The intricacies of managing and reporting the financial affairs of controlled foreign affiliates are detailed in Canada's T1134B form, presenting a comprehensive framework aiming to ensure transparency and adherence to the Income Tax Act's stipulations. Businesses and individuals with international ties, specifically involving controlled foreign affiliates, are required to navigate through the meticulous process of filing separate returns for each affiliate, excluding those deemed "dormant" or "inactive." This form delves into the resolution of various reporting issues, from identifying the taxpayer and detailing the foreign affiliate's general information to specifying their group structure and providing financial as well as surplus account information. Additionally, it extends into the nature of income, highlighting the compositions of revenue and foreign accrual property income that paint a detailed picture of a foreign affiliate’s financial health. Critical to this process is the certification of the accuracy and completeness of the information provided, emphasizing the legal obligation to present true and thorough documentation. This detailed reporting mechanism not only aids in the proper assessment of tax liabilities but also in maintaining the integrity of Canada's taxation system by monitoring the international activities of its tax residents. By adhering to these requirements, taxpayers can navigate complex cross-border tax obligations, ensuring compliance and facilitating a transparent international tax environment.

| Question | Answer |

|---|---|

| Form Name | T1134B Form |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | t1134 form, t1134 fillable, t1134b filing instructions, canadian foreign entity classification |

Canada Customs |

Agence des douanes |

INFORMATION RETURN RELATING TO CONTROLLED FOREIGN AFFILIATES |

and Revenue Agency |

et du revenu du Canada |

Do not use this area

λA separate return must be filed for each controlled foreign affiliate (including a

λDo not file a return for "dormant" or "inactive" foreign affiliates. Refer to the attached instructions for the definition of dormant or inactive foreign affiliates.

λReferences on this return to the foreign affiliate or the affiliate refer to the foreign affiliate in respect of which the reporting taxpayer is filing this return.

λIf you are reporting on a partnership, references to year or taxation year should be read as fiscal period and references to taxpayer should be read as partnership.

λIf you need more space to report information, you can use attachments.

λUnless otherwise noted, all amounts should be in Canadian dollars.

Part I – Identification

Section 1 – Reporting taxpayer information

Tick a box to indicate who you are reporting for, and complete the areas that apply.

|

|

individual |

First name |

Last name |

|

|

|

Initial |

|

|

Social insurance number |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporation |

Corporation's name |

|

Business Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

C |

|

|

|

|

|

|

||||

|

|

trust |

Trust's name |

|

|

|

|

|

|

Account number |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

T |

|

|

|

– |

|

|

|

|

|

|

|

|

– |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

partnership |

Partnership's name |

|

|

|

|

|

|

Partnership's identification number |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reporting taxpayer's address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. |

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

Province or territory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Month |

|

Day |

|

|

|

|

Year |

|

Month |

Day |

|||||||||||||

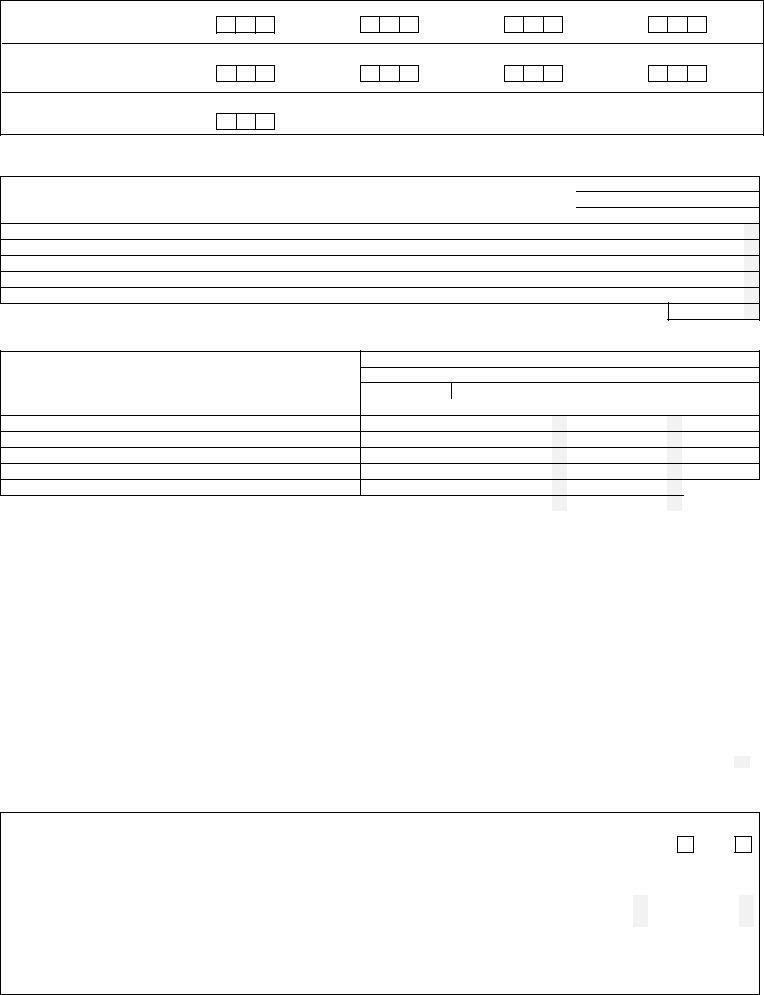

For what taxation year are you filing this return?

or from

to

Is this the first time that the reporting taxpayer has filed form T1134 for this foreign affiliate? |

Yes |

No

Total number of T1134's filed by the reporting taxpayer for this taxation year.

