The PDF editor makes filling out forms easy. It is really easy to manage the [FORMNAME] document. Comply with these steps if you want to accomplish this:

Step 1: Click on the "Get Form Here" button.

Step 2: As soon as you have accessed your 2004 edit page, you'll see all options it is possible to undertake with regards to your template within the top menu.

Complete the 2004 PDF by entering the information needed for every part.

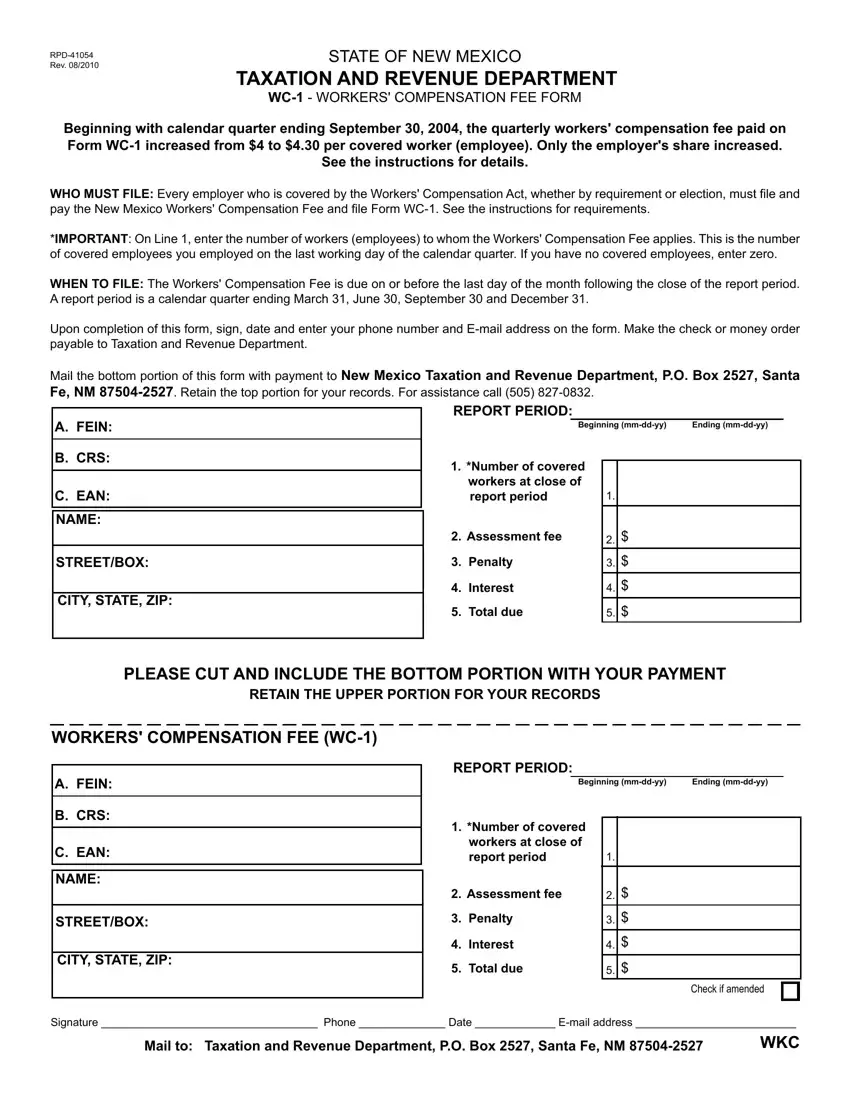

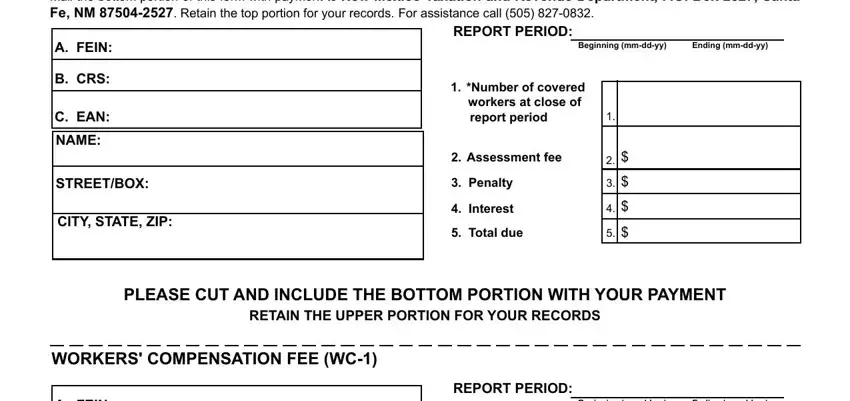

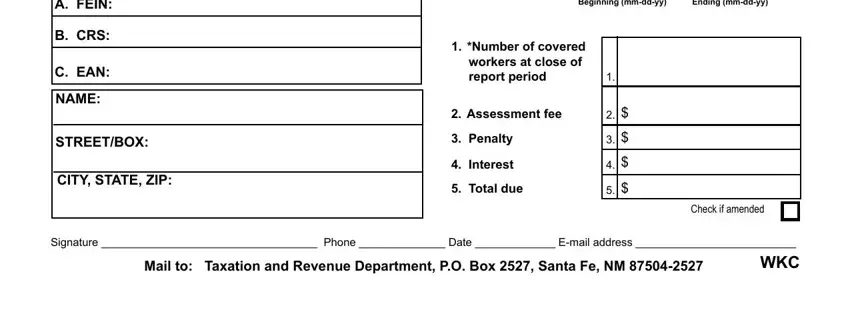

In the A FEIN, B CRS, C EAN, NAME, STREETBOX, CITY STATE ZIP, Beginning mmddyy, Ending mmddyy, Number of covered workers at, Assessment fee, Penalty, Interest, Total due, Signature Phone Date Email, and Mail to Taxation and Revenue field, note your data.

Step 3: When you are done, choose the "Done" button to upload the PDF document.

Step 4: You could make duplicates of the file tostay away from all of the potential future challenges. Don't worry, we cannot distribute or track your data.