|

|

|

|

|

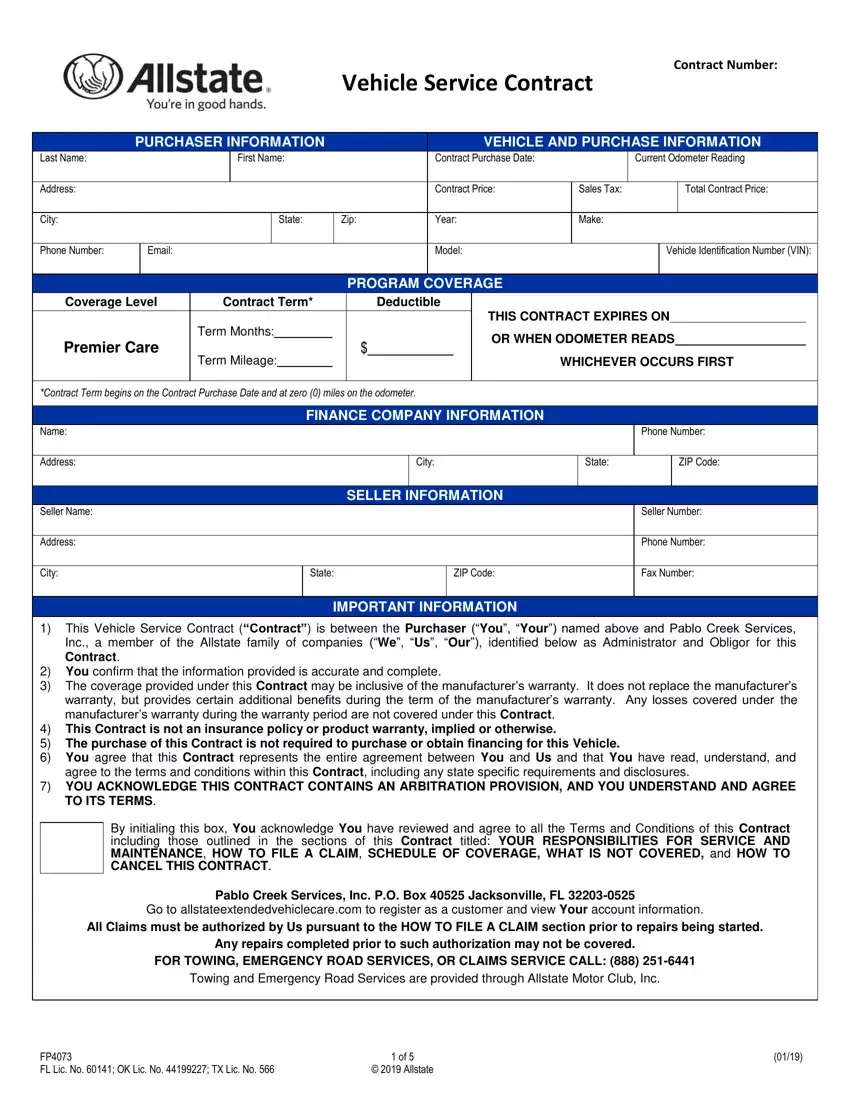

Vehicle Service Contract |

|

Contract Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

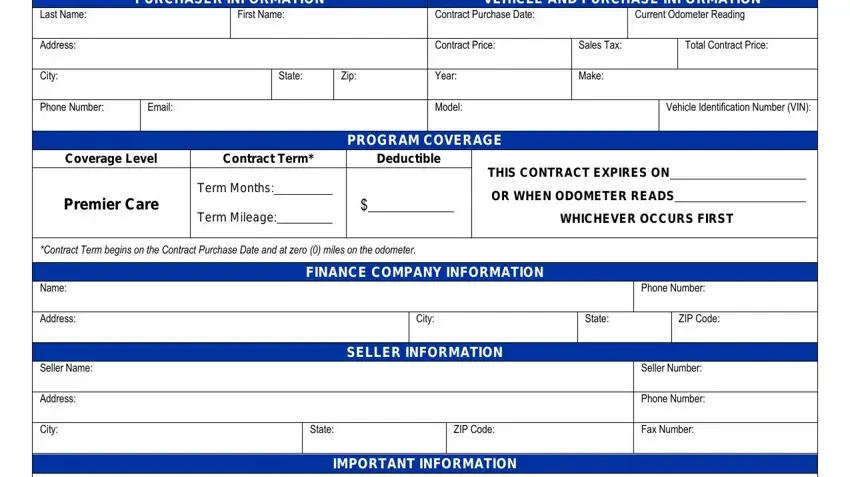

PURCHASER INFORMATION |

|

VEHICLE AND PURCHASE INFORMATION |

Last Name: |

|

|

First Name: |

|

Contract Purchase Date: |

|

Current Odometer Reading |

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

Contract Price: |

Sales Tax: |

|

|

Total Contract Price: |

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

State: |

Zip: |

Year: |

Make: |

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number: |

|

Email: |

|

Model: |

|

|

Vehicle Identification Number (VIN): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROGRAM COVERAGE |

|

|

|

|

|

|

|

Coverage Level |

Contract Term* |

|

Deductible |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS CONTRACT EXPIRES ON |

|

|

|

|

Term Months: |

|

|

|

|

|

|

|

|

|

|

|

|

OR WHEN ODOMETER READS |

|

|

|

Premier Care |

|

|

|

|

$ |

|

|

|

|

|

Term Mileage: |

|

|

|

|

|

|

|

|

|

|

|

WHICHEVER OCCURS FIRST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Contract Term begins on the Contract Purchase Date and at zero (0) miles on the odometer. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCE COMPANY INFORMATION |

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

City: |

|

|

|

State: |

|

|

ZIP Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER INFORMATION |

|

|

|

|

|

|

|

Seller Name: |

|

|

|

|

|

|

|

|

|

|

|

|

Seller Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

State: |

|

|

|

|

ZIP Code: |

|

|

Fax Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT INFORMATION |

|

|

|

|

|

|

