This PDF editor was created with the intention of making it as simple and user-friendly as it can be. All of these steps will help make managing the irs bank account easy and fast.

Step 1: The initial step is to click the orange "Get Form Now" button.

Step 2: You will find all the actions which you can use on the document as soon as you've accessed the irs bank account editing page.

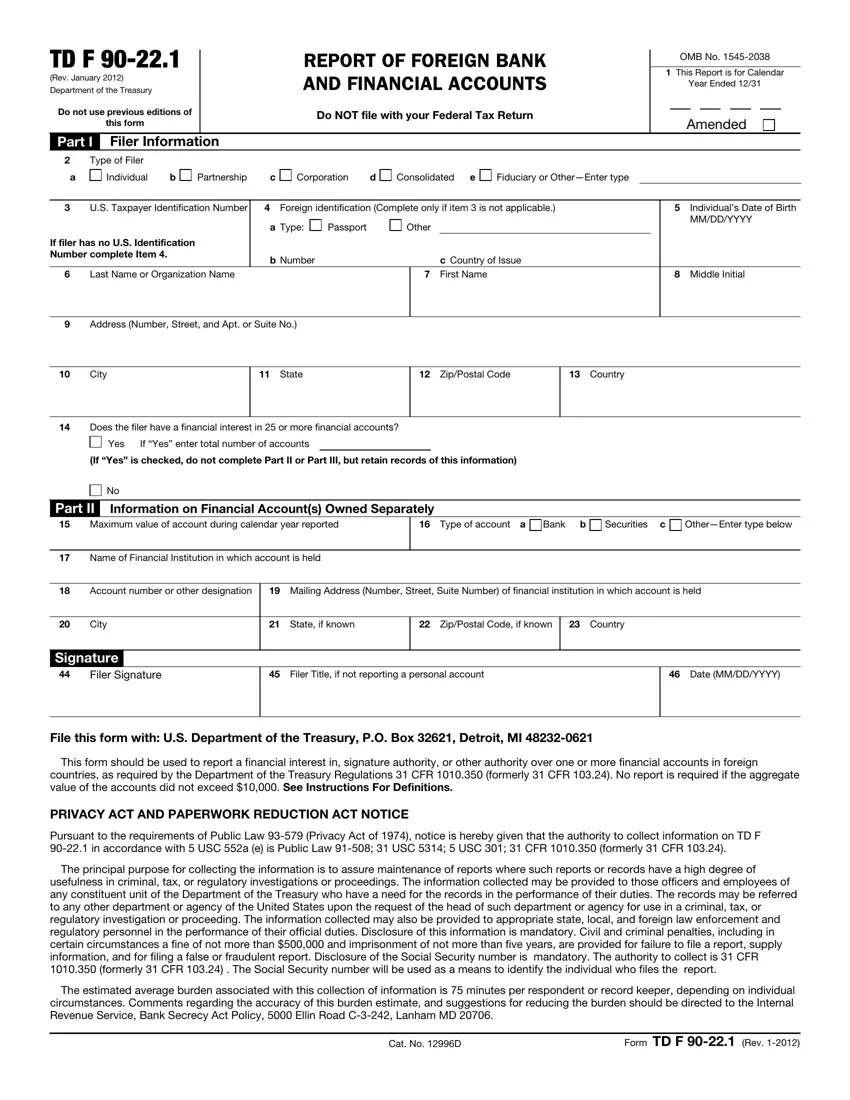

Prepare the irs bank account PDF and enter the details for every single part:

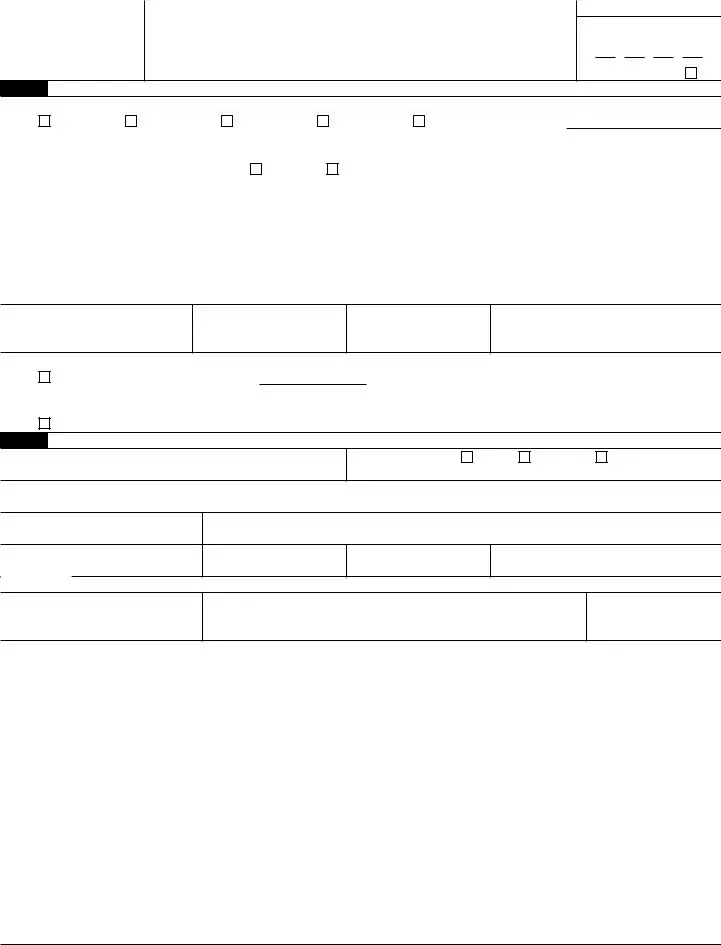

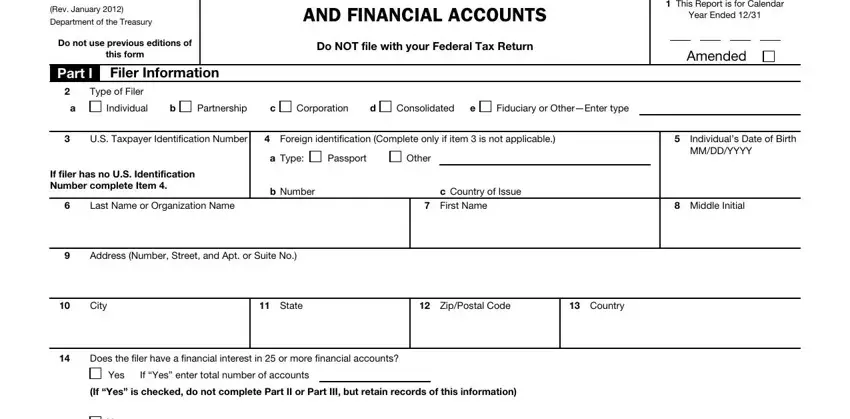

Complete the Information on Financial Accounts, Part II, Maximum value of account during, Type of account a, Bank, Securities c, OtherEnter type below, Name of Financial Institution in, Account number or other designation, Mailing Address Number Street, City, State if known, ZipPostal Code if known, Country, and Signature space using the data demanded by the program.

