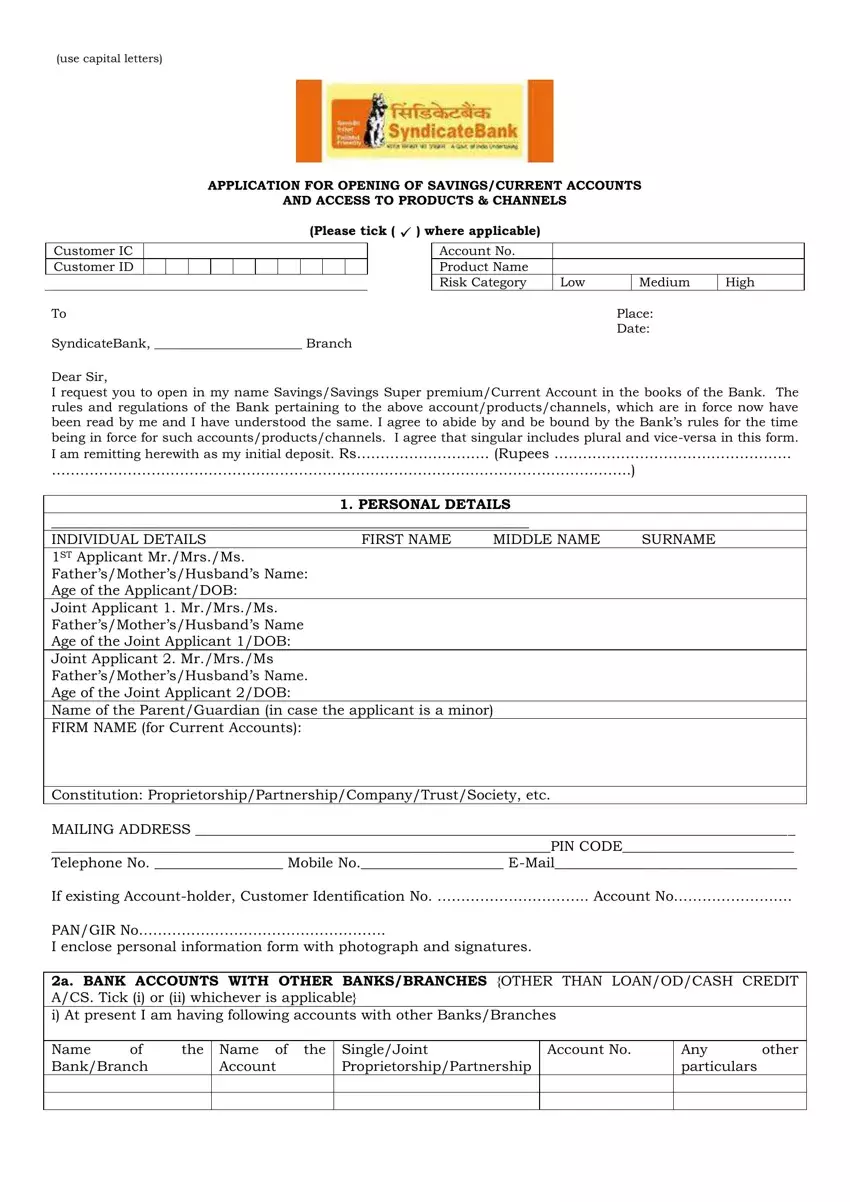

(use capital letters)

