We have used the endeavours of our best computer programmers to build the PDF editor you intend to begin using. Our software will help you create the ar1000f document without any difficulty and don’t waste time. Everything you should do is adhere to these particular easy steps.

Step 1: To begin with, click on the orange "Get form now" button.

Step 2: So you should be on your form edit page. You can add, alter, highlight, check, cross, include or erase areas or text.

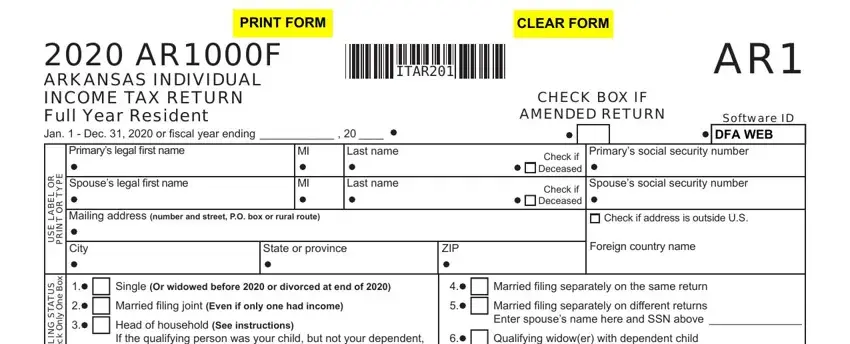

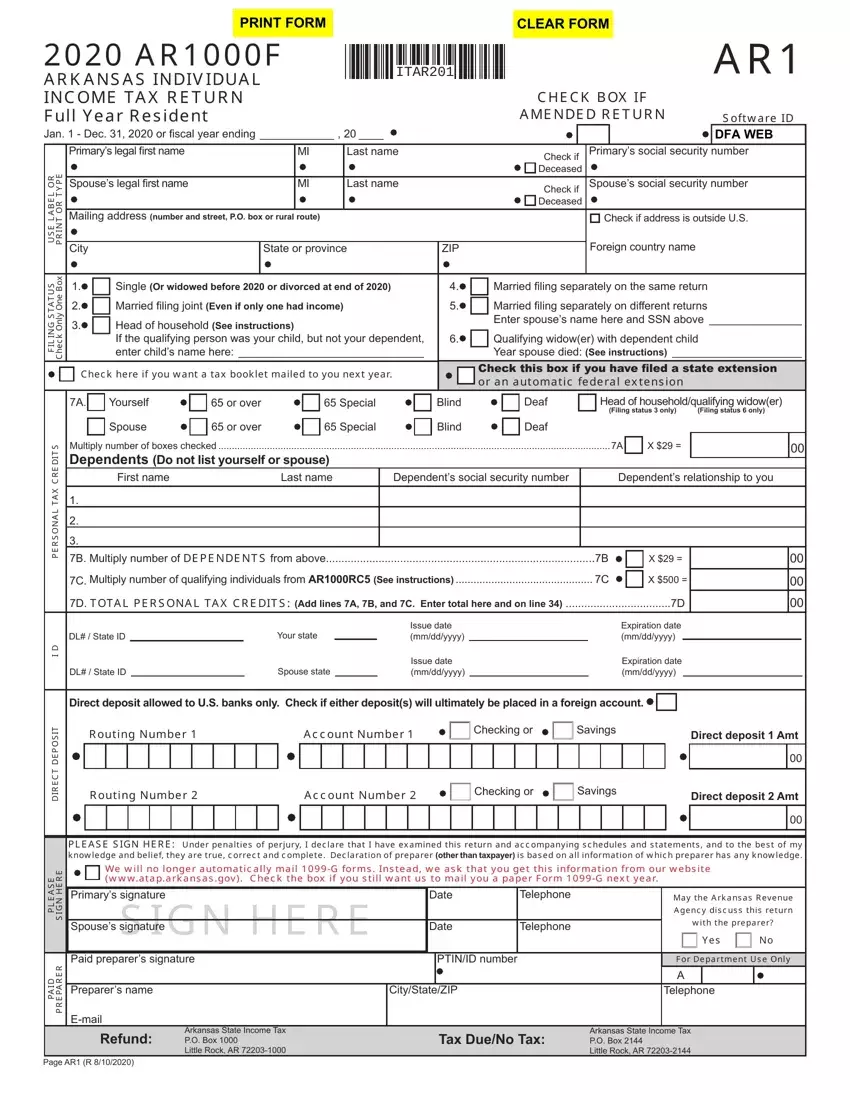

Create the next segments to complete the document:

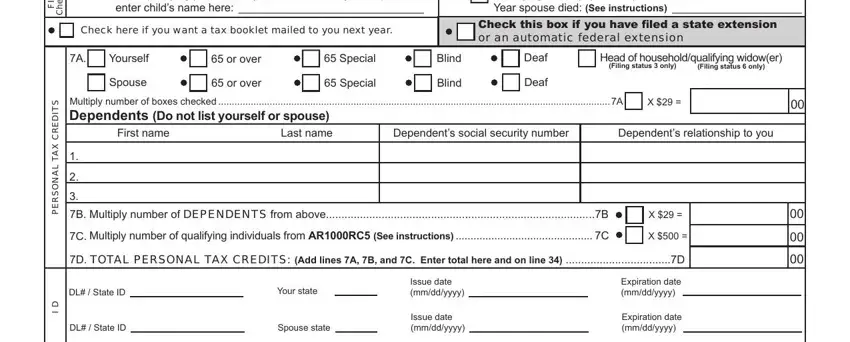

Put down the details in the cid, Check here if you want a tax, cidcidcidcidcidcidcidcid, cidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcidcidcidcid, cidcidcid cid, Blind, Blind, cidcidcidcid, cidcidcidcid, Filing status only, and Filing status only area.

