Our PDF editor was created to be as easy as it can be. As you try out these actions, the procedure for managing the social security earnings information file will be easy.

Step 1: At first, click the orange "Get form now" button.

Step 2: Now you may edit your social security earnings information. You may use the multifunctional toolbar to add, delete, and alter the text of the form.

Enter the data requested by the system to complete the form.

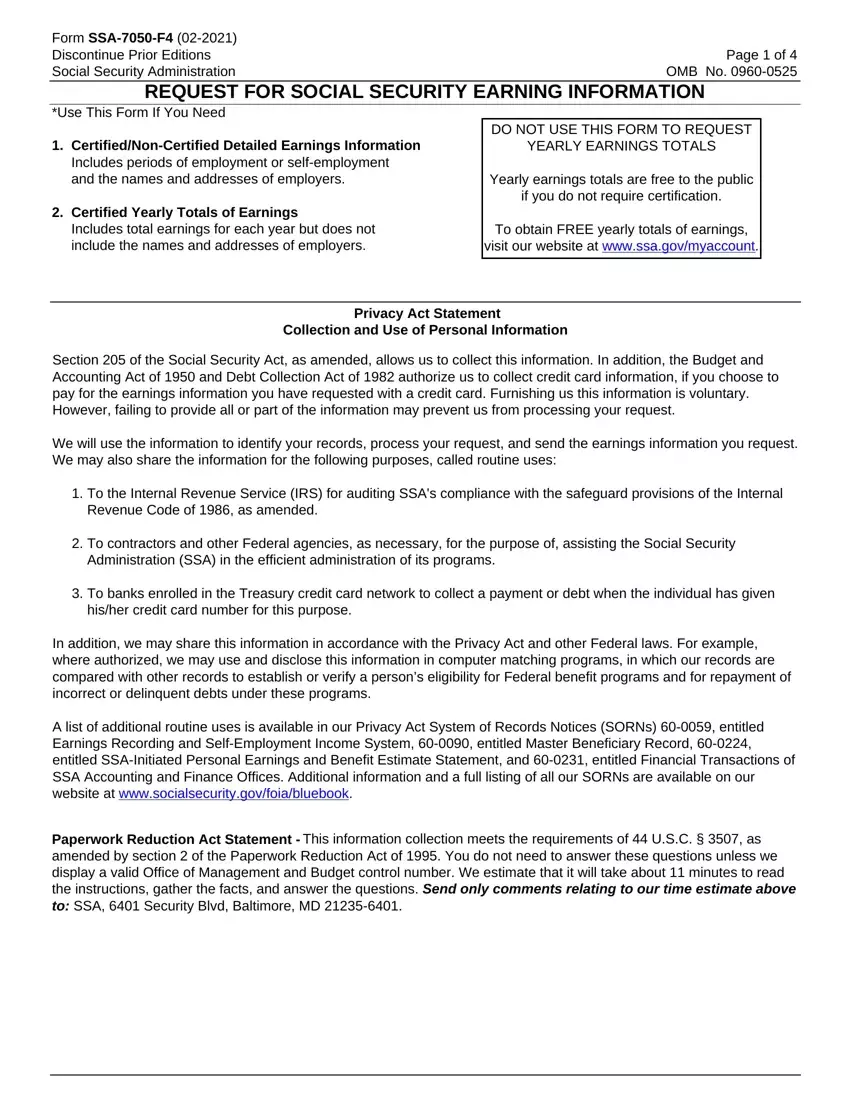

Put down the data in the A list of additional routine uses, and This information collection meets area.

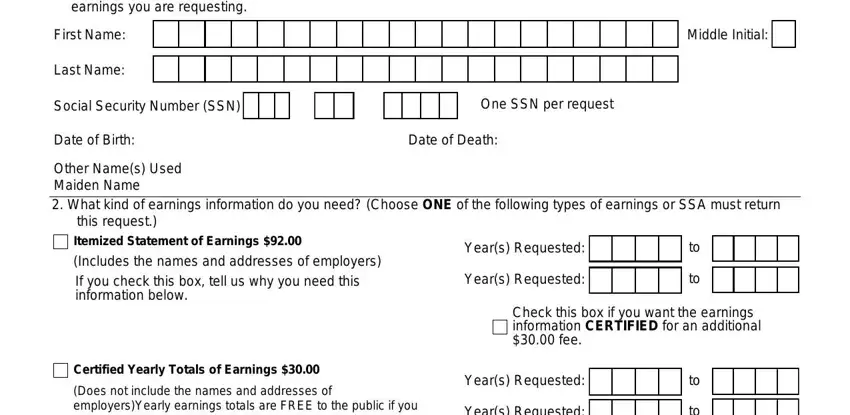

The system will ask you for information to quickly fill up the section Provide your name as it appears, First Name, Last Name, Middle Initial, Social Security Number SSN, One SSN per request, Date of Birth, Date of Death, Other Names Used Maiden Name What, this request Itemized Statement of, Certified Yearly Totals of, Does not include the names and, Years Requested, Years Requested, and Check this box if you want the.

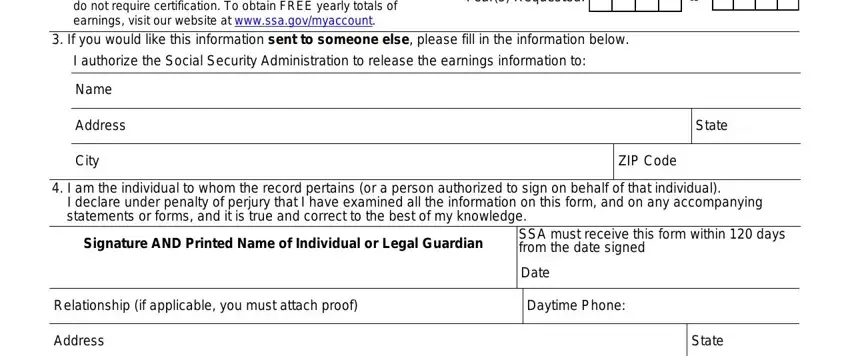

The Does not include the names and, Years Requested, If you would like this, I authorize the Social Security, Name, Address, City, State, ZIP Code, I am the individual to whom the, statements or forms and it is true, Signature AND Printed Name of, SSA must receive this form within, Date, and Relationship if applicable you area could be used to indicate the rights and responsibilities of all sides.

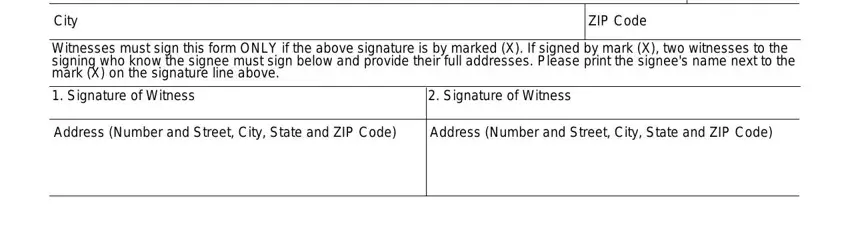

Check the areas City, ZIP Code, Witnesses must sign this form ONLY, Signature of Witness, Signature of Witness, Address Number and Street City, and Address Number and Street City and next fill them in.

Step 3: If you're done, choose the "Done" button to export the PDF document.

Step 4: Create duplicates of the document. This is going to protect you from future complications. We don't check or reveal your data, hence be assured it's going to be secure.

Itemized Statement of Earnings $92.00

Itemized Statement of Earnings $92.00

Certified Yearly Totals of Earnings $30.00

Certified Yearly Totals of Earnings $30.00