If you intend to fill out st587, you won't have to download and install any sort of applications - just make use of our online tool. To make our editor better and more convenient to use, we consistently implement new features, with our users' suggestions in mind. If you're seeking to start, here's what it will take:

Step 1: Click on the orange "Get Form" button above. It'll open up our editor so that you could start filling in your form.

Step 2: This tool will give you the capability to customize your PDF document in various ways. Change it by writing customized text, correct what is already in the file, and add a signature - all when it's needed!

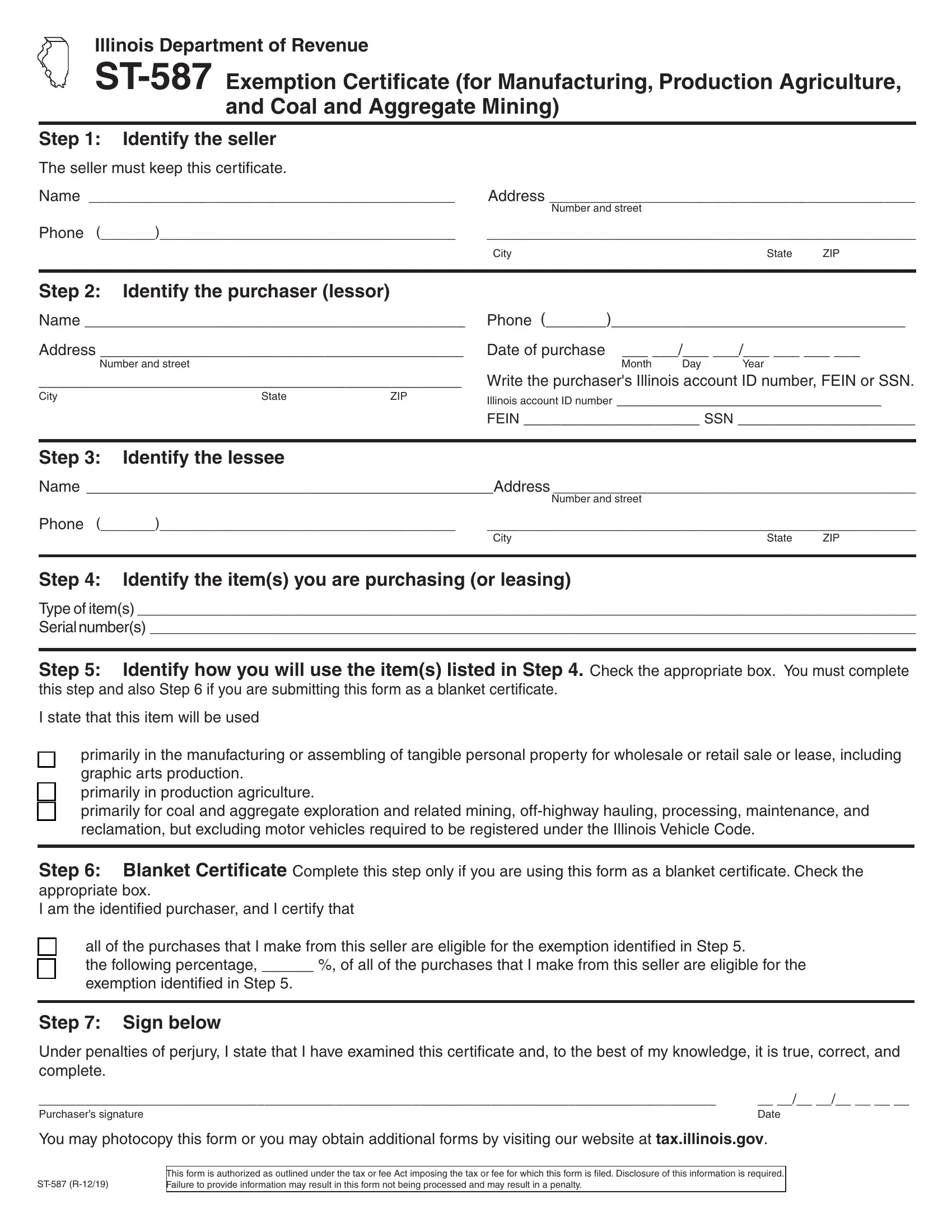

As for the fields of this specific document, here's what you want to do:

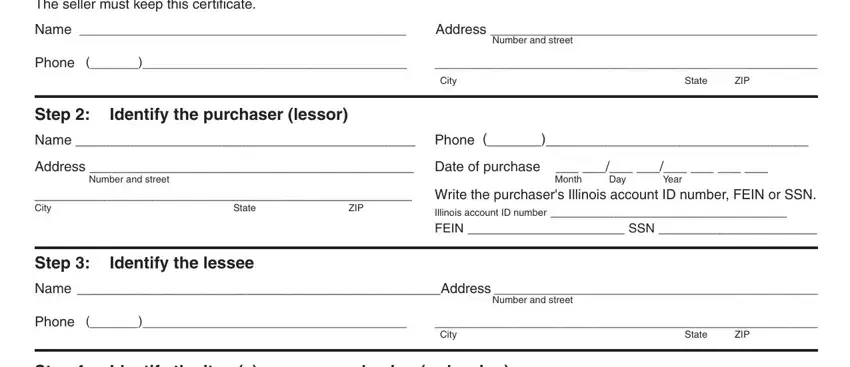

1. To start off, once filling in the st587, start with the part that includes the subsequent blank fields:

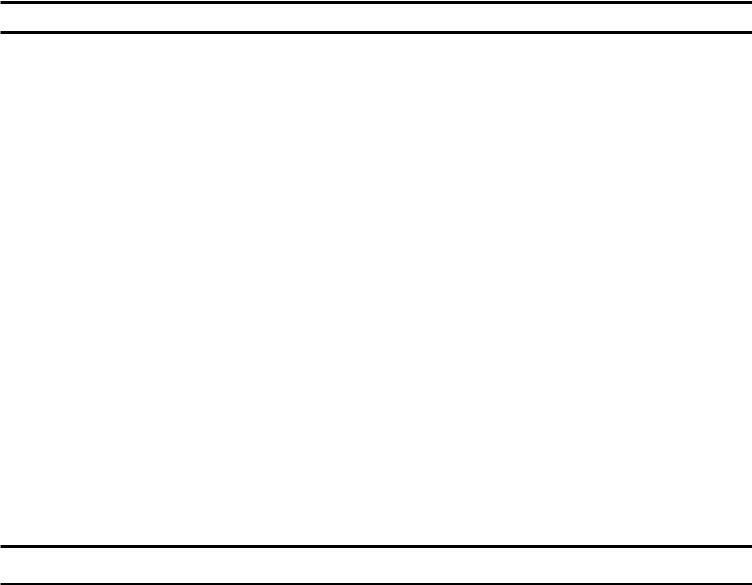

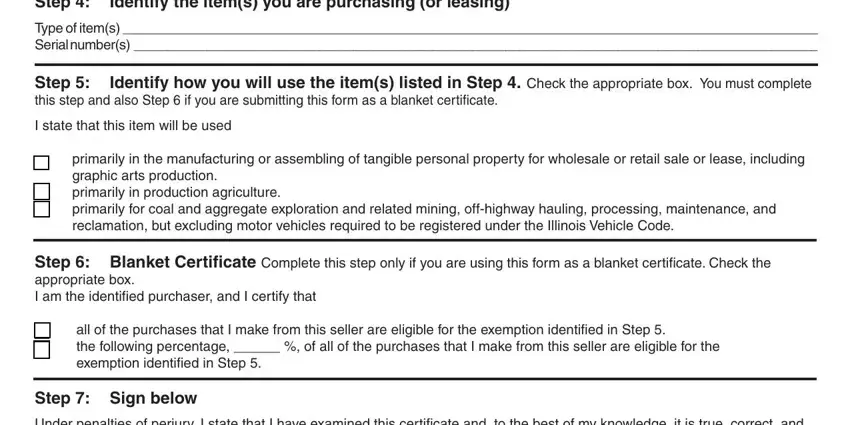

2. Your next step would be to submit all of the following blank fields: Step, Identify the items you are, Type of items Serial numbers, Step this step and also Step if, Identify how you will use the, I state that this item will be used, primarily in the manufacturing or, Step Blanket Certificate Complete, all of the purchases that I make, Step Sign below, and Under penalties of perjury I state.

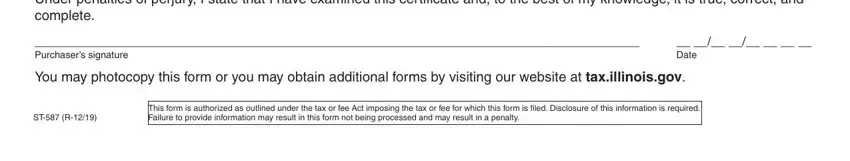

3. In this step, take a look at Under penalties of perjury I state, Purchasers signature, Date, You may photocopy this form or you, ST R, and This form is authorized as. Each one of these should be taken care of with greatest awareness of detail.

You can potentially get it wrong while filling in your ST R, hence ensure that you go through it again before you'll submit it.

Step 3: Right after taking another look at your form fields you have filled out, click "Done" and you're done and dusted! Try a 7-day free trial account at FormsPal and get direct access to st587 - downloadable, emailable, and editable from your personal cabinet. When you work with FormsPal, you're able to complete documents without stressing about personal data incidents or entries being distributed. Our secure system helps to ensure that your private details are stored safely.