The following member agency processes ACDBE/ DBE applications. Please forward your completed certification packet to MMBC Uniform Certification Agency serving the area where your firm has its principal place of business:

Uniform Certification Agency P.O. Box 3060

158 Madison Avenue, Suite 300 Memphis, TN 38173 (901)525-6512(T) (901)525-5204(Fax) www.mmbc-memphis.org

Tennessee Uniform Certification Program (TNUCP)

Application for Certification as a Disadvantaged Business Enterprise

(DBE)

INSTRUCTIONS AND INFORMATION

Please read these instructions completely and thoroughly!!!

1.All questions must be answered. Questions that do not apply to your firm should be marked “N/A.”

2.All documents requested on the Certification Checklist must be provided. Mark “N/A” for any items that do not pertain to your company.

3.The Personal Financial Statement enclosed must be filled out in its entirety leaving no line blank. This form

must be completed for each DBE applicant and this form must be signed by each DBE applicant in the presence of a Notary Public.

4.The Affidavit of Certification must be signed by the principal owner(s) in the presence of a Notary Public.

Please note that failure to complete the application as instructed above will delay processing and may result in a denial of certification as a Disadvantaged Business Enterprise.

For Your Information

1.An on-site interview will be required for all in-state applicants, as part of the certification process. Once the application is complete, this should occur within 90 business days of receipt of the certification package.

2.Additional information may be required during the processing period. Delays in submitting requested information will cause a delay in processing the application.

3.Changes in ownership, control, or operation of the business should be reported within 30 days of the occurrence. Any changes in ownership or transfer of ownership two (2) years prior to submission of an application with the Tennessee Uniform Certification Program will not be acceptable and will be seriously scrutinized for timing and reasons for ownership change.

4.An applicant has the right to protest a Denial of Certification by filing an appeal with the U.S. Department of Transportation.

5.All certified businesses will be listed in the Directory of Disadvantaged Business Enterprises for the Tennessee Uniform Certification Program.

Page 2 of 18

Rev. 12-2008

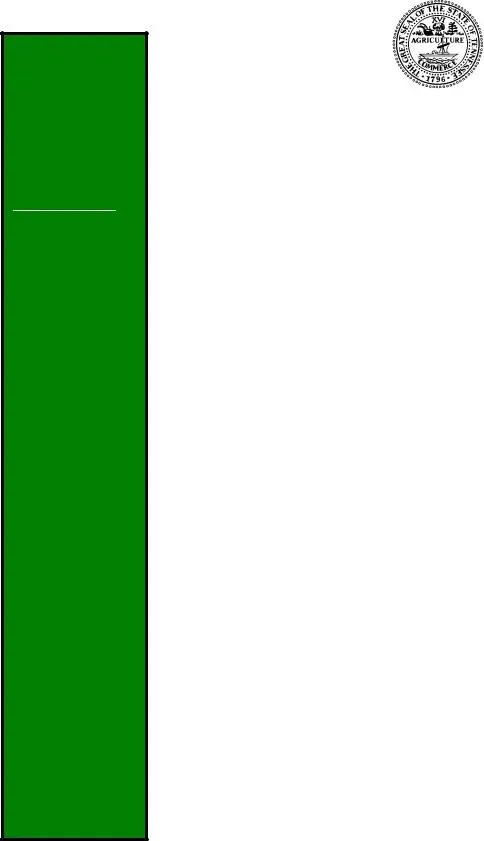

Tennessee Uniform Certification Program

(TNUCP)

Disadvantaged Business Enterprise

(DBE)

Renewal Application

→This document and its attachment must be completed in their entirety for each DBE owner←

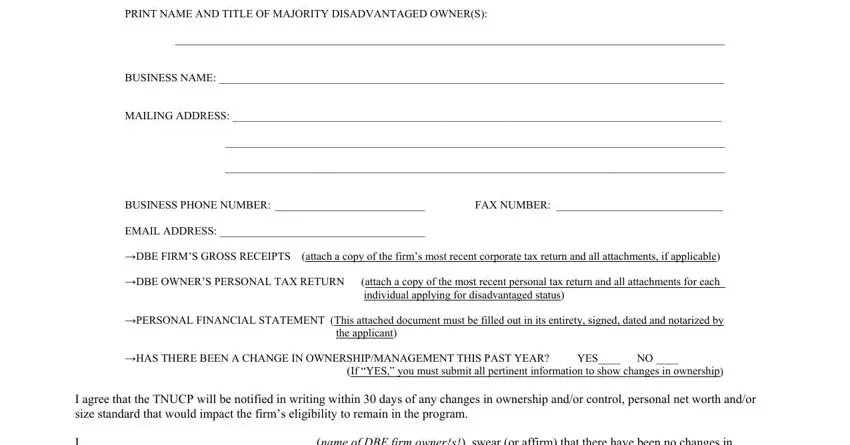

PRINT NAME AND TITLE OF MAJORITY DISADVANTAGED OWNER(S):

