Working with PDF documents online can be quite easy using our PDF tool. You can fill out t1 adj t1 adjustment request here effortlessly. Our editor is continually developing to deliver the very best user experience attainable, and that's due to our dedication to continuous improvement and listening closely to customer opinions. It just takes just a few simple steps:

Step 1: Click the "Get Form" button at the top of this page to open our editor.

Step 2: Using our handy PDF editor, it is possible to do more than simply fill in forms. Edit away and make your documents appear faultless with customized text put in, or optimize the file's original input to excellence - all that comes along with the capability to insert stunning graphics and sign the document off.

It will be simple to complete the pdf with our helpful guide! Here's what you must do:

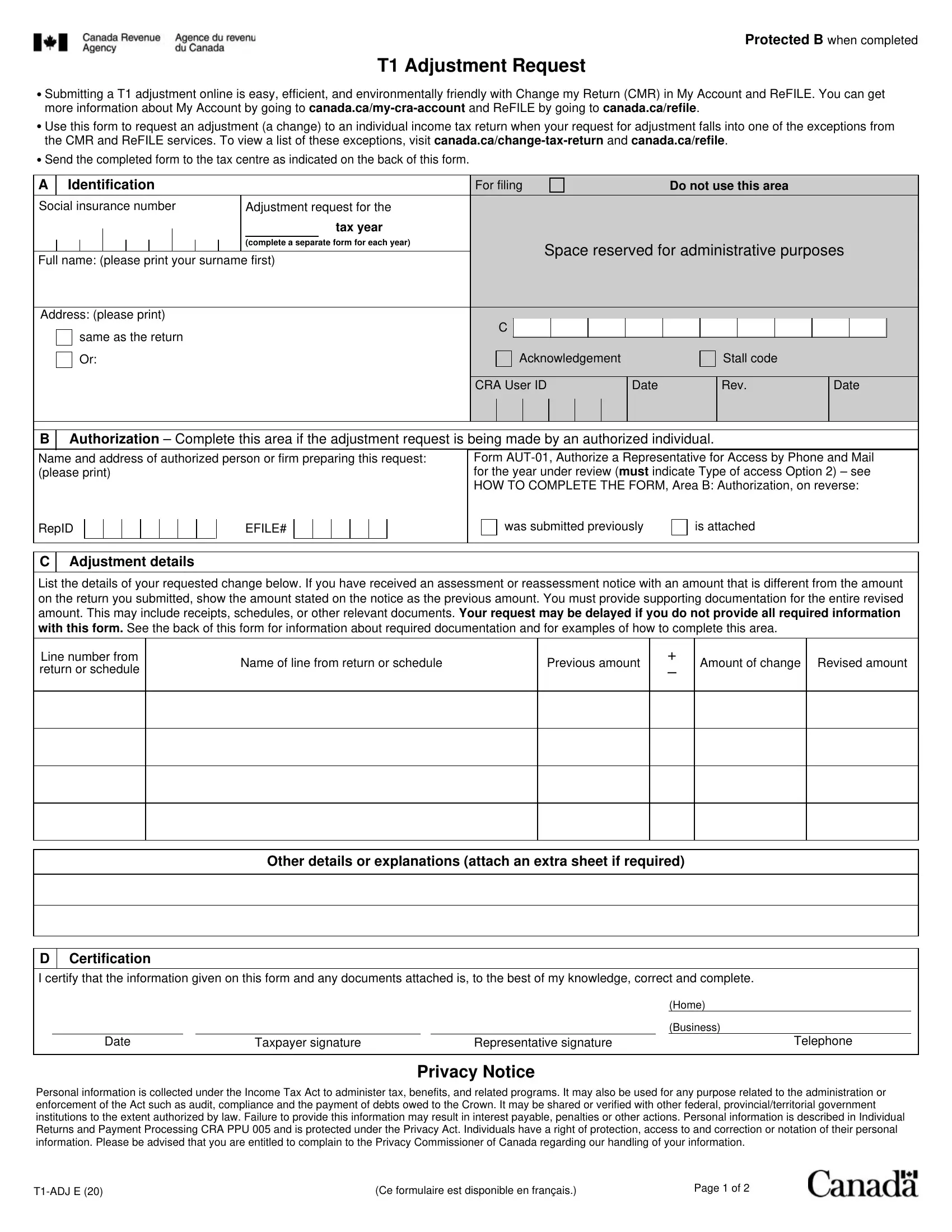

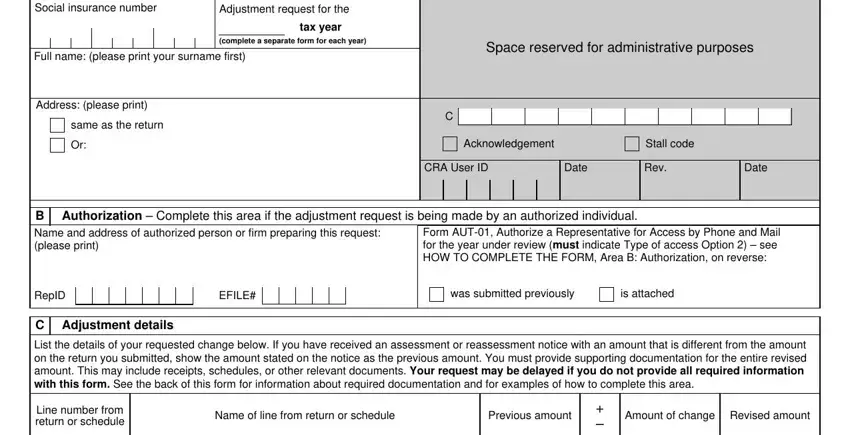

1. First of all, once filling out the t1 adj t1 adjustment request, start in the area that includes the subsequent blank fields:

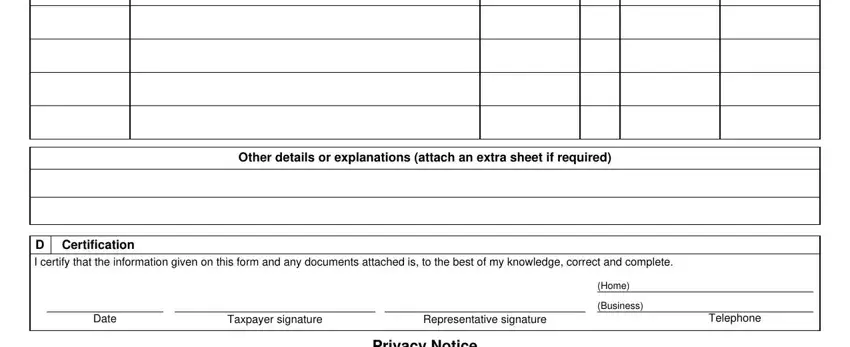

2. After this section is completed, go to type in the suitable details in all these - Other details or explanations, D Certification I certify that the, Date, Taxpayer signature, Representative signature, Telephone, Privacy Notice, Home, and Business.

Concerning Home and Business, be certain you do everything correctly in this section. Those two could be the most significant fields in the PDF.

Step 3: Immediately after taking one more look at your entries, click "Done" and you're done and dusted! After creating afree trial account at FormsPal, you will be able to download t1 adj t1 adjustment request or send it via email directly. The PDF form will also be accessible from your personal cabinet with your each modification. We don't share or sell any details you type in when working with forms at our site.