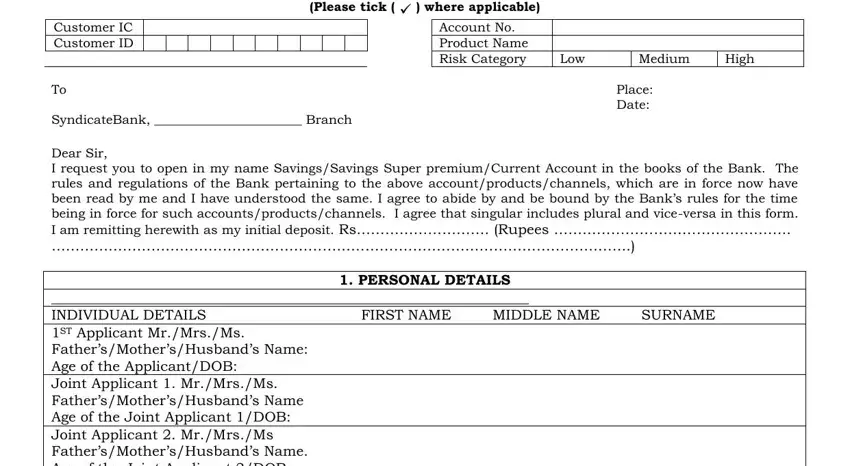

APPLICATION FOR OPENING OF SAVINGS/CURRENT ACCOUNTS

AND ACCESS TO PRODUCTS & CHANNELS

(Please tick ( ) where applicable)

Customer IC

Customer ID

To

SyndicateBank, _______________________ Branch

Account No. |

|

|

|

Product Name |

|

|

|

Risk Category |

Low |

Medium |

High |

Place:

Date:

Dear Sir,

I request you to open in my name Savings/Savings Super premium/Current Account in the books of the Bank. The

rules and regulations of the Bank pertaining to the above account/products/channels, which are in force now have been read by me and I have understood the same. I agree to abide by and be bound by the Bank’s rules for the time

being in force for such accounts/products/channels. I agree that singular includes plural and vice-versa in this form. I am remitting herewith as my initial deposit. Rs………………………. (Rupees …………………………………………..

…………………………………………………………………………………………………………..)

1.PERSONAL DETAILS

___________________________________________________________________

INDIVIDUAL DETAILS |

FIRST NAME |

MIDDLE NAME |

SURNAME |

1ST Applicant Mr./Mrs./Ms. |

|

|

|

Father’s/Mother’s/Husband’s Name: |

|

|

|

Age of the Applicant/DOB: |

|

|

|

Joint Applicant 1. Mr./Mrs./Ms. |

|

|

|

Father’s/Mother’s/Husband’s Name |

|

|

|

Age of the Joint Applicant 1/DOB: |

|

|

|

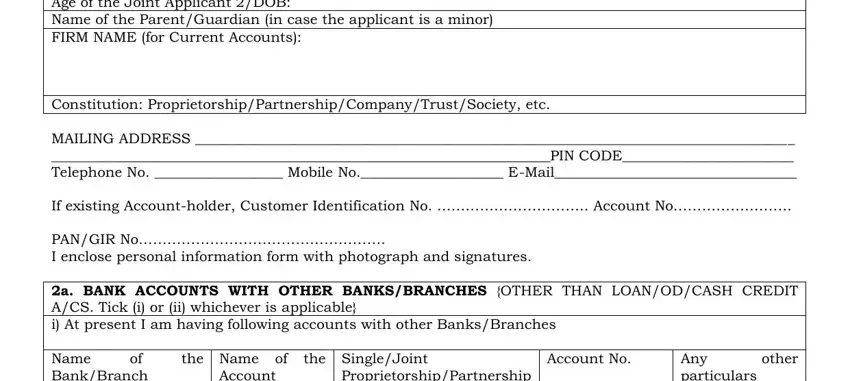

Joint Applicant 2. Mr./Mrs./Ms

Father’s/Mother’s/Husband’s Name.

Age of the Joint Applicant 2/DOB:

Name of the Parent/Guardian (in case the applicant is a minor)

FIRM NAME (for Current Accounts):

Constitution: Proprietorship/Partnership/Company/Trust/Society, etc.

MAILING ADDRESS ____________________________________________________________________________________

______________________________________________________________________PIN CODE________________________

Telephone No. __________________ Mobile No.____________________ E-Mail__________________________________

If existing Account-holder, Customer Identification No. ………………………….. Account No…………………….

PAN/GIR No…………………………………………….

I enclose personal information form with photograph and signatures.

