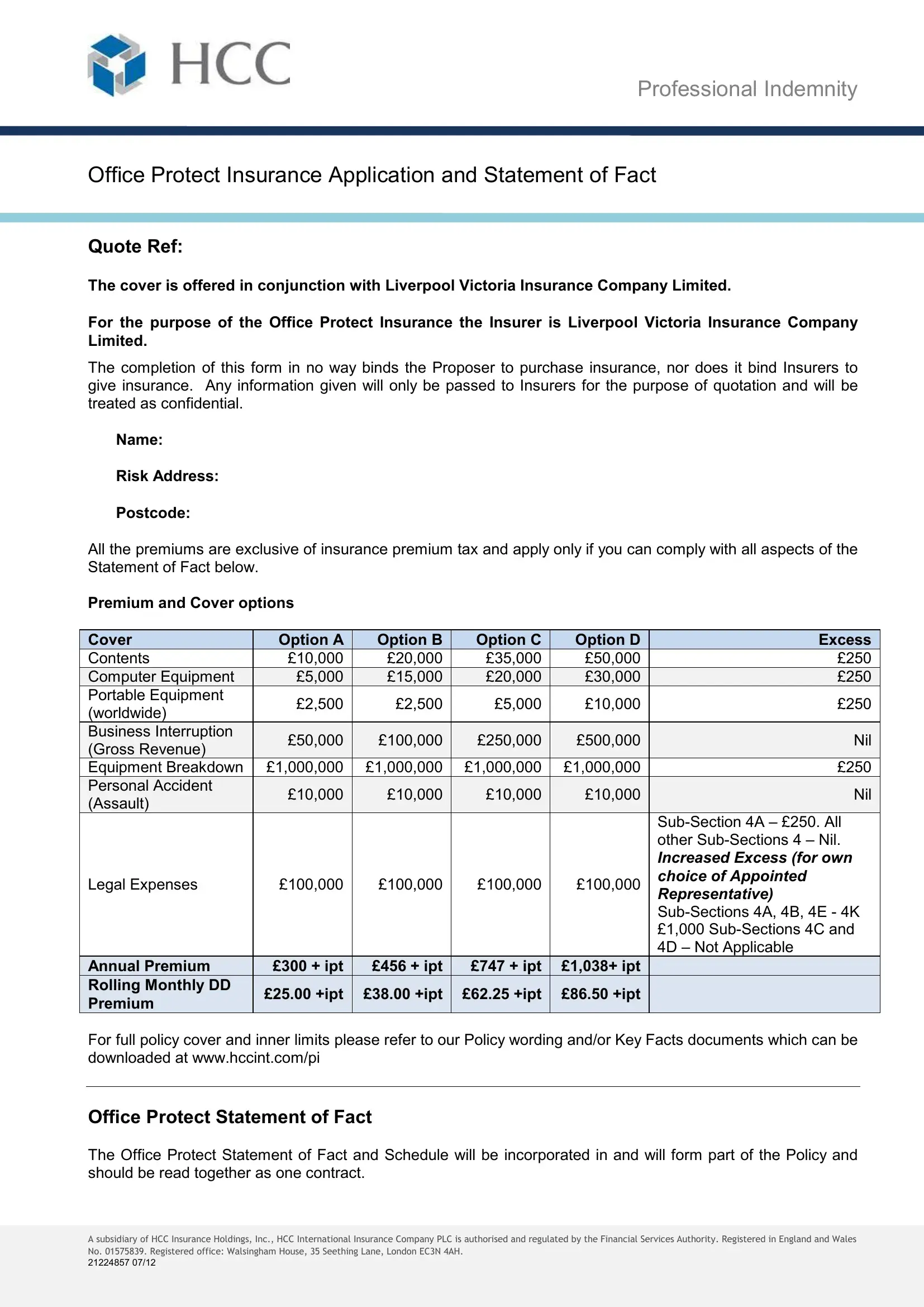

Professional Indemnity

Office Protect Insurance Application and Statement of Fact

Quote Ref:

The cover is offered in conjunction with Liverpool Victoria Insurance Company Limited.

For the purpose of the Office Protect Insurance the Insurer is Liverpool Victoria Insurance Company Limited.

The completion of this form in no way binds the Proposer to purchase insurance, nor does it bind Insurers to give insurance. Any information given will only be passed to Insurers for the purpose of quotation and will be treated as confidential.

Name:

Risk Address:

Postcode:

All the premiums are exclusive of insurance premium tax and apply only if you can comply with all aspects of the Statement of Fact below.