1) This Vehicle Service Contract (“Contract”) is between the Purchaser (“You”, “Your”) named above and Pablo Creek Services, Inc., a member of the Allstate family of companies (“We”, “Us”, “Our”), identified below as Administrator and Obligor for this Contract.

2) You confirm that the information provided is accurate and complete.

3) The coverage provided under this Contract may be inclusive of the manufacturer’s warranty. It does not replace the manufacturer’s warranty, but provides certain additional benefits during the term of the manufacturer’s warranty. Any losses covered under the manufacturer’s warranty during the warranty period are not covered under this Contract.

4) This Contract is not an insurance policy or product warranty, implied or otherwise.

5) The purchase of this Contract is not required to purchase or obtain financing for this Vehicle.

6) You agree that this Contract represents the entire agreement between You and Us and that You have read, understand, and agree to the terms and conditions within this Contract, including any state specific requirements and disclosures.

7) YOU ACKNOWLEDGE THIS CONTRACT CONTAINS AN ARBITRATION PROVISION, AND YOU UNDERSTAND AND AGREE TO ITS TERMS.

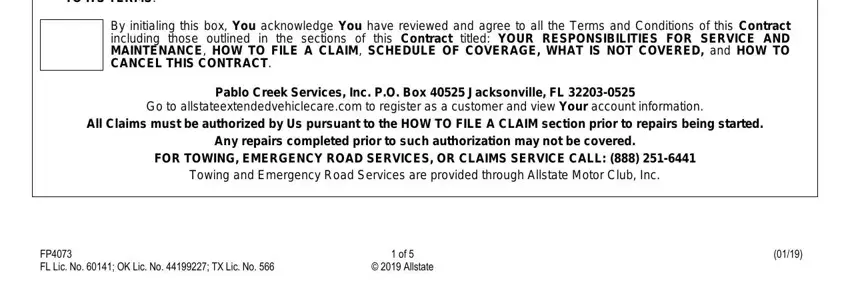

By initialing this box, You acknowledge You have reviewed and agree to all the Terms and Conditions of this Contract including those outlined in the sections of this Contract titled: YOUR RESPONSIBILITIES FOR SERVICE AND MAINTENANCE, HOW TO FILE A CLAIM, SCHEDULE OF COVERAGE, WHAT IS NOT COVERED, and HOW TO CANCEL THIS CONTRACT.

Pablo Creek Services, Inc. P.O. Box 40525 Jacksonville, FL 32203-0525

Go to allstateextendedvehiclecare.com to register as a customer and view Your account information.

All Claims must be authorized by Us pursuant to the HOW TO FILE A CLAIM section prior to repairs being started.

Any repairs completed prior to such authorization may not be covered.

