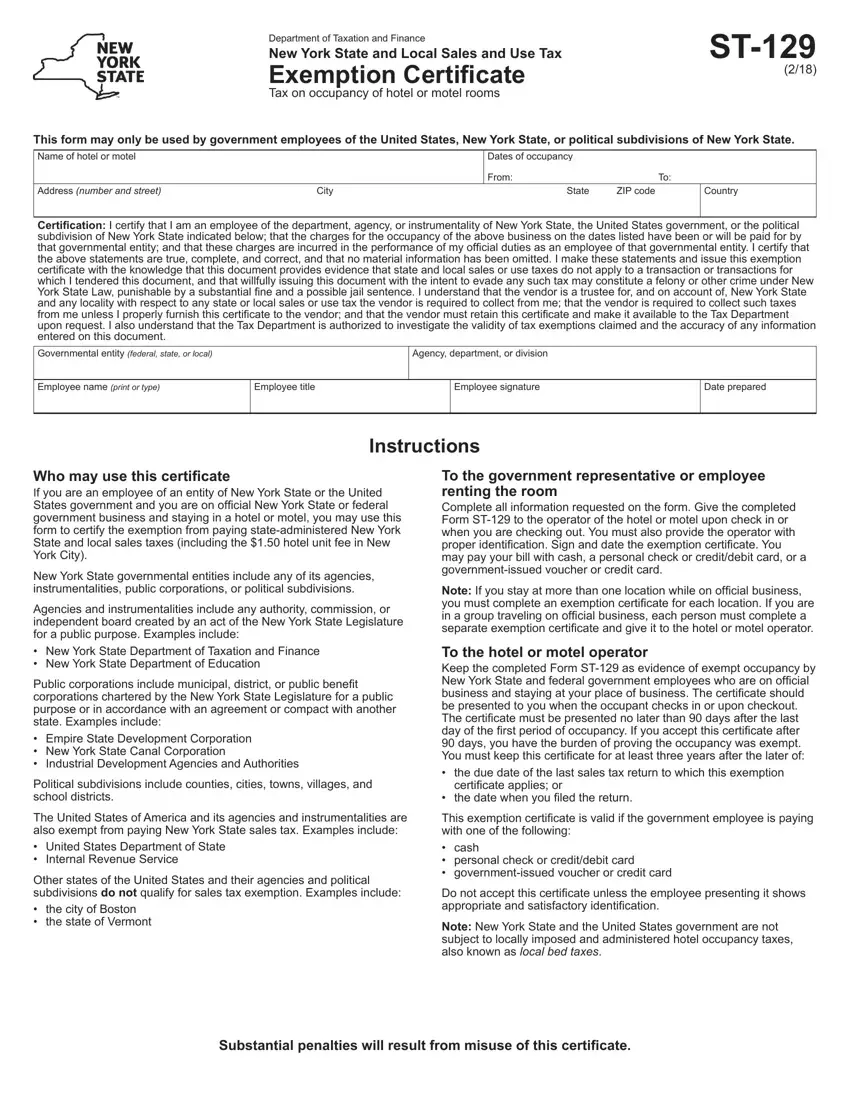

Who may use this certificate

If you are an employee of an entity of New York State or the United States government and you are on official New York State or federal government business and staying in a hotel or motel, you may use this form to certify the exemption from paying state-administered New York State and local sales taxes (including the $1.50 hotel unit fee in New York City).

New York State governmental entities include any of its agencies, instrumentalities, public corporations, or political subdivisions.

Agencies and instrumentalities include any authority, commission, or independent board created by an act of the New York State Legislature for a public purpose. Examples include:

•New York State Department of Taxation and Finance

•New York State Department of Education

Public corporations include municipal, district, or public benefit corporations chartered by the New York State Legislature for a public purpose or in accordance with an agreement or compact with another state. Examples include:

•Empire State Development Corporation

•New York State Canal Corporation

•Industrial Development Agencies and Authorities

Political subdivisions include counties, cities, towns, villages, and school districts.

The United States of America and its agencies and instrumentalities are also exempt from paying New York State sales tax. Examples include:

•United States Department of State

•Internal Revenue Service

Other states of the United States and their agencies and political subdivisions do not qualify for sales tax exemption. Examples include:

•the city of Boston

•the state of Vermont

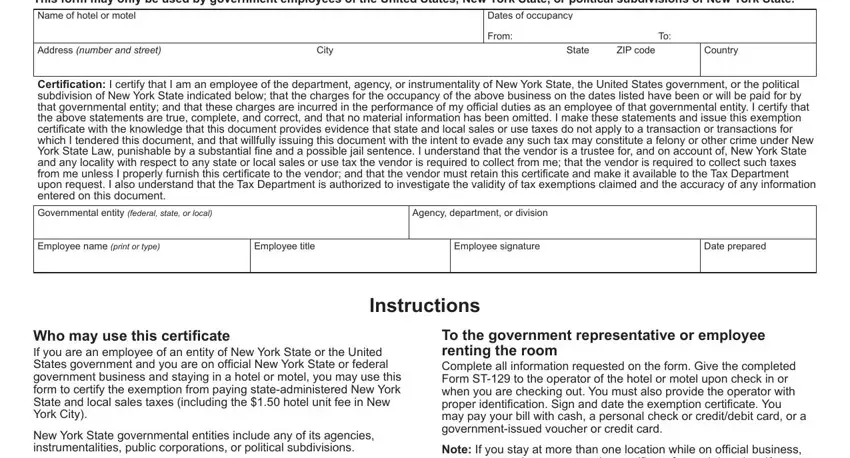

To the government representative or employee renting the room

Complete all information requested on the form. Give the completed Form ST-129 to the operator of the hotel or motel upon check in or when you are checking out. You must also provide the operator with proper identification. Sign and date the exemption certificate. You may pay your bill with cash, a personal check or credit/debit card, or a government-issued voucher or credit card.

Note: If you stay at more than one location while on official business, you must complete an exemption certificate for each location. If you are in a group traveling on official business, each person must complete a separate exemption certificate and give it to the hotel or motel operator.

To the hotel or motel operator

Keep the completed Form ST-129 as evidence of exempt occupancy by New York State and federal government employees who are on official business and staying at your place of business. The certificate should be presented to you when the occupant checks in or upon checkout. The certificate must be presented no later than 90 days after the last day of the first period of occupancy. If you accept this certificate after

90 days, you have the burden of proving the occupancy was exempt. You must keep this certificate for at least three years after the later of:

•the due date of the last sales tax return to which this exemption certificate applies; or

•the date when you filed the return.

This exemption certificate is valid if the government employee is paying with one of the following:

•cash

•personal check or credit/debit card

•government-issued voucher or credit card

Do not accept this certificate unless the employee presenting it shows appropriate and satisfactory identification.

Note: New York State and the United States government are not subject to locally imposed and administered hotel occupancy taxes, also known as local bed taxes.