Dealing with PDF forms online is super easy with this PDF editor. You can fill out 220 ca here without trouble. FormsPal professional team is relentlessly endeavoring to develop the editor and help it become much faster for clients with its many functions. Enjoy an ever-improving experience now! Getting underway is simple! All that you should do is adhere to the following simple steps below:

Step 1: Open the PDF inside our tool by clicking on the "Get Form Button" in the top section of this webpage.

Step 2: After you access the PDF editor, you will notice the form prepared to be completed. Apart from filling out different fields, it's also possible to do other things with the PDF, that is writing custom words, editing the original text, inserting images, affixing your signature to the form, and a lot more.

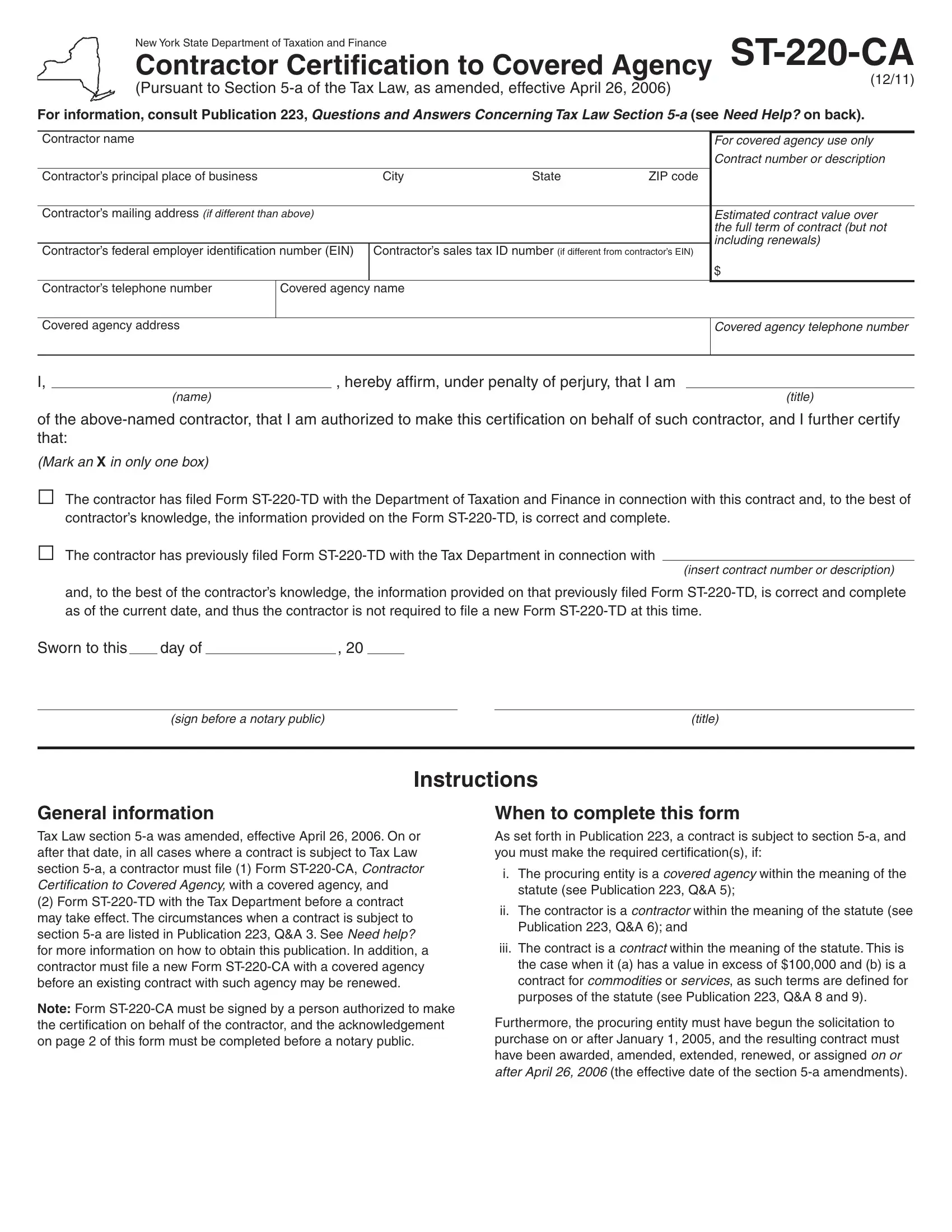

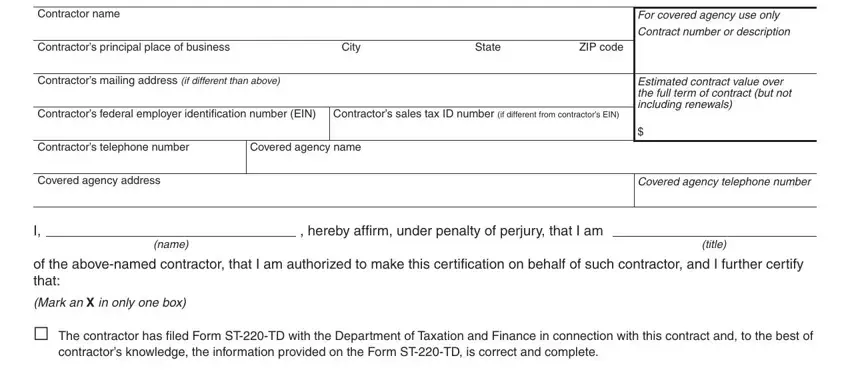

This document will require particular info to be filled in, hence be certain to take whatever time to provide exactly what is required:

1. Whenever completing the 220 ca, be certain to complete all of the needed fields within its relevant part. It will help expedite the work, making it possible for your information to be processed fast and accurately.

