This PDF editor was developed to be so simple as it can be. As you try out the following steps, the procedure for creating the form 01 339 file will undoubtedly be hassle-free.

Step 1: Find the button "Get Form Here" on the website and select it.

Step 2: At this point, you're on the document editing page. You may add content, edit current information, highlight certain words or phrases, place crosses or checks, add images, sign the document, erase unneeded fields, etc.

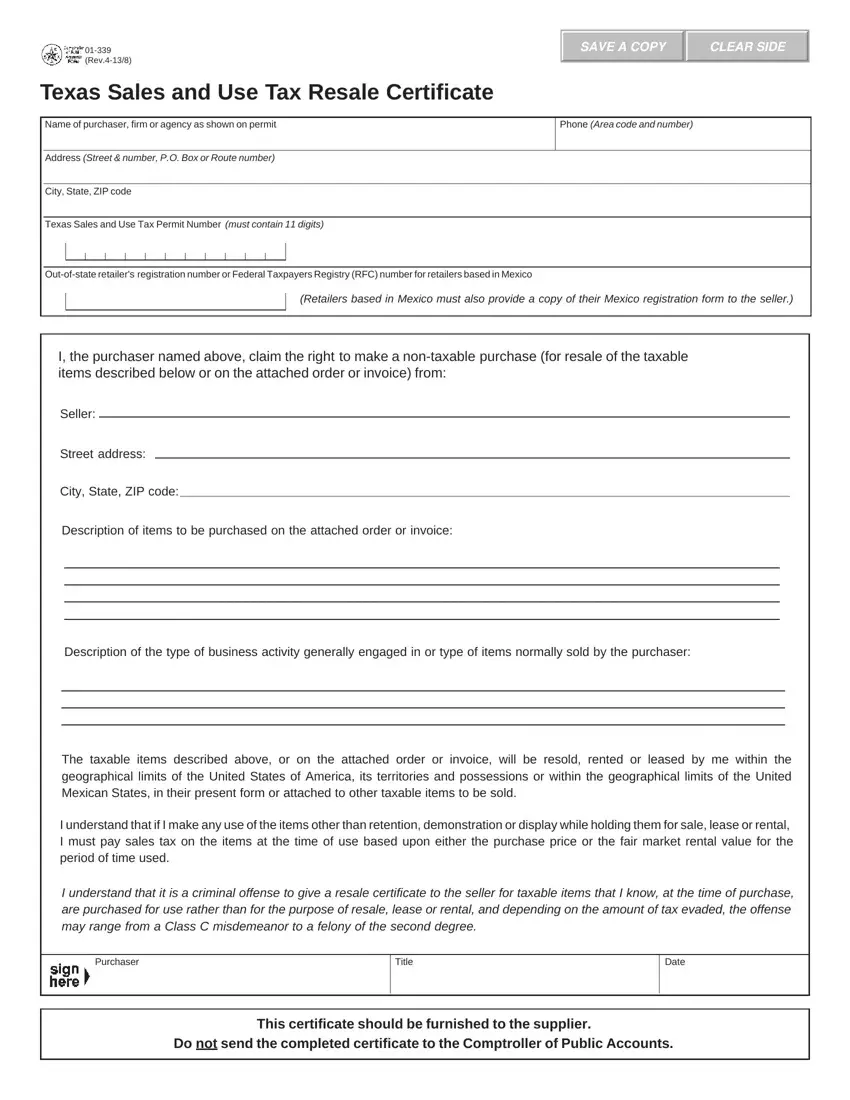

Type in the information demanded by the application to fill in the file.

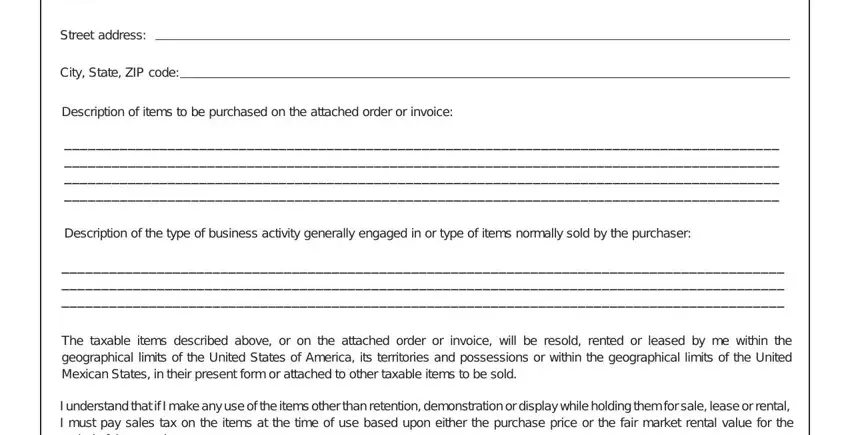

Provide the required data in the Seller, Street address, City State ZIP code, Description of items to be, Description of the type of, The taxable items described above, and I understand that if I make any area.