Section 2 – Group structure – Attach a separate page with the following information

List the name and country of residence of each corporation (other than another foreign affiliate of the reporting taxpayer) that is related to the reporting taxpayer and that has an equity percentage (as defined in subsection 95(4) of the Act) in the foreign affiliate.

If the reporting taxpayer is a partnership, list the name and address of each member of the partnership.

List the name and country of residence of each other foreign affiliate of the reporting taxpayer that has an equity percentage in the foreign affiliate.

List the name and country of residence of each other controlled foreign affiliate of the reporting taxpayer in which the foreign affiliate has an equity percentage and of each

l

Note: You can satisfy the above requirements by submitting a group organizational chart that includes the requested information. You only have to file one organizational chart

for a group of persons that are related to each other. |

Name |

Identify the reporting taxpayer filing the organizational chart for the related group.

Part II – Foreign Affiliate Information

Section 1 – General information

A. Identification of foreign affiliate

Name |

|

|

|

|

|

|

Address of head office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Identification number (optional) (see filing instructions) |

|

|

|

|

|

C |

|

– |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(country code) |

|

|

|

(assigned number) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Year in which the corporation or trust became |

|

|

Year |

Did the corporation or trust cease to be a foreign affiliate |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

a foreign affiliate of the taxpayer |

|

|

|

|

|

|

of the reporting taxpayer in the year? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify the principal activities of the foreign affiliate. (Enter the appropriate standard industrial code(s) from the list in the instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Standard industrial code(s): |

1 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Ce formulaire existe en français.) |

|

|

|

|

|

|

|

3901 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

PAGE 1 OF 8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify the countries or jurisdictions in which the foreign affiliate carries on a business or other income earning activity. (Enter the appropriate country code(s) from the list in the

instructions.) Country code(s): |

1 |

2

3

4

Specify the countries or jurisdictions in which the foreign affiliate carries on business through a permanent establishment. (Enter the appropriate country code(s) from the list in

the instructions.) Country code(s): |

1 |

2

3

4

Country or jurisdiction of residence of the foreign affiliate. (Enter the appropriate country code from the list in the instructions.) Country code:

B. Capital stock of foreign affiliate (including a paragraph 94(1)(d) trust)

(i) |

|

Number and book cost of shares |

||

Description of shares of the foreign affiliate's capital stock owned by the reporting taxpayer |

|

|

|

|

|

|

End of year |

||

|

|

No. |

|

Cost |

|

|

|

|

|

Total

00

00

— 00

(ii)Description of shares of the foreign affiliate's capital stock owned by a controlled foreign affiliate of the reporting

taxpayer or other person related to the reporting taxpayer

No.

Total

C. Other information

Number and book cost of shares

End of year

Cost

|

Canadian $ (if available) |

Foreign currency* |

|

Currency code |

||

|

00 |

|

00 |

|

|

|

|

00 |

|

00 |

|

|

|

|

— |

|

— |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

||

|

— |

|

— |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(i) |

What was the reporting taxpayer's equity percentage in the foreign affiliate at the beginning of the reporting taxpayer's taxation year? |

|

|

|

|

% |

|

||

|

|

|

|

|

|

|

|||

(ii) |

What was the reporting taxpayer's equity percentage in the foreign affiliate at the end of the reporting taxpayer's taxation year? |

|

|

|

% |

|

|||

|

|

|

|

|

|

|

|

|

|

(iii) |

If the Act were read without paragraph 95(2.2)(a), would the reporting taxpayer have a qualifying interest in the foreign affiliate: |

|

|

|

|

|

|

|

|

|

(a) at the beginning of the reporting taxpayer's taxation year? |

|

|

|

|

|

|||

|

Yes |

|

|

No |

|

|

|||

|

(b) at the end of the reporting taxpayer's taxation year? |

|

|

|

|||||

|

Yes |

|

|

No |

|

|

|||

|

|

|

|

||||||

(iv) Was the foreign affiliate indebted to the reporting taxpayer at any time during the reporting taxpayer's taxation year? |

Yes |

|

|

No |

|

|

|||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

(v) |

If yes, specify the gross amount of debt the affiliate owed to the reporting taxpayer at the end of the reporting taxpayer's taxation year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Section 2 – Financial information of the foreign affiliate (including a paragraph 94(1)(d) trust)

