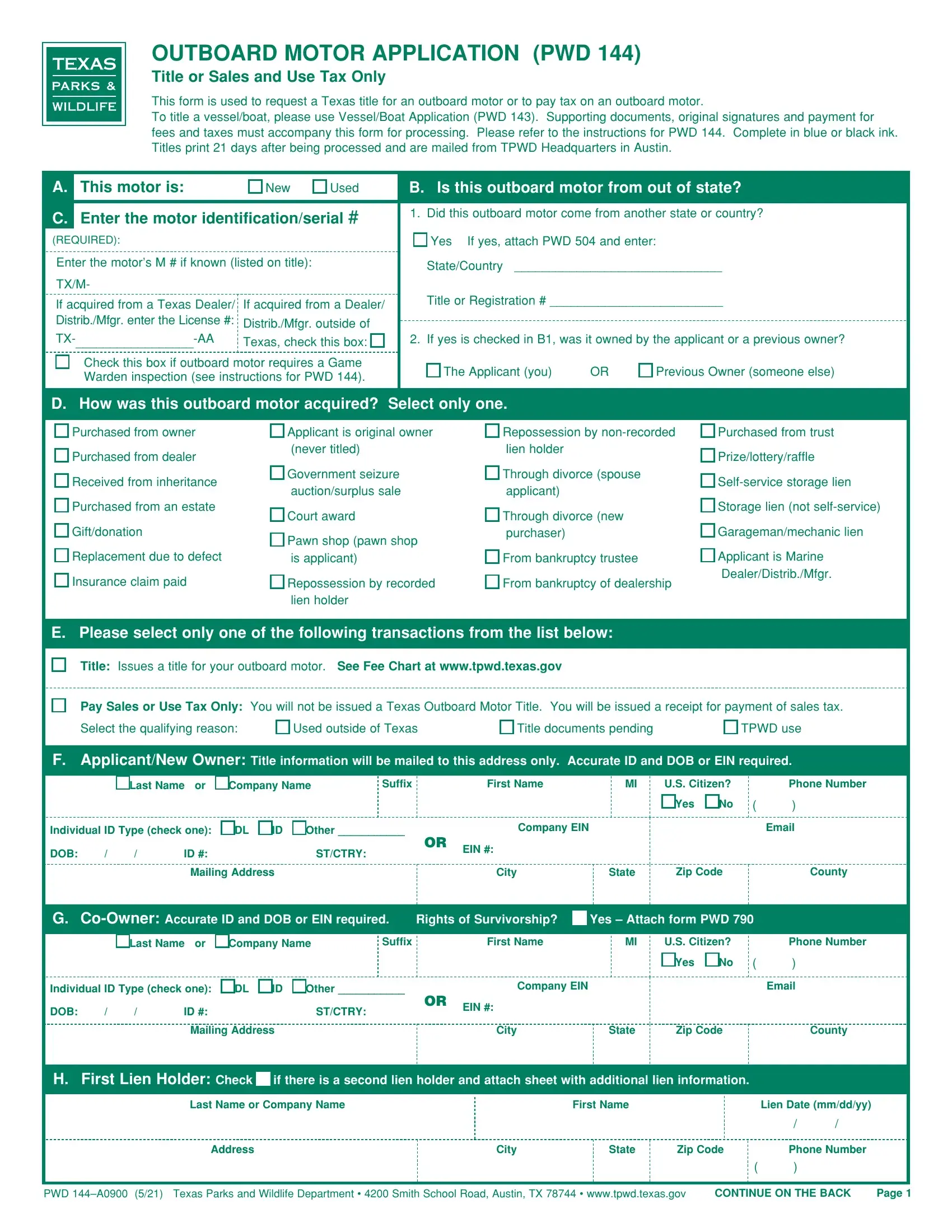

INSTRUCTIONS FOR PAGE 2 OF OUTBOARD MOTOR APPLICATION (PWD 144)