2a. BANK ACCOUNTS WITH OTHER BANKS/BRANCHES {OTHER THAN LOAN/OD/CASH CREDIT A/CS. Tick (i) or (ii) whichever is applicable}

i) At present I am having following accounts with other Banks/Branches

Name |

of |

the |

Name of the |

Single/Joint |

Bank/Branch |

|

Account |

Proprietorship/Partnership |

|

|

|

|

|

ii)At present, I do not have any account with any other Bank/Branch. I undertake to inform you as and when accounts are opened with other Banks/Branches

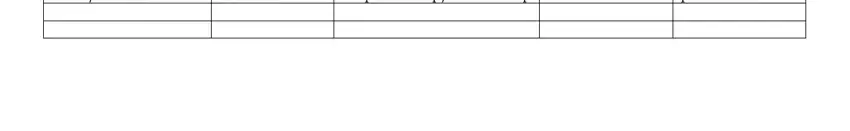

2b. LOAN/OD/CASH CREDIT FACILITY, ETC., ENJOYED WITH OTHER BANKS/BRANCHES : (tick (i) or (ii) whichever is applicable)

i) At present I am enjoying the following facilities with other Banks/Branches

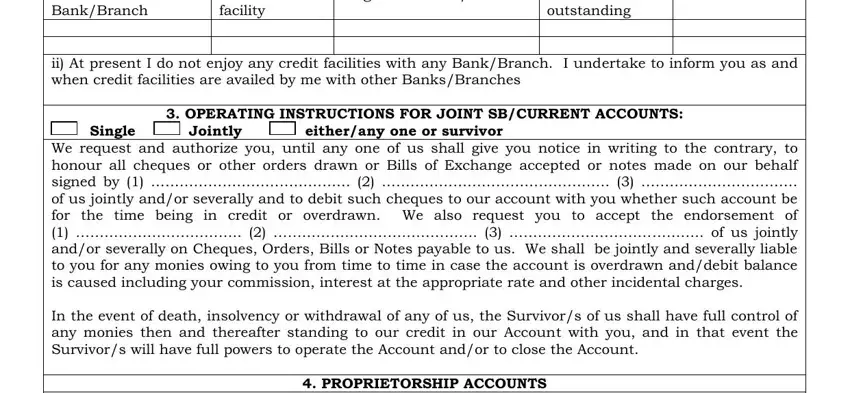

ii)At present I do not enjoy any credit facilities with any Bank/Branch. I undertake to inform you as and when credit facilities are availed by me with other Banks/Branches

|

3. OPERATING INSTRUCTIONS FOR JOINT SB/CURRENT ACCOUNTS: |

Single |

|

Jointly |

|

either/any one or survivor |

|

|

We request and authorize you, until any one of us shall give you notice in writing to the contrary, to

honour all cheques or other orders drawn or Bills of Exchange accepted or notes made on our behalf signed by (1) …………………………………… (2) ………………………………………… (3) ……………………………

of us jointly and/or severally and to debit such cheques to our account with you whether such account be for the time being in credit or overdrawn. We also request you to accept the endorsement of

(1)…………………………….. (2) ……………………………………. (3) ………………………………….. of us jointly and/or severally on Cheques, Orders, Bills or Notes payable to us. We shall be jointly and severally liable to you for any monies owing to you from time to time in case the account is overdrawn and/debit balance is caused including your commission, interest at the appropriate rate and other incidental charges.

In the event of death, insolvency or withdrawal of any of us, the Survivor/s of us shall have full control of any monies then and thereafter standing to our credit in our Account with you, and in that event the Survivor/s will have full powers to operate the Account and/or to close the Account.

4. PROPRIETORSHIP ACCOUNTS

I………………………………… am trading under the name and style of ……………………………………………

and that I am the sole proprietor of the said concern. I authorize you to open the account in the name of

M/s…………………………………………….. and any cheques, instruments etc. payable to self and/or

M/s……………………………………………… may also be accepted, collected and credited in the said account

at my risk and responsibility. I further wish to intimate that I am responsible for all the transactions entered into and obligations incurred with you whether under the trade name or in my individual name or in conjunction with others till I inform in writing otherwise.

Signature of the Proprietor

(without Rubber Stamp of the Firm)

5. MINOR’S ACCOUNTS

I ………………………………………………. hereby declare that I will represent the said Minor as *Natural

Guardian/Guardian appointed by the Court in all future transactions of any description in the above account until the said Minor attains majority, I shall indemnify the Bank against the claim of above Minor for any withdrawal/transaction made by me in his/her account.

