Are you a business owner in the state of Florida and struggling to understand the requirements for filing State Form 39080? If so, you’ve come to the right place! This blog post will walk you through all that is required when filing this important form—from understanding the eligibility criteria to gathering any applicable supporting documents. We go into detail on how and why your tax information is necessary, while also covering what refunds may be issued or penalties incurred if certain steps are missed. Read on as we demystify all aspects of filing State Form 39080, helping ensure your business remains in compliance with tax regulations across Florida.

| Question | Answer |

|---|---|

| Form Name | State Form 39080 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | indiana secretary of state form 39080, form indiana form 39080, state form 39080, R7 |

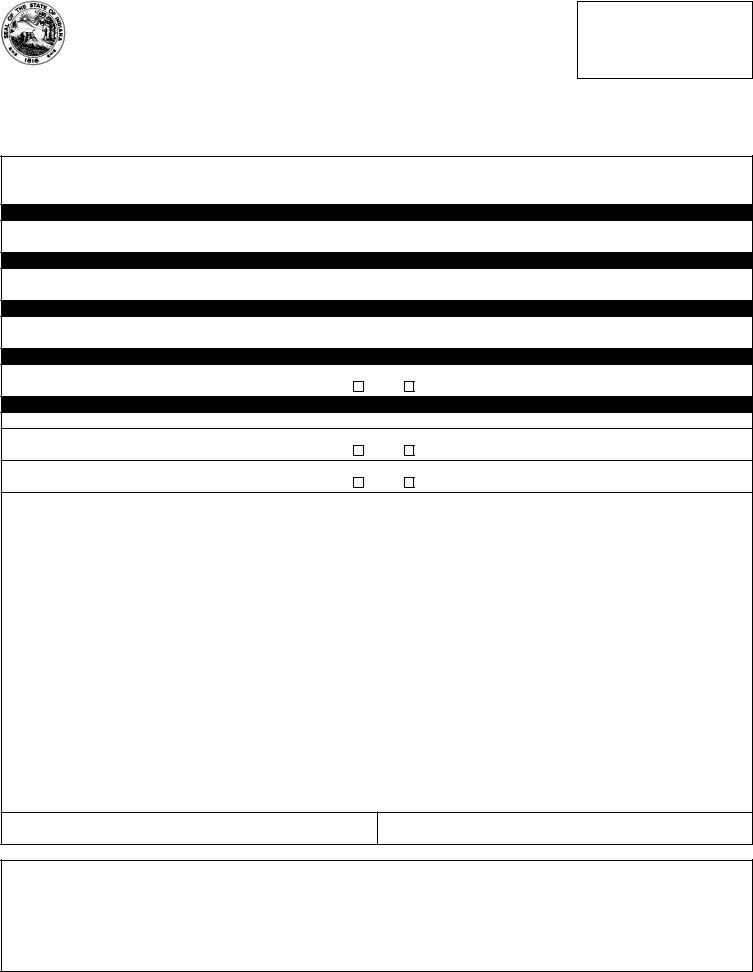

ARTICLES OF DISSOLUTION OF A

DOMESTIC NONPROFIT CORPORATION

State Form 39080 (R7 /

Approved by State Board of Accounts, 1995

INSTRUCTIONS: Use 8 1/2" x 11" white paper for attachments.

Present original and one copy to address in upper right corner of this form. Please TYPE or PRINT.

Please visit our office on the web at: www.sos.in.gov.

CHARLES P. WHITE

SECRETARY OF STATE

CORPORATIONS DIVISION

302 W. Washington St., Rm. E018

Indianapolis, IN 46204

Telephone: (317)

Indiana Code

FILING FEE IS $30.00

The undersigned officer of the Indiana Nonprofit Corporation named in Article I below (hereinafter referred to as the "Corporation") desiring to give notice of corporate action effectuating the dissolution of the Corporation pursuant to the provisions of the Indiana Nonprofit Corporation Act of 1991 (hereinafter referred to as the "Act"), certifies the following facts:

ARTICLE I - CORPORATE NAME

Name of Corporation

ARTICLE II - DATE OF INCORPORATION

Date of Incorporation (month, day, year)

ARTICLE III - AUTHORIZATION

Dissolution was authorized (pursuant to Indiana Code

.

ARTICLE IV - APPROVAL OF BOARD OF DIRECTORS

Dissolution was approved by a sufficient vote of the Board of Directors.

Yes

No

ARTICLE V - APPROVAL OF MEMBERS

IF APPROVAL OF MEMBERS WAS NOT REQUIRED:

Dissolution was approved by a sufficient vote of the Board of Directors or incorporators.

Yes |

No |

Dissolution was approved by a person other than the members, and that approval pursuant to Indiana Code

Yes

No

IF APPROVAL OF MEMBERS WAS REQUIRED, A OR B MUST BE COMPLETED:

|

|

MEMBERS OR DELEGATES |

|

||

A. VOTES CAST FOR OR AGAINST DISSOLUTION |

TOTAL |

ENTITLED TO VOTE AS A CLASS |

|||

|

|

|

|

||

|

|

|

|

|

|

|

|

1 |

2 |

|

3 |

|

|

|

|

|

|

MEMBERS OR DELEGATES ENTITLED TO VOTE |

|

|

|

|

|

|

|

|

|

|

|

MEMBERS OR DELEGATES VOTED IN FAVOR |

|

|

|

|

|

|

|

|

|

|

|

MEMBERS OR DELEGATES VOTED AGAINST |

|

|

|

|

|

|

|

|

|

|

|

|

|

MEMBERS OR DELEGATES |

|

||

B. FOR USE WHERE VOTES ARE UNDISPUTED |

TOTAL |

ENTITLED TO VOTE AS A CLASS |

|||

|

|

|

|

||

|

|

|

|

|

|

|

|

1 |

2 |

|

3 |

|

|

|

|

|

|

MEMBERS OR DELEGATES ENTITLED TO VOTE |

|

|

|

|

|

|

|

|

|

|

|

TOTAL NUMBER OF UNDISPUTED VOTES |

|

|

|

|

|

|

|

|

|

|

|

IN WITNESS WHEREOF, the undersigned being the _______________________ of the Corporation executes these Articles of Dissolution and

(Title)

verifies, under penalties of perjury, that the statements herein are true, this __________ day of ______________________ , 20 _________.

Signature

Printed name

NOTE: Notice of Voluntary Dissolution must be filed with the following State agencies: the Unclaimed Property Section of the Attorney General of Indiana (IC

Indiana Department of Revenue |

Indiana Department of Workforce Development |

Indiana Attorney General |

Compliance Division |

Employer Audit Section |

Unclaimed Property Section |

100 N. Senate Ave., Room N203 |

10 N. Senate Ave. |

402 W. Washington St., 5th Floor |

Indianapolis IN 46204 |

Indianapolis IN 46204 |

Indianapolis, IN 46204 |

Telephone: (317) |

Telephone: (317) |

Telephone: (317) |