Form SSA-11-BK (06-2017) uf (06-2017) |

|

|

|

|

|

Destroy Prior Editions |

|

|

|

|

Page 1 of 10 |

SOCIAL SECURITY ADMINISTRATION |

|

|

|

|

OMB No. 0960-0014 |

|

|

FOR SSA USE ONLY |

|

FOR SSA USE ONLY |

|

|

|

|

|

|

|

|

Name or |

Program |

Date of |

Type Gdn. Cus. Inst. |

Nam. |

|

Bene. Sym. |

Birth |

|

|

|

|

|

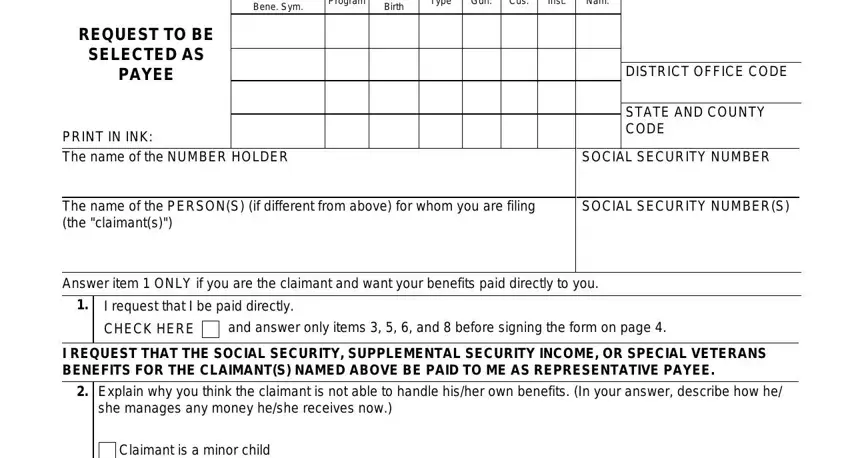

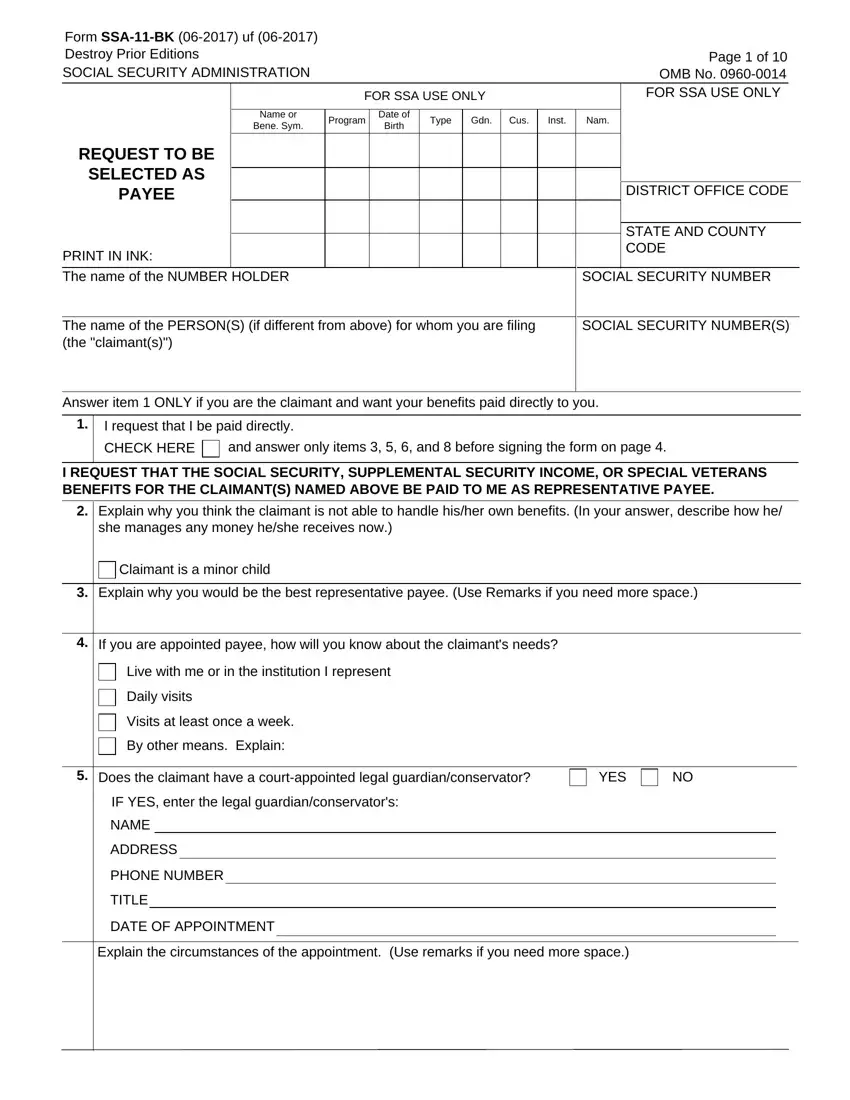

REQUEST TO BE |

|

|

|

|

|

SELECTED AS |

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE |

|

|

|

|

DISTRICT OFFICE CODE |

|

|

|

|

|

|

|

|

|

|

|

|

STATE AND COUNTY |

|

|

|

|

|

PRINT IN INK: |

|

|

|

CODE |

|

|

|

|

|

The name of the NUMBER HOLDER |

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

The name of the PERSON(S) (if different from above) for whom you are filing |

|

SOCIAL SECURITY NUMBER(S) |

(the "claimant(s)") |

|

|

|

|

|

Answer item 1 ONLY if you are the claimant and want your benefits paid directly to you.

