The PDF editor makes managing files stress-free. It is very easy to modify the [FORMNAME] form. Use the following steps in order to accomplish this:

Step 1: Look for the button "Get Form Here" on this site and select it.

Step 2: It's now possible to update your wells fargo stock power forms. The multifunctional toolbar lets you insert, remove, improve, and highlight content or perhaps carry out many other commands.

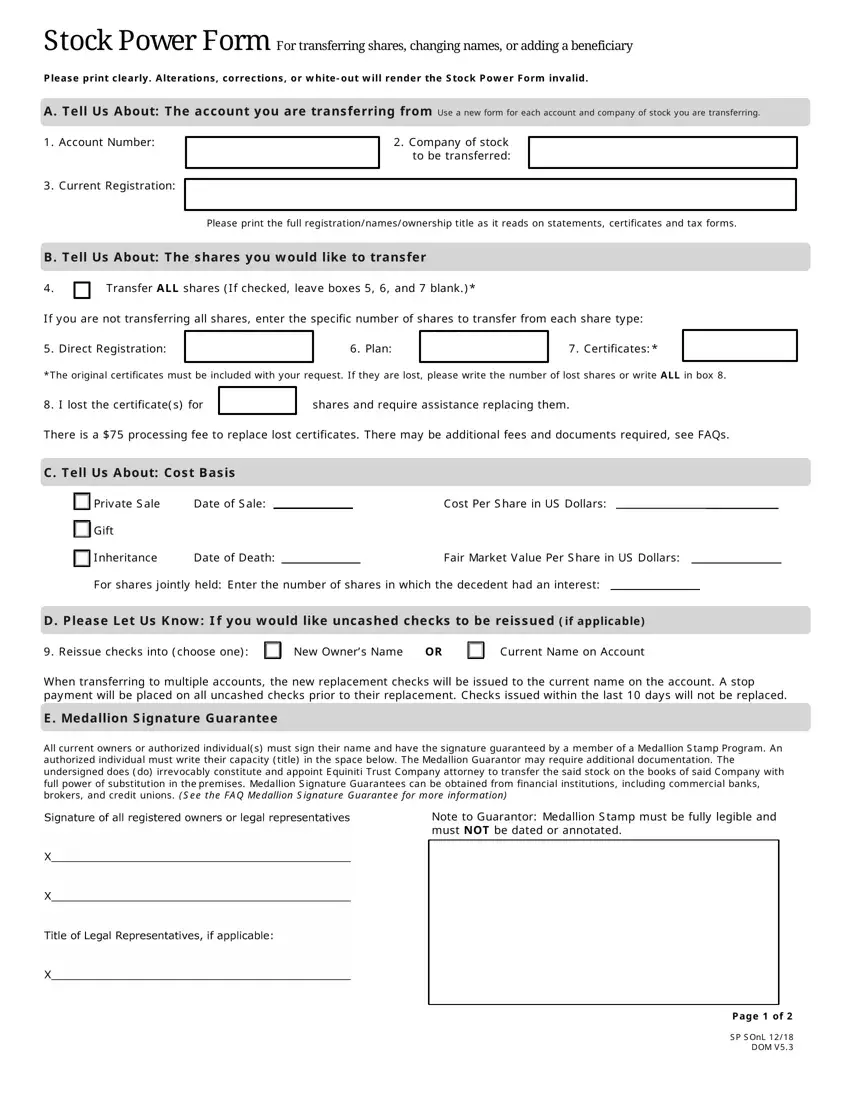

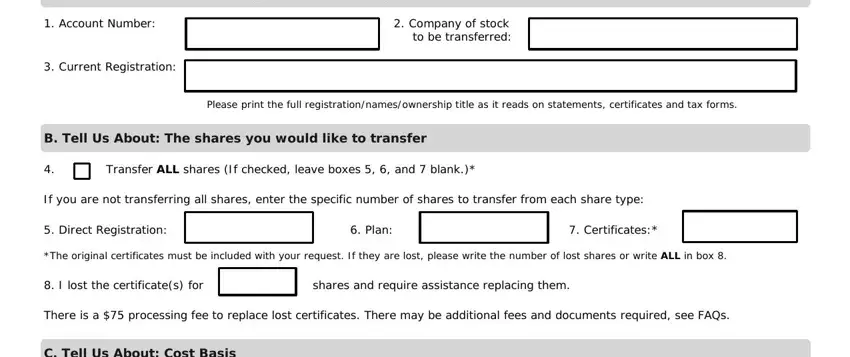

To fill in the document, enter the content the platform will ask you to for each of the following areas:

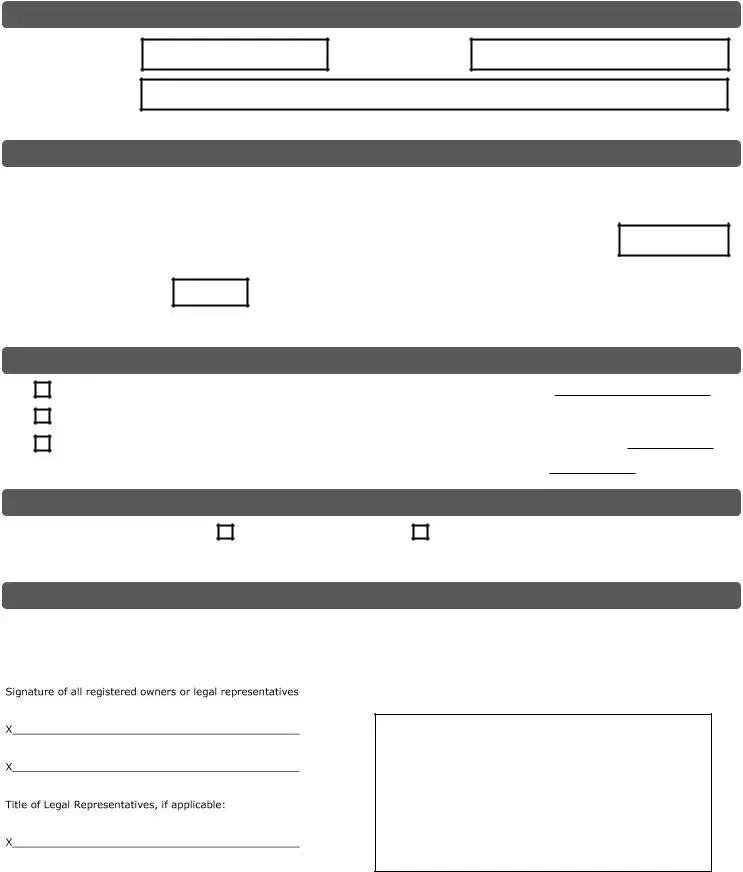

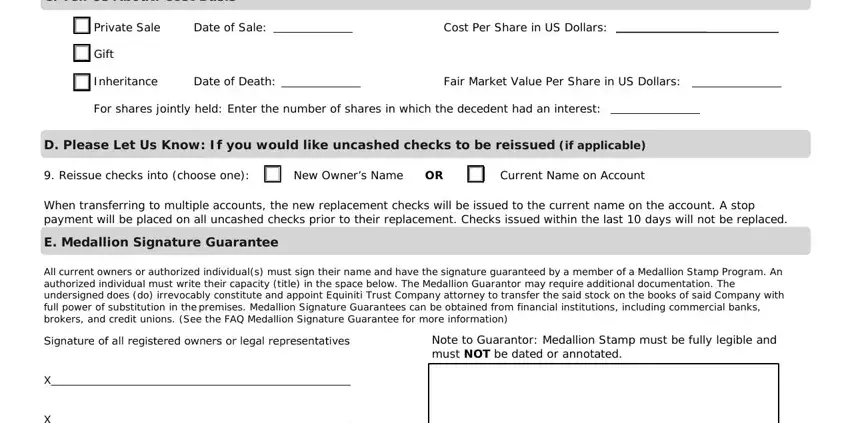

Provide the appropriate particulars in the C Tell Us About Cost Basis, Private Sale, Date of Sale, Cost Per Share in US Dollars, Gift, Inheritance, Date of Death, Fair Market Value Per Share in US, For shares jointly held Enter the, D Please Let Us Know If you would, Reissue checks into choose one, New Owners Name OR, Current Name on Account, When transferring to multiple, and E Medallion Signature Guarantee box.

