There is nothing troublesome in relation to completing the form bus tn after you open our PDF tool. By taking these basic steps, you can receive the fully filled out document in the shortest time frame you can.

Step 1: Seek out the button "Get Form Here" and then click it.

Step 2: You're now on the document editing page. You can edit, add content, highlight certain words or phrases, place crosses or checks, and include images.

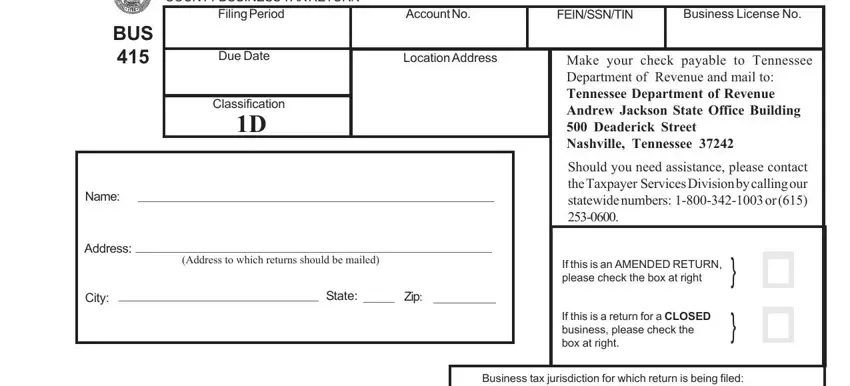

If you want to prepare the template, type in the data the application will request you to for each of the appropriate sections:

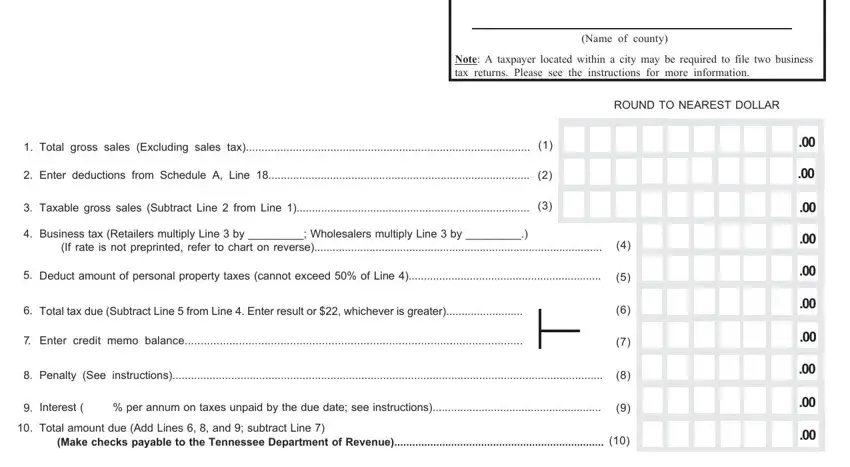

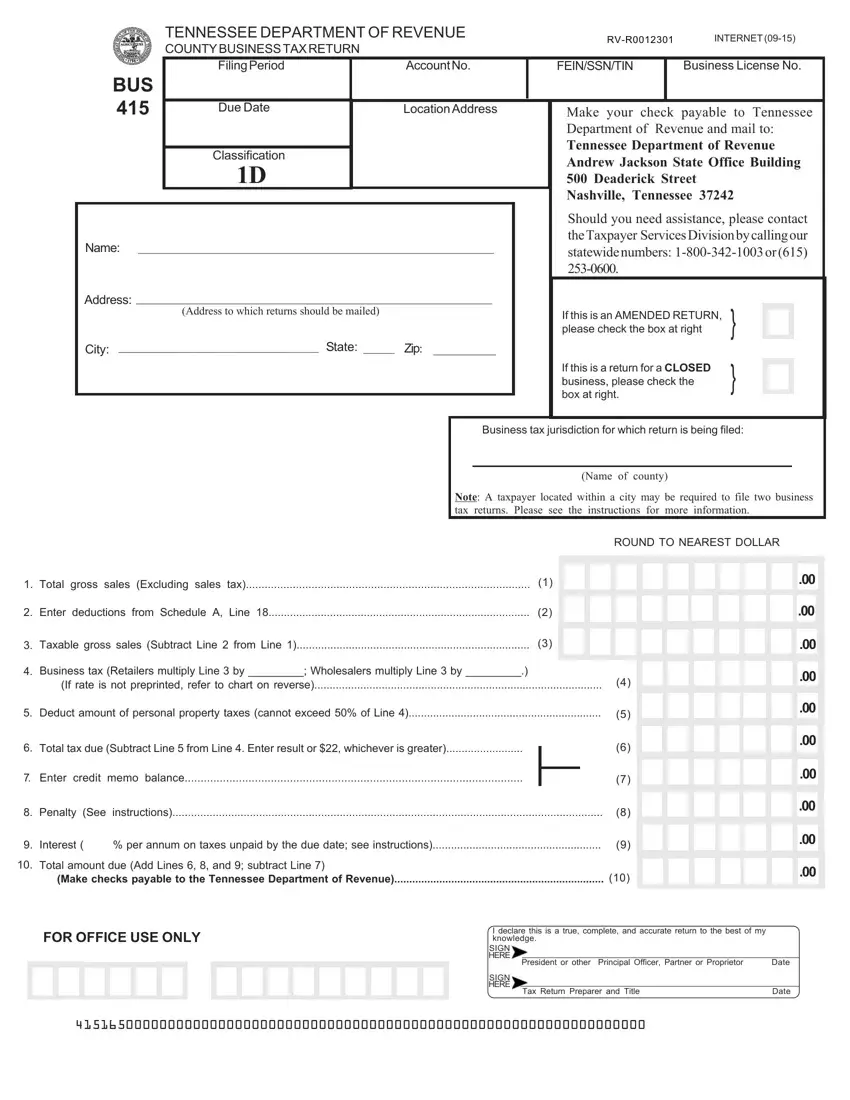

Make sure you provide the crucial details in the Name of county, Note A taxpayer located within a, ROUND TO NEAREST DOLLAR, Total gross sales Excluding sales, Enter deductions from Schedule A, Taxable gross sales Subtract Line, Business tax Retailers multiply, Deduct amount of personal property, Total tax due Subtract Line from, Enter credit memo balance, Penalty See instructions, Interest per annum on taxes, and Total amount due Add Lines and field.

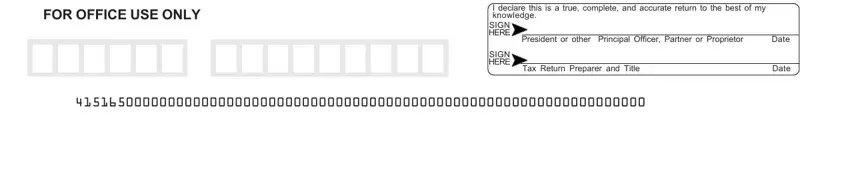

You will need to insert particular particulars inside the space FOR OFFICE USE ONLY, I declare this is a true complete, President or other Principal, SIGN HERE, Tax Return Preparer and Title, Date, and Date.

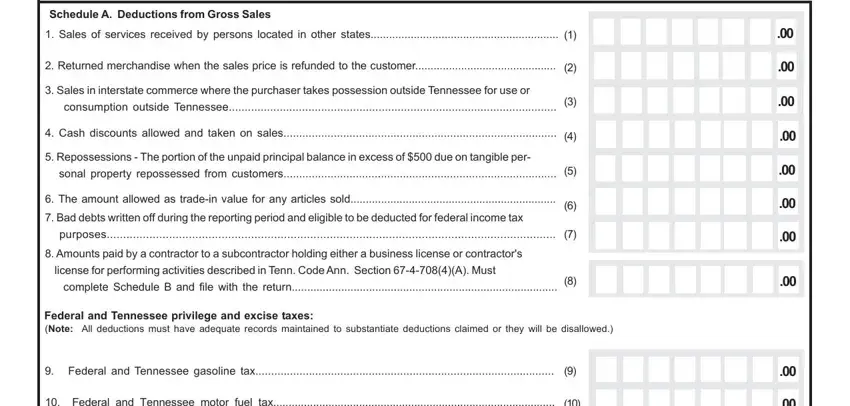

Within the paragraph Schedule A Deductions from Gross, Sales of services received by, Returned merchandise when the, Sales in interstate commerce, consumption outside Tennessee, Cash discounts allowed and taken, Repossessions The portion of the, sonal property repossessed from, The amount allowed as tradein, Bad debts written off during the, purposes, Amounts paid by a contractor to a, license for performing activities, complete Schedule B and file with, and Federal and Tennessee privilege, list the rights and obligations of the parties.

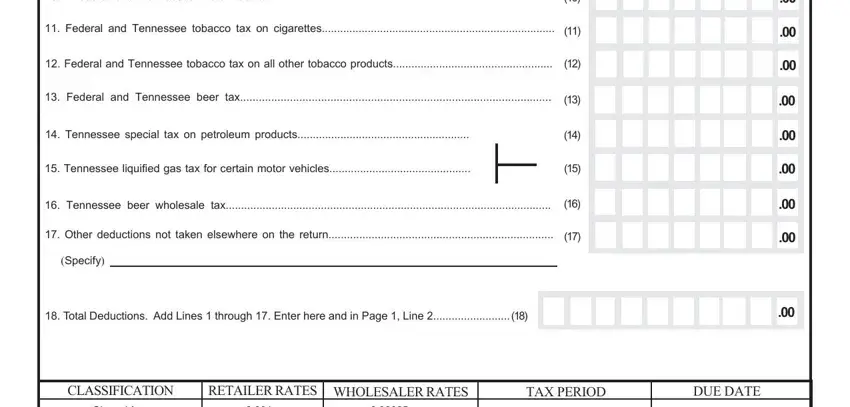

End by analyzing these fields and filling them out accordingly: Federal and Tennessee motor fuel, Federal and Tennessee tobacco tax, Federal and Tennessee tobacco tax, Federal and Tennessee beer tax, Tennessee special tax on, Tennessee liquified gas tax for, Tennessee beer wholesale tax, Other deductions not taken, Specify, Total Deductions Add Lines, CLASSIFICATION, RETAILER RATES WHOLESALER RATES, TAX PERIOD, DUE DATE, and Class A Class B C Class D Class E.

Step 3: When you have clicked the Done button, your document should be ready for upload to any kind of electronic device or email you identify.

Step 4: Get as much as several copies of your form to stay away from any sort of future concerns.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00