1.I request that I be paid directly.

CHECK HERE  and answer only items 3, 5, 6, and 8 before signing the form on page 4.

and answer only items 3, 5, 6, and 8 before signing the form on page 4.

I REQUEST THAT THE SOCIAL SECURITY, SUPPLEMENTAL SECURITY INCOME, OR SPECIAL VETERANS BENEFITS FOR THE CLAIMANT(S) NAMED ABOVE BE PAID TO ME AS REPRESENTATIVE PAYEE.

2.Explain why you think the claimant is not able to handle his/her own benefits. (In your answer, describe how he/ she manages any money he/she receives now.)

Claimant is a minor child

Claimant is a minor child

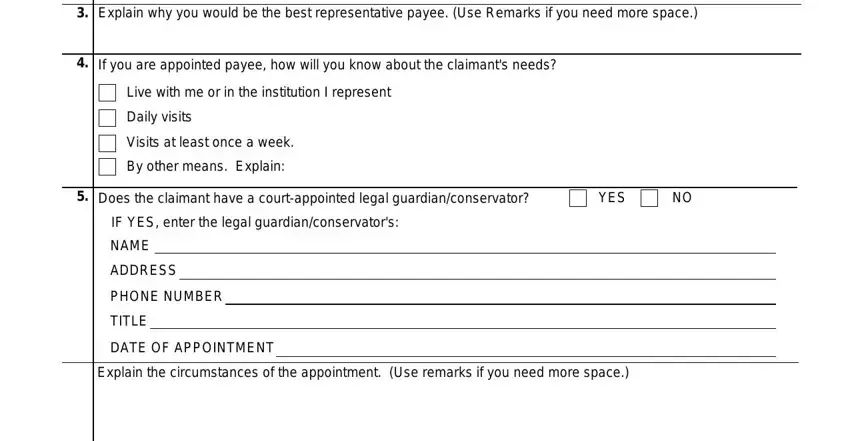

3.Explain why you would be the best representative payee. (Use Remarks if you need more space.)

4.If you are appointed payee, how will you know about the claimant's needs?

Live with me or in the institution I represent

Live with me or in the institution I represent

Daily visits

Daily visits

Visits at least once a week.

Visits at least once a week.

