When you desire to fill out standard form 425 fillable, you won't need to download and install any sort of programs - just make use of our PDF tool. The editor is continually maintained by our team, getting powerful features and growing to be better. Here's what you'll want to do to get started:

Step 1: Hit the "Get Form" button in the top part of this page to get into our PDF tool.

Step 2: As soon as you open the PDF editor, you'll notice the document prepared to be filled in. In addition to filling in various fields, it's also possible to perform many other actions with the PDF, specifically writing your own text, editing the initial text, inserting illustrations or photos, affixing your signature to the PDF, and a lot more.

It really is simple to fill out the document using this detailed guide! Here is what you should do:

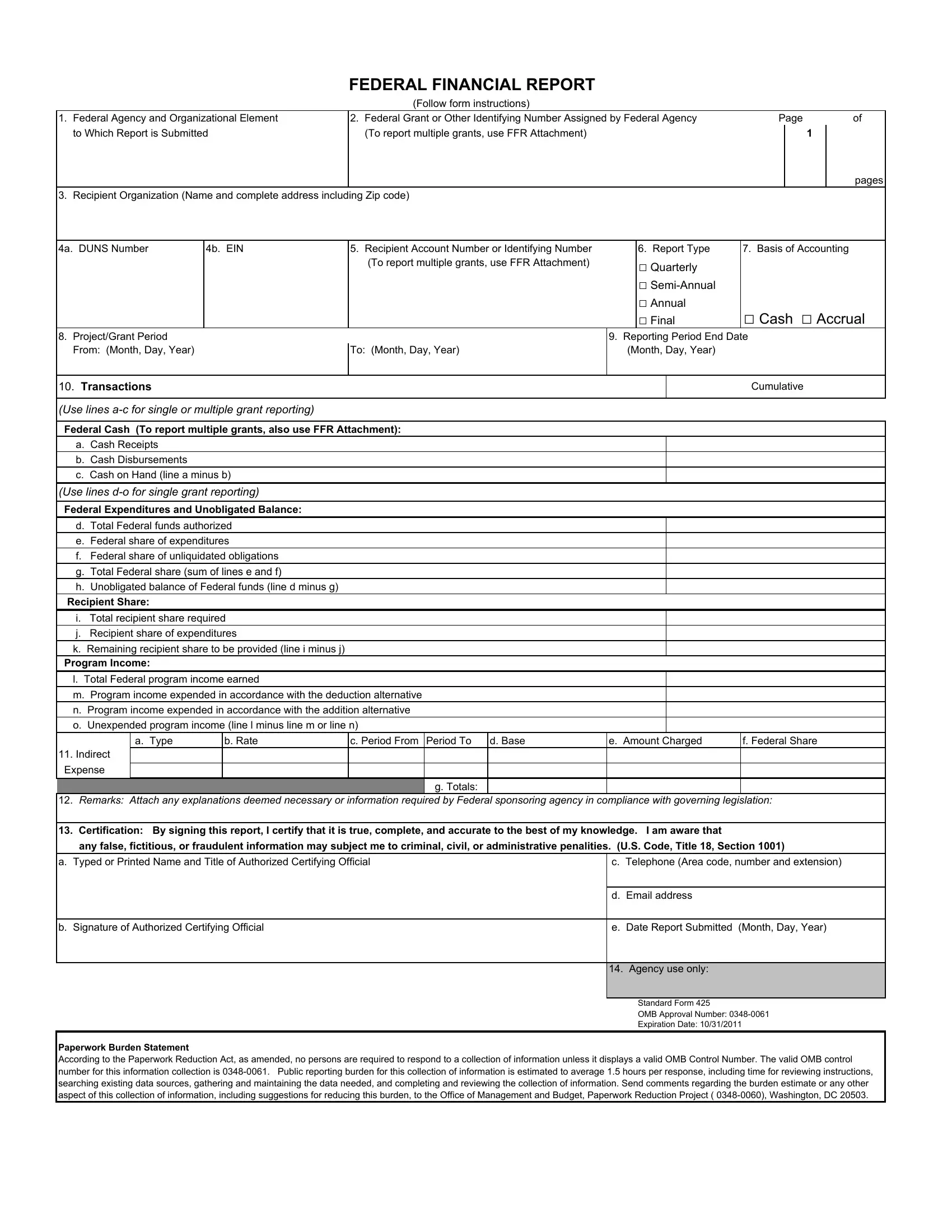

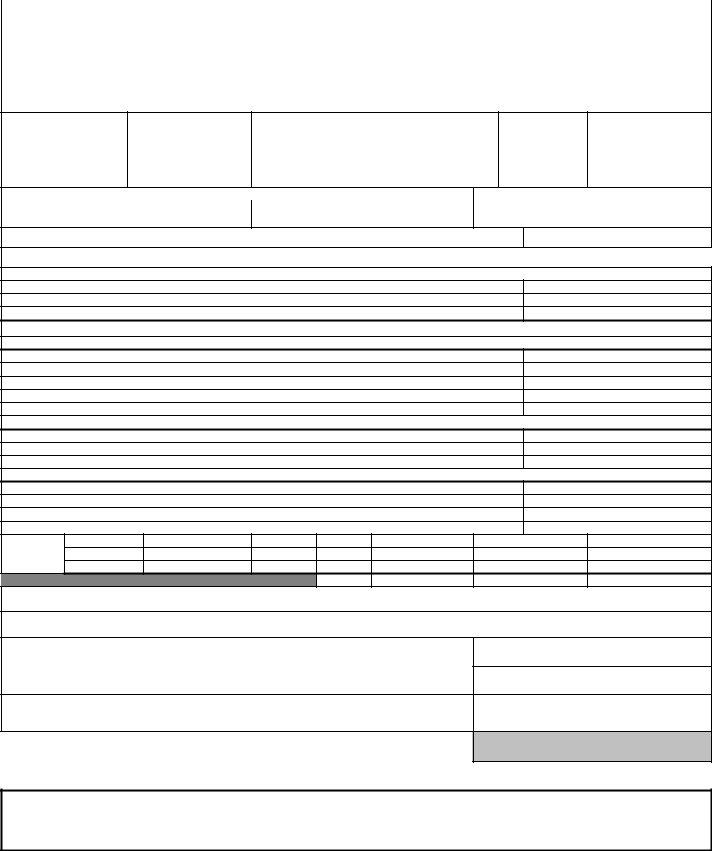

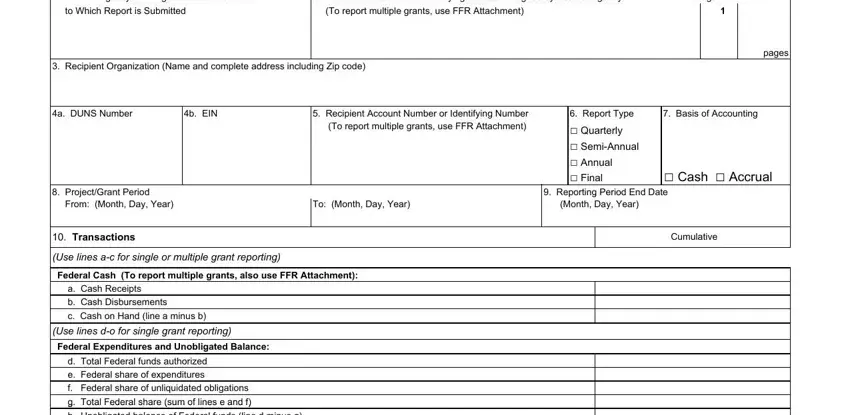

1. You will need to complete the standard form 425 fillable accurately, hence take care when filling out the parts comprising all of these blank fields:

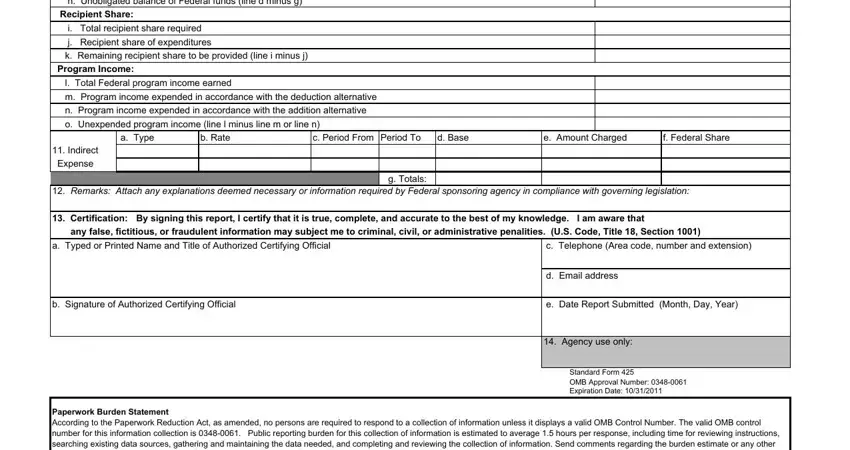

2. The next stage is usually to complete the following blank fields: h Unobligated balance of Federal, Recipient Share, i Total recipient share required, j Recipient share of expenditures, k Remaining recipient share to be, l Total Federal program income, m Program income expended in, n Program income expended in, o Unexpended program income line l, a Type, b Rate, c Period From Period To, d Base, e Amount Charged, and f Federal Share.

Be really attentive when filling out e Amount Charged and n Program income expended in, because this is where most people make some mistakes.

Step 3: Prior to finalizing your form, check that all blanks were filled in correctly. Once you’re satisfied with it, click “Done." Go for a 7-day free trial account with us and obtain instant access to standard form 425 fillable - download, email, or change in your FormsPal account. FormsPal ensures your data privacy via a secure method that in no way saves or distributes any type of sensitive information involved. Feel safe knowing your files are kept protected each time you work with our editor!