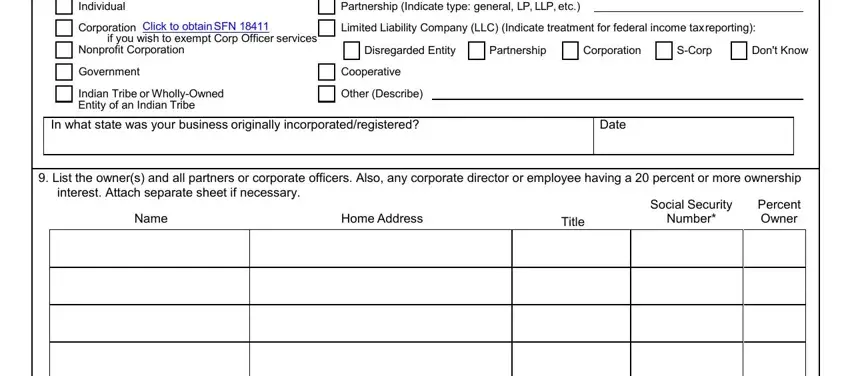

2. Once your current task is complete, take the next step – fill out all of these fields - Individual, Corporation Click to obtain SFN, if you wish to exempt Corp Officer, Nonprofit Corporation, Partnership Indicate type general, Limited Liability Company LLC, Disregarded Entity, Partnership, Corporation, SCorp, Dont Know, Government, Indian Tribe or WhollyOwned Entity, Cooperative, and Other Describe with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

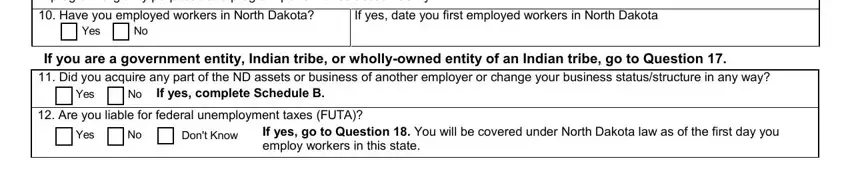

3. Your next step will be hassle-free - fill out all of the form fields in In compliance with the Privacy, Have you employed workers in, If yes date you first employed, Yes, If you are a government entity, Yes, If yes complete Schedule B, Are you liable for federal, Yes, Dont Know, and If yes go to Question You will be in order to complete this part.

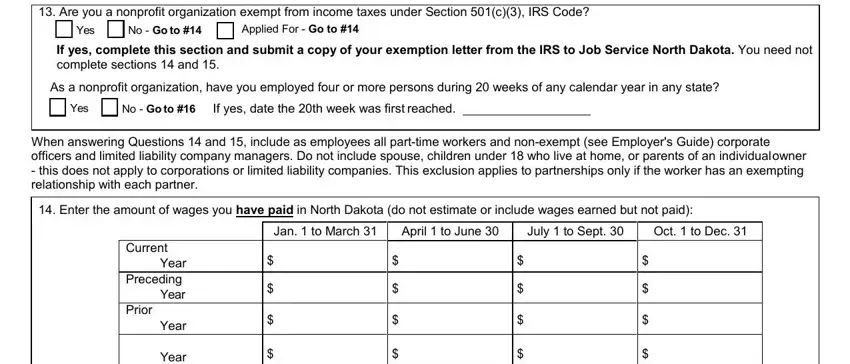

4. The subsequent section will require your information in the subsequent areas: Are you a nonprofit organization, Yes, No Go to, Applied For Go to, If yes complete this section and, As a nonprofit organization have, Yes, No Go to, If yes date the th week was first, When answering Questions and, Enter the amount of wages you, Jan to March, April to June, July to Sept, and Oct to Dec. Ensure you fill in all needed info to go forward.