By other means. Explain:

By other means. Explain:

5. Does the claimant have a court-appointed legal guardian/conservator? |

YES |

NO |

|

IF YES, enter the legal guardian/conservator's: |

|

|

|

|

NAME |

|

|

|

|

|

ADDRESS |

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

TITLE |

|

|

|

|

|

DATE OF APPOINTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Explain the circumstances of the appointment. (Use remarks if you need more space.) |

|

|

|

Form SSA-11-BK (06-2017) uf (06-2017) |

|

Page 2 of 10 |

|

|

|

|

|

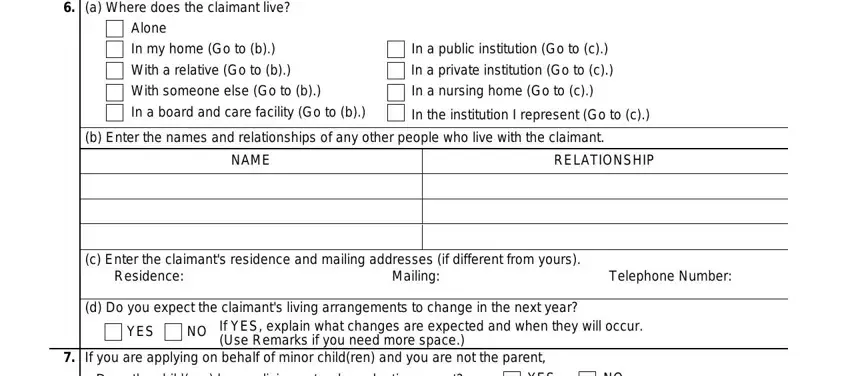

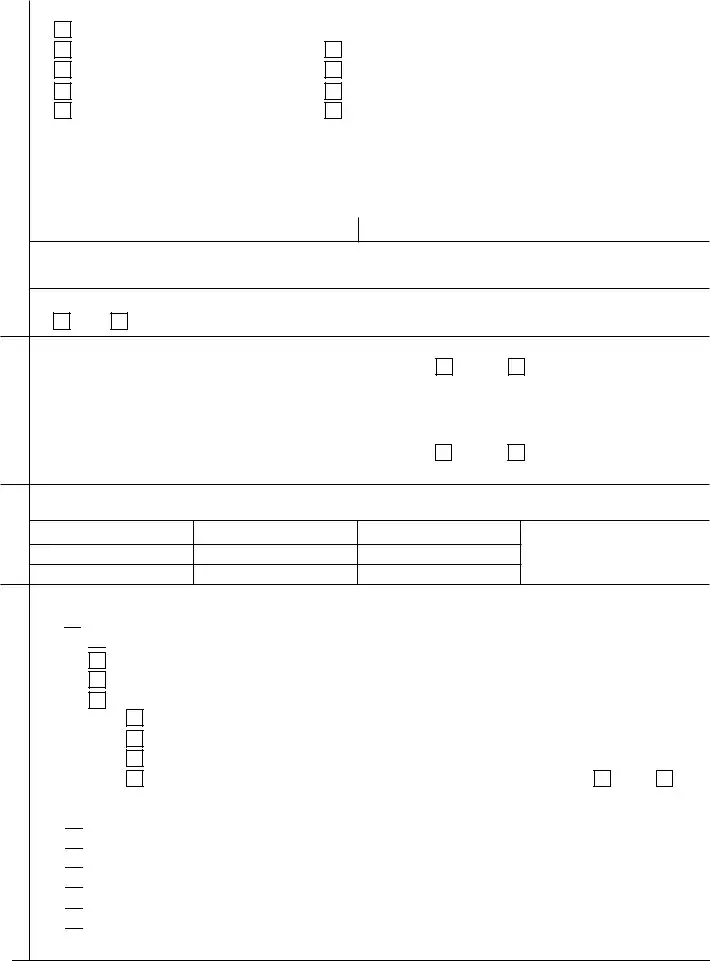

6. (a) Where does the claimant live? |

|

|

|

|

Alone |

|

|

|

|

In my home (Go to (b).) |

In a public institution (Go to (c).) |

|

With a relative (Go to (b).) |

In a private institution (Go to (c).) |

|

With someone else (Go to (b).) |

In a nursing home (Go to (c).) |

|

In a board and care facility (Go to (b).) |

In the institution I represent (Go to (c).) |

|

|

|

|

(b) Enter the names and relationships of any other people who live with the claimant. |

|

|

NAME |

|

RELATIONSHIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Enter the claimant's residence and mailing addresses (if different from yours). |

|

Residence: |

Mailing: |

Telephone Number: |

(d) Do you expect the claimant's living arrangements to change in the next year?

YES NO If YES, explain what changes are expected and when they will occur. (Use Remarks if you need more space.)

