Due to the purpose of allowing it to be as easy to work with as it can be, we set up our PDF editor. The procedure of completing the form st 5 nj will be painless if you try out the next actions.

Step 1: The initial step should be to press the orange "Get Form Now" button.

Step 2: Right now, you can start editing the form st 5 nj. Our multifunctional toolbar is available to you - add, delete, adjust, highlight, and undertake various other commands with the content in the file.

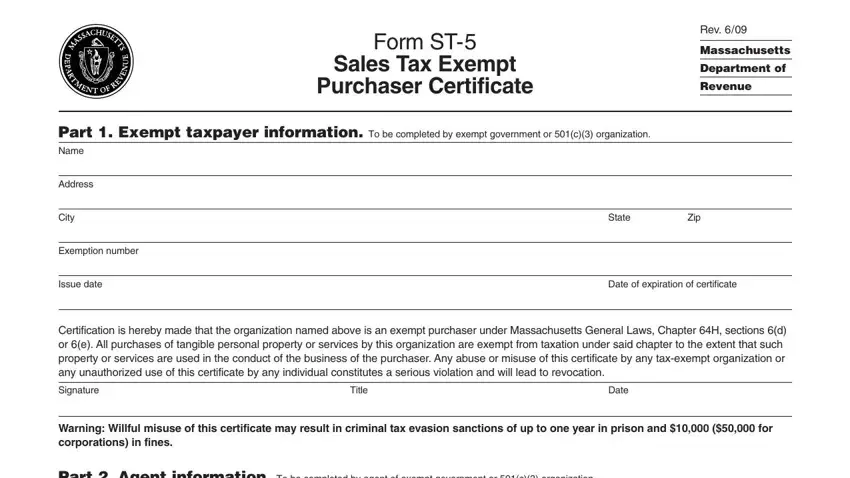

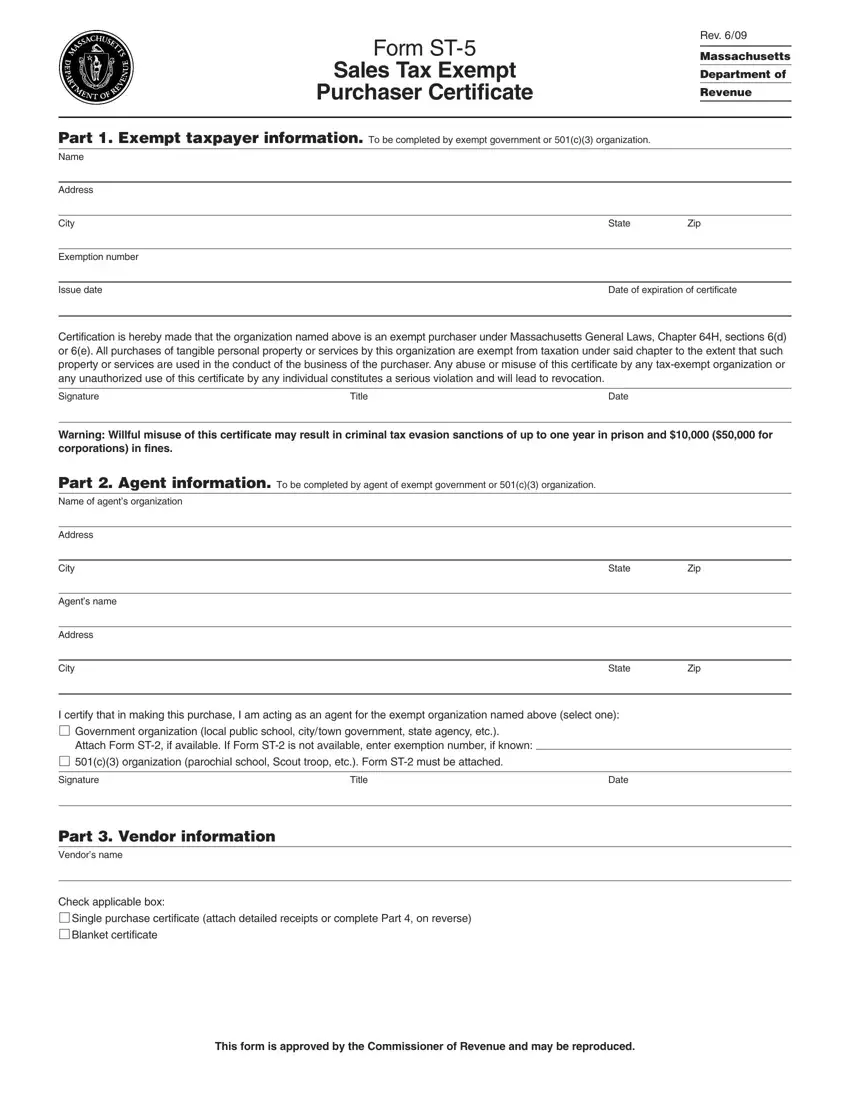

For every single segment, create the information asked by the system.

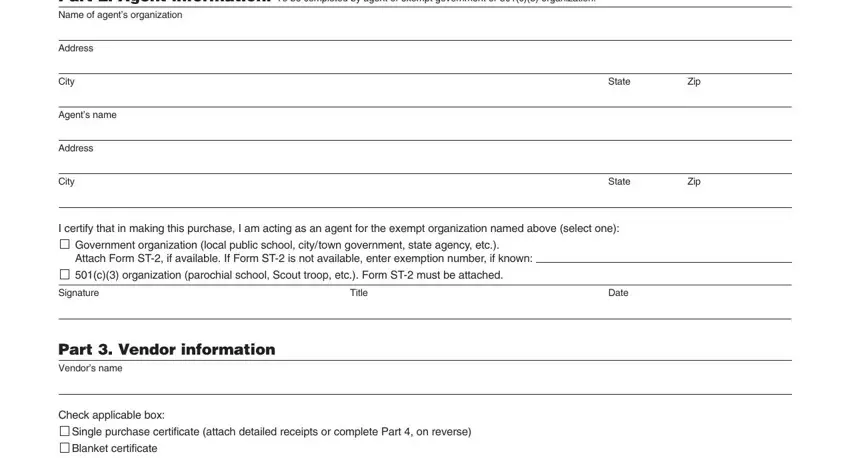

Put the requested particulars in the Part Agent information To be, Address, City, Agents name, Address, City, State, Zip, State, Zip, I certify that in making this, Government organization local, Signature, Title, and Date part.

Outline the crucial data in the section.

Step 3: As soon as you've hit the Done button, your file will be readily available transfer to any type of gadget or email address you identify.

Step 4: It is safer to keep duplicates of your file. There is no doubt that we won't share or view your information.

Single purchase certificate (attach detailed receipts or complete Part 4, on reverse)

Single purchase certificate (attach detailed receipts or complete Part 4, on reverse)

Blanket certificate

Blanket certificate