For each tax year of the foreign affiliate ending in the reporting taxpayer's taxation year, provide the following information in respect of the affiliate:

Attached (tick)

λ unconsolidated financial statements or, if unavailable, the financial information that is available to you as a shareholder |

Yes |

No

|

|

|

|

|

Canadian $ (if available) |

|

Foreign Currency* |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

λ accounting net income before tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

λ income or profits tax paid or payable on income |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

λ country to which income or profits tax was paid or payable |

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

|

4 |

|

|

|

(Enter appropriate country code(s) from the list in the instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

λ currency code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

*If financial information is reported in a foreign currency, provide the appropriate currency code from the list in the instructions. |

|

|

|

|

|

|

|

|

|

||||||||

PAGE 2 OF 8

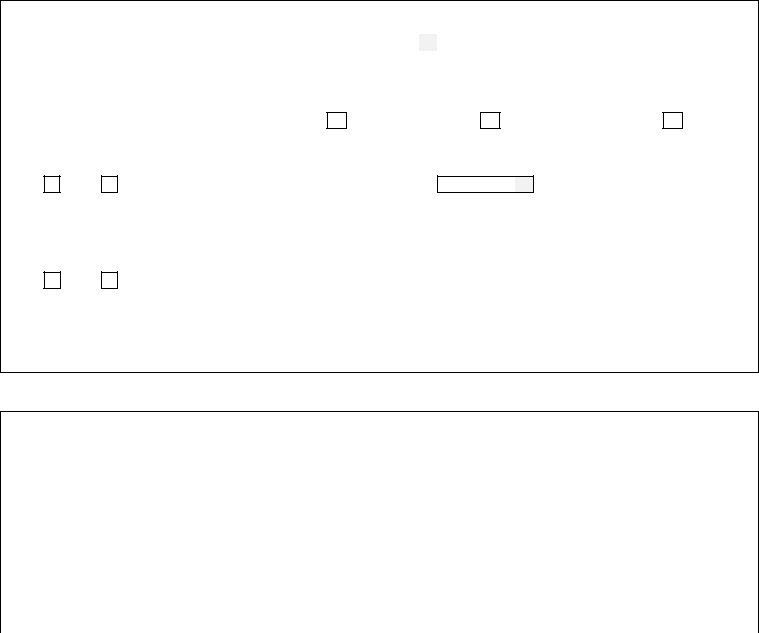

Section 3 – Surplus accounts

1.Did the reporting taxpayer, at any time in the taxation year, receive a dividend on a share of the capital stock of the foreign affiliate for which an amount is deductible from the income of the reporting taxpayer under subsection 91(5) or section 113 of the Act?

Yes |

|

No |

|

If yes, provide amount of dividend. |

If yes, and the reporting taxpayer is a corporation, the reporting taxpayer must provide summary calculations of the exempt surplus, exempt deficit, taxable surplus, taxable deficit, and underlying foreign tax of the foreign affiliate at the end of the affiliate's last taxation year ending in the reporting taxpayer's taxation year in support of the dividend deduction claimed. Documentation supporting these calculations need not be filed but should be retained as it may be requested for examination. Surplus calculations should be made in the calculating currency under Regulation 5907(6).

From what surplus account was the dividend paid ? Exempt

Taxable

2. Was a subsection 93(1) election made or will such an election be made for the disposition of shares of the foreign affiliate in the year?

Yes

No

If yes, provide the actual or estimated amount elected on.

—

00

3.At any time in the taxation year of the reporting taxpayer, was the reporting taxpayer or any foreign affiliate of the reporting taxpayer involved in a corporate or other organization, reorganization, amalgamation, merger,

Yes

No

4.At any time in the taxation year of the reporting taxpayer, did the reporting taxpayer or another foreign affiliate of the reporting taxpayer acquire or dispose of a share of the capital stock of the foreign affiliate?

Yes |

|

No |

|

If the answer to either question 3 or 4 is yes, provide a summary description of each transaction or event. |

Part III – Nature of Income

Section 1 – Employees per business

How many

(Enter the appropriate standard industrial code(s) from the list in the instructions and tick the appropriate box or boxes.)