7.If you are applying on behalf of minor child(ren) and you are not the parent,

|

|

|

|

|

|

|

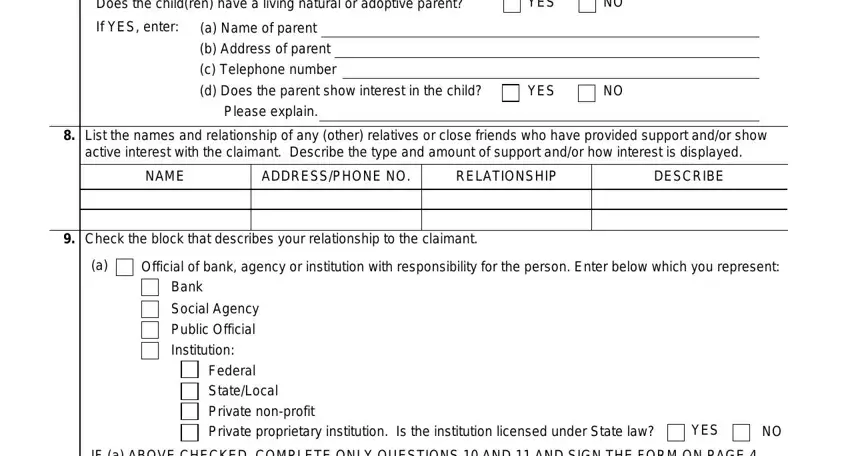

Does the child(ren) have a living natural or adoptive parent? |

YES |

NO |

If YES, enter: (a) Name of parent |

|

|

|

(b) Address of parent |

|

|

|

(c) Telephone number |

|

|

|

(d) Does the parent show interest in the child? |

YES |

NO |

Please explain. |

|

|

|

8.List the names and relationship of any (other) relatives or close friends who have provided support and/or show active interest with the claimant. Describe the type and amount of support and/or how interest is displayed.

NAME |

ADDRESS/PHONE NO. |

RELATIONSHIP |

DESCRIBE |

|

|

|

|

|

|

|

|

9.Check the block that describes your relationship to the claimant.

(a)

Official of bank, agency or institution with responsibility for the person. Enter below which you represent:

Official of bank, agency or institution with responsibility for the person. Enter below which you represent:

Bank

Bank

Social Agency |

|

|

Public Official |

|

|

Institution: |

|

|

Federal |

|

|

State/Local |

|

|

Private non-profit |

YES |

|

Private proprietary institution. Is the institution licensed under State law? |

NO |

IF (a) ABOVE CHECKED, COMPLETE ONLY QUESTIONS 10 AND 11 AND SIGN THE FORM ON PAGE 4.

