With the objective of making it as effortless to use as possible, we established our PDF editor. The whole process of filling out the ssa 2490 bk is going to be uncomplicated in the event you keep to the following actions.

Step 1: To get started, hit the orange button "Get Form Now".

Step 2: You can now alter the ssa 2490 bk. This multifunctional toolbar can help you add, eliminate, improve, and highlight content or undertake similar commands.

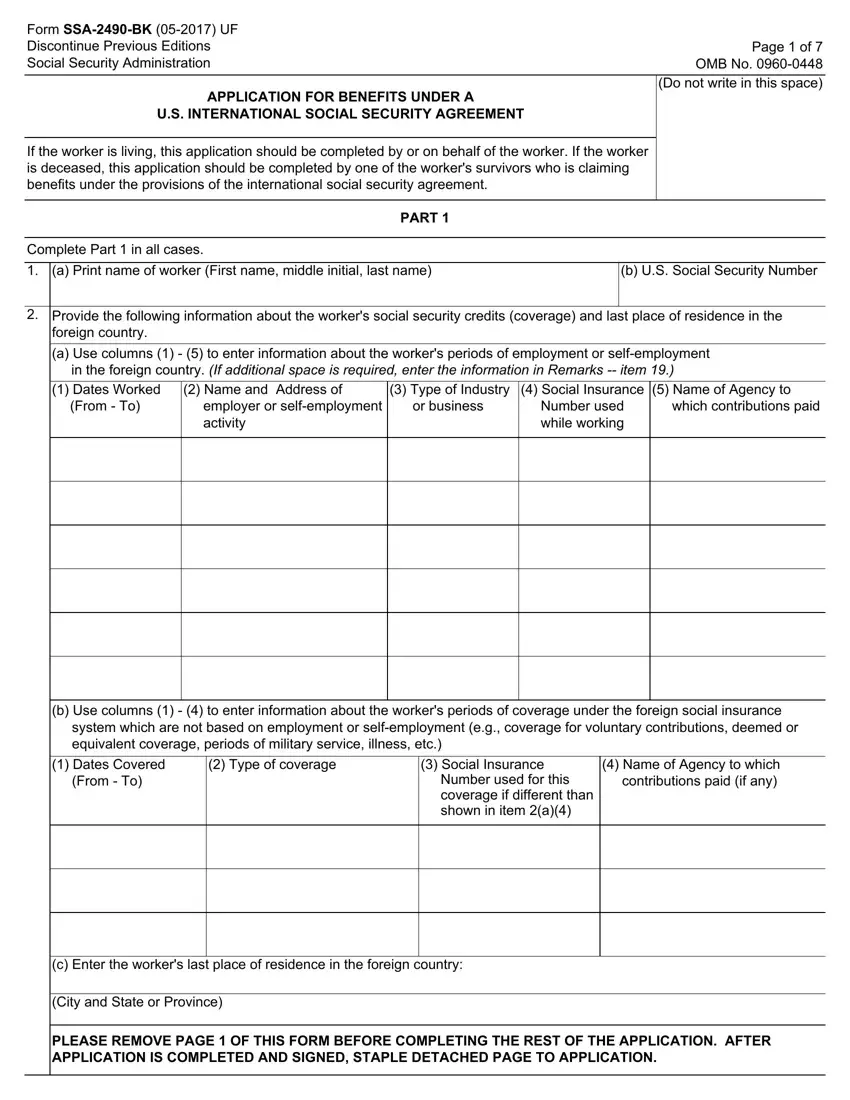

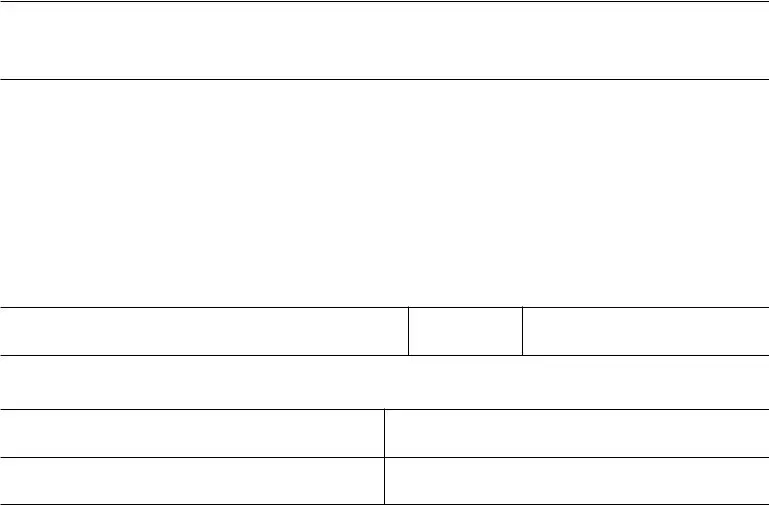

The PDF template you decide to fill in will consist of the next parts:

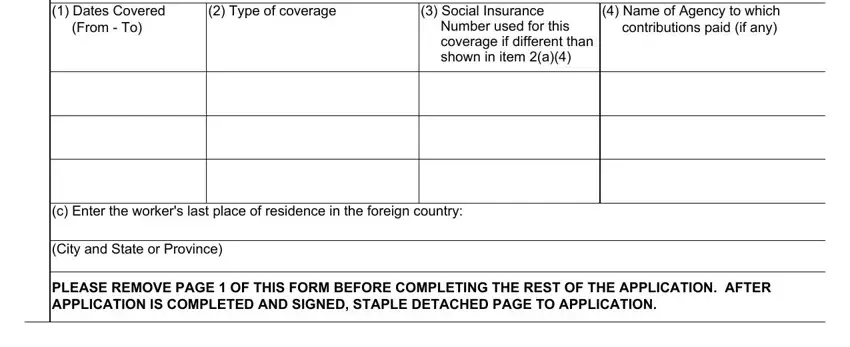

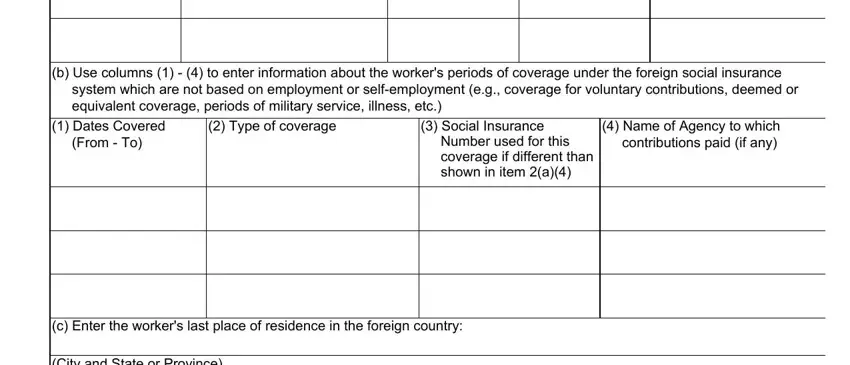

Write down the details in Dates Covered From To, Type of coverage, Social Insurance, Number used for this coverage if, Name of Agency to which, c Enter the workers last place of, City and State or Province, and PLEASE REMOVE PAGE OF THIS FORM.

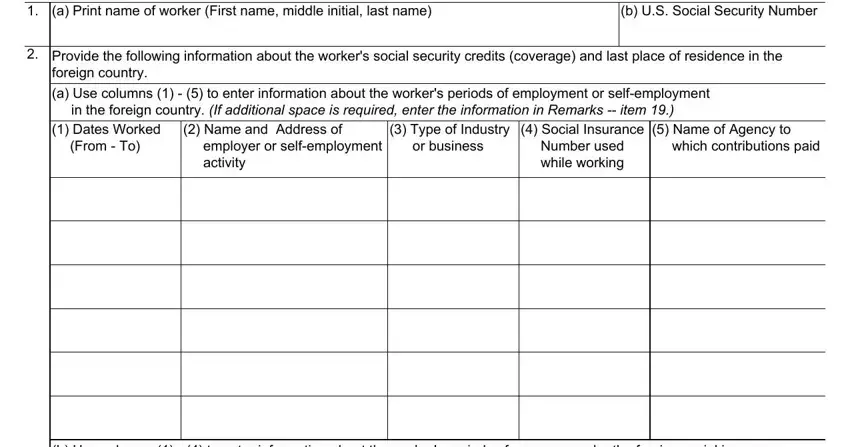

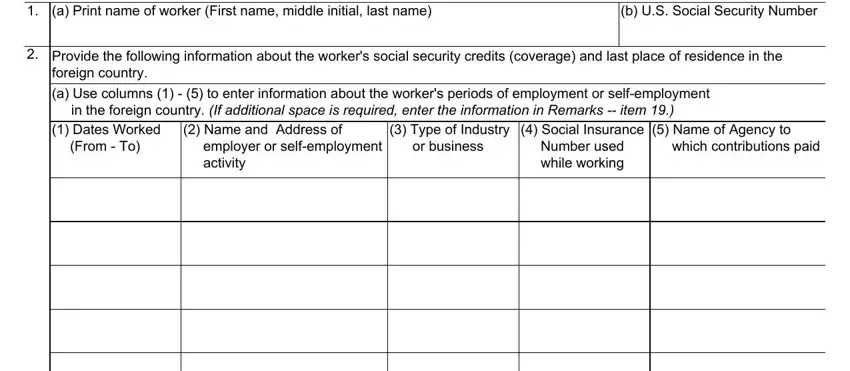

In the section talking about a Print name of worker First name, b US Social Security Number, Provide the following information, foreign country a Use columns, Type of Industry or business, Name and Address of, employer or selfemployment activity, Social Insurance Number used, Name of Agency to, and which contributions paid, you have to put down some vital data.

The b Use columns to enter, system which are not based on, Dates Covered From To, Type of coverage, Social Insurance, Number used for this coverage if, Name of Agency to which, c Enter the workers last place of, and City and State or Province area is the place where all parties can put their rights and obligations.

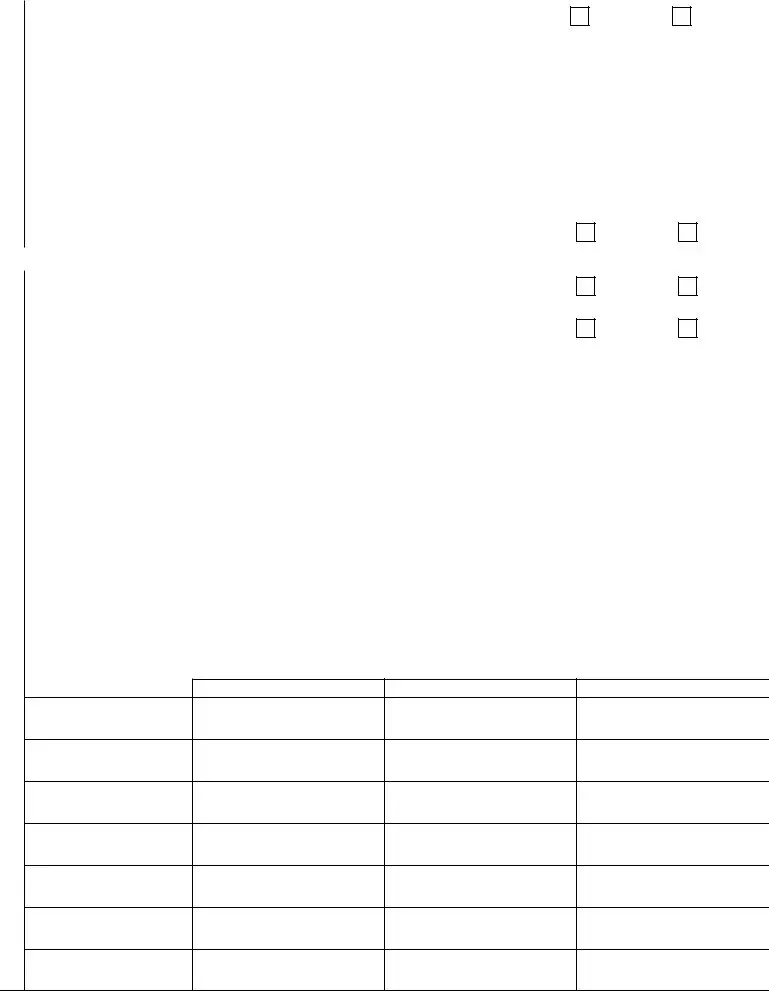

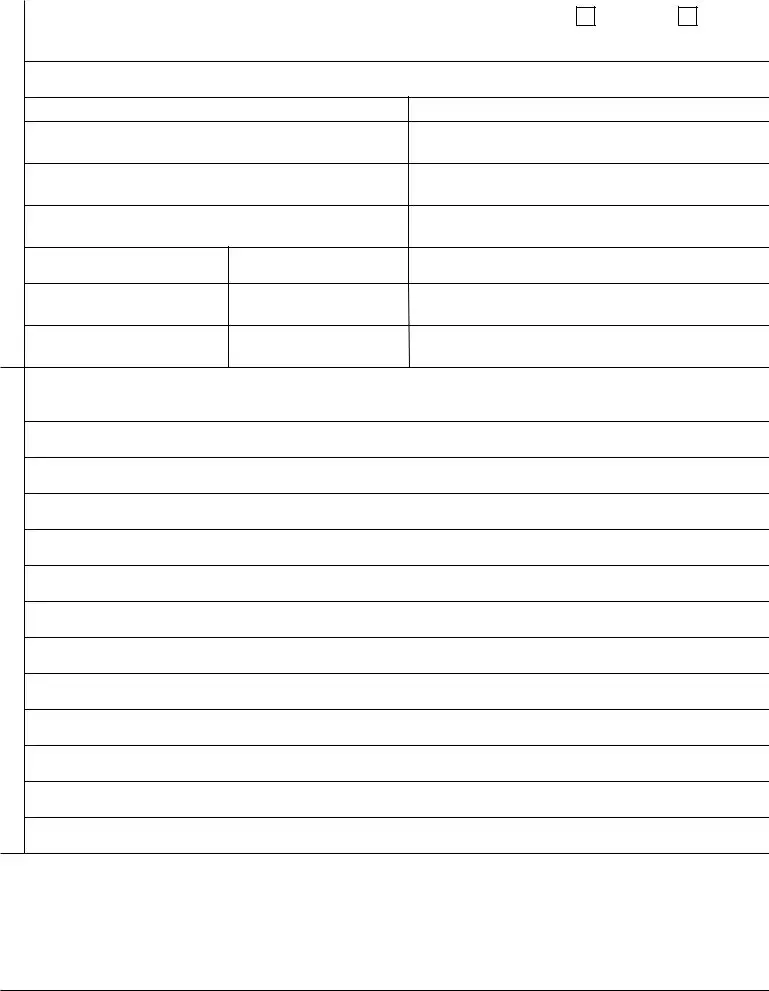

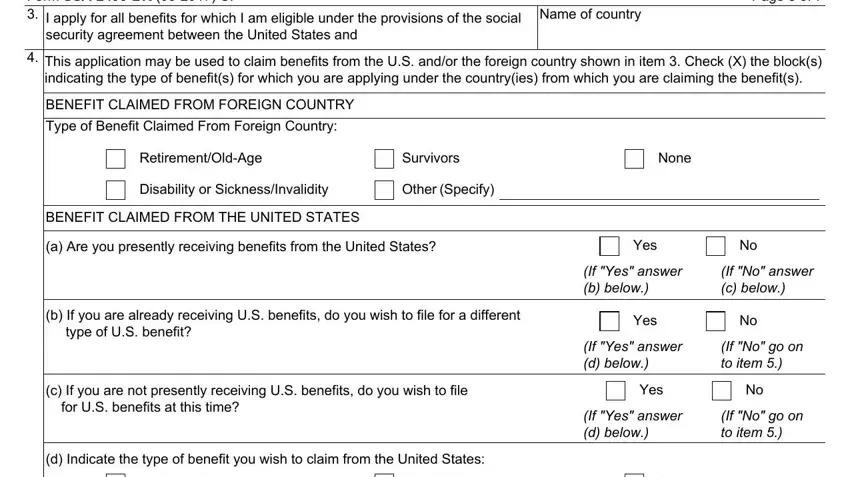

Prepare the template by checking these fields: Form SSABK UF I apply for all, Name of country, Page of, security agreement between the, This application may be used to, BENEFIT CLAIMED FROM FOREIGN, Type of Benefit Claimed From, RetirementOldAge, Survivors, None, Disability or SicknessInvalidity, Other Specify, BENEFIT CLAIMED FROM THE UNITED, a Are you presently receiving, and Yes.

Step 3: Choose the "Done" button. So now, you may transfer your PDF document - upload it to your electronic device or send it via email.

Step 4: In order to prevent possible future difficulties, be sure you have more than two or more copies of each separate file.