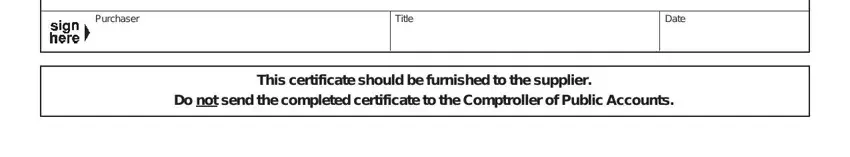

The system will ask for more info to instantly fill out the field Purchaser, Title, Date, and This certificate should be.

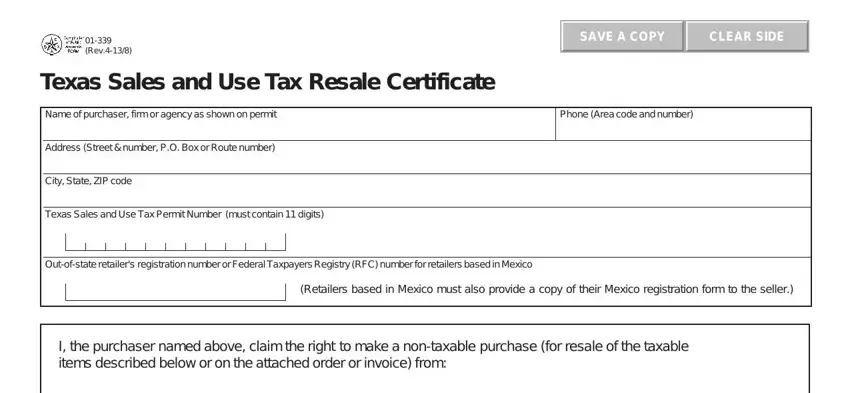

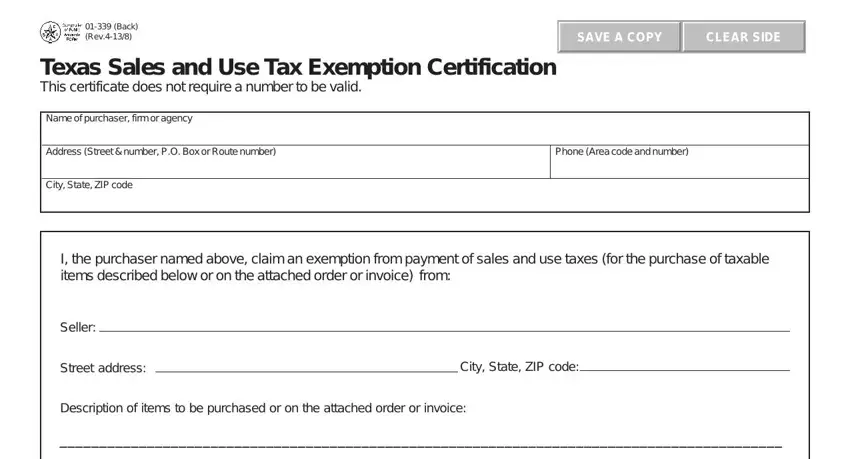

Inside the part Back Rev, Texas Sales and Use Tax Exemption, Name of purchaser firm or agency, Address Street number PO Box or, Phone Area code and number, City State ZIP code, I the purchaser named above claim, Seller, Street address, City State ZIP code, and Description of items to be, identify the rights and obligations of the sides.

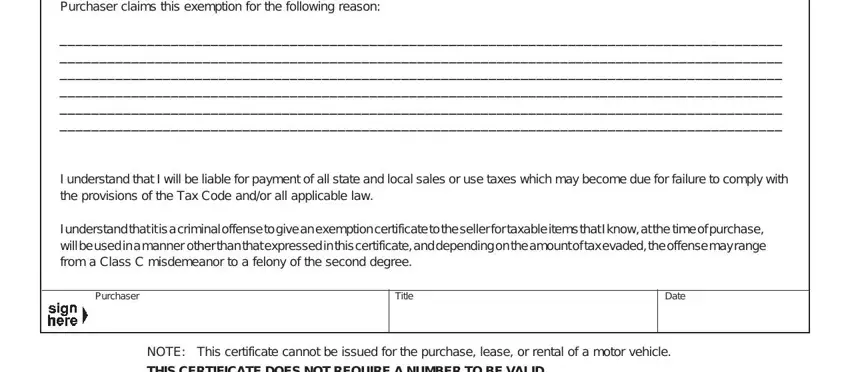

Finalize by analyzing the next areas and filling them in accordingly: Purchaser claims this exemption, I understand that I will be liable, I understand that it is a criminal, Purchaser, Title, Date, NOTE This certificate cannot be, and THIS CERTIFICATE DOES NOT REQUIRE.

Step 3: Press "Done". Now you may upload your PDF file.

Step 4: Create copies of the file - it can help you keep away from possible challenges. And don't be concerned - we are not meant to publish or look at your information.