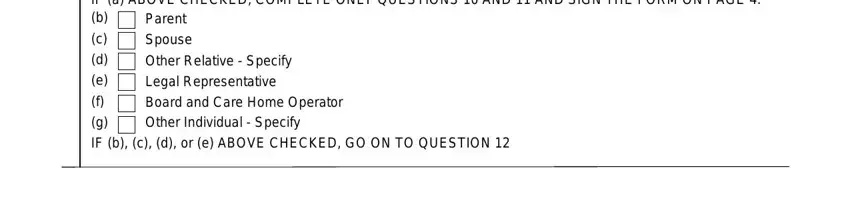

(b) Parent

Parent

(c) Spouse

Spouse

(d) Other Relative - Specify

Other Relative - Specify

(e) Legal Representative

Legal Representative

(f) Board and Care Home Operator

Board and Care Home Operator

(g) Other Individual - Specify

Other Individual - Specify

IF (b), (c), (d), or (e) ABOVE CHECKED, GO ON TO QUESTION 12

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 3 of 10 |

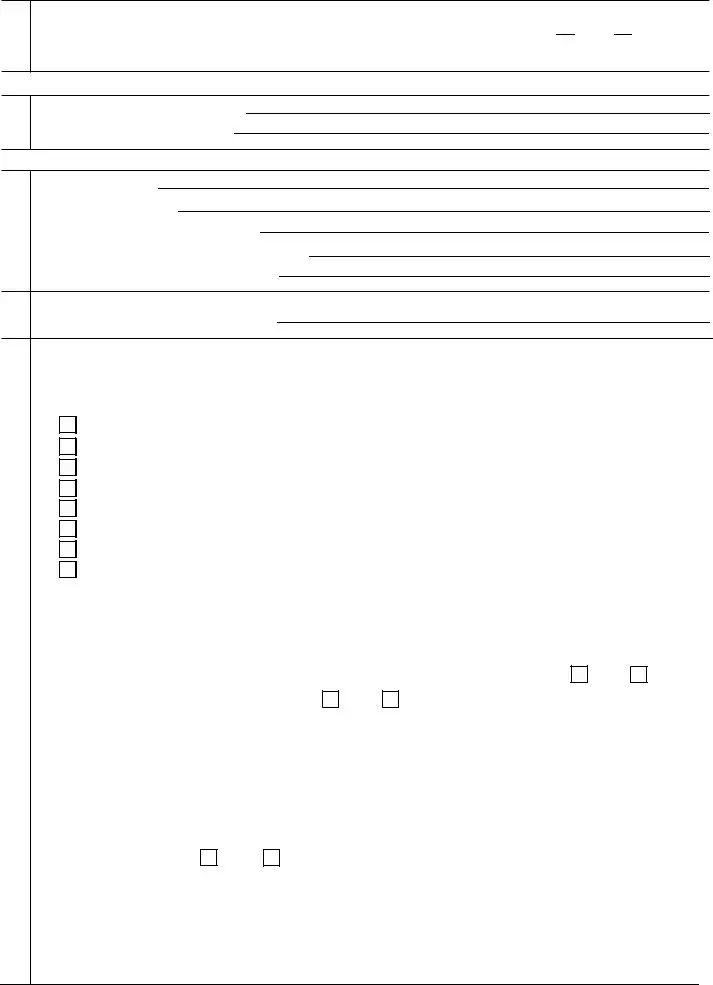

10.Does the claimant owe you/your organization any money now or will he/she owe you money in the future?

YES

YES

NO

NO

If YES, enter the amount he/she owes you/your organization, the date(s) was/will be incurred and describe why the debt was/will be incurred.

INFORMATION ABOUT INSTITUTIONS, AGENCIES AND BANKS APPLYING TO BE REPRESENTATIVE PAYEE

11.(a) Enter the name of the institution

(b) Enter the EIN of the institution

INFORMATION ABOUT INDIVIDUALS APPLYING TO BE REPRESENTATIVE PAYEE

12.Enter: YOUR NAME

DATE OF BIRTH

SOCIAL SECURITY NUMBER

ANY OTHER NAME YOU HAVE USED

OTHER SSN'S YOU HAVE USED

13.How long have you known the claimant?

14.If the claimant lives with you, who takes care of the claimant when work or other activity takes you away from home?

|

What is his/her relationship to the claimant? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

(a) Main source of your income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employed (answer (b) below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-employed (Type of Business |

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security benefits (Claim Number |

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pension (describe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

Supplemental Security Income payments (Claim Number |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Temporary Assistance For Needy Families (TANF |

|

|

|

|

|

) |

|

|

Other State or Public Assistance (describe |

|

|

|

|

|

|

|

) |

|

|

Other (describe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Enter your employer's name and address: |

|

|

|

|

|

|

|

|

|

|

|

How long have you been employed by this employer? |

|

|

|

|

|

|

|

|

|

|

(If less than 1 year, enter name and address of previous employer in Remarks.) |

|

|

|

|

|

|

|

|

|

|

16. |

Do you give Social Security permision to conduct a criminal background check on you? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

(a) Have you ever been convicted of a felony? |

YES |

NO |

|

|

|

|

|

|

If YES: What was the crime? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On what date were you convicted? |

|

|

|

|

|

|

|

|

|

|

|

What was your sentence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If imprisoned, when were you released? |

|

|

|

|

|

|

|

|

|

|

|

|

If probation was ordered, when did/will your probation end? |

|

|

|

|

|

|

|

(b) Have you ever been convicted of any offense under federal or state law which resulted in imprisonment for |

|

|

more than one year? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

If YES: What was the crime? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On what date were you convicted? |

|

|

|

|

|

|

|

|

|

|

|

What was your sentence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If imprisoned, when were you released? |

|

|

|

|

|

|

|

|

|

|

|

|

If probation was ordered, when did/will your probation end? |

|

|

|

|

|

|

SIGNATURE OF APPLICANT

Signature (First name, middle initial, last name) (Write in ink)