Business |

Number of |

|

|

|

|||||||||

|

|

|

|

|

Less than 6 |

Between 6 and 15 |

More than 15 |

||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2 – Composition of revenue |

|

|

|

|

|

|

|||||||

Give the amount of the foreign affiliate's gross revenue from a business or property for each of the affiliate's taxation years ending in the reporting taxpayer's taxation year, derived from each of the following sources. (Tick appropriate box or boxes.)

|

Source |

|

|

|

|

|

|

Foreign affiliate's gross revenue |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) |

Interest |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(ii) |

Dividends |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(iii) |

Royalties |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(iv) Rental and leasing activities |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(v) Loans or lending activities |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(vi) Insurance or reinsurance of risks |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(vii) Factoring of trade accounts receivable |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(viii) Disposition of investment property |

less than $25,000 |

$25,000 to $100,000 |

$100,000 to $500,000 |

$500,000 to $1 million |

more than $1 million |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE 3 OF 8

Section 3 – Foreign accrual property income (FAPI)

(i) |

Did the foreign affiliate earn FAPI in any taxation year of the affiliate that ended in the reporting taxpayer's taxation year? |

Yes |

|

|

No |

|

|

||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(ii) |

If yes, give the reporting taxpayer's total participating percentage for the foreign affiliate for that year |

|

|

|

|

% |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||

Also, give the amount of FAPI the affiliate earned that year in respect of each of the following: |

|

|

|

Amount |

|

|

|||

|

|

|

|

|

|

|

|

|

|

(iii) |

FAPI that is income from property under subsection 95(1) of the Act |

|

|

|

|

|

|

00 |

|

(iv) |

FAPI from the sale of property under paragraph 95(2)(a.1) of the Act |

|

|

|

|

|

|

00 |

|

(v) |

FAPI from the insurance or reinsurance of risks under paragraph 95(2)(a.2) of the Act |

|

|

|

|

|

|

00 |

|

(vi) |

FAPI from indebtedness and lease obligations under paragraph 95(2)(a.3) of the Act |

|

|

|

|

— |

00 |

||

|

|

|

|

— |

|||||

(vii) |

FAPI from indebtedness and lease obligations under paragraph 95(2)(a.4) of the Act |

|

|

|

|

|

|

||

|

|

|

|

— |

00 |

||||

(viii) FAPI from providing services under paragraph 95(2)(b) of the Act |

|

|

|

|

— |

00 |

|||

|

|

|

|

— — |

|||||

(ix) |

FAPI from the disposition of capital property |

|

|

|

|

00 |

|||

(x) |

FAPI under the description of paragraph (c) in the definition of FAPI in subsection 95(1) of the Act |

|

|

|

|

— |

00 |

||

|

|

|

|

|

|

||||

|

Total FAPI |

|

|

|

00 |

||||

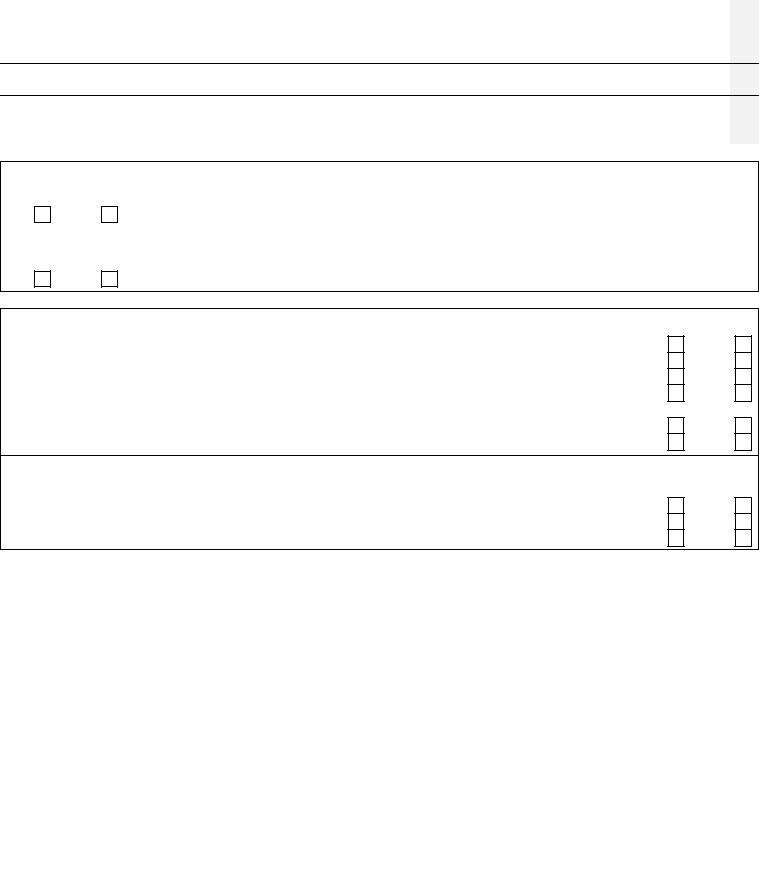

Section 4 – Capital gains and losses

A. Excluded property

Did the foreign affiliate dispose of a share in another foreign affiliate that was excluded property or an interest in a partnership that was excluded property in a taxation year of the affiliate that ended in the reporting taxpayer's taxation year?

Yes

No

B. Property that is not excluded property

Did the foreign affiliate dispose of capital property that was not excluded property in a taxation year of the affiliate that ended in the reporting taxpayer's taxation year?

