Navigating the complexities of tax compliance and legal documentation can be daunting for businesses and individuals alike. The TC1 Tax Clearance Form serves as a crucial tool in this landscape, facilitating a range of financial and regulatory activities. Required by various entities to ensure tax obligations are met, this form not only acts as a requisite for licensure in several industries—including liquor retailing, bookmaking, and vehicle hire—but also plays a pivotal role in transactions with the government, such as securing contracts or participating in legal aid schemes. Applicants must detail their tax registration numbers, disclose any partnerships, and outline previous business affiliations, ensuring a comprehensive account of their tax standing. With sections tailored to cater to both residents and non-residents, the form underscores the importance of tax compliance across borders, especially for those seeking to undertake government contracts internationally. The declaration segment mandates an assertion of the truthfulness and completeness of the information provided, underscoring the gravity and legal implications of the form. Submissions of this document, pivotal for affirming one's tax clearance status, must be directed to the relevant local revenue district, with provisions made for online verification to third parties—an acknowledgment of the digital age's role in streamlining bureaucratic processes.

| Question | Answer |

|---|---|

| Form Name | Tc1 Tax Clearance Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tax clearance tc1 form, tc1 onlain, tax tc1 form, ie tax clearance |

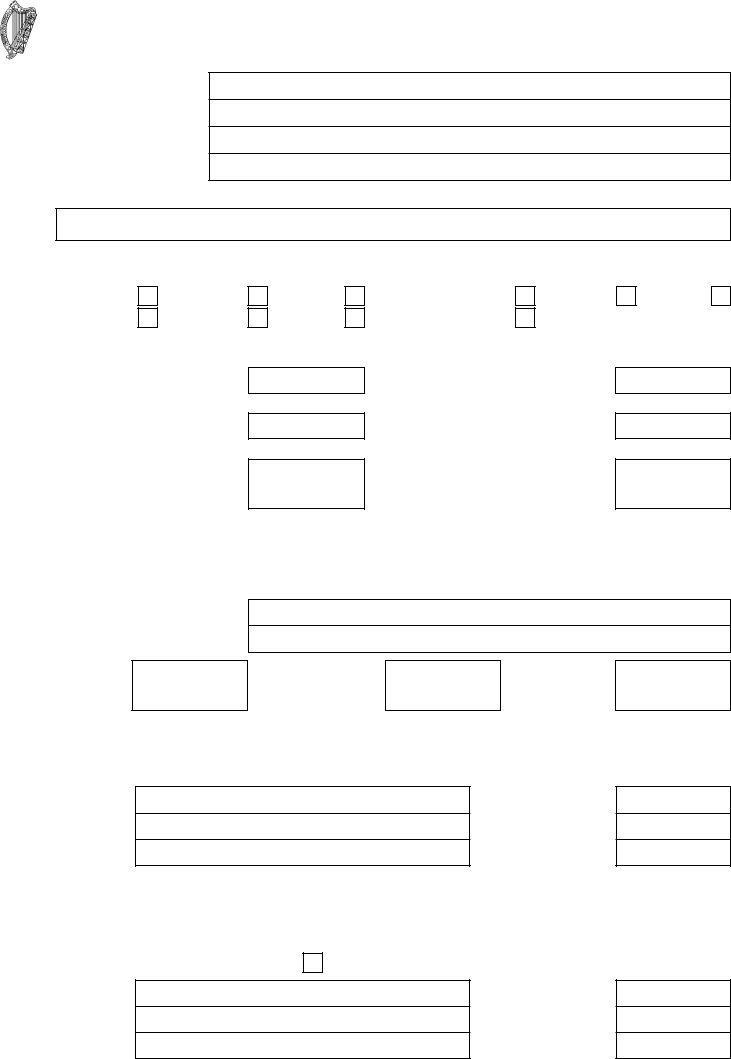

APPLICATION FOR A TAX CLEARANCE CERTIFICATE

TC1

1.APPLICANT’S NAME ADDRESS

2.(a) PLEASE SPECIFY THE PURPOSE FOR WHICH THE TAX CLEARANCE CERTIFICATE IS REQUIRED

(b)IF REQUIRED FOR RENEWAL OF AN EXCISE/SPSV/SPSV DRIVER’S LICENCE PLEASE SPECIFY TYPE OF LICENCE REQUIRED

Liquor Retailer |

Hydrocarbon |

Auctioneer |

SPSV |

SPSVD |

3.APPLICANT’S TAX REFERENCE NUMBER(S)

Wholesale Liquor Dealer

Other

Bookmaker

Gaming

PPS Number/Corporation Tax Number

Employer

PAYE/PRSI Number

Spouse’s PPS Number

[Only required if your spouse is the taxable person under joint assessment for Income Tax]

VAT Number

RCT Number

GROUP REMITTER VAT Number

[Only required where VAT is not accounted for under own VAT number]

4.(a) IF THE APPLICANT IS, OR WAS, A MEMBER OF A PARTNERSHIP

Please give the following details in respect of any partnership of which you are, or were, a member. (If more than one partnership is involved, please use additional sheets as necessary).