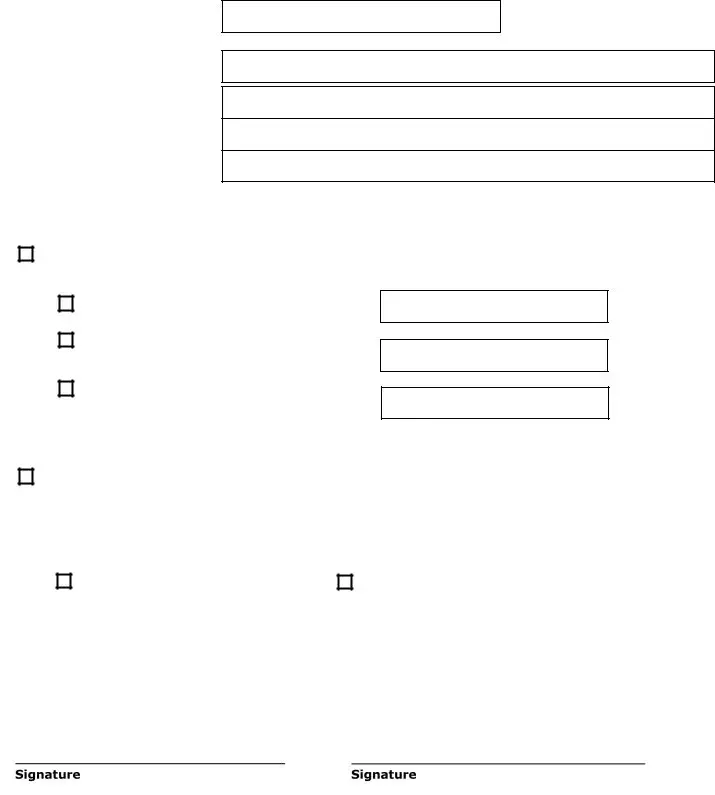

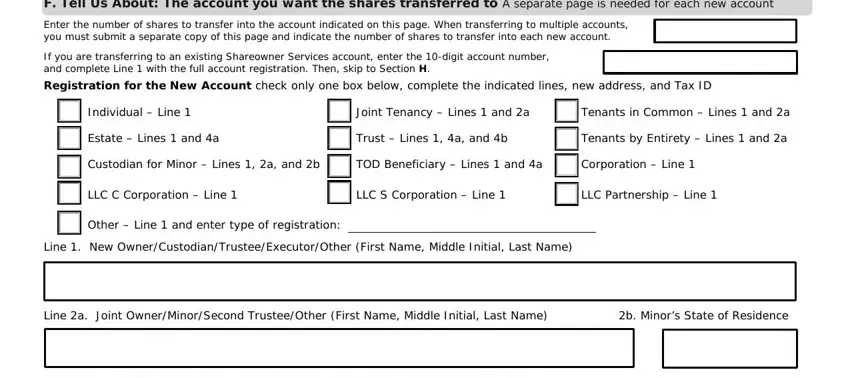

You're going to be requested to note the data to let the application fill out the area F Tell Us About The account you, Enter the number of shares to, If you are transferring to an, Registration for the New Account, Individual Line, Joint Tenancy Lines and a, Tenants in Common Lines and a, Estate Lines and a, Trust Lines a and b, Tenants by Entirety Lines and a, Custodian for Minor Lines a and b, TOD Beneficiary Lines and a, Corporation Line, LLC C Corporation Line, and LLC S Corporation Line.