Yes

No

Section 5 – Income included in income from an active business

A. Was income of the foreign affiliate that would otherwise have been included in its income from property included in its income from an active business:

λ because of subparagraph 95(2)(a)(i) of the Act? |

Yes |

λ because of subparagraph 95(2)(a)(ii) of the Act? |

Yes |

λ because of subparagraph 95(2)(a)(iii) of the Act? |

Yes |

λ because of subparagraph 95(2)(a)(iv) of the Act? |

Yes |

λbecause of the type of business carried on and the number of persons employed by the foreign affiliate in the business pursuant

to paragraphs (a) and (b) of the definition of investment business in subsection 95(1) of the Act? |

Yes |

λ because of paragraph 95(2)(l) of the Act? |

Yes |

No

No

No

No

No

No

B. Was income of the foreign affiliate that would otherwise have been included in its income from a business other than an active business included in its income from an active business:

λ because of the 90% test in paragraphs 95(2)(a.1) through (a.4) of the Act? |

Yes |

λ because of subsection 95(2.3) of the Act? |

Yes |

λ because of subsection 95(2.4) of the Act? |

Yes |

No

No

No

Section 6 – Disclosure

Is any information requested in this return not available? |

Yes |

|

No |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

If yes, please specify the information and the reason it is not available. Also indicate the steps taken in attempting to obtain the information. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification

I certify that the information given on this return and in any documents attached is, to my |

Person or firm paid to prepare this return: |

|

||||||||

knowledge, correct and complete, except as disclosed in Section 6. |

|

|

|

|

||||||

|

|

|

|

|

|

|

Name |

|

|

|

Print name |

|

|

|

|

|

Address |

|

|

||

Sign here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

It is a serious offence to file a false return. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or title |

Postal code |

|

|

|

|||

Telephone ( |

) |

|

Date |

Telephone ( |

) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

Printed in Canada

PAGE 4 OF 8

All legislative references on this sheet refer to the Income Tax Act (the Act.)

Do you have to file this return?

Form

λa taxpayer resident in Canada (other than a taxpayer all of whose taxable income for the year is exempt from tax under Part I of the Act) for which a

λa partnership where:

–the share of the income or loss of the partnership for the year of

–a

Note: A trust deemed under paragraph 94(1)(c) of the Act to be resident in Canada for purposes of Part I (i.e., a

A

If you are reporting for a foreign affiliate that is not a CFA, use Form

are not Controlled Foreign Affiliates.

Do not file this return for a foreign affiliate that is "dormant" or "inactive" for the affiliate's taxation year ending in your taxation year. For purposes of completing Form

λhad gross receipts (including proceeds from the disposition of property) of less than $10,000 in the year; and

λat no time in the year had assets with a total fair market value of more than $100,000.

As an individual (other than a trust) you do not have to file Form

Note: In determining whether a

λthe reference to "any corporation" in paragraph (b) of the definition of "equity percentage" in subsection 95(4) of the Act should be read as if it were a reference to "any corporation other than a corporation resident in Canada";

λthe definitions "direct equity percentage" and "equity percentage" in subsection 95(4) of the Act should be read as if a partnership were a person; and

λthe definitions "controlled foreign affiliate" and "foreign affiliate" in subsection 95(1) of the Act should be read as if a partnership were a taxpayer resident in Canada.

Only the lowest tier subsidiary in a group of Canadian corporations under common control has to report for its CFA. However, if another corporation in the Canadian group has a direct equity percentage in the CFA, it too is required to report on that CFA.

If a CFA is owned indirectly by a partnership through a Canadian corporation(s), only the lowest tier Canadian corporation reports for the CFA. However, if a member of the partnership also has a direct equity percentage in the CFA, it too is required to report on the CFA.

Due dates for filing this return

The reporting requirements for foreign affiliates apply to taxation years that begin after 1995. Form

Where your taxation year ends in 1996, 1997 or 1998, Form

λJune 30, 1998; or

λthe day on or before which the return is otherwise required to be filed.

Foreign currency conversion

When converting amounts into Canadian dollars from a foreign currency, you should use the exchange rate in effect at the time of the transaction (e.g., the time the income was received.) If income is received throughout the year, we will accept an average rate for the year.

Where you are required to provide an amount at the beginning or at the end of the year, you may use the exchange rate in effect at the relevant time.

Currency |

Code |

Canadian dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . CAD U.S. dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . USD Pounds sterling. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GBP French francs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . FRF Swiss francs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . CHF Deutsche marks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . DEM Japanese yen . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . JPY Hong Kong dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . HKD Netherlands guilders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NLG Australian dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . AUD New Zealand dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NZD Italian lira. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ITL Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . OTH

More information

If you need more information, you can write, phone or visit your local tax services office. For our address and telephone numbers, see the listings in the Government of Canada section of your telephone book.