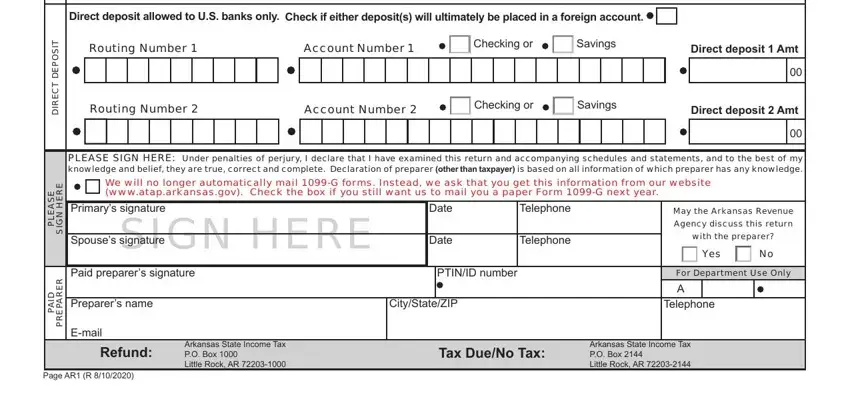

It's important to record some particulars within the space Direct deposit allowed to US banks, Check if either deposits will, Routing Number, Account Number, cidcidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcid, Routing Number, Account Number, cidcidcidcidcidcidcidcidcidcidcid, cidcidcidcidcidcidcid, PLEASE SIGN HERE Under penalties, We will no longer automatically, SIGN HERE, cidcidcidcid, and cidcidcidcid.

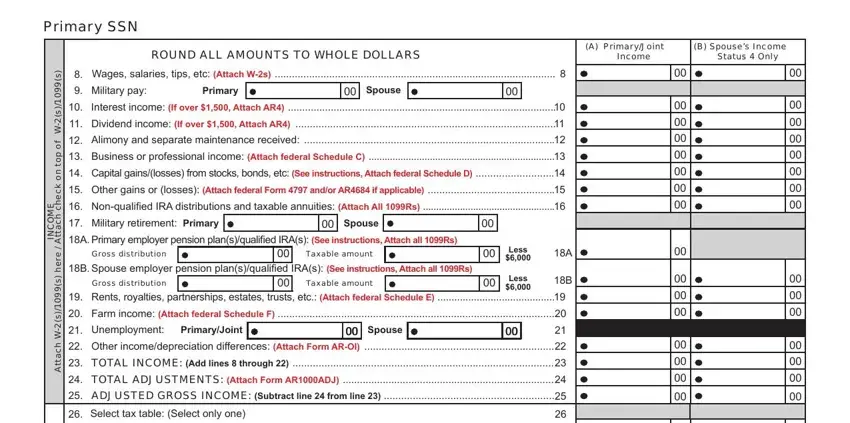

The Primary SSN, ROUND ALL AMOUNTS TO WHOLE DOLLARS, A PrimaryJoint, B Spouses Income, Income, Status Only, s s W, f o p o t n o k c e h c h c a t t A, E M O C N, e r e h s s W h c a t t A, Spouse, Spouse, Gross distribution, Taxable amount, and Gross distribution field can be used to point out the rights and obligations of either side.

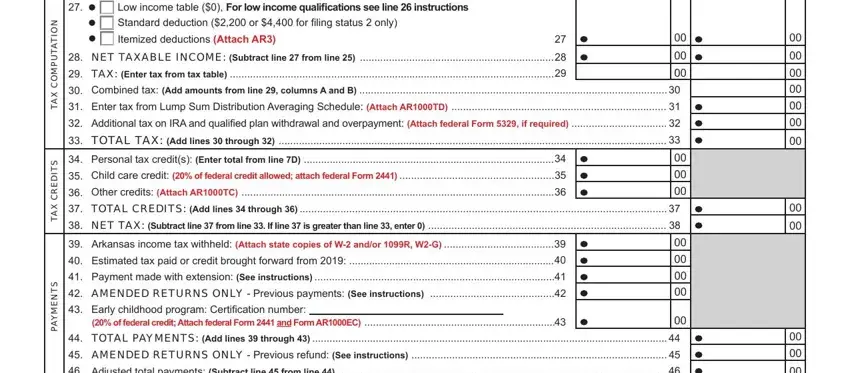

Look at the fields N O I T A T U P M O C X A T, S T I D E R C X A T, S T N E M Y A P, NET TAXABLE INCOME Subtract line, and TOTAL PAYMENTS Add lines through and then complete them.

Step 3: Hit the button "Done". The PDF document is available to be transferred. You can easily obtain it to your device or email it.

Step 4: To prevent yourself from potential future concerns, you need to hold more than two or three copies of each document.

Check if address is outside U.S.

Check if address is outside U.S.