You are able to complete Ssa Form 821 Bk without difficulty in our PDFinity® online tool. FormsPal team is committed to providing you with the ideal experience with our tool by continuously introducing new features and upgrades. With all of these updates, using our editor becomes easier than ever! With some simple steps, you'll be able to start your PDF journey:

Step 1: Click on the "Get Form" button above on this page to get into our tool.

Step 2: As you open the file editor, you'll see the document ready to be filled in. In addition to filling in different blank fields, you might also do other actions with the PDF, specifically writing your own text, modifying the original text, inserting images, affixing your signature to the document, and a lot more.

With regards to the blanks of this specific form, this is what you should do:

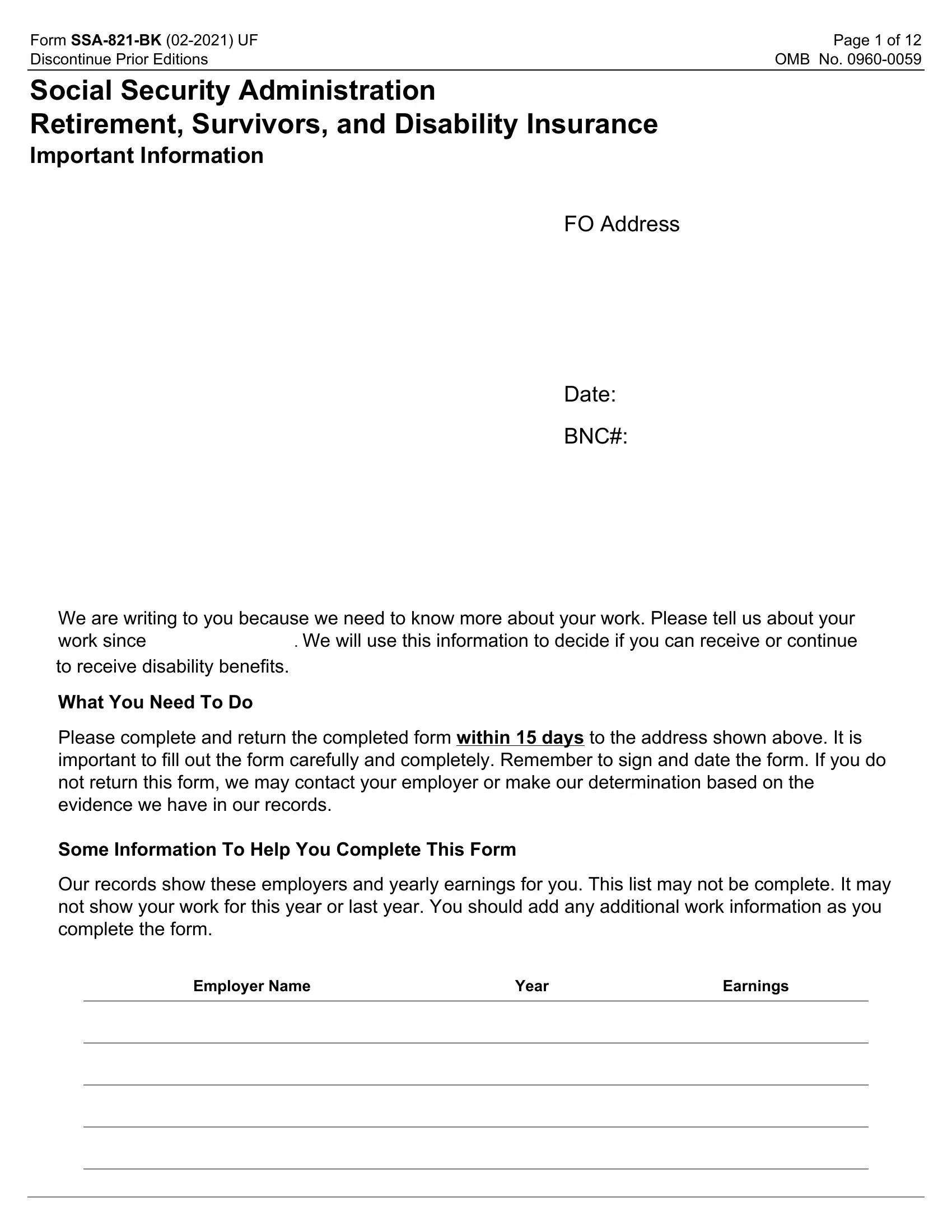

1. Start filling out your Ssa Form 821 Bk with a selection of necessary blank fields. Collect all the required information and make certain nothing is overlooked!

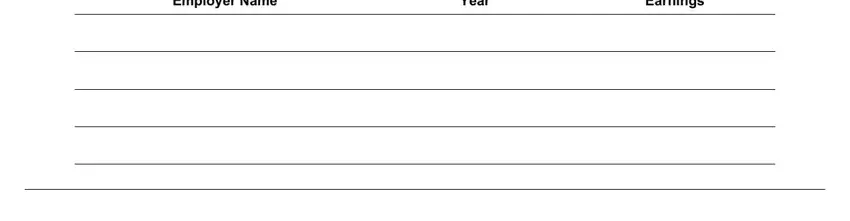

2. The subsequent step would be to fill out these blank fields: Employer Name, Year, and Earnings.

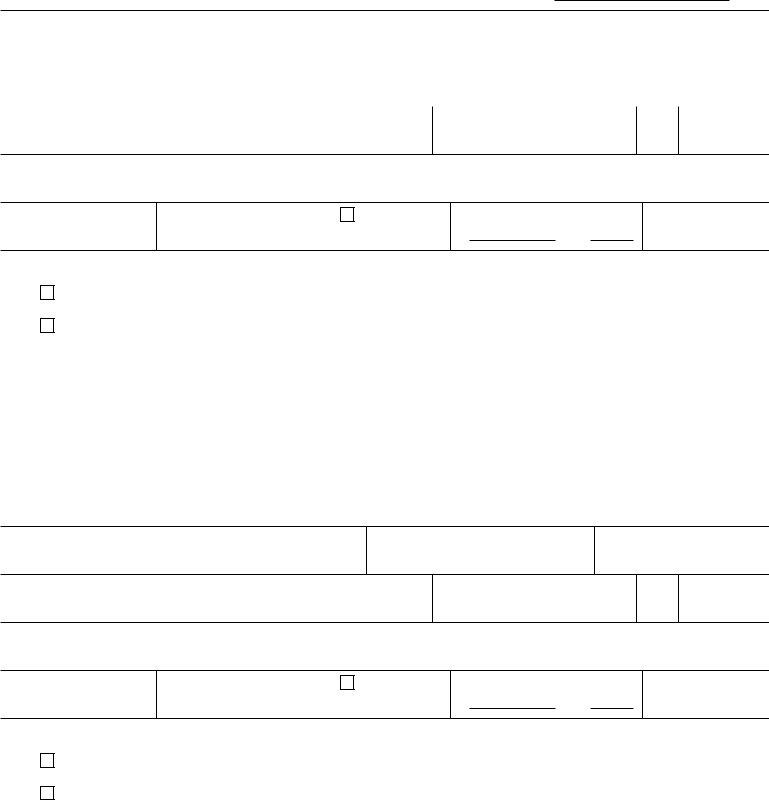

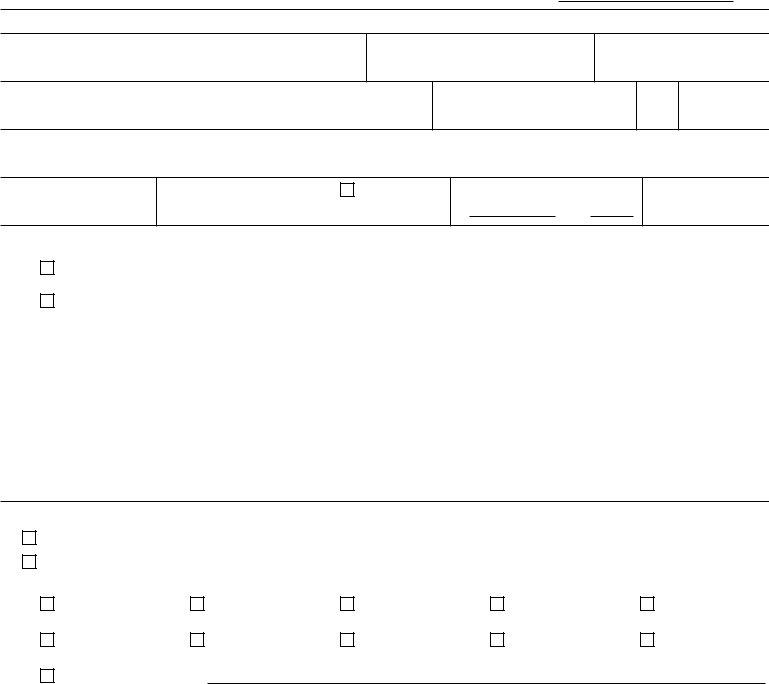

3. Throughout this part, look at Visit our website at wwwssagov to, call your Social Security contact, Write or visit any Social, make an appointment The office, If you are deaf or hard of hearing, and If you are in Canada visit. All of these are required to be filled in with highest attention to detail.

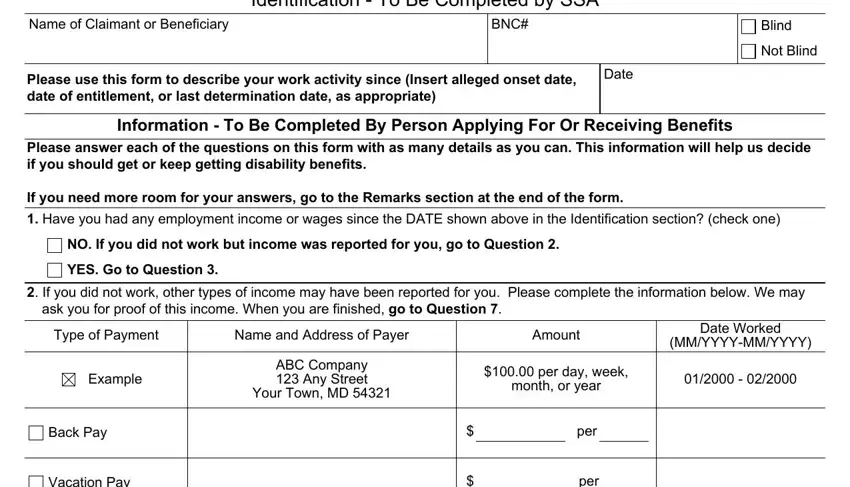

4. It is time to begin working on this fourth part! In this case you will get all of these Name of Claimant or Beneficiary, BNC, Identification To Be Completed by, Blind, Not Blind, Please use this form to describe, Date, Information To Be Completed By, Please answer each of the, Have you had any employment, NO If you did not work but income, YES Go to Question, If you did not work other types, ask you for proof of this income, and Type of Payment empty form fields to fill in.

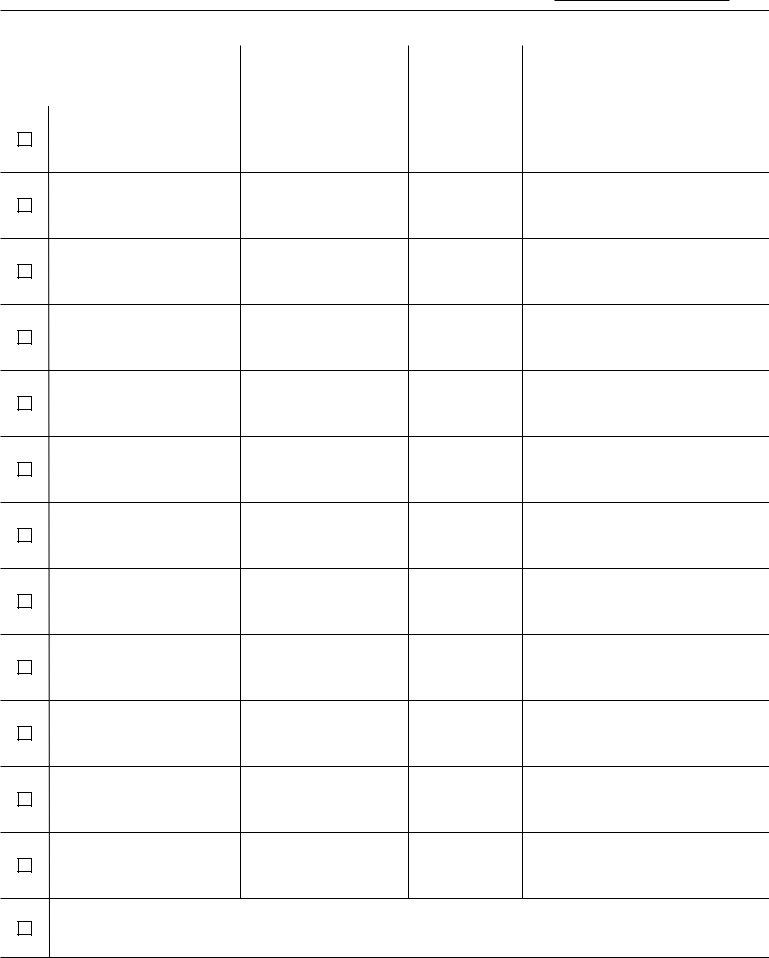

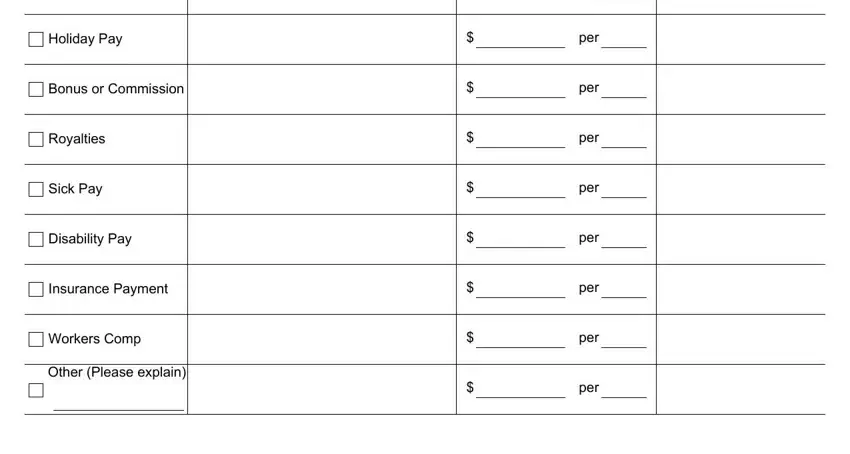

5. To finish your document, the last part incorporates a few extra blanks. Entering Holiday Pay, Bonus or Commission, Royalties, Sick Pay, Disability Pay, Insurance Payment, Workers Comp, Other Please explain, per, per, per, per, per, per, and per should finalize everything and you can be done very quickly!

People often make some mistakes when filling out Holiday Pay in this area. Be certain to re-examine what you type in right here.

Step 3: Make certain your information is right and then click "Done" to proceed further. Find the Ssa Form 821 Bk when you join for a 7-day free trial. Immediately view the form from your FormsPal cabinet, along with any modifications and adjustments conveniently synced! Whenever you work with FormsPal, you're able to fill out documents without being concerned about personal data leaks or records being shared. Our secure platform ensures that your private data is kept safe.