PAGE 5 OF 8

How to complete this return

Part I – Identification

Section 1 – Reporting taxpayer information

Identify the reporting taxpayer.

Section 2 – Group structure

Provide information about the structure of the group (including trusts and partnerships) at the end of the taxation year. A group organizational chart that includes the requested information is acceptable. Only one organizational chart has to be filed by a related group.

Part II – Foreign Affiliate Information

Section 1 – General information

A. Identification of foreign affiliate

Identify the foreign affiliate for which this return is being filed.

You may use an optional identification number to identify the foreign affiliate. The country code used in the identifier should be the country code of the country of residence of the foreign affiliate (see the list of country codes included in the instructions). The last five characters should be 5 digits of your choice.

For the purpose of this return, residence generally means where the foreign affiliate's mind and management is.

B. Capital stock of foreign affiliate

Provide information about your direct ownership and ownership by another controlled foreign affiliate and by other related parties of the capital stock of the foreign affiliate. The book cost of the shares on a

If book cost is not available in Canadian dollars, report the amount in the foreign currency and provide the appropriate currency code from the list in the instructions. If book cost is available in Canadian dollars, report only Canadian dollars.

C. Other information

Provide additional information about your interest in the foreign affiliate.

For purposes of completing this return, gross indebtedness does not include

Section 2 – Financial information of the foreign affiliate

Include the unconsolidated financial statements of the foreign affiliate or, if unavailable, the financial information that is available to you as a shareholder.

The net income should be accounting net income. Tax paid or payable should be actual tax paid or payable and not deferred tax. Do not include withholding tax.

When income and tax amounts are available in Canadian dollars, report only in Canadian dollars. If the information is only available in a foreign currency, report in that currency and provide the appropriate currency code from the list in the instructions.

Foreign language information will only be accepted if the information is not available in English or French.

Section 3 – Surplus accounts

Provide information about dividends you received from the foreign affiliate and information about events that affected the foreign affiliate's surplus accounts.

Part III – Nature of Income

Section 1 – Employees per business

Provide the number of full time employees or employee equivalents employed by the foreign affiliate. This should be done on a business by business basis.

Section 2 – Composition of revenue

Provide the amount of the foreign affiliate's gross revenue from the sources listed.

Section 3 – Foreign accrual property income (FAPI)

Provide information about the foreign accrual property income earned by the foreign affiliate.

Section 4 – Capital gains and losses

Provide information about capital gains and losses realized by the foreign affiliate.

Only dispositions of shares or partnership interests that are excluded property and capital property that is not excluded property needs to be reported.

Section 5 – Income included in income from an active business

Provide information about the income of the foreign affiliate that is from an active business.

Section 6 – Disclosure

Indicate whether any information requested in Form

If information is not available, specify what information is not available and why it is not available. Also indicate what steps were taken in attempting to obtain the information.

PAGE 6 OF 8

Due diligence exception

The information required to be filed on Form

(a)there is reasonable disclosure in the return of the unavailability of the information;

(b)before that day, the person or partnership exercised due diligence in attempting to obtain the information;

(c)it was reasonable to expect, at the time of each transaction, if any, entered into by the person or partnership after March 5, 1996 that gives rise to the requirement to file the return or that affects the information to be reported in the return, that sufficient information would be available to the person or partnership to comply with the reporting requirements; and

(d)if the information subsequently becomes available to the person or partnership, it is filed not more than 90 days after it becomes so available.

Certification

This area should be completed and signed by:

λthe person filing Form

λan authorized officer in the case of a corporation;

λthe trustee, executor or administrator where the person filing the return is a trust; or

λan authorized partner in the case of a partnership.

Name of the person or firm who completed this return

If you are not the reporting taxpayer, and were paid to prepare this return, give your name and address.

Filing this return

Form

Before you file this return, make a copy of it for your records.

Send the original return and any information subsequently received to:

Ottawa Technology Centre

Employer Services Division

Other Programs Unit

875 Heron Road

Ottawa ON K1A 1A2

Specifications for diskette filing are available. If you have any questions or need more inforamtion, please contact:

Magnetic Media Processing Team

Ottawa Technology Centre

Canada Customs and Revenue Agency

875 Heron Road

Ottawa ON K1A 1A2

Telephone:

Penalties for

There are substantial penalties for failing to complete and file Form

Voluntary disclosures

To promote compliance with Canada's tax laws, we encourage you to voluntarily correct any deficiencies in your past tax affairs.

You can make a voluntary disclosure by contacting your tax services office. For our address and telephone numbers, see the listings in the Government of Canada section of your telephone book.

For more information, see Information Circular

Disclosures.