FOR TOWING, EMERGENCY ROAD SERVICES, OR CLAIMS SERVICE CALL: (888) 251-6441

Towing and Emergency Road Services are provided through Allstate Motor Club, Inc.

FP4073 |

1 of 5 |

(01/19) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2019 Allstate |

|

Terms and Conditions

DEFINITIONS

Approved Repair Facility: A licensed repair facility that has a Taxpayer Identification Number (“TIN”), provides a minimum of a twelve

(12)months or twelve thousand (12,000) mile warranty on parts and labor from the date of service on all repairs completed, and is approved by Us.

Authorized Amount: The total amount of a Claim authorized by Us, including all covered charges minus the Deductible. Any charges that exceed the Authorized Amount are Your responsibility. Labor cost is the Approved Repair Facility’s approved labor rate multiplied by the labor time as specified in Motors, All Data or Mitchell on Demand online labor guides. The manufacturer’s suggested retail pricing (“MSRP”) will be the maximum part cost paid under this Contract.

Breakdown: The inability of a Covered Part to perform the function for which it was designed due to a material defect that is not related to the action or inaction of any non-covered part or outside influence. A gradual reduction in performance commonly referred to as “wear and tear,” will be considered a Breakdown when the wear has exceeded the manufacturer’s published tolerances. Please refer to the WHAT IS NOT COVERED section for a listing of conditions under which the failure of a Covered Part is not considered a Breakdown.

Claim: A request by You for benefits under this Contract.

Covered Part: Parts listed under the SCHEDULE OF COVERAGE section corresponding to the Coverage Level You selected on the first page of this Contract.

Deductible: The portion of the authorized repairs You must pay for each repair visit. Should a Breakdown require more than one repair visit, only one Deductible will be charged for that Breakdown.

Expiration Date: The Expiration Date is the Contract Purchase Date plus the number of Term Months stated under Contract Term on the first page of this Contract.

Expiration Mileage: The Expiration Mileage is the Term Mileage stated under Contract Term on the first page of this Contract.

Finance Company: Any financial institution or premium payment financing company that provides financing to You for the Total Contract Price, and is shown on the first page of this Contract.

Pre-existing Condition: Any damage, failure, or Breakdown that existed prior to the Contract Purchase Date which would have been obvious and apparent if that component was inspected at the time of Contract purchase.

Vehicle: The vehicle identified in the Vehicle and Purchase Information fields on the first page of this Contract.

CONTRACT TERM

Your Contract Term, as shown on the first page of this Contract, begins on the Contract Purchase Date and at zero (0) miles, and ends when the Expiration Date or Expiration Mileage is reached, whichever occurs first.

YOUR RESPONSIBILITIES FOR SERVICE AND MAINTENANCE

You must maintain the Vehicle in accordance with the manufacturer’s published maintenance requirements and maintain proper fluid levels.

Before any repair is authorized, We may require You to provide records showing that You have properly maintained the Vehicle. You must retain all receipts as proof of maintenance. Acceptable receipts will include Your name and signature, date, mileage, services performed, year, make, model, of the Vehicle and VIN. Reimbursement of maintenance services is not covered under this Contract.

If You perform the required maintenance on the Vehicle yourself, You must maintain a log noting the date, mileage and type of maintenance service performed. Each log entry must have a corresponding receipt, dated within the two (2) weeks prior to the date on the log, for the materials needed for the service performed (e.g., filters, oils and lubricants). Receipts that do not reflect a date within two (2) weeks of the service date are not acceptable.

SCHEDULE OF COVERAGE

In consideration of Your payment to Us of the Total Contract Price shown on the first page of this Contract, subject to the terms and conditions of this Contract, and in reliance on the warranties and representations made by You related to the Vehicle, We agree to pay for the repair or replacement of the Covered Parts listed below in the event of a covered Breakdown sustained during the Contract term. If You experience a Breakdown, please refer to the HOW TO FILE A CLAIM section. Parts used to repair the Vehicle may be new parts, remanufactured parts, or parts of like kind and quality, as We deem appropriate. All parts of like kind and quality purchased and provided by Us are guaranteed by Our supplier for a period of twelve (12) months or twelve thousand (12,000) miles regardless of Expiration Date and Expiration Mileage of this Contract. This Contract covers Breakdowns that occur or are repaired within the fifty (50) United States, the District of Columbia, and Canada.