___________________________________________________________________________________________________

BUSINESS NAME: ___________________________________________________________________________________________

MAILING ADDRESS: ________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

BUSINESS PHONE NUMBER: ___________________________ |

FAX NUMBER: ______________________________ |

EMAIL ADDRESS: _____________________________________ |

|

→DBE FIRM’S GROSS RECEIPTS (attach a copy of the firm’s most recent corporate tax return and all attachments, if applicable)

→DBE OWNER’S PERSONAL TAX RETURN (attach a copy of the most recent personal tax return and all attachments for each individual applying for disadvantaged status)

→PERSONAL FINANCIAL STATEMENT (This attached document must be filled out in its entirety, signed, dated and notarized by the applicant)

→HAS THERE BEEN A CHANGE IN OWNERSHIP/MANAGEMENT THIS PAST YEAR? YES____ NO ____

(If “YES,” you must submit all pertinent information to show changes in ownership)

I agree that the TNUCP will be notified in writing within 30 days of any changes in ownership and/or control, personal net worth and/or size standard that would impact the firm’s eligibility to remain in the program.

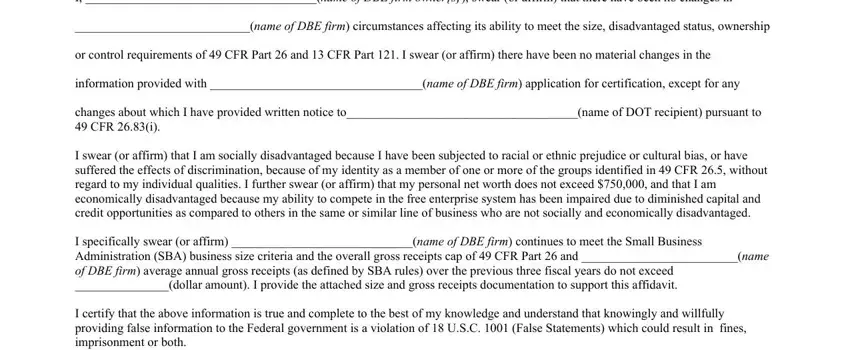

I, _____________________________________(NAME OF DBE FIRM OWNER{S}), swear (or affirm) that there have been no changes in

____________________________(NAME OF DBE FIRM) circumstances affecting its ability to meet the size, disadvantaged status, ownership

or control requirements of 49 CFR Part 26 and 13 CFR Part 121. I swear (or affirm) there have been no material changes in the information provided with __________________________________(NAME OF DBE FIRM) application for certification, except for any

changes about which I have provided written notice to_____________________________________(name of DOT recipient) pursuant to

49 CFR 26.83(i).

I swear (or affirm) that I am socially disadvantaged because I have been subjected to racial or ethnic prejudice or cultural bias, or have suffered the effects of discrimination, because of my identity as a member of one or more of the groups identified in 49 CFR 26.5, without regard to my individual qualities. I further swear (or affirm) that my personal net worth does not exceed $750,000, and that I am economically disadvantaged because my ability to compete in the free enterprise system has been impaired due to diminished capital and credit opportunities as compared to others in the same or similar line of business who are not socially and economically disadvantaged.

I specifically swear (or affirm) _____________________________(NAME OF DBE FIRM) continues to meet the Small Business

Administration (SBA) business size criteria and the overall gross receipts cap of 49 CFR Part 26 and _________________________(NAME

OF DBE FIRM) average annual gross receipts (as defined by SBA rules) over the previous three fiscal years do not exceed

_______________(dollar amount). I provide the attached size and gross receipts documentation to support this affidavit.

I certify that the above information is true and complete to the best of my knowledge and understand that knowingly and willfully providing false information to the Federal government is a violation of 18 U.S.C. 1001 (False Statements) which could result in fines, imprisonment or both.