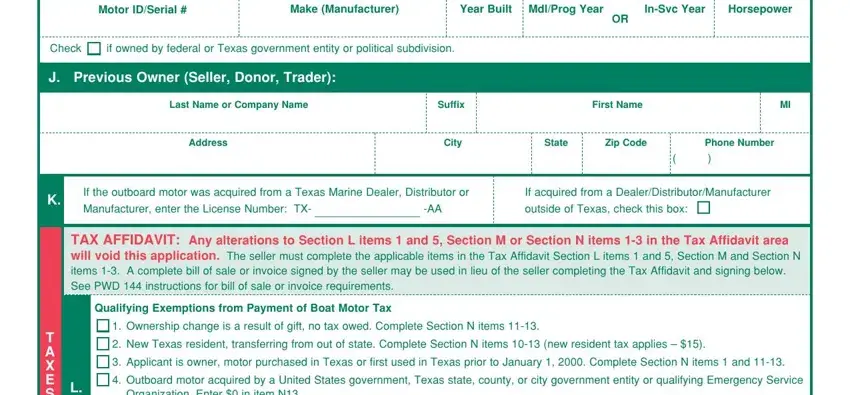

Section I: Outboard Motor Description.

• Complete each of the fields with the appropriate outboard motor information.

Section J: Previous Owner (Seller, Donor, or Trader).

•Provide the name, address, and phone number of the person(s) or company that previously owned the outboard motor. This would apply to the seller, donor, dealer, or trader of the outboard motor.

Section K: Marine License Number (complete this section and Section C, third line).

•If the outboard motor was acquired from a Texas Marine Dealer, Distributor or Manufacturer, enter their license number in the space provided. Example: TX-0321-AA. If this outboard motor was not acquired through a Texas Marine Dealer, Distributor or Manufacturer, leave this blank.

•If the outboard motor was acquired from a Dealer, Distributor or Manufacturer from outside of Texas, check the box. If it was not, leave this box blank.

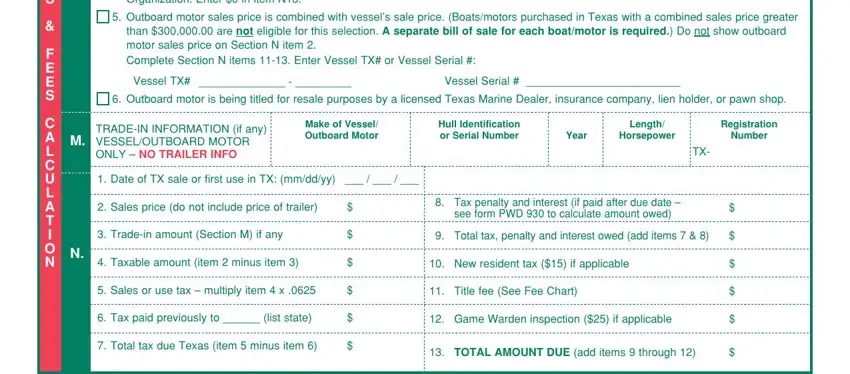

OUTBOARD MOTOR TAX AFFIDAVIT: Sections L-P.

•Any alterations in Section L items 1 and 5, Section M or Section N items 1-3 will void the application.

•The seller must complete Section J and the applicable items in the Tax Affidavit Section L items 1 and 5, Section M and Section N items 1-3 and sign in Section O.

•A bill of sale or invoice may be used in lieu of the seller completing the Tax Affidavit Section and signing Section O. A bill of sale or invoice must contain the purchaser’s name, description of outboard motor (make, year built, TX/M# or MIN), date of sale, sales price, and an original signature of the seller.

Section L: Qualifying Exemptions from Payment of Boat Sales Tax.

If any of the following exemptions are checked, enter $0 in Section N item 9.

1.If the ownership change is the result of a gift, the donor must check this box. Complete Section N items 11-13.

2.If you are a new resident and are transferring title from another state, check this box. Enter the new resident tax fee of $15 in Section N item 10. Complete Section N items 11-13.

3.Sales Tax will not be collected if the applicant purchased the outboard motor or first used the outboard motor more than 4 years from the date of application. If this situation applies to you, check this box and complete Section N item 1 (date of sale or date first used in Texas) and 11-13.

4.If the applicant is a federal or Texas government entity (political subdivision), or a qualifying Emergency Service Organization who can claim a tax exemption, check this box. Enter $0 in Section N item 13.