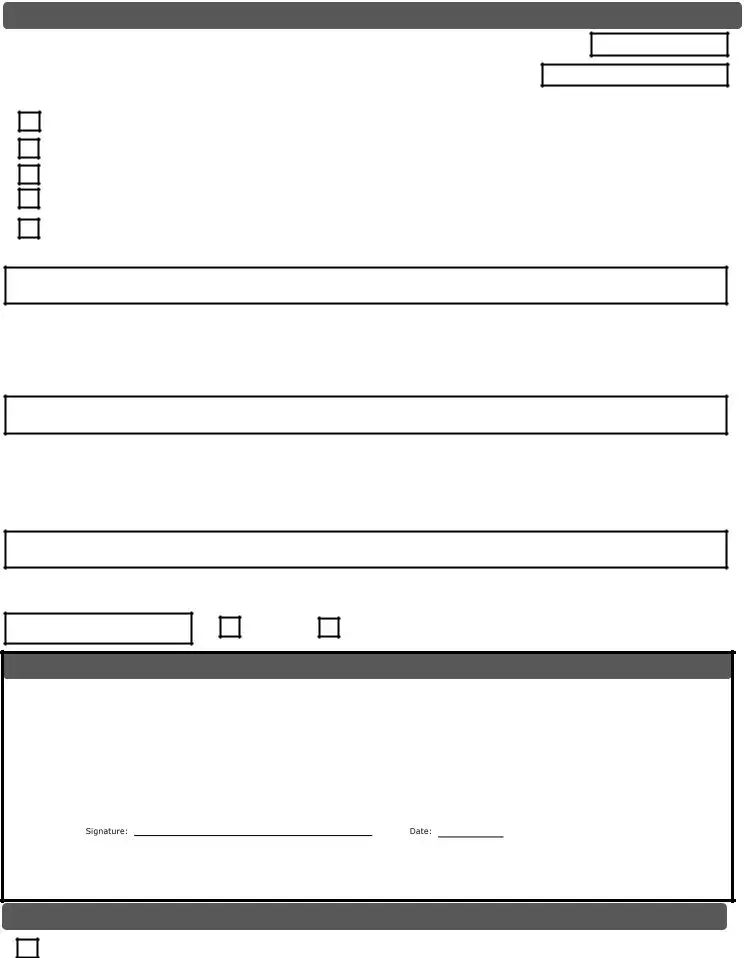

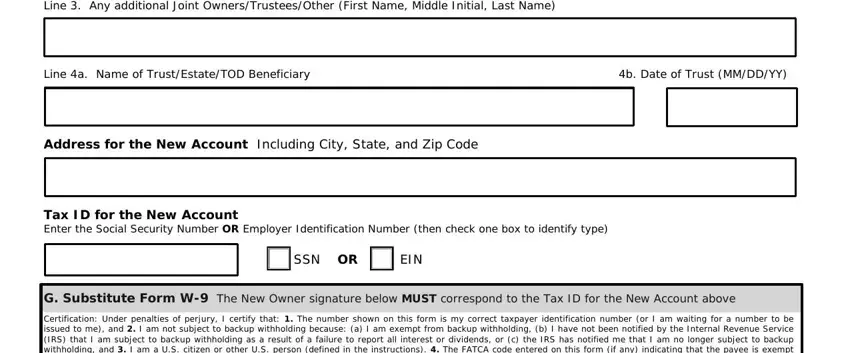

The space Line Any additional Joint, Line a Name of TrustEstateTOD, b Date of Trust MMDDYY, Address for the New Account, Tax ID for the New Account Enter, SSN OR, EIN, G Substitute Form W The New Owner, and Certification Under penalties of will be where you can include all parties' rights and responsibilities.

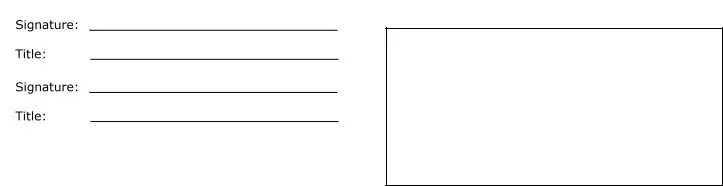

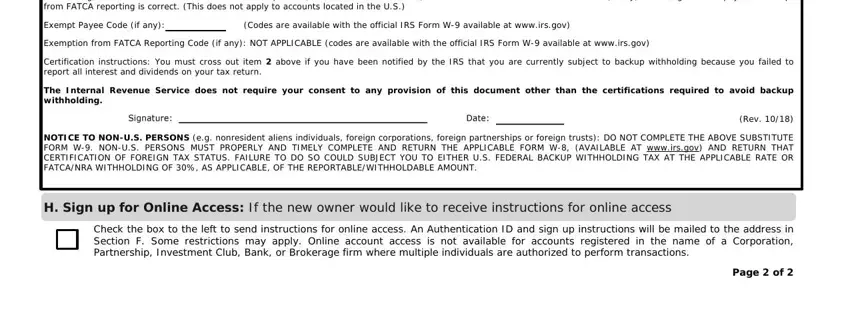

Finalize by analyzing all of these areas and filling in the required data: Certification Under penalties of, Exempt Payee Code if any, Codes are available with the, Exemption from FATCA Reporting, Certification instructions You, The Internal Revenue Service does, Rev, NOTICE TO NONUS PERSONS eg, H Sign up for Online Access If the, Check the box to the left to send, and Page of.

Step 3: Click the "Done" button. You can now transfer the PDF document to your device. As well as that, it is possible to deliver it by email.

Step 4: In order to avoid any headaches in the long run, you should prepare no less than two or three duplicates of the form.