Name of partnership

Applicant’s period of membership

VAT Number of partnership

Employer’s

PAYE/PRSI Number

of partnership

RCT Number of partnership

(b)IF THE APPLICANT IS A PARTNERSHIP

Please give the names and tax reference numbers of each member of the partnership. (Please use additional sheets as necessary.)

Name of partner

Name of partner

Name of partner

PPS Number

PPS Number

PPS Number

(c)IF THE APPLICANT IS A COMPANY

Please give the name and tax reference number of each person who is either the beneicial owner of, or able,

directly or indirectly, to control, more than 50% of the ordinary share capital of the company.

(Please use additional sheets as necessary).

If there is no such person, insert P in this box

Name

Name

Name

PPS Number

PPS Number PPS Number

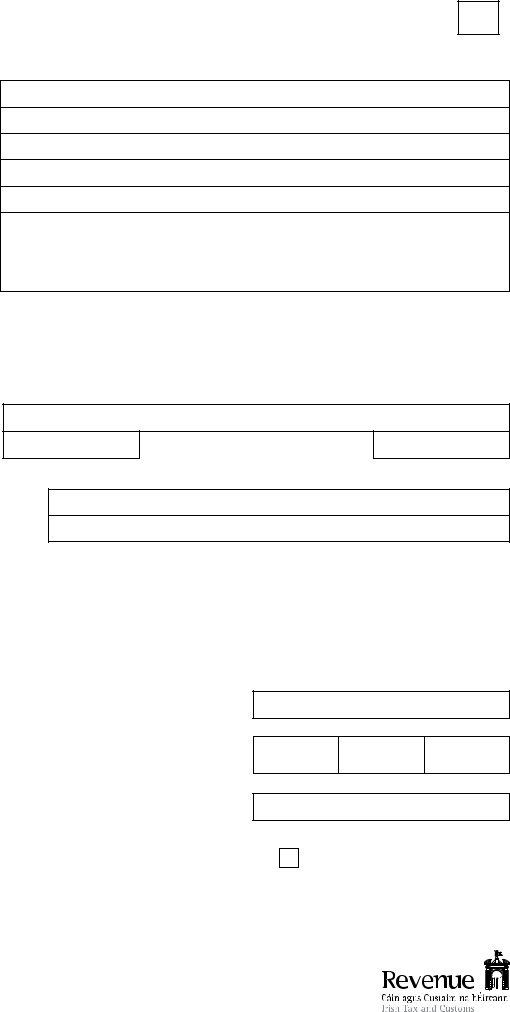

5. |

PREVIOUS BUSINESS ACTIVITY |

|

|

(a) Was the business activity to which this application relates previously carried on in the |

|

|

YES |

|

|

last ive years by another person, company or partnership connected to you? |

|

|

|

|

|

|

|

If the answer to (a) is YES please complete (b) to (d) below in respect of the previous person, company or partnership.

(b)Name & Address

(c)VAT Number

(d)Basis on which business was transferred and applicant’s relationship with previous trading entity

NO

6.TAX CLEARANCE TO PARTICIPATE IN THE CRIMINAL JUSTICE LEGAL AID SCHEME

If you are applying for tax clearance in your own name and you are an employee (paying tax under the PAYE system) please provide the following details in relation to your employer:

Name of your employer

VAT Number

Employer’s PAYE/PRSI Number

7.IF THE APPLICANT IS

(a)What is the nature of the contract?

(b)Where will the work be carried out?

8.DECLARATION TO BE COMPLETED IN ALL CASES

If the applicant is an individual that individual must complete this declaration.

If the applicant is a partnership this declaration must be completed by one of the members of the partnership. If the applicant is a company this declaration must be completed by a Director or the Company Secretary.

The information provided in this form is true and correct to the best of my knowledge and belief. I have included all information relevant to this application.

Signatory’s Name

Signature |

|

|

in Block Capitals |

|

Position |

|

|

||

|

|

|

Date |

|

|

(Director, Company Secretary, Partner) |

|

||

|

|

|

||

|

|

|

|

|

Daytime Telephone |

|

|

Email address |

|

Number |

|

|

||

|

|

|

||

Day

Month

Year

Online veriication of your Tax Clearance Certiicate to Third Parties. Tick here

Note: This form should be sent to your Local Revenue District, the address of which is available on the Revenue Website at www.revenue.ie. The address for

RPC001418_EN_WB_L_1