Premium and Cover options

|

|

Cover |

|

Option A |

|

|

Option B |

|

Option C |

|

Option D |

|

|

Excess |

|

Contents |

£10,000 |

£20,000 |

£35,000 |

£50,000 |

£250 |

|

|

Computer Equipment |

£5,000 |

|

|

£15,000 |

|

£20,000 |

£30,000 |

|

|

£250 |

|

Portable Equipment |

£2,500 |

£2,500 |

£5,000 |

£10,000 |

£250 |

|

(worldwide) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Interruption |

|

£50,000 |

|

|

£100,000 |

|

£250,000 |

|

£500,000 |

|

|

Nil |

|

|

|

|

|

|

|

|

|

|

|

(Gross Revenue) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment Breakdown |

£1,000,000 |

|

£1,000,000 |

|

£1,000,000 |

|

£1,000,000 |

|

£250 |

|

|

Personal Accident |

|

|

£10,000 |

|

|

£10,000 |

|

|

£10,000 |

|

|

£10,000 |

|

|

Nil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Assault) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Section 4A – £250. All |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

other Sub-Sections 4 – Nil. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increased Excess (for own |

|

Legal Expenses |

£100,000 |

|

£100,000 |

|

£100,000 |

£100,000 |

choice of Appointed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Sections 4A, 4B, 4E - 4K |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£1,000 Sub-Sections 4C and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4D – Not Applicable |

|

|

Annual Premium |

|

£300 + ipt |

|

|

£456 + ipt |

|

£747 + ipt |

|

£1,038+ ipt |

|

|

|

|

|

|

Rolling Monthly DD |

|

|

£25.00 +ipt |

|

|

£38.00 +ipt |

|

£62.25 +ipt |

|

£86.50 +ipt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For full policy cover and inner limits please refer to our Policy wording and/or Key Facts documents which can be downloaded at www.hccint.com/pi

Office Protect Statement of Fact

The Office Protect Statement of Fact and Schedule will be incorporated in and will form part of the Policy and should be read together as one contract.

A subsidiary of HCC Insurance Holdings, Inc., HCC International Insurance Company PLC is authorised and regulated by the Financial Services Authority. Registered in England and Wales No. 01575839. Registered office: Walsingham House, 35 Seething Lane, London EC3N 4AH.

21224857 07/12

Professional Indemnity

Please check that all the information you have provided in this Statement of Fact is correct and complete.

This is important because inaccurate or incomplete information may result in your insurance being cancelled from its start date and/or your claim not being paid.

If you are not sure whether you need to provide information, or if any of the information is incorrect you should immediately notify the Broker, Intermediary or Agent who arranged the contract of insurance.

Financial

Neither I nor any directors or partners in the business or in the name of any other business in which any of us had an interest have ever:-

•been declared bankrupt or insolvent either as private individuals or in connection with any business

•been disqualified from holding a directorship

•been the subject of a County Court Judgement in respect of debt either as private individuals or in connection with any business or in the name of any business (or the Scottish equivalents)

•been officers of a company that has been declared insolvent, or had a receiver or liquidator appointed, or entered into arrangements with creditors in accordance with the Insolvency Act 1986

•been convicted of or charged with but not yet tried for a criminal offence other than a motoring offence

Insurance

Neither I nor any directors or partners in the business have ever:-

•had an insurance contract cancelled or declared void due to a breach of a policy condition or due to non- disclosure or misrepresentation of a material fact

•had insurance cover restricted or cancelled due to non-compliance with risk improvement requirements

•made a claim or suffered an incident that could have given rise to a claim in respect of cover given under Section 3 – Office Protect Insurance in the last three years

Current Insurance

Neither I nor any directors or partners in the business:-

•hold a current insurance policy with Liverpool Victoria Insurance Company in respect of any cover given under Section 3 – Office Protect Insurance

Note

For the purposes of the following paragraphs premises shall mean the office space occupied by you at the Risk Address

Premises – Business

•The business is solely based in and trading from the above Risk Address within Great Britain, Northern Ireland, the Isle of Man or the Channel Islands

•Our business is the sole occupant of the premises

•No part of the premises are unoccupied

Premises – Construction

•The buildings at the Risk Address in which the business is situated are entirely constructed of: O Walls: Brick, stone or concrete

O External covering of roof: Slates, tiles, concrete, metal, glass or asbestos

•All premises are and will be maintained in a good state of repair

•Any flat felted roof has been and will be inspected at least once every two years by a qualified builder or property surveyor and any defect identified by that inspection is repaired immediately

•All premises are not undergoing or will be undergoing any structural alterations or repairs or have planning permission or planning permission is being sought to undertake any such alteration or repair

Premises - Flooding

•All premises are not in an area prone to or with a history of flooding or potential flooding

•To our knowledge the premises have never been flooded nor show signs of having been flooded

•All premises are not in the immediate vicinity of any river open body of water or the sea

Premises – Security

•Minimum level of Security

All premises meet the Minimum Level of Security as detailed below (contained within Policy Wording under Section 3, Conditions applying to Sub-Section 1, Condition no.6).