5.The seller should check this box if the outboard motor sale price was included in the vessel’s sale price on the vessel application PWD 143. Provide the vessel’s TX number and/or vessel serial/hull ID number. If checked, do not show outboard motor sales price on Section N item 2. Complete Section N items 11-13.

6.If the applicant is a Marine Dealer, insurance company, lien holder or pawn shop and are required by a state or governmental entity to title for resale purposes only, check this box. Complete Section N items 11-13.

Section M: Trade-In Information.

•Trade-In Information – If you have traded a vessel or outboard motor towards the purchase of the outboard motor, the seller must complete Section M. Include the make, hull identification/serial number, year built, length and/or horsepower and, if applicable, the registration or TX number of the vessel/ outboard motor traded in. Any trade other than a vessel or outboard motor requires the seller to provide the value of the item traded as the sales price in Section N item 2.

Section N: Date of Sale, Sales Price, Taxes, and Fees Owed.

1.Date of Sale – The seller must fill in the date that the purchaser took delivery of the outboard motor.

2.Sales Price – The seller must fill in the sales price for the outboard motor.

3.Trade-In Amount – The seller must fill in the amount you were credited for a taxable vessel and/or outboard motor that was accepted as trade-in for the transaction.

4.Taxable Amount – Subtract the amount of the trade-in from the sales price and enter that value on this line. (Item 2 minus item 3)

5.Sales Tax – Multiply the amount on item 4 by .0625 or use form PWD 930 to calculate this amount for you. Enter that amount here. For additional information regarding sales tax, contact the Comptroller of Public Accounts at (800) 252-5555 or (512) 463-4600 or TTD at (800) 248-4099.

6.Tax Paid – If the applicant previously paid tax in Texas or another state on this outboard motor, enter the abbreviation of the state where the tax was paid and the amount of sales tax paid. You will have to provide proof for any tax claimed under this item.

7.Total Tax Due Texas – Subtract sales tax paid to Texas or another state from Texas Sales Tax. (Item 5 minus item 6)

8.Sales Tax Penalty & Interest – If you do not owe a penalty, enter zero ($0). If you have not paid sales tax within 20 working days from the date of delivery or the date the outboard motor is brought into Texas, you will owe a sales tax penalty and interest may be due. To calculate the amount of penalty and interest owed, please use form PWD 930 which can be found at www.tpwd.state.tx.us/boat/forms.phtml. You will need to enter the date of sale, the sales price, any trade-in amount (Section N items 1-3), and any sales tax previously paid in Texas or another state (Section N item 6).

9.Total Sales Tax, Penalty & Interest Owed – Add items 7 and 8 and enter the total on this line.

10.New Resident Tax – If you owned the outboard motor in another state, you will need to pay New Resident Tax of $15.

11.Title Fee – If you are titling this outboard motor, enter fee for a regular title, or enter bonded title fee if this is an application for a bonded title.

12.Game Warden Inspection – If you are paying for an inspection by a Texas Game Warden, enter $25 on this line.

13.Total Amount to Be Paid – Add the amounts from item 9 through 12 and enter the total on this line. This is the amount you owe.

A fee chart can be obtained:

•online at www.tpwd.state.tx.us/fishboat/boat/forms

•by telephone utilizing the Boat Information System (800) 262-8755

•at the Texas Parks and Wildlife Headquarters in Austin

•from any of the 28 TPWD Law Enforcement field offices throughout the state

•from any participating Tax Assessor-Collector office (contact your local tax office to confirm if they process boat registration titles)

Section O: Seller(s), Previous Owner(s), or Lawful Representative – Original signatures are required, copies will not be accepted.

•The previous owner (s) must sign their name and date this section. A bill of sale or invoice may be used in lieu of the seller(s) completing the Tax Affidavit and signing this section. A bill of sale or invoice must contain the purchaser(s) name, description of outboard motor (make, year built, TX# or MIN), date of sale, sales price, and an original signature of the seller(s).

Section P: Purchaser(s), Applicant(s), or Lawful Representative – Original signatures are required, copies will not be accepted.

• The applicant(s) must sign their name and date this section.