PAGE 7 OF 8

COUNTRY CODES

AFG |

Afghanistan |

TMP |

East Timor |

LBY |

Libyan Arab Jamahiriya |

VCT |

Saint Vincent and the |

ALB |

Albania |

ECU |

Ecuador |

LIE |

Liechtenstein |

SMA |

Grenadines |

DZA |

Algeria |

EGY |

Egypt |

LTU |

Lithuania |

Samoa (American) |

|

ASM |

American Samoa |

SLV |

El Salvador |

LUX |

Luxembourg |

SMR |

San Marino |

AND |

Andorra |

GNQ |

Equatorial Guinea |

MAC |

Macau |

STP |

Sao Tome and Principe |

AGO |

Angola |

ERI |

Eritrea |

MDG |

Madagascar |

SAU |

Saudi Arabia |

AIA |

Anguilla |

EST |

Estonia |

MDR |

Madeira |

SEN |

Senegal |

ATA |

Antarctica |

ETH |

Ethiopia |

MWI |

Malawi |

SYC |

Seychelles |

ATG |

Antigua and Barbuda |

FLK |

Falkland Islands (Malvinas) |

MYS |

Malaysia |

SLE |

Sierra Leone |

ARG |

Argentina |

FRO |

Faroe Islands |

MDV |

Maldives |

SGP |

Singapore |

ARM |

Armenia |

FJI |

Fiji |

MLI |

Mali |

SVK |

Slovak Republic |

ABW |

Aruba |

FIN |

Finland |

MLT |

Malta |

SUN |

Slovenia |

AUS |

Australia |

FRA |

France |

MHL |

Marshall Islands |

SLB |

Solomon Islands |

AUT |

Austria |

GUF |

French Guiana |

MTQ |

Martinique |

SOM |

Somalia |

AZE |

Azerbaijan |

PYF |

French Polynesia |

MRT |

Mauritania |

ZAF |

South Africa |

AZO |

Azores |

GAB |

Gabon |

MUS |

Mauritius |

SGS |

South Georgia and the South |

BHS |

Bahamas |

GMB |

Gambia |

MYT |

Mayotte |

ESP |

Sandwich Islands |

BHR |

Bahrain |

GEO |

Georgia |

MEX |

Mexico |

Spain |

|

BGD |

Bangladesh |

DEU |

Germany |

FSM |

Micronesia |

LKA |

Sri Lanka |

BRB |

Barbados |

GHA |

Ghana |

MDA |

Moldova |

SDN |

Sudan |

BLR |

Belarus |

GIB |

Gibraltar |

MCO |

Monaco |

SUR |

Surinam |

BEL |

Belgium |

GRC |

Greece |

MNG |

Mongolia |

SJM |

Svalbard and Jan Mayen |

BLZ |

Belize |

GRL |

Greenland |

MSR |

Monteserrat |

SWZ |

Swaziland |

BEN |

Benin |

GRD |

Grenada |

MAR |

Morocco |

SWE |

Sweden |

BMU |

Bermuda |

GLP |

Guadeloupe |

MOZ |

Mozambique |

CHE |

Switzerland |

BTN |

Bhutan |

GUM |

Guam |

MMR |

Myanmar (Burma) |

SYR |

Syrian Arab Republic |

BOL |

Bolivia |

GTM |

Guatemala |

NAM |

Namibia |

TJK |

Tajikistan |

BIH |

Bosnia and Herzegovina |

GNS |

Guernsey |

NRU |

Nauru |

TWN |

Taiwan |

BWA |

Botswana |

GIN |

Guinea |

NPL |

Nepal |

TZA |

Tanzania |

BVT |

Bouvet Island |

GNB |

NLD |

Netherlands |

THA |

Thailand |

|

BRA |

Brazil |

GUY |

Guyana |

ANT |

Netherlands Antilles |

TGO |

Togo |

IOT |

British Indian OceanTerritory |

HTI |

Haiti |

|

(Bonaire, Curacao, |

TKL |

Tokelau |

BRN |

Brunei Darussalam |

HMD |

Heard Island and |

|

St. Maarten) |

TON |

Tonga |

BGR |

Bulgaria |

|

McDonald Islands |

NCL |

New Caledonia |

TTO |

Trinidad and Tobago |

BFA |

Burkina Faso (Upper Volta) |

HND |

Honduras |

NZL |

New Zealand |

TUN |

Tunisia |

BDI |

Burundi |

HKG |

Hong Kong |

NIC |

Nicaragua |

TUR |

Turkey |

KHM |

Cambodia (Kampuchea) |

HUN |

Hungary |

NER |

Niger |

TKM |

Turkmenistan |

CMR |

Cameroon |

ISL |

Iceland |

NGA |

Nigeria |

TCA |

Turks & Caicos Islands |

CMP |

Campione |

IND |

India |

NIU |

Niue |

TUV |

Tuvalu |

CAN |

Canada |

IDN |

Indonesia |

NFK |

Norfolk Island |

UGA |

Uganda |

CNP |

Canary Islands |

IRN |

Iran |

MNP |

Northern Mariana Islands |

UKR |

Ukraine |

CPV |

Cape Verde |

IRQ |

Iraq |

NOR |

Norway |

ARE |

United Arab Emirates |

CYM |

Cayman Islands |

IRL |