A subsidiary of HCC Insurance Holdings, Inc., HCC International Insurance Company PLC is authorised and regulated by the Financial Services Authority. Registered in England and Wales No. 01575839. Registered office: Walsingham House, 35 Seething Lane, London EC3N 4AH.

21224857 07/12

Professional Indemnity

Minimum Level of Security

It is a condition precedent to the Insurer’s liability for loss or Damage by Insured Peril 7 under Sub-Section 1 that the Insured shall have in place in full working order and in operation whenever the Premises are closed for business or left unattended the following minimum level of security or such level as is specified in the Schedule

a.the final exit door of the Insured’s portion of the Buildings is to be fitted with either

i.for timber or steel framed doors a mortice deadlock that has 5 or more levers and matching box striking plate which conform to BS 3621 or

ii.for timber or steel framed doors a rim latch deadlock that conforms to BS 3621

b.all other external doors and internal doors giving access to any part of the buildings not occupied by the Insured are to be fitted with either

i.as described in a) i. and ii. above or

ii.2 key-operated security bolts for doors fitted approximately 30cms from the top and bottom of the doors respectively

c.aluminium or UPVC framed doors are to be fitted with integral cylinder key operated mortice deadlocks

d.all ground floor and basement opening windows/skylights and other opening windows/skylights accessible from roofs decks balconies fire escapes canopies down pipes are to be fitted with key operated window locks. This requirement does not apply to windows/skylights which are protected by solid steel bars grilles gates expanded metal or weld-mesh securely fixed to the brickwork surrounding the window

Any door or window officially designated a fire exit by the fire authority is excluded from these requirements. These are to be secured internally by panic bolts or fire exit bolts. Any additional devices are to be approved by the local Fire Prevention Officer

•Alarm Requirement Applicable to Cover Option D only

The Intruder Alarm System at the premises complies with the terms of the Confirmed Signalling Requirement (as detailed below) and is maintained in full and effective working order in accordance with the provisions of the Intruder Alarm System Condition (contained within Policy Wording under Section 3, Conditions applying to Sub-Section 1, Condition no.2)

Section 3 Sub-section 1 Confirmed Signalling Alarm Requirement

It is a condition precedent to the Insurer’s liability under Section 1 Material Damage Insured Peril 7 that the Premises are fitted with an Intruder Alarm System which is maintained by a company that is inspected by a UKAS accredited inspectorate (NSI or SSAIB) and installed to BS 4737 Pt 1 or EN 50131-1.

Where the Intruder Alarm System is installed to BS 4737 Pt 1 it must include the following:

1.Detection circuits which cover the Premises to include contacts fitted to external doors and internal trap protection (e.g. movement sensors) to detect movement by intruders around the Premises

2.An external self actuating sounder (bell, siren, or klaxon) and remote signalling to an alarm receiving centre via a confirmed system in accordance with DD243, using sequential, audio or visual confirmation.

Where an alarm is installed under EN 50131-1, it must be installed in accordance with the scheme described in PD6662:2004 for a minimum of a Grade 2 system, with notification locally by an external self actuating sounder and remote signalling by an appropriate European Grade 3 or Grade 4 signalling method to an alarm receiving centre conforming to BS 5979.

Confirmation of activation in accordance with DD243 must also be by sequential means if audio or visual confirmation technology is used.

Declared variations from the above statements including claims declared

A subsidiary of HCC Insurance Holdings, Inc., HCC International Insurance Company PLC is authorised and regulated by the Financial Services Authority. Registered in England and Wales No. 01575839. Registered office: Walsingham House, 35 Seething Lane, London EC3N 4AH.

21224857 07/12

Professional Indemnity

Acceptance |

|

|

|

• |

I/we |

would like to proceed with: |

Cover Option: A B C |

D |

• |

I/we |

would like cover to commence from: |

/ |

/20__ |

I /we declare that, after full enquiry, the contents of this Statement of Fact are true and that I/we have not misstated, omitted or suppressed any material fact or information. I/we agree that this Statement of Fact together with any other information supplied by me/us shall form the basis of any contract of insurance which may be effected. If there is any material alteration to the facts and information which I/we have provided or any new material matter arises before the completion of the contract of insurance, I/we undertake to inform Insurers.