All Claims must be authorized by Us pursuant to the HOW TO FILE A CLAIM section prior to repairs being started.

PREMIER CARE EXCLUSIONARY COVERAGE

All parts on the Vehicle are covered subject to the WHAT IS NOT COVERED section of this Contract.

ADDITIONAL BENEFITS

Please contact Us at (888) 251-6441 to have services dispatched for Towing or Emergency Road Services, and/or to receive instructions on filing a Claim for reimbursement. Towing and Emergency Road Services are provided through Allstate Motor Club, Inc. Please retain all receipts and documentation related to any services received. You are not required to pay a Deductible for any of the following Additional Benefits:

Towing: If the Vehicle requires towing in the event of a mechanical Breakdown (covered under this Contract or not), You may have the Vehicle towed to an Approved Repair Facility of Your choice. Your benefit limit is one hundred dollars ($100) per Breakdown.

Emergency Road Services: If the Vehicle requires on-site emergency road services for jump starts, fuel delivery, lockout assistance, and installation of Your spare tire, We will pay up to one hundred dollars ($100) per occurrence.

Rental Vehicle/Alternate Transportation Reimbursement: If a covered Breakdown requires the Vehicle to be left at an Approved Repair Facility, You may be eligible for reimbursement for Your expenses incurred from an automobile rental, licensed taxi, on-demand ridesharing, or public transportation company. We will pay or reimburse up to a maximum of forty dollars ($40) per day until repairs are completed, not to exceed seven (7) consecutive days. Rental vehicles must be obtained from a licensed rental agency. You must be the primary signee or be listed as an additional driver on the rental agreement.

FP4073 |

2 of 5 |

(01/19) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2019 Allstate |

|

Trip Interruption Reimbursement: If a covered Breakdown occurs more than one hundred (100) miles from Your home and before You reach Your destination that requires the Vehicle to be left at an Approved Repair Facility overnight, You may be eligible for reimbursement of certain unplanned expenses. We will reimburse You for receipted lodging, meals, one-way airfare expenses, and boarding for Your pet(s). Benefits end on the date You return to Your home or the date the repairs are completed, whichever occurs first. This benefit is limited to a maximum of three (3) consecutive days from the date the repair order was written. Reimbursement is limited to up to five hundred dollars ($500) per occurrence. You are responsible for any amounts exceeding the per occurrence limit.

Manufacturer’s Deductible Reimbursement: If a part is replaced under the manufacturer’s warranty and that same part is covered under this Contract, We will pay the deductible that the manufacturer charged up to one hundred dollars ($100) per occurrence.

HOW TO FILE A CLAIM

ALL CLAIMS MUST BE AUTHORIZED BY US BEFORE STARTING REPAIRS, OR THEY MAY NOT BE COVERED

FOR TOWING, EMERGENCY ROAD SERVICES, OR CLAIMS SERVICE CALL: (888) 251-6441

Towing and Emergency Road Services are provided through Allstate Motor Club, Inc.

You are responsible for all expenses and repair costs if the Breakdown is not covered under this Contract. If the Vehicle experiences a Breakdown, You are responsible to ensure that You and Approved Repair Facility follow the procedures listed below:

1)Prevent Further Damage: You must take all reasonable means to protect the Vehicle from further damage. If the Vehicle is disabled or if it is unsafe to drive, please call for towing assistance at the number above. This Contract will not cover additional damage caused by Your failure to prevent further damage.

2)Take the Vehicle to an Approved Repair Facility: Have the Approved Repair Facility contact Us prior to authorizing any diagnosis.

3)Copy of Contract: Provide the Approved Repair Facility with a copy of the first page of this Contract.

4)Authorize Diagnosis: You must authorize the Approved Repair Facility to complete all work needed to accurately diagnose the cause of the Vehicle’s Breakdown and provide Us with a complete estimate to include all part numbers and prices, labor involved and any other charges required for the repairs. The Vehicle may require disassembly to diagnose the failure and complete the repair estimate. This Contract will cover reasonable diagnosis for covered repairs as provided by online labor time guides, Motors, All Data or Mitchell on Demand. The Approved Repair Facility must save all parts, fluids and filters, and must not clean any parts without Our authorization. You will be responsible for all charges if the Breakdown is not covered under this Contract. We reserve the right to inspect the Vehicle prior to authorizing any repair.