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 4 of 10 |

18.Do you have any unsatisfied FELONY warrants (or in jurisdictions that do not define crimes as felonies, a crime

punishable by death or imprisonment exceeding 1 year) for your arrest? |

YES |

NO |

|

If YES: Date of Warrant |

|

|

|

|

State where warrant was issued |

|

|

|

|

|

|

|

|

|

19. How long have you lived at your current address? (Give Date MM/YY) |

|

|

|

REMARKS: (This space may be used for explaining any answers to the questions. If you need more space, attach a separate sheet.)

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE SIGNING THIS FORM

I/my organization:

• Must use all payments made to me/my organization as the representative payee for the claimant's current needs or (if not currently needed) save them for his/her future needs.

• May be held liable for repayment if I/my organization misuse the payments or if I/my organization am/is at fault for any overpayment of benefits.

• May be punished under Federal law by fine, imprisonment or both if I/my organization am/is found guilty of misuse of Social Security or SSI benefits.

I/my organization will:

• Use the payments for the claimant's current needs and save any currently unneeded benefits for future use.

• File an accounting report on how the payments were used, and make all supporting records available for review if requested by the Social Security Administration.

• Reimburse the amount of any loss suffered by any claimant due to misuse of Social Security or SSI funds by me/my organization.

• Notify the Social Security Administration when the claimant dies, leaves my/my organization's custody or otherwise changes his/her living arrangements or he/she is no longer my/my organization's responsibility.

• Comply with the conditions for reporting certain events (listed on the attached sheets(s) which I/my organization will keep for my/my organization's records) and for returning checks the claimant is not due.

• File an annual report of earnings if required.

• Notify the Social Security Administration as soon as I/my organization can no longer act as representative payee or the claimant no longer needs a payee.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

DATE (Month, day, year)

Telephone number(s) at which you may be contacted during the day

Print Your Name & Title (if a representative or employee of an institution/organization)

Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route)

Residence Address (Number and street, Apt. No., P.O. Box, or Rural Route)

Witnesses are only required if this application has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the applicant making the request must sign below, giving their full addresses.

1. SIGNATURE OF WITNESS |

2. SIGNATURE OF WITNESS |

ADDRESS (Number and street, City, State and ZIP Code) |

ADDRESS (Number and street, City, State and ZIP Code) |

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 5 of 10 |

|

|

SOCIAL SECURITY |

|

Information for Representative Payees Who Recieve Social Security Benefits |

|

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant DIES (Social Security entitlement ends the month before the month the claimant dies);

•the claimant MARRIES, if the claimant is entitled to child's, widow's, mother's, father's, widower's or parent's benefits, or to wife's or husband's benefits as divorced wife/husband, or to special age 72 payments;

•the claimant's marriage ends in DIVORCE or ANNULMENT, if the claimant is entitled to wife's, husband's or special age 72 payments;

•the claimant's SCHOOL ATTENDANCE CHANGES if the claimant is age 18 or over and entitled to child's benefits as a full time student

•the claimant is entitled as a stepchild and the parents DIVORCE (benefits terminate the month after the month the divorce becomes final);

•the claimant is under FULL RETIREMENT AGE (FRA) and WORKS for more than the annual limit (as determined each year) or more than the allowable time (for work outside the United States);

•the claimant receives a GOVERNMENT PENSION or ANNUITY or the amount of the annuity changes, if the claimant is entitled to husband's, widower's, or divorced spouse's benefit's;

•the claimant leaves your custody or care or otherwise CHANGES ADDRESS;

•the claimant NO LONGER HAS A CHILD IN CARE, if he/she is entitled to benefits because of caring for a child under age 16 or who is disabled;

•the claimant is confined to jail, prison, penal institution or correctional facility;

•the claimant is confined to a public institution by court order in connection WITH A CRIME.

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issue for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

IF THE CLAIMANT IS RECEIVING DISABILITY BENEFITS, YOU MUST ALSO REPORT IF:

•the claimant's MEDICAL CONDITION IMPROVES;

•the claimant STARTS WORKING;

•the claimant applies for or receives WORKER'S COMPENSATION BENEFITS, Black Lung Benefits from the Department of Labor, or a public disability benefit;

•the claimant is DISCHARGED FROM THE HOSPITAL (if now hospitalized).

