We've used the efforts of the best computer programmers to design the PDF editor you are about to use. Our software will permit you to prepare the tc201 due date 2021 form effortlessly and don’t waste time. All you need to undertake is comply with these particular straightforward guidelines.

Step 1: Click the orange "Get Form Now" button on this web page.

Step 2: Now, you are on the file editing page. You may add content, edit existing information, highlight certain words or phrases, put crosses or checks, insert images, sign the form, erase needless fields, etc.

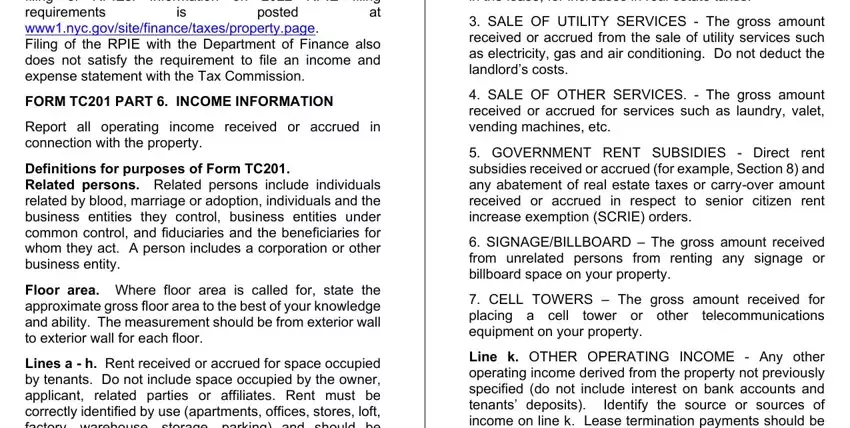

You should enter the next details to be able to prepare the file:

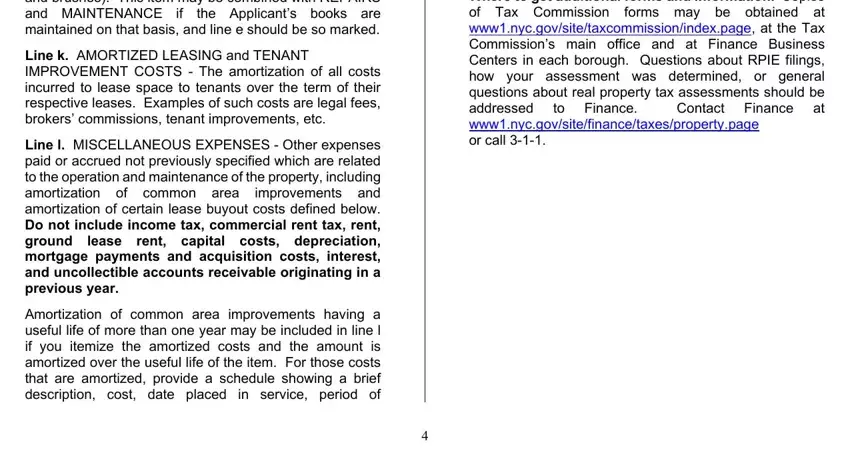

Provide the requested information in Contact, Finance and to, Finance segment.

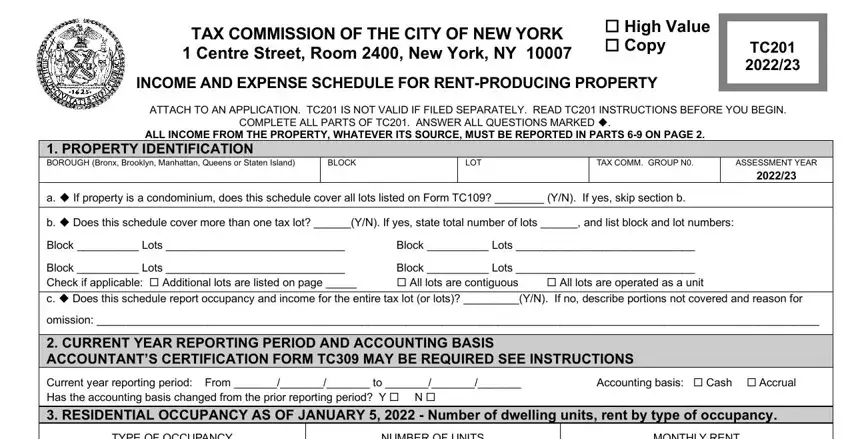

You should point out the fundamental particulars from the High, Value, Copy BLOCK, LOT, TAX, COM, M, GROUP, N ASSESSMENT, YEAR Block, Lots Accounting, basis, Cash, Accrual TYPE, OF, OCCUPANCY NUMBER, OF, UNITS and MONTHLY, RENT area.

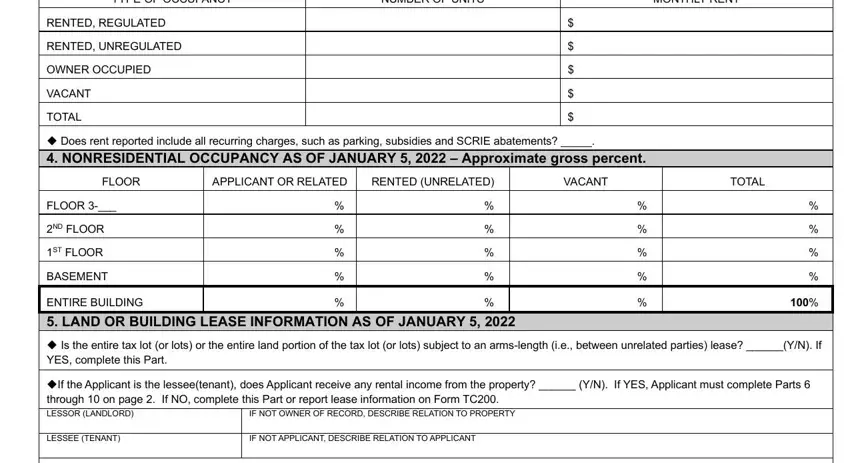

In the paragraph TYPE, OF, OCCUPANCY NUMBER, OF, UNITS MONTHLY, RENT RENTED, REGULATED RENTED, UNREGULATED OWNER, OCCUPIED VACANT, TOTAL, FLOOR, APPLICANT, OR, RELATED RENTED, UNRELATED VACANT, TOTAL, FLOOR, and ND, FLOOR include the rights and responsibilities of the sides.

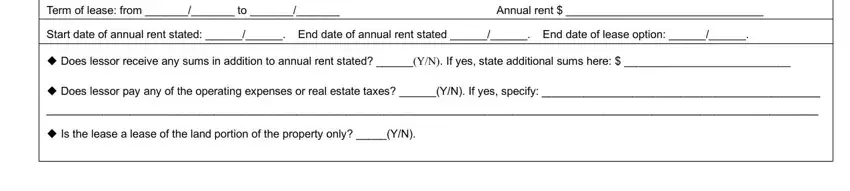

Fill in the template by checking the next fields: Term, of, lease, from, to and Annual, rent

Step 3: Click the Done button to assure that your completed file is available to be exported to any kind of device you want or mailed to an email you specify.

Step 4: It is better to maintain duplicates of the form. You can rest assured that we won't publish or see your data.