5)Obtain Payment Authorization: It is Your responsibility to instruct the Approved Repair Facility to contact Us to obtain payment authorization before any repairs are started. The amount We authorize is the maximum amount that will be paid for repairs covered under this Contract. If additional repairs are required after authorization is given, the Approved Repair Facility must also receive payment authorization before starting.

6)Authorize the Repair: We will provide an authorization number and an Authorized Amount to the Approved Repair Facility upon approval. Any charges that exceed the initial Authorized Amount must receive additional approval from Us or You will be responsible for those charges. We authorize payment for the repair, You must authorize the repair to be completed. You must not authorize repairs until We have issued an authorization number to the Approved Repair Facility.

7)Pay Applicable Deductible: We will reimburse the Approved Repair Facility or You for the Authorized Amount. You must pay the Approved Repair Facility Your Deductible and any charges not included in the Authorized Amount.

8)Request Reimbursement: To obtain payment for a covered Breakdown, You or the Approved Repair Facility must submit a

legible copy of the repair invoice to Us. Repair invoices must include the following: authorization number, Authorized Amount, Your name/address/phone number and signature, Approved Repair Facility’s name/address and phone number, VIN, Vehicle mileage and repair date, Your description of the Breakdown and the repair facility’s description of the diagnosis and repair, part numbers, part descriptions and prices, labor hours, labor descriptions, labor rate, and the total amount requested for payment. All documents pertaining to a Claim must be submitted to Us within ninety (90) days from the date repairs are completed. Failure to provide documents within this time period may result in the denial of reimbursement. When submitting Your Claim for payment, send only photocopies of Your documents. Keep the originals for Your records.

9)Emergency Repairs: A Breakdown which renders the Vehicle inoperable or unsafe to operate for transportation purposes may occur when Our offices are closed. You may, at Your discretion, authorize the necessary emergency repairs. If any portion of the repair carries over into Our normal business hours, You must have the repair facility stop working on the Vehicle and contact Us as soon as We are open for business. You are responsible for all expenses and repair costs if it is determined that the failure or the Breakdown does not qualify as an emergency repair as defined by this Contract.

LIMITS OF LIABILITY

The total of all benefits paid or payable under this Contract shall not exceed fifty thousand dollars ($50,000). In no event will Our liability for an individual repair visit exceed the retail value of the Vehicle as stated in the current online National Automobile Dealer Association (N.A.D.A.) pricing guide immediately prior to the Breakdown, less any Deductible.

Our Right to Recover Payment: If You have a right to recover any funds that We have paid under this Contract, You hereby assign those rights to Us. Your rights become Our rights and You agree to do whatever is necessary to enable Us to enforce those rights. We shall be entitled to retain only funds that reimburse Our actual costs and only after You are fully compensated for Your Claim.

INELIGIBLE VEHICLES

The following vehicles are ineligible under this Contract:

1)Any vehicle that is older than the current calendar year minus four (4) years or the Current Odometer Reading shown on the first page of this Contract exceeds fifty thousand (50,000) miles at the time of Contract purchase.

2)Any imported vehicle that does not meet U.S. federal motor vehicle standards.

3)Any vehicle that has the following characteristics: dump bed, incomplete vehicles, or vehicles that have special bodies designed for commercial use.

4)Any vehicle equipped with a snow plow or suspension/tire modification.

5)Any vehicle that has powertrain modifications, or performance enhancing add-on parts.

6)Any vehicle that is or will be used/equipped or identified as: competitive driving or racing, vehicles used for municipal or professional emergency or police services, taxi, or vehicles used for hire to the public or to transport people for hire except for personal vehicles used by a single driver for on-demand ridesharing services (e.g., Uber, Lyft, etc.).

7)Any vehicle that was reconstructed from salvage, declared a total loss, declared a lemon, or if the original manufacturer’s warranty was voided for any reason.

