It shouldn’t be challenging to create online spousal support calculator for california making use of our PDF editor. Here's how you can rapidly prepare your file.

Step 1: Initially, click the orange button "Get Form Now".

Step 2: At this point, you are on the document editing page. You may add information, edit existing information, highlight particular words or phrases, place crosses or checks, add images, sign the form, erase unrequired fields, etc.

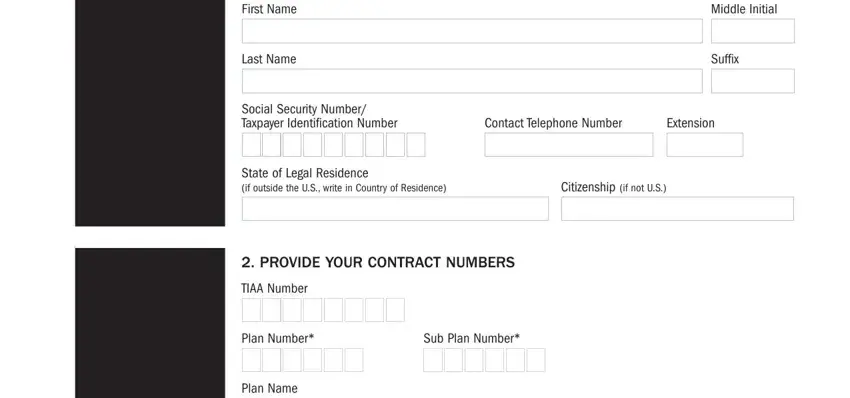

Enter the necessary content in each one part to create the PDF online spousal support calculator for california

In the part Was this contract issued as a, and Yes note the information that the system asks you to do.

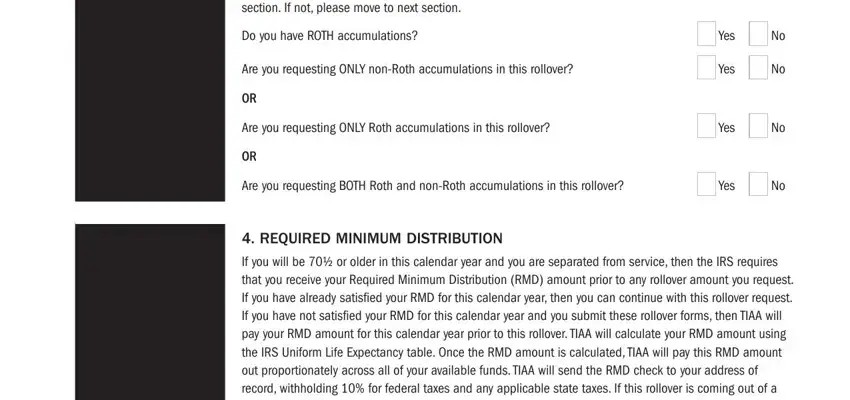

Remember to emphasize the necessary data in the If you made Roth AfterTax, Do you have ROTH accumulations, Are you requesting ONLY nonRoth, Yes, Yes, Are you requesting ONLY Roth, Yes, Are you requesting BOTH Roth and, Yes, REQUIRED MINIMUM DISTRIBUTION, If you will be or older in this, NOTE Satisfied means that you have, and If you want different options area.

The If you will be or older in this, and I attest that I have already box could be used to specify the rights and responsibilities of each party.

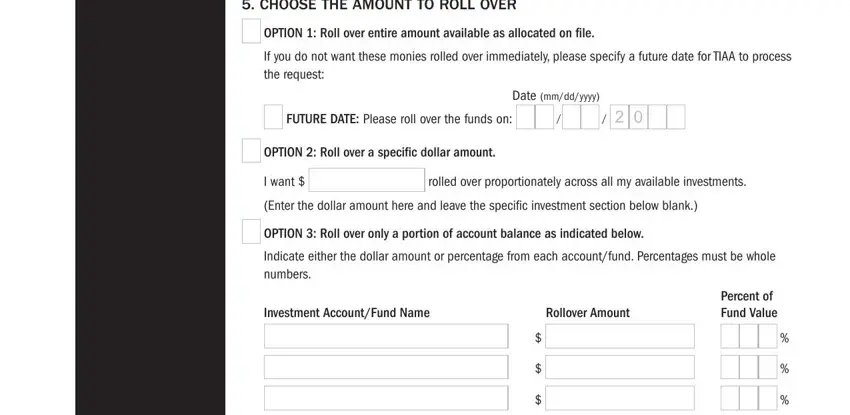

Finalize by looking at these areas and typing in the suitable data: Rollover amount will be based on, If no option is selected or your, CREF has more than one class which, IMPORTANT NOTE If you are, If you elect a systematic rollover, CHOOSE THE AMOUNT TO ROLL OVER, OPTION Roll over entire amount, FUTURE DATE Please roll over the, Date mmddyyyy, OPTION Roll over a specific, I want, rolled over proportionately across, Enter the dollar amount here and, OPTION Roll over only a portion, and Investment AccountFund Name.

Step 3: Hit the Done button to save the file. Now it is obtainable for upload to your electronic device.

Step 4: Produce at least several copies of your file to stay clear of any specific potential troubles.

0

0

0

0

% (must be greater than 20%)

% (must be greater than 20%)

0

0