IF THE CLAIMAINT IS RECEIVING SPECIAL AGE 72 PAYMENTS, YOU MUST ALSO REPORT IF:

•the claimant or spouse becomes ELIGIBLE FOR PERIODIC GOVERNMENTAL PAYMENTS, whether from the U. S. Federal government or from any State or local government;

•the claimant or spouse receives SUPPLEMENTAL SECURITY INCOME or PUBLIC ASSISTANCE CASH BENEFITS;

•the claimant or spouse MOVES outside the United States (the 50 States, the District of Columbia and the Northern Marian Islands).

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have a UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

BENEFITS MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You should read the informational booklet we will send you to see how these events affect benefits. You may make your reports by telephone, mail, or in person.

REMEMBER:

•payments must be used for the claimant's current needs or saved if not currently needed;

•you may be held liable for repayment of any payments not used for the claimant's needs or of any over payment that occured due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with correct accounting;

•to tell us as soon as you know you will no longer be able to act as representative payee or the claimant no longer needs a payee.

Keep in mind that benefits may be deposited directly into an account set up for the claimant with you as payee. As soon as you set up such an account, contact us for more information about receiving the claimant's payments using direct deposit.

Form SSA-11-BK (06-2017) uf (06-2017) |

|

Page 6 of 10 |

|

|

|

|

|

A REMINDER TO PAYEE APPLICANTS |

|

|

|

|

|

TELEPHONE |

BEFORE YOU RECEIVE A |

SSA OFFICE |

DATE REQUEST RECEIVED |

NUMBER(S) TO |

DECISION NOTICE |

|

|

|

|

|

CALL IF YOU HAVE |

|

|

|

A QUESTION OR |

AFTER YOU RECEIVE A |

|

|

SOMETHING TO |

DECISION NOTICE |

|

|

REPORT |

|

|

|

|

|

|

|

|

RECEIPT FOR YOUR REQUEST |

|

Your request for Social Security benefits on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

90-0090, entitled Master Beneficiary Record; 60-0222, entitled Master Representative Payee File; and 60-0103, entitled Supplemental Security Income Record and Special Veterans Benefits.

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for federally-funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-0001.

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 7 of 10 |

SUPPLEMENTAL SECURITY INCOME

Information for Representative Payees Who Receive Social Security Benefits

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant or any member of the claimant's household DIES (SSI eligibility ends with the month in which the claimant dies);

•the claimant's HOUSEHOLD CHANGES (someone moves in/out of the place where the claimant lives);

•the claimant LEAVES THE U.S. (the 50 states, the District of Columbia, and the Northern Mariana Islands) for 30 consecutive days or more;

•the claimant MOVES or otherwise changes the place where he/she actually lives (including adoption, and whereabouts unknown);

•the claimant is ADMITTED TO A HOSPITAL, skilled nursing facility, nursing home, intermediate care facility, or other institution;

•the INCOME of the claimant or anyone in the claimant's household CHANGES (this includes income paid by an organization or employer, as well as monetary benefits from other sources);

•the RESOURCES of the claimant or anyone in the claimant's household CHANGES (this includes when conserved funds reach over $2,000);

•the claimant or anyone in the claimant's household MARRIES;

•the marriage of the claimant or anyone in the claimant's household ends in DIVORCE or ANNULMENT;

•the claimant SEPARATES from his/her spouse;

•the claimant is confined to jail, prison, penal institution or correctional facility;

•the claimant is confined to a public institution by court order in connection WITH A CRIME;

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

IF THE CLAIMANT IS RECEIVING PAYMENTS DUE TO DISABILITY OR BLINDNESS, YOU MUST ALSO REPORT IF:

•the claimant's MEDICAL CONDITION IMPROVES;

•the claimant GOES TO WORK;

•the claimant's VISION IMPROVES, if the claimant is entitled due to blindness;

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

PAYMENT MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You should read the informational booklet we will send you to see how these events affect benefits. You may make your reports by telephone, mail or in person.

REMEMBER :

•payments must be used for the claimant's current needs or saved if not currently needed. (Savings are considered resources and may affect the claimant's eligibility to payment.);

•you may be held liable for repayment of any payments not used for the claimant's needs or of any overpayment that occurred due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with a correct accounting;

•to let us know as soon as you know you are unable to continue as representative payee or the claimant no longer needs a payee

•you will be asked to help in periodically redetermining the claimant's continued eligibility or payment. You will need to keep evidence to help us with the redetermination (e.g., evidence of income and living arrangements).

•you may be required to obtain medical treatment for the claimant's disabling condition if he/she is eligible under the childhood disability provision.

Keep in mind that payments may be deposited directly into an account set up for the claimant with you as payee. As soon as you set up such an account, contact us for more information about receiving the claimant's payments using direct deposit.

Form SSA-11-BK (06-2017) uf (06-2017) |

|

Page 8 of 10 |

|

|

|

|

|

A REMINDER TO PAYEE APPLICANTS |

|

|

|

|

|

TELEPHONE |

BEFORE YOU RECEIVE A |

SSA OFFICE |

DATE REQUEST RECEIVED |

NUMBER(S) TO |

DECISION NOTICE |

|

|

|

|

|

CALL IF YOU HAVE |

|

|

|

A QUESTION OR |

AFTER YOU RECEIVE A |

|

|

SOMETHING TO |

DECISION NOTICE |

|

|

REPORT |

|

|

|

|

RECEIPT FOR YOUR REQUEST |

|

Your request for SSI payments on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

90-0090, entitled Master Beneficiary Record; 60-0222, entitled Master Representative Payee File; and 60-0103, entitled Supplemental Security Income Record and Special Veterans Benefits.

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for federally-funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-0001.

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 9 of 10 |

SPECIAL BENEFITS FOR WORLD WAR II VETERANS

Information for Representative Payees Who Receive Special Benefits for WW II Veterans

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant DIES (special veterans entitlement ends the month after the claimant dies);

•the claimant returns to the United States for a calendar month or longer;

•the claimant moves or changes the place where he/she actually lives;

•the claimant receives a pension, annuity or other recurring payment (includes workers' compensation, veterans benefits or disability benefits), or the amount of the annuity changes;

•the claimant is or has been deported or removed from U.S.;

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

BENEFITS MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You can make your reports by telephone, mail or in person. You can contact any U.S. Embassy, Consulate, Veterans Affairs Regional Office in the Philippines or any U.S. Social Security Office.

REMEMBER:

•payments must be used for the claimant's current needs or saved if not currently needed;

•you may be held liable for repayment of any payments not used for the claimant's needs or of any overpayment that occurred due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with a correct accounting;

•to let us know, as soon as you know you are unable to continue as representative payee or the claimant no longer needs a payee.

Form SSA-11-BK (06-2017) uf (06-2017) |

Page 10 of 10 |

|

|

A REMINDER TO PAYEE APPLICANTS |

|

TELEPHONE NUMBER(S) TO CALL IF YOU HAVE A QUESTION OR SOMETHING TO REPORT

BEFORE YOU RECEIVE A DECISION NOTICE

AFTER YOU RECEIVE A DECISION NOTICE

SSA OFFICE |

DATE REQUEST RECEIVED |

Your request for Special benefits for WW II Veterans on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

90-0090, entitled Master Beneficiary Record; 60-0222, entitled Master Representative Payee File; and 60-0103, entitled Supplemental Security Income Record and Special Veterans Benefits.

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for federally-funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about

11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401.

and answer only items 3, 5, 6, and 8 before signing the form on page 4.

and answer only items 3, 5, 6, and 8 before signing the form on page 4. Claimant is a minor child

Claimant is a minor child Live with me or in the institution I represent

Live with me or in the institution I represent Daily visits

Daily visits Visits at least once a week.

Visits at least once a week. By other means. Explain:

By other means. Explain:

Official of bank, agency or institution with responsibility for the person. Enter below which you represent:

Official of bank, agency or institution with responsibility for the person. Enter below which you represent: Bank

Bank Parent

Parent Spouse

Spouse Other Relative - Specify

Other Relative - Specify Legal Representative

Legal Representative Board and Care Home Operator

Board and Care Home Operator Other Individual - Specify

Other Individual - Specify

YES

YES

NO

NO