FP4073 |

3 of 5 |

(01/19) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2019 Allstate |

|

WHAT IS NOT COVERED

1)This Contract excludes the following parts and services:

a)Accessory drive belts, hoses and clamps, spark plugs and wires, clogged fuel injectors where a mechanical/electrical failure has not occurred, tires, wheels and wheel covers, wiper blades, standard transmission clutch parts (including pressure plate, clutch disc, pilot bearing, throw-out bearing, clutch engagement arm and pivot), steering wheel (except for integral electrical failures), batteries (either stand alone or integral to a component), electric vehicle external charging stations, hybrid power packs, fuses, fusible links and circuit breakers, brake drums, rotors, pads and shoes, sub-frame, frame, frame bushings, retractable roof/convertible top, glass, lenses, light emitting assemblies (except for integral electrical failures), any individual light emitting device (i.e. bulbs of any type) that can be removed from an assembly, exhaust pipes, filters (except in conjunction with a covered repair), exhaust gas recirculation pipes/hoses and check valves, catalytic converter, conversion van appliances, door handles (except for integral electrical failures).

b)Loss of fuel, trim, upholstery, insulation, carpet and paint, air or water leaks or wind noise, squeaks and rattles, jack and tool kit, wheel lugs and lug nuts, shop supplies, environmental waste charges or disposal fees, lost or missing parts, electronic diagnostic equipment fees, freight, vehicle body parts including but not limited to: bumpers, body panels, fasteners and mounts, moldings and outside ornamentation, bright metal parts, door stops, hinges, and weather stripping.

c)Any non-manufacturer installed parts including but not limited to: turbochargers, superchargers, convertible tops, audio, navigation and security systems.

d)Replacement of oil, lubricants, coolants, additives and/or other fluids, except in conjunction with the repair of a Covered Part. Replacement of A/C refrigerant and/or oil unless in conjunction with a leak resulting from the failure of a Covered Part.

e)The use of parts that improve the Vehicle beyond its condition immediately prior to the Breakdown.

f)Any service considered to be regular maintenance, or a service, labor, or adjustment operation completed to correct a complaint where a Covered Part has not failed.

g)Suspension alignment (unless required in conjunction with the repair of a Breakdown).

h)Any part or repair that an Approved Repair Facility or manufacturer recommends or requires to be repaired, replaced, adjusted or updated (including updating software or programming) in conjunction with a covered repair when a Breakdown of that part has not occurred. This includes modifications, replacement or alteration of original systems necessitated by the replacement of an obsolete, superseded, redesigned, or unavailable part.

2)This Contract excludes the following conditions:

a)Any Breakdown resulting from damage caused to a Covered Part by: impact or any other external force known or unknown, collision, bent or twisted parts, fire, terrorism, theft, vandalism, riot, explosion, restricted oil passages, rust or corrosion, salt, environmental damage, contamination, oxidation, carbon, sludge, varnish, damage caused when the engine exceeds the manufacturer’s maximum recommended operating temperature (as indicated by gauges, warning lights or audible warning sounds, warped or melted parts), lack of proper quality or quantity of fluids or lubricants, acts of nature including but not limited to lightning, earthquake, flood, windstorm, volcanic eruption, and freezing.

b)Any Pre-existing Conditions or Breakdowns that were reported after the expiration of this Contract or occurred following a change of Vehicle ownership where the Contract was not transferred in accordance with the HOW TO TRANSFER THIS CONTRACT section.

c)Any repair(s) started without receiving prior authorization from Us, except for emergency repairs. (Please refer to the HOW TO FILE A CLAIM section.)

d)Any Breakdown caused by Your failure to follow the instructions in the YOUR RESPONSIBILITIES FOR SERVICE AND MAINTENANCE section or any Breakdown where maintenance records pertaining to a Breakdown have been requested by Us but cannot be produced or verified.

e)Any Breakdown caused by non-manufacturer alterations made to the Vehicle before or after the Contract Purchase Date. Alterations include, but are not limited to: emissions equipment removal or modification, custom or add-on parts, trailer hitches, modification of powertrain components and/or their control systems, or offset rims.

f)Any loss if the odometer has failed, been broken, disconnected or altered, or if for any reason the Vehicle’s actual accumulated mileage cannot be determined.

g)Any charges or costs for inconvenience, loss of time, loss of income, commercial loss or any other consequential losses or expenses not specifically covered by this Contract.

h)Any liability for consequential or incidental damage to property or injury or death of any person.

i)Any loss caused by faulty or negligent auto repair work, improper servicing, or installation of defective parts.

j)Any Breakdown if a manufacturer has announced its responsibility through any means, including but not limited to public recalls and special policies.

k)Any Breakdown covered by any limited warranty, manufacturer’s warranty, repairer’s guarantee, road club, or any other guarantee, warranty, or insurance policy, whether collectible or not.

l)Any Breakdown when the Vehicle has been repossessed or declared a total loss.

m)Towing Benefit: recovery for any reason other than a mechanical Breakdown, and any expenses that exceed Your benefit limit.

n)Emergency Road Services: the cost for fuel, labor to produce keys, replacement keys, and mechanical failure of locks or ignition system, any expenses not specifically mentioned as covered by this Contract, and any expenses that exceed Your benefit limit.

o)Rental Vehicle/Alternate Transportation: for expenses for fuel, insurance, tolls, GPS or similar equipment, or maintenance charges; for delays due to shop scheduling, and any expenses that exceed Your benefit limit.