Ireland |

OMN |

Oman |

GBR |

United Kingdom |

CAF |

Central African Republic |

GBA |

Isle of Man |

PAK |

Pakistan |

USA |

United States |

TCD |

Chad |

ISR |

Israel |

PLW |

Palau |

UMI |

United States Minor |

CHL |

Chile |

ITA |

Italy |

PAN |

Panama |

URY |

Outlying Islands |

CHN |

China (Mainland) |

JAM |

Jamaica |

PNG |

Papua New Guinea |

Uruguay |

|

CXR |

Christmas Island (Australia) |

JPN |

Japan |

PRY |

Paraguay |

UZB |

Uzbekistan |

CCK |

Cocos (Keeling) Islands |

JRS |

Jersey |

PER |

Peru |

VUT |

Vanuatu (New Hebrides) |

COL |

Colombia |

JOR |

Jordan |

PHL |

Philippines |

VAT |

Vatican City State (Holy See) |

COM |

Comoros |

KAZ |

Kazakhstan |

PCN |

Pitcairn |

VEN |

Venezuela |

COG |

Congo |

KEN |

Kenya |

POL |

Poland |

VNM |

Vietnam |

COK |

Cook Islands |

KIR |

Kiribati |

PRT |

Portugal |

VGB |

Virgin Islands (British) |

CRI |

Costa Rica |

PRK |

Korea, Democratic People's |

PRI |

Puerto Rico |

VIR |

Virgin Islands (U.S.) |

CIV |

Côte d'Ivoire (Ivory Coast) |

|

Republic of (North) |

QAT |

Qatar |

WLF |

Wallis and Futuna Islands |

HRV |

Croatia |

KOR |

Korea, Republic of (South) |

REU |

Reunion |

ESH |

Western Sahara |

CUB |

Cuba |

KWT |

Kuwait |

ROM |

Romania |

WSM |

Western Samoa |

CYP |

Cyprus |

KGZ |

Kyrgyzstan |

RUS |

Russian Federation |

YEM |

Yemen |

CZE |

Czech Republic |

LAO |

Lao |

RWA |

Rwanda |

YUG |

Yugoslavia |

DNK |

Denmark |

LVA |

Latvia |

SHN |

St. Helena |

ZAR |

Zaire |

DJI |

Djibouti |

LBN |

Lebanon |

KNA |

Saint Kitts and Nevis |

ZMB |

Zambia |

DMA |

Dominica |

LSO |

Lesotho |

LCA |

Saint Lucia |

ZWE |

Zimbabwe |

DOM |

Dominican Republic |

LBR |

Liberia |

SPM |

St. Pierre and Miquelon |

|

|

|

|

|

STANDARD INDUSTRIAL CODE (SIC) |

|

|

||

9100 |

Services: |

|

Financial: |

3300 |

Electrical & Electronics |

1200 |

Tobacco |

Accommodations |

7000 |

Banks, Trusts & Credit |

1000 |

Food |

3200 |

Transport Equipment |

|

0100 |

Agricultural |

|

Unions |

2600 |

Furniture & Fixtures |

2500 |

Wood |

7700 |

Business Professionals |

7100 |

Finance & Loans |

1700 |

Leather |

3900 |

Other |

7720 |

Computer and Related |

7130 |

Internal Financing Companies |

3100 |

Machinery |

|

Retail: |

4800 |

Services |

7131 |

Leasing of Property |

3000 |

Metal Fabrication |

6100 |

|

Communications |

7132 |

Licensing of Property |

0800 |

Mineral Extraction Services |

Apparel & Furnishings |

||

4000 |

Construction |

7200 |

Investment & Mortgages |

0600 |

Mines |

6300 |

Automotive |

8500 |

Educational Services |

7215 |

Holding Companies |

3500 |

6000 |

Foodstuffs & Drugs |

|

9600 |

Entertainment & Recreation |

7216 |

Other Investment Activities |

2700 |

Paper & Allied Products |

6400 |

Merchandising |

0300 |

Forestry, Fishing & Trapping |

7300 |

Insurance |

0700 |

Petroleum & Gas |

6500 |

Other Retail |

8600 |

Medical Professionals |

7400 |

Brokerage |

2900 |

Prime Metal |

4700 |

Storage & Warehousing |

9700 |

Personal Services |

|

Manufacturing: |

2800 |

Printing & Publishing |

4500 |

Transportation & Allied |

7400 |

Real Estate & Other Financial |

1100 |

Beverages |

1500 |

Rubber & Plastics |

|

Services |

9900 |

Repair & Other Services |

3700 |

Chemical Products |

3600 |

Refineries & Coal Products |

4900 |

Utilities |

|

|

2400 |

Clothing |

1800 |

Textiles |

5000 |

Wholesale Trade |

PAGE 8 OF 8