*Strike out whatever is not applicable

Relationship with the Minor:Signature of the Guardian with Date:

6. AUTHORISATION FOR AVAILING “SWEEP OUT, SWEEP IN” FACILITY:

I hereby authorize you to transfer amounts in excess of Rs………………………... in my SB Account

No…………………………… on any day into a fixed deposit of 180 days/one year one day/3 years tenor in

units of Rs.1000/10000. I further authorize that inadequacy of funds in my SB account referred above may be met any time by prematurely breaking the fixed deposit into units of Rs.1000/10000 and transferring the required amount into the said SB Account.

7. Nomination

I, __________________________________________________________________________________________________

(Name & Address of the customer) nominate following person to whom, in the event of my/our/minor’s death, the amount of the deposit outstanding in the above said account, (after adjusting the amount due, if any, to the Bank) may be paid by SyndicateBank .

Nature of Account |

Account Number |

Additional details, if any |

SB/Current Account |

|

|

Nominee |

|

|

Name & address of the Nominee

Relationship with the accountholder

If nominee is a minor,

Date of Birth *

*As the nominee is a minor on this date, I appoint Sri/Smt./Kum._______________________________________

__________________________________________________________________________________________________________________

(name, age, relationship and address)

to receive the balance lying in above said a/c. on behalf of the nominee in the event of my/our/minor's death during the minority of the minor.

I do not require any nomination.

I request you to indicate/not to indicate the name of the nominee on the passbook.

*Strike out if nominee is not a minor. Place:

Date:

**Signature(s) of Account holder(s)

**Where account is in the name of a minor, the nomination should be signed by a person lawfully entitled to act on behalf of the minor.

8. APPLICATION FOR CHANNEL REGISTRATION

I hereby apply for access to/use of the following channels (Please tick the appropriate Box)

Global Debit/ATM Card

SMS facility

Any Branch Banking with Multicity cheques

The Global Debit/ATM Card should Carry my name as

E-mail address *Unique personal identification |

(Operate account |

particulars for identification |

from any |

over phone etc. |

CBS branch) |

…………………………………………….. ………………….. ………………………………….. …………………….

1st Applicant

…………………………………………….. ………………….. …………………………………. …………………….

Joint Applicant 1

…………………………………………….. ………………….. …………………………………. …………………….

Joint Applicant 2

*Please write unique personal identification information, for authenticating the card holder, which will, be useful to the Bank to identify you in case you forgot your ATM PIN or to service any other specific request.

Declaration

I have read and understood the Terms and conditions (a copy of which supplied to me by the bank and I am in possession of) relating to the Channels mentioned hereinabove.

I understand that any changes in terms and conditions applicable to the channels mentioned above would be made available to me on request at the branch/displayed on Branch Notice Board.

I undertake that I will be wholly liable/responsible for all types of transactions done on my above said account through my card(s) issued by the Bank to me. I have read the rules and regulations with regard to issue of SyndicateBank VISA Global Debit/ATM Card and I shall abide by the same.

I hereby declare that the transactions under this/these Debit Card(s) shall be strictly in conformity with the guidelines under Foreign Exchange Management Act (FEMA), and that they will not be designed for the purpose of any contravention or evasion of the provisions of the FEMA or any rule, regulation, notification, direction or order made thereunder from time to time.

I further undertake that it will be my sole responsibility to adhere to the provisions of the FEMA or any rule, regulation, notification, direction or order made thereunder from time to time, while transacting with this/these Debit Card(s).

I accept and agree to be bound by the Terms and Conditions including those excluding/limiting the Bank’s liability in respect of SyndinetBanking. I understand that the Bank may, at its absolute discretion, discontinue any of the services completely or partially without any notice to me. I agree that the Bank may debit my account for service charges as applicable from time to time. I confirm that I am resident of India.

I hereby confirm that all accounts under this Customer ID are operated singly and in case of joint account, operated by either or survivor/anyone of survivor(s).

I hereby authorize issuance of Global Debit/ATM Card and provision of TeleBanking/Syndinet Banking services as above. I undertake to ratify and confirm all that the user/(s) do/(es) or cause(s) to do through Global Debit/ATM Card, Telebanking/SyndinetBanking channels. This authority shall continue to be in force until any one of us revokes it by a notice in writing delivered to you.

Please dispatch the SyndicateBank Global debit/ATM card, Tele Banking T-PIN, SyndiNet Banking Login and transaction password to my above mailing address.

I am aware that Savings Accounts can be opened by Individuals for Non-Business purposes only.

I will provide all necessary documentation as mandated by the Regulatory/Bank Authorities for opening the accounts.

I declare, confirm and agree:

a.That all the particulars and information given in the Application form are true, correct, complete and up to date in all respects and I have not withheld any information.

b.That I have/had no insolvency proceedings initiated against me nor have I ever been adjudicated insolvent.

c.That the Multicity cheques/Any branch Banking facility will not be utilized for making money/profits by conducting commission agency business or otherwise.

d.That I have received a copy of the Code of Bank’s Commitment to customers.

I agree, undertake and authorize:

a.SyndicateBank or their agents to make references and enquiries relative to information in this application which SyndicateBank or their agents consider necessary.

b.to keep the Bank informed at all times, of any change in my communication address and employment and authorize the Bank to update the change in their books. I shall be solely responsible to ensure that the Bank has been informed of the correct address for communication. I agree to indemnify the Bank against any fraud or any loss or damage suffered by the Bank due to my providing any incorrect communication address or any other reason not attributable to Bank.

c.Bank to exchange, share or part with all the information relating to my loan/investment/credit facility details and repayment history information to other Banks/Financial Institutions/Credit Bureaus/Agencies, Statutory Bodies as may be required and shall not hold SyndicateBank liable for use of this information.

d.To provide any further information that SyndicateBank may require from time to time.

e.To pay any debit balance/overdrawal allowed either at my request or by compulsions of circumstances or oversight or mistake.

9. APPLICANT’S SIGNATURE / THUMB IMPRESSION

I confirm the correctness of the information furnished in this application. I am agreeable to abide by the rules pertaining to the deposit in force from time to time.

1st APPLICANT |

JOINT APPLICANT 1 |

JOINT APPLICANT 2 |

Signature |

Signature |

Signature |

|

|

|

10.ACCOUNTS OF DEPOSITORS USING THUMB IMPRESSION:

Attestor’s Name and A/c No.:

Full address of the Attestor:Signature of the Attestor with date

11. INTRODUCER’S DETAILS (FOR NEW CUSTOMER)

I have known the depositor for ………… years. I confirm the identity and address of the applicant.

Name: ……………………………………… Customer ID No………………………… A/c No……………………

Date: |

Signature of the Introducer |

(FOR BANK USE ONLY)

Signature of introducer verified and account is opened as per information furnished by depositor(s) exercising due diligence. Debit Card issue approved. Customer ID informed. Relevant flag for ATM/Debit Card/Tele- banking/Syndinet Banking/ABB has been set. Data forwarded to DCC/IVR Centre/Internet Banking Cell on

………………………………

Nomination Registration No. & Date.

KYC Certification:

The applicant has signed this form in my presence. I have verified the copy of the documents submitted as identity proof and address proof with the originals as produced by the applicant.

Whether the account is KYC compliant : YES/NO

Date:Account No.:Officer/Manager Head of the Branch

Note:

Any one of the following documents (subject to the satisfaction of the Bank) is accepted as –

|

Identity Proof |

Address Proof |

|

|

Passport |

Passport |

|

|

PAN Card |

Telephone bill |

|

|

Voter’s Identity Card |

Bank Account Statement |

|

|

Driving Licence |

Electricity bill |

|

|

Letter from a recognized public authority or public |

Ration Card |

|

|

servant verifying the identity and residence of the |

Letter from Employer (subject to satisfaction of the |

|

|

customer to the satisfaction of the Bank. |

Bank) |

|

|

|

Letter from a recognized public authority or public |

|

|

|

servant verifying the identity and residence of the |

|

|

|

customer to the satisfaction of the Bank. |

|

|

|

|

|

|

|

|

|