Signature_____________________________________________ Date____________________________________________________

NOTARY CERTIFICATE:

|

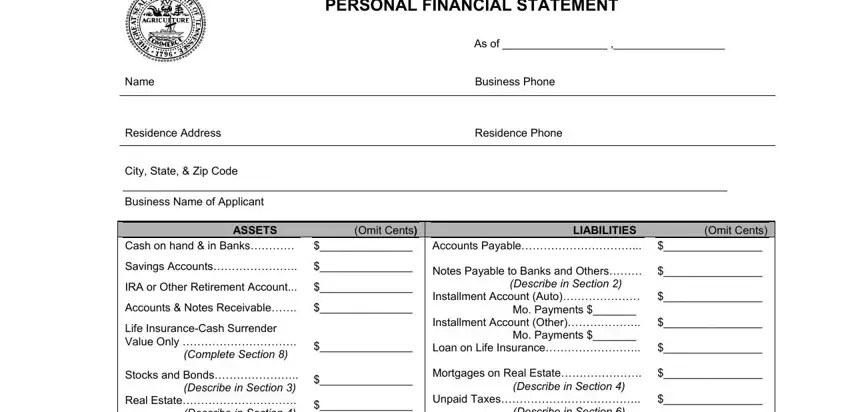

PERSONAL FINANCIAL STATEMENT |

|

As of _________________ ,__________________ |

Name |

Business Phone |

|

|

Residence Address |

Residence Phone |

|

|

City, State, & Zip Code

Business Name of Applicant

|

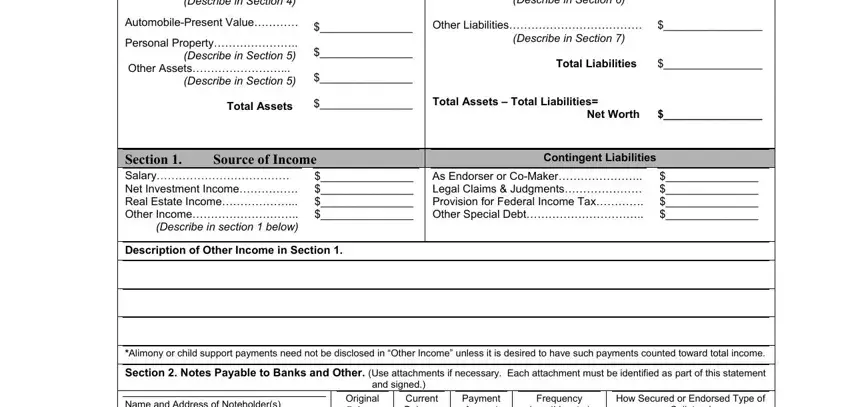

ASSETS |

(Omit Cents) |

|

LIABILITIES |

(Omit Cents) |

|

|

Cash on hand & in Banks………… |

$_______________ |

|

Accounts Payable…………………………... |

$________________ |

|

|

Savings Accounts………………….. |

$_______________ |

|

Notes Payable to Banks and Others……… |

$________________ |

|

|

|

|

|

|

|

IRA or Other Retirement Account... |

$_______________ |

|

(Describe in Section 2) |

|

|

|

|

|

|

Installment Account (Auto)………………… |

$________________ |

|

|

Accounts & Notes Receivable……. |

$_______________ |

|

Mo. Payments $_______ |

|

|

|

Life Insurance-Cash Surrender |

|

|

Installment Account (Other)……………….. |

$________________ |

|

|

|

|

Mo. Payments $_______ |

|

|

|

Value Only …………………………. |

|

|

|

|

|

$_______________ |

|

Loan on Life Insurance…………………….. |

$________________ |

|

|

(Complete Section 8) |

|

|

|

|

|

|

|

|

|

Stocks and Bonds………………….. |

$_______________ |

|

Mortgages on Real Estate…………………. |

$________________ |

|

|

(Describe in Section 3) |

|

(Describe in Section 4) |

|

|

|

|

|

|

|

|

Real Estate…………………………. |

$_______________ |

|

Unpaid Taxes……………………………….. |

$________________ |

|

|

(Describe in Section 4) |

|

(Describe in Section 6) |

|

|

|

|

|

|

|

|

Automobile-Present Value………… |

$_______________ |

|

Other Liabilities……………………………… |

$________________ |

|

|

|

|

|

|

Personal Property………………….. |

|

|

(Describe in Section 7) |

|

|

|

$_______________ |

|

|

|

|

|

(Describe in Section 5) |

|

|

|

|

|

|

|

Total Liabilities |

$________________ |

|

|

Other Assets……………………... |

|

|

|

|

$_______________ |

|

|

|

|

|

(Describe in Section 5) |

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$_______________ |

|

Total Assets – Total Liabilities= |

|

|

|

|

|

Net Worth |

$________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 1. |

Source of Income |

|

|

Contingent Liabilities |

|

|

|

Salary……………………………… |

$_______________ |

|

|

As Endorser or Co-Maker………………….. |

$_______________ |

|

|

Net Investment Income……………. |

$_______________ |

|

|

Legal Claims & Judgments………………… |

$_______________ |

|

|

Real Estate Income………………... |

$_______________ |

|

|

Provision for Federal Income Tax…………. |

$_______________ |