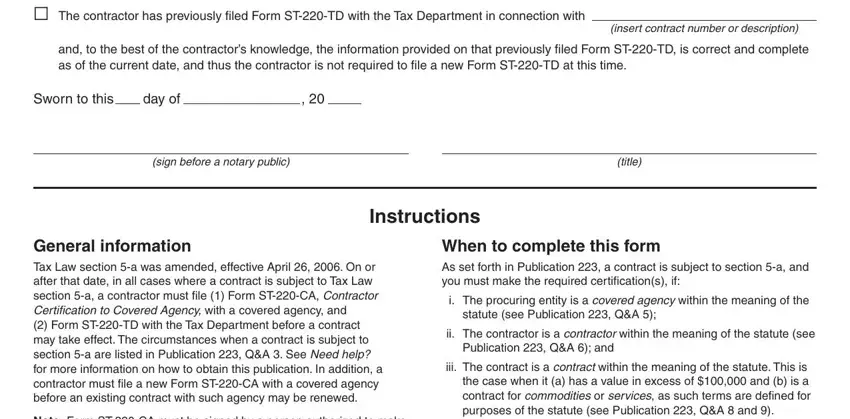

2. Just after filling out this section, go on to the subsequent part and fill in the necessary particulars in all these fields - G The contractor has previously, insert contract number or, and to the best of the contractors, Sworn to this, day of, sign before a notary public, title, Instructions, General information Tax Law, Note Form STCA must be signed by a, When to complete this form As set, i The procuring entity is a, statute see Publication QA, ii The contractor is a contractor, and Publication QA and.

Concerning Note Form STCA must be signed by a and ii The contractor is a contractor, be certain you review things here. These could be the most important ones in the PDF.

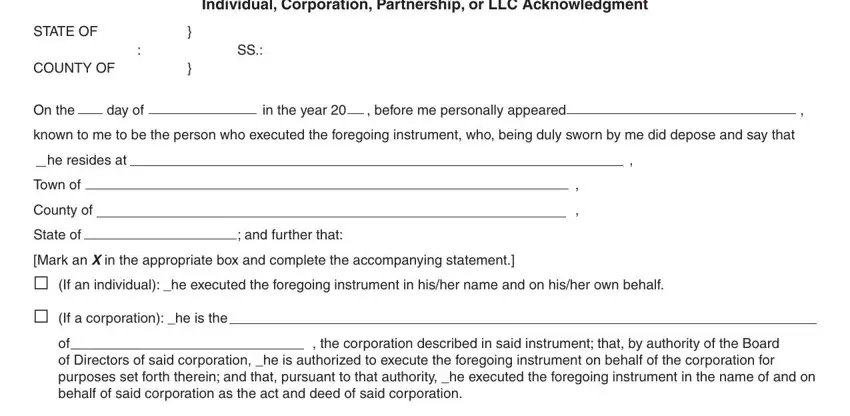

3. This subsequent part should be pretty straightforward, Individual Corporation Partnership, STATE OF COUNTY OF, On the, day of, in the year, before me personally appeared, known to me to be the person who, he resides at, Town of, County of, State of, and further that, Mark an X in the appropriate box, G If a corporation he is the, and of the corporation described in - all these blanks is required to be filled out here.

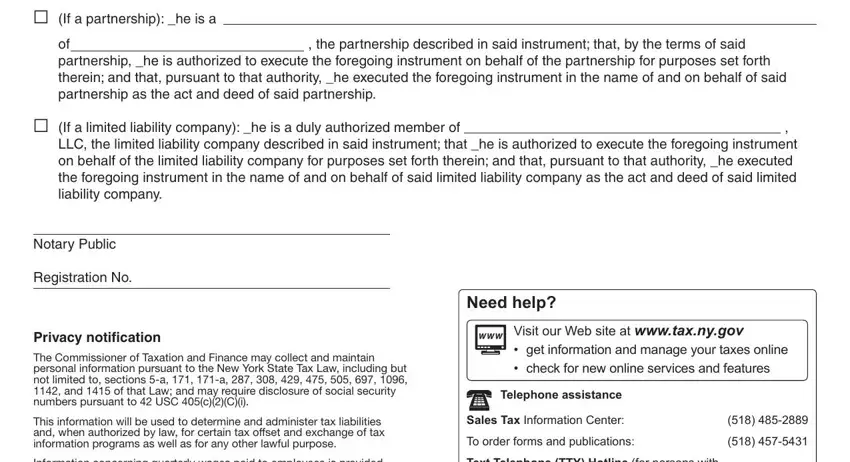

4. This fourth part comes next with these blanks to consider: G If a partnership he is a, of partnership he is authorized to, the partnership described in said, G If a limited liability company, LLC the limited liability company, Notary Public, Registration No, Privacy notification, The Commissioner of Taxation and, This information will be used to, Information concerning quarterly, Need help, Visit our Web site at wwwtaxnygov, Telephone assistance, and Sales Tax Information Center.

Step 3: As soon as you have looked once more at the details you given, press "Done" to complete your document creation. After setting up afree trial account at FormsPal, you'll be able to download 220 ca or email it immediately. The form will also be available through your personal account menu with your adjustments. FormsPal guarantees your information privacy with a secure method that never records or shares any sort of personal information provided. Be assured knowing your docs are kept confidential when you work with our service!