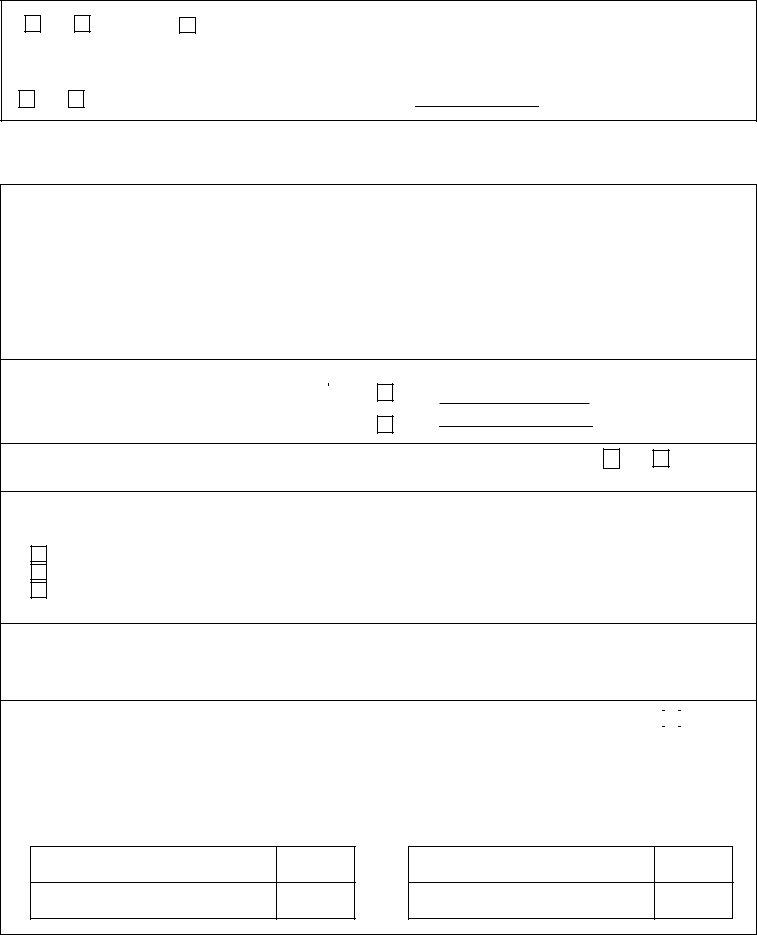

Always be very attentive while filling out Applied For Go to and Yes, because this is where most people make some mistakes.

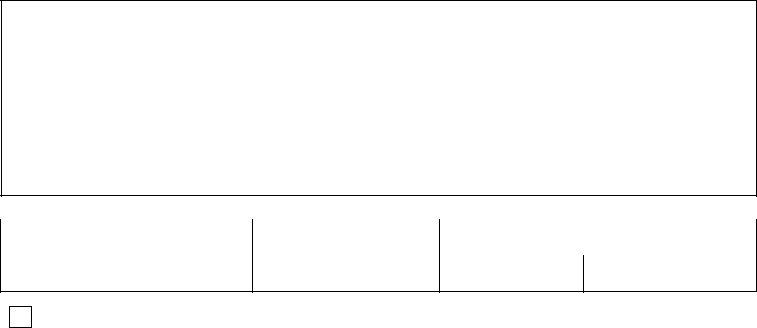

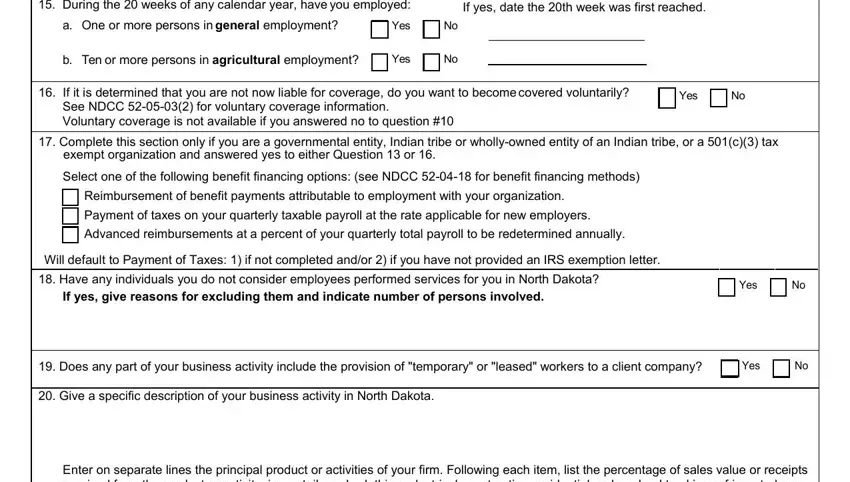

5. To wrap up your form, the particular area has a few additional blank fields. Entering During the weeks of any calendar, If yes date the th week was first, a One or more persons in general, Yes, b Ten or more persons in, Yes, If it is determined that you are, Yes, Complete this section only if you, exempt organization and answered, Select one of the following, Reimbursement of benefit payments, Payment of taxes on your quarterly, Advanced reimbursements at a, and Will default to Payment of Taxes is going to wrap up everything and you will be done in a flash!

Step 3: Go through everything you have entered into the blanks and then click on the "Done" button. Try a free trial option at FormsPal and acquire instant access to form sfn 41263 for 2019 - which you'll be able to then use as you wish in your FormsPal account page. FormsPal offers protected document editing without personal information recording or sharing. Rest assured that your data is secure here!