3)This Contract excludes the following uses:

a)Any Breakdown resulting from neglect, abuse or misuse of the Vehicle, or failure to protect the Vehicle from further damage when any Breakdown has occurred, or if You have used the Vehicle in any manner not recommended by the manufacturer.

b)Any Breakdown caused by loading the Vehicle in any way beyond the limitations established by the manufacturer.

c)Any Breakdown resulting when the Vehicle is or will be used/equipped or identified as: competitive driving or racing, taxi, or used for hire to the public or used to transport people for hire except for personal vehicles used by a single

FP4073 |

4 of 5 |

(01/19) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2019 Allstate |

|

driver for on-demand ridesharing services (e.g. Uber, Lyft, etc.), vehicles used for municipal or professional emergency or police services.

HOW TO CANCEL THIS CONTRACT

By You: You may cancel this Contract at any time. You may go to allstateextendedvehiclecare.com to initiate a cancellation request, or

You may submit Your cancellation request to Us in writing with the following information: 1) Your name and address or copy of this Contract, 2) VIN, 3) Contract number, 4) odometer reading at time of cancellation request, and 5) reason for cancellation.

By Us: We may cancel this Contract for material misrepresentation, fraud, non-payment of Total Contract Price, or if We find the Vehicle to be ineligible for coverage under the INELIGIBLE VEHICLES section.

Refund Calculation: If this Contract is cancelled within the first sixty (60) days and no Claim has been paid, the Seller will refund one hundred percent (100%) of the Total Contract Price. If You cancel this Contract after the first sixty (60) days from the Contract Purchase Date, or if a Claim has been paid, the Seller will refund a pro-rated amount of the Total Contract Price, based on the lesser of the months or miles remaining, less a fifty-dollar ($50) cancellation fee. If We cancel this Contract and no Claim has been paid, the Seller will refund one hundred percent (100%) of the Total Contract Price. If this Contract is financed and there is a remaining balance owed to the Finance Company, the refund will be paid to the Finance Company; otherwise, the refund will be paid to You.

Limited Rights of Finance Company: If this Contract is financed, the Finance Company named on the first page of this Contract has the right to receive any portion of the cancellation refund amounts. The Finance Company has the right to cancel this Contract in the event of non-payment, provided the Total Contract Price was financed.

HOW TO TRANSFER THIS CONTRACT

You may transfer this Contract to a private party, provided that:

1)This Contract has not been previously transferred;

2)The Vehicle has not been sold or traded to or through any automobile dealer, auto broker, auto auction or financial institution;

3)The Total Contract Price has been paid in full;

4)You provide the new owner all records confirming that maintenance has been completed pursuant to the Contract terms; and

5)You submit a completed transfer request form to Us within thirty (30) days of an ownership change. You must include:

a)An odometer statement for the Vehicle, and

b)A fifty-dollar ($50) transfer fee.

6)To transfer this Contract please go to allstateextendedvehiclecare.com to obtain a transfer form, or You may contact Us for assistance.

INSURANCE STATEMENT

Our obligations under this Contract are insured by an insurance policy issued by First Colonial Insurance Company, a member of the Allstate family of companies. If a covered Claim is not paid or a covered service is not provided within sixty (60) days after You have filed proof of loss with Us, You may file a Claim directly with First Colonial Insurance Company at (800) 621-4871; 1776 American Heritage Life Drive, Jacksonville, FL 32224.

ARBITRATION

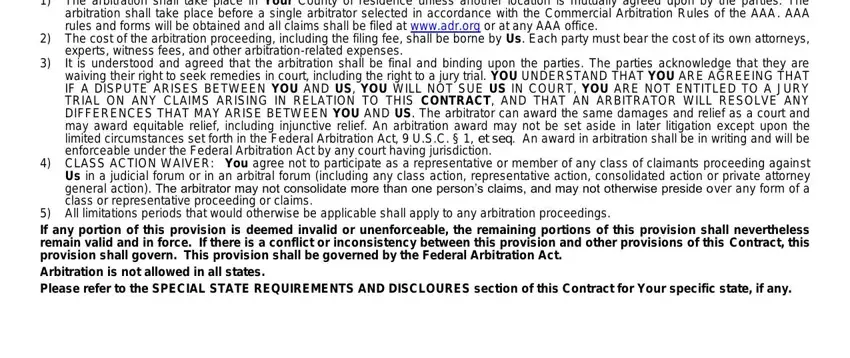

It is understood and agreed that the transaction evidenced by this Contract takes place in and substantially affects interstate commerce. All disputes between the parties are subject to binding arbitration, including disputes concerning the arbitrability of disputes, disputes related to the making or administration of this Contract, disputes regarding recovery of any Claim or refund under this Contract, and disputes arising out of or relating in any way to the sale or marketing of this Contract. In the first instance, the parties agree to attempt to resolve any dispute through informal negotiation. The parties agree to contact each other about a dispute before initiating any legal action. If the parties are unable to resolve any dispute through informal negotiations, the parties agree to submit all disputes to arbitration under the Commercial Arbitration Rules of the American Arbitration Association (AAA) in effect at the time the dispute arises. All preliminary issues of arbitrability of any dispute will be decided by the arbitrator.

1)The arbitration shall take place in Your County of residence unless another location is mutually agreed upon by the parties. The arbitration shall take place before a single arbitrator selected in accordance with the Commercial Arbitration Rules of the AAA. AAA rules and forms will be obtained and all claims shall be filed at www.adr.org or at any AAA office.

2)The cost of the arbitration proceeding, including the filing fee, shall be borne by Us. Each party must bear the cost of its own attorneys, experts, witness fees, and other arbitration-related expenses.

3)It is understood and agreed that the arbitration shall be final and binding upon the parties. The parties acknowledge that they are waiving their right to seek remedies in court, including the right to a jury trial. YOU UNDERSTAND THAT YOU ARE AGREEING THAT IF A DISPUTE ARISES BETWEEN YOU AND US, YOU WILL NOT SUE US IN COURT, YOU ARE NOT ENTITLED TO A JURY TRIAL ON ANY CLAIMS ARISING IN RELATION TO THIS CONTRACT, AND THAT AN ARBITRATOR WILL RESOLVE ANY DIFFERENCES THAT MAY ARISE BETWEEN YOU AND US. The arbitrator can award the same damages and relief as a court and may award equitable relief, including injunctive relief. An arbitration award may not be set aside in later litigation except upon the limited circumstances set forth in the Federal Arbitration Act, 9 U.S.C. § 1, et seq. An award in arbitration shall be in writing and will be enforceable under the Federal Arbitration Act by any court having jurisdiction.

4)CLASS ACTION WAIVER: You agree not to participate as a representative or member of any class of claimants proceeding against Us in a judicial forum or in an arbitral forum (including any class action, representative action, consolidated action or private attorney general action). The arbitrator may not consolidate more than one person’s claims, and may not otherwise preside over any form of a class or representative proceeding or claims.

5)All limitations periods that would otherwise be applicable shall apply to any arbitration proceedings.

If any portion of this provision is deemed invalid or unenforceable, the remaining portions of this provision shall nevertheless remain valid and in force. If there is a conflict or inconsistency between this provision and other provisions of this Contract, this provision shall govern. This provision shall be governed by the Federal Arbitration Act.

Arbitration is not allowed in all states.

Please refer to the SPECIAL STATE REQUIREMENTS AND DISCLOURES section of this Contract for Your specific state, if any.

FP4073 |

5 of 5 |

(01/19) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2019 Allstate |

|

SPECIAL STATE REQUIREMENTS AND DISCLOSURES

THIS CONTRACT IS AMENDED TO COMPLY WITH THE FOLLOWING REQUIREMENTS AND DISCLOSURES FOR YOUR STATE:

Alabama: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: We may cancel this Contract by mailing written notice to You at Your last known address, stating the reason for the cancellation and the effective date, at least five (5) days before the cancellation effective date. Written notice of cancellation is not required if the Contract cancellation is due to either nonpayment of the Total Contract Price by You or a material misrepresentation by You to Us relating to the Vehicle or its use.

Refund Calculation paