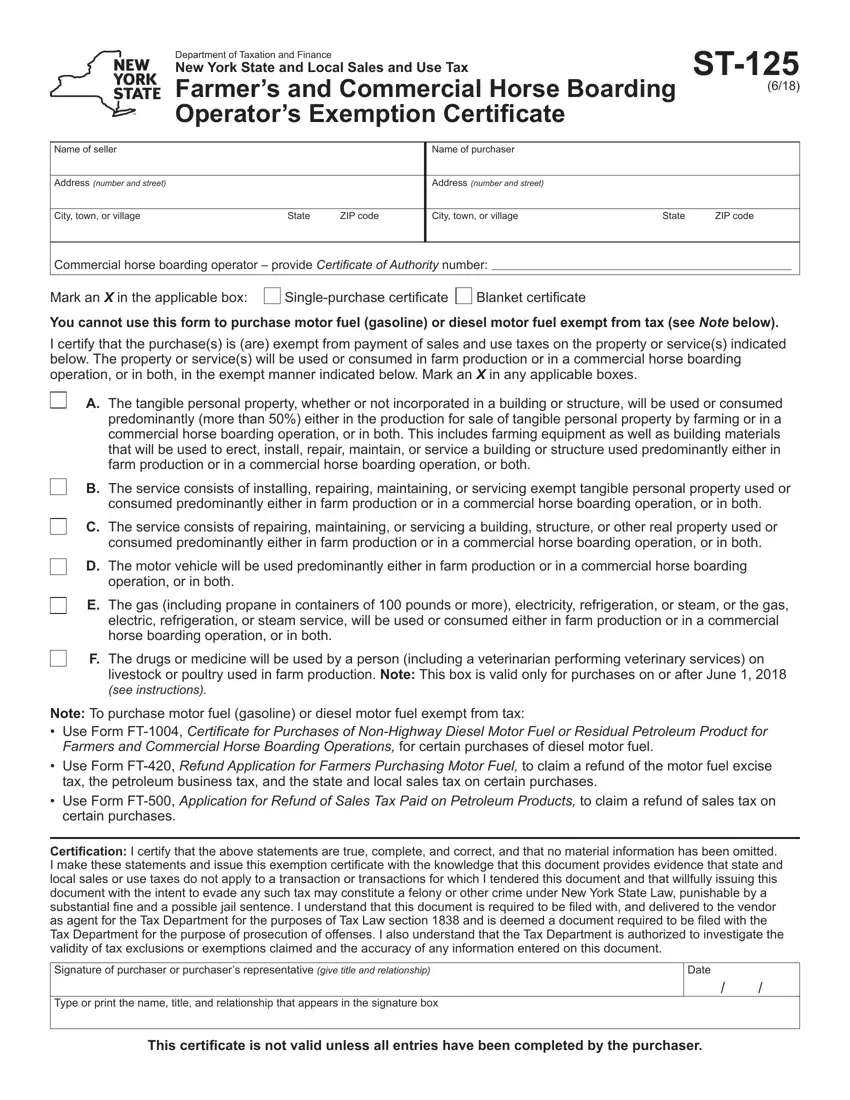

New

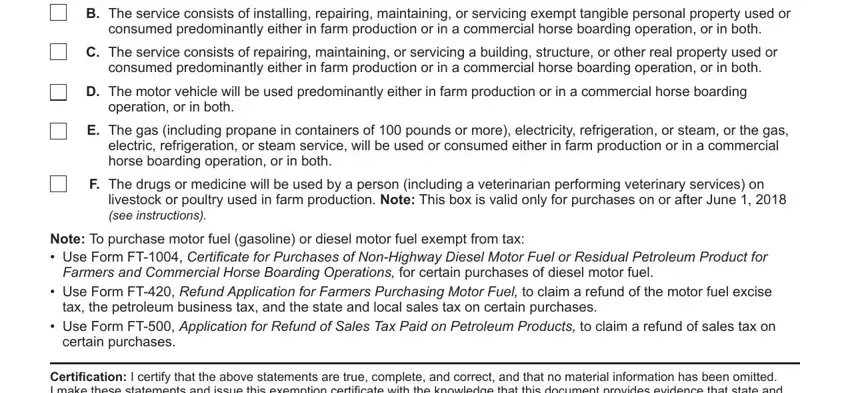

Box F – Effective June 1, 2018, mark an X in this box for purchases of drugs or medicine that will be used by a person (including a veterinarian performing veterinary services) on livestock or poultry used in farm production. Box F is not valid for purchases of drugs or medicine made before June 1, 2018, and the purchaser must use

Form AU-11, Application for Credit or Refund of Sales and Use Tax, to request a refund or credit of any sales taxes paid for such purchases. For more information, see TSB-M-18(1)S, Summary of Sales and Use Tax Changes Enacted in the 2018-2019 Budget Bill.