|

|

Other Income……………………….. |

$_______________ |

|

|

Other Special Debt………………………….. |

$_______________ |

|

|

(Describe in section 1 below) |

|

|

|

|

|

|

Description of Other Income in Section 1.

*Alimony or child support payments need not be disclosed in “Other Income” unless it is desired to have such payments counted toward total income.

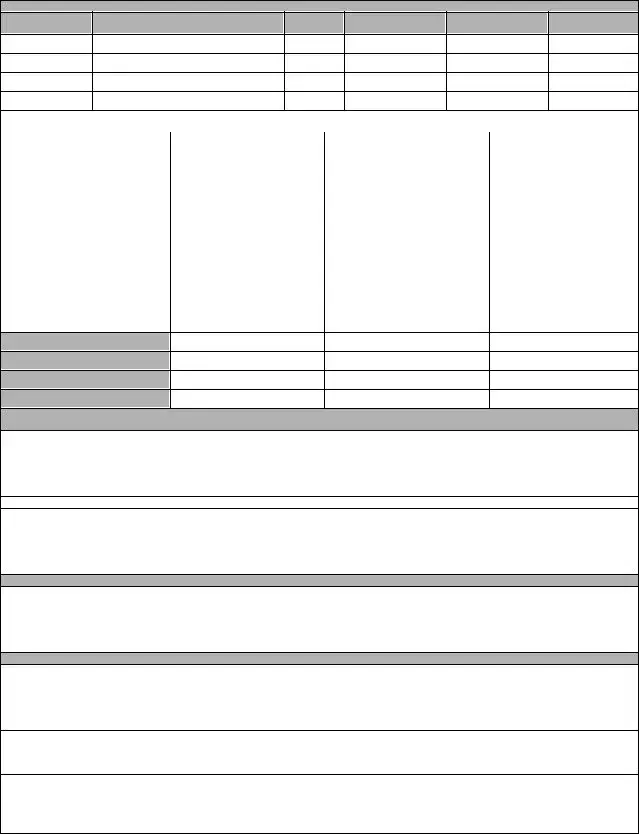

Section 2. Notes Payable to Banks and Other. (Use attachments if necessary. Each attachment must be identified as part of this statement and signed.)

|

|

|

|

Original |

|

|

Current |

|

Payment |

|

|

Frequency |

|

|

How Secured or Endorsed Type of |

|

|

Name and Address of Noteholder(s) |

|

|

|

|

Balance |

|

|

Balance |

|

Amount |

|

|

(monthly, etc.) |

|

|

Collateral |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Market Value

Quotation/Exchange

Date of

Quotation/Exchange

Section 4. Real Estate Owned |

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a |

|

part of this statement and signed.) |

|

|

|

Primary Residence |

Property B |

Property C |

Type of Property |

|

|

|

Address |

|

|

|

|

|

|

|

Date Purchased |

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

Present Market Value |

|

|

|

|

|

|

|

Name & |

|

|

|

Address of Mortgage Holder |

|

|

|

|

|

|

|

Mortgage Account Number

Mortgage Balance

Amount of Payment per Month/Year

Status of Mortgage

Section 5. Personal Property and Other Assets. (Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms of payment and if delinquent, describe delinquency)

Section 6. |

Unpaid Taxes (Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.) |

Section 7. Other Liabilities (Describe in detail.)

Section 8. Life Insurance Held. (Give face amount and cash surrender value of policies – name of insurance company and beneficiaries.)

I authorize the Tennessee Uniform Certification Program to make inquiries as necessary to verify the accuracy of the statements made and to determine my eligibility. I certify the above and the statements contained in the attachments are true and accurate as of the stated date(s). These statements are made for the purpose of determining Disadvantaged Business Enterprise eligibility. I understand FALSE statements may result in forfeiture of benefits and possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001)

Signature: |

Date: Social Security Number |

|

|

Signature: |

Date: Social Security Number |

NOTARY

Subscribed and sworn to before me this ____day of _________20__

Signed_____________________________, Notary Public in and for the

County of __________________, State_________________

My Commission Expires____________________________