Signature(s) of Principal(s) or Partners:

Date:

Data Protection - How we use your personal information

This information explains how we may use your details and tells you about the systems we use that allow us to detect and prevent fraudulent applications and claims. The savings that we make help us to keep premiums and products competitive.

The way in which we may use your personal data is controlled by the requirements of the Data Protection Act 1998. Liverpool Victoria Insurance Company Limited is registered for the purpose of processing personal data.

Information provided to us may be held, whether or not you purchase a product, on computer, paper file or other format. We will hold this information for a reasonable period of time to ensure that a clear and complete history of insurance enquiries, applications, policy records and transactions is maintained.

Subject to payment of a fee, you can ask for a copy of the personal information we hold about you by writing to the CCA Department, LV=, County Gates, Bournemouth, BH1 2NF. For details of the Liverpool Victoria group of companies please refer to www.lv.com

The information (some of which may be sensitive data) may be used to process and administer your insurance by us and our agents (e.g. service providers both within and outside the European Economic area with which we have agreements). It may also be used or disclosed to regulators for the purposes of monitoring and enforcing our compliance with any regulation. Occasionally, your personal information may be disclosed to selected third parties who are assisting us in service improvement activities.

All phone calls may be monitored and recorded and may be used for fraud prevention and detection, quality control and training purposes.

If credit or debit card details are provided to us we may use this information to automatically renew your insurance policies. We will only do this where we have your permission.

If your details have been obtained through one of our affinity associations we may pass some of your information, including product details and ongoing information, to that affinity organisation for membership, business analysis and other relevant purposes.

If you move to a new insurance provider we may confirm certain details relating to your insurance to them. We will only do this where we are satisfied that it is a genuine request.

If we receive a request for policy information by an individual other than the policy holder we will check that the policy holder has given permission to do this.

Sensitive personal data will not be used for marketing purposes.

Credit Search

We use information obtained from a number of sources including credit reference agencies. This helps us to confirm your identity, allows us to give you a quote and decide which payment options we can offer you, for example, paying monthly.

A subsidiary of HCC Insurance Holdings, Inc., HCC International Insurance Company PLC is authorised and regulated by the Financial Services Authority. Registered in England and Wales No. 01575839. Registered office: Walsingham House, 35 Seething Lane, London EC3N 4AH.

21224857 07/12

Professional Indemnity

You’ll see a record of this search if you request a Credit Report. No other organisation who may conduct credit searches will be able to see it.

The search won’t affect your credit record or credit rating in any way.

Fraud prevention and detection

If false or inaccurate information is provided and fraud is identified, details will be passed to fraud prevention agencies. Law enforcement agencies may access and use this information.

We and other organisations may also access and use this information to prevent fraud and money laundering, for example, when:

-checking details on applications for credit and credit related or other facilities

-managing credit and credit related accounts or facilities

-recovering debt

-checking details on proposals and claims for all types of insurance

-checking details of job applicants and employees

Please contact us at GFC, LV=, County Gates, Bournemouth, BH1 2NF if you want to receive details of the relevant fraud prevention agencies.

We and other organisations may access and use from other countries the information recorded by fraud prevention agencies.

Some of the registers we make use of are:

The Claims and Underwriting Exchange (CUE). This is run by Insurance Database Services Ltd. The CUE database is used by most UK insurers and holds details of most motor and household insurance claims.

Insurance Hunter. This is a central insurance anti fraud system to which other insurers also have access. This database is designed to combat activities such as identity theft and money laundering.

The Motor Insurance Anti-Fraud and Theft Register. This central database contains details of stolen and written off vehicles.

To protect your interests, we will check any information provided against these registers for completeness and accuracy. If we find that false or inaccurate information has been given to us, or we suspect fraud, we’ll take action, which could result in prosecution.

21224857 08.12

LV= and Liverpool Victoria are registered trademarks of Liverpool Victoria Friendly Society Limited and LV= and LV= Liverpool Victoria are trading styles of the Liverpool Victoria Group of companies. Liverpool Victoria Insurance Company Limited, registered in England and Wales number 3232514, is authorised and regulated by the Financial Services Authority, register number 202965. Registered address for both companies: County Gates, Bournemouth BH1 2NF. Tel: 01202 292333

HCC International Walsingham House, 35 Seething Lane, London EC3N 4AH, United Kingdom hcc.com/international/pi main +44 (0)20 7702 4700 facsimile +44 (0)20 7626 4820

A subsidiary of HCC Insurance Holdings, Inc.

A subsidiary of HCC Insurance Holdings, Inc., HCC International Insurance Company PLC is authorised and regulated by the Financial Services Authority. Registered in England and Wales No. 01575839. Registered office: Walsingham House, 35 Seething Lane, London EC3N 4AH.

21224857 07/12