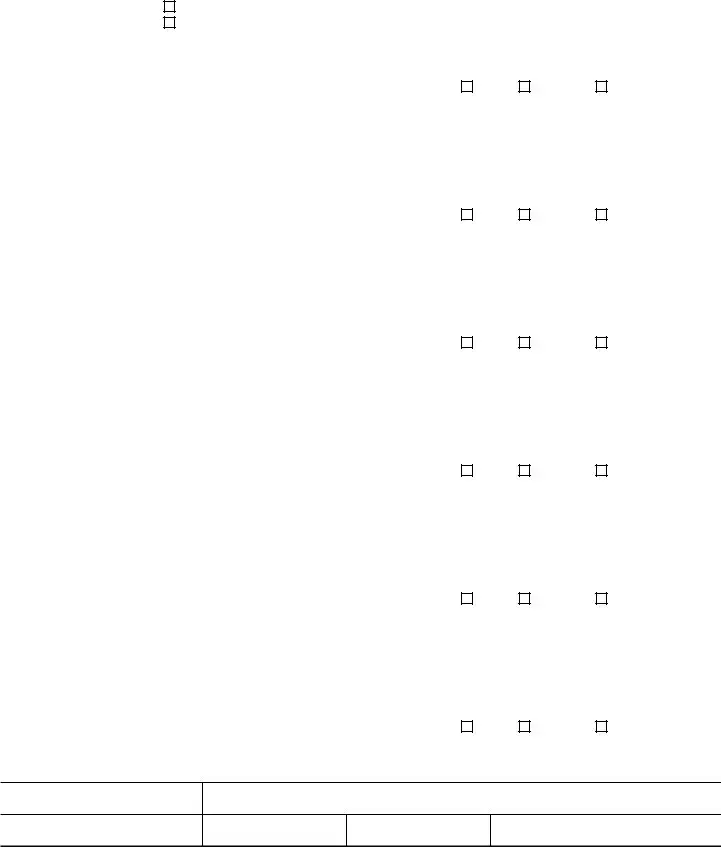

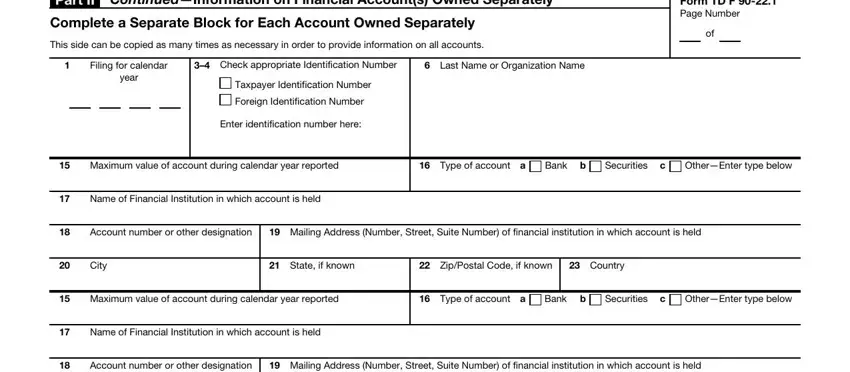

Inside the segment dealing with Part II ContinuedInformation on, Complete a Separate Block for Each, This side can be copied as many, Form TD F Page Number, Filing for calendar year, Check appropriate Identification, Last Name or Organization Name, Taxpayer Identification Number, Foreign Identification Number, Enter identification number here, Maximum value of account during, Type of account a, Bank b, Securities c, and OtherEnter type below, you will need to note down some essential particulars.

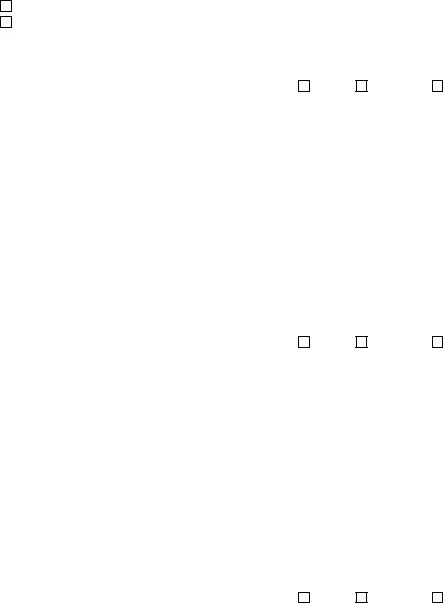

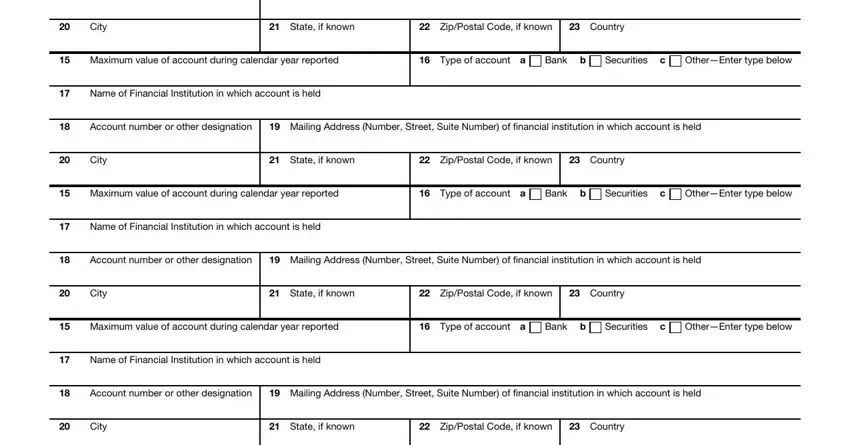

The space City, State if known, ZipPostal Code if known, Country, Maximum value of account during, Type of account a, Bank b, Securities c, OtherEnter type below, Name of Financial Institution in, Account number or other designation, Mailing Address Number Street, City, State if known, and ZipPostal Code if known should be where to place all sides' rights and responsibilities.

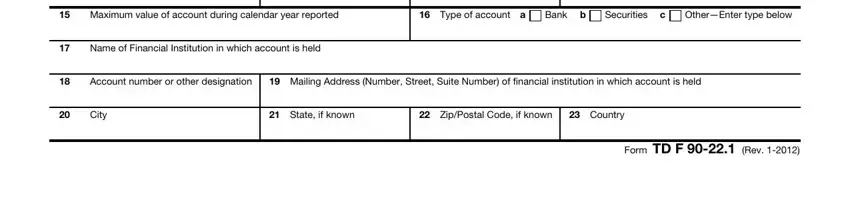

Finish by checking all of these fields and filling out the proper data: Maximum value of account during, Type of account a, Bank b, Securities c, OtherEnter type below, Name of Financial Institution in, Account number or other designation, Mailing Address Number Street, City, State if known, ZipPostal Code if known, Country, and Form TD F Rev.

Step 3: Once you press the Done button, your ready form may be exported to all of your devices or to email specified by you.

Step 4: Ensure you keep away from upcoming difficulties by getting at least 2 duplicates of your document.