Deinitions

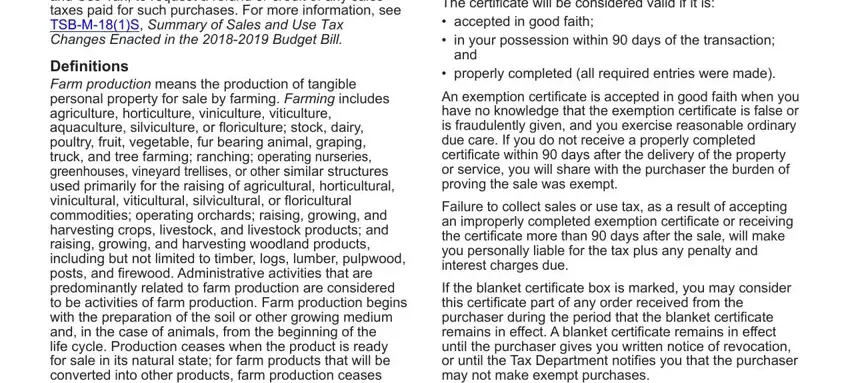

Farm production means the production of tangible personal property for sale by farming. Farming includes agriculture, horticulture, viniculture, viticulture, aquaculture, silviculture, or loriculture; stock, dairy, poultry, fruit, vegetable, fur bearing animal, graping, truck, and tree farming; ranching; operating nurseries, greenhouses, vineyard trellises, or other similar structures

used primarily for the raising of agricultural, horticultural, vinicultural, viticultural, silvicultural, or loricultural commodities; operating orchards; raising, growing, and harvesting crops, livestock, and livestock products; and

raising, growing, and harvesting woodland products,

including but not limited to timber, logs, lumber, pulpwood, posts, and irewood. Administrative activities that are predominantly related to farm production are considered

to be activities of farm production. Farm production begins

with the preparation of the soil or other growing medium and, in the case of animals, from the beginning of the

life cycle. Production ceases when the product is ready for sale in its natural state; for farm products that will be

converted into other products, farm production ceases when the normal development of the farm product has reached a stage where it will be processed or converted into a related product.

Predominantly means more than 50%, measured, for example, by hours of usage or by miles traveled.

Commercial horse boarding operation means an agricultural enterprise of at least seven acres and boarding at least

10 horses, regardless of ownership, that receives $10,000 or more in gross receipts annually from fees generated either through the boarding of horses or through the production for sale of crops, livestock, and livestock products, or through

both such boarding and such production. Under no circumstances shall this include an operation whose primary on-site function is horse racing.

Misuse of this certiicate

Misuse of this exemption certiicate may subject you

to serious civil and criminal sanctions in addition to the payment of any tax and interest due. These include:

•a penalty equal to 100% of the tax due;

•a $50 penalty for each fraudulent exemption certiicate issued;

•criminal felony prosecution, punishable by a substantial ine and a possible jail sentence; and

•revocation of your Certiicate of Authority, if you are required to be registered as a vendor. See

TSB-M-09(17)S, Amendments that Encourage Compliance with the Tax Law and Enhance the Tax Department’s Enforcement Ability, for more information.

To the seller

When making purchases that qualify for exemption from

sales and use tax, the purchaser must provide you with this exemption certiicate with all entries completed to

establish the right to the exemption.

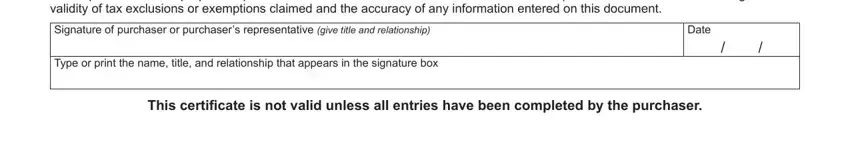

As a New York State registered vendor, you may accept an exemption certiicate in lieu of collecting tax and be protected from liability for the tax if the certiicate is valid. The certiicate will be considered valid if it is:

•accepted in good faith;

•in your possession within 90 days of the transaction; and

•properly completed (all required entries were made).

An exemption certiicate is accepted in good faith when you have no knowledge that the exemption certiicate is false or

is fraudulently given, and you exercise reasonable ordinary

due care. If you do not receive a properly completed certiicate within 90 days after the delivery of the property

or service, you will share with the purchaser the burden of proving the sale was exempt.

Failure to collect sales or use tax, as a result of accepting an improperly completed exemption certiicate or receiving the certiicate more than 90 days after the sale, will make

you personally liable for the tax plus any penalty and interest charges due.

If the blanket certiicate box is marked, you may consider this certiicate part of any order received from the purchaser during the period that the blanket certiicate remains in effect. A blanket certiicate remains in effect

until the purchaser gives you written notice of revocation,

or until the Tax Department notiies you that the purchaser

may not make exempt purchases.

You must maintain a method of associating an invoice

(or other source document) for an exempt sale with the exemption certiicate you have on ile from the purchaser. You must keep this certiicate at least three years after the

due date of your sales tax return to which it relates, or the date the return was iled, if later.

Privacy notiication

New York State Law requires all government agencies that

maintain a system of records to provide notiication of the legal

authority for any request for personal information, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our

website, or, if you do not have Internet access, call and request Publication 54, Privacy Notiication. See Need help? for the Web address and telephone number.

Need help?

Visit our website at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

518-485-2889 |

To order forms and publications: |

518-457-5431 |

Text Telephone (TTY) or TDD |

Dial 7-1-1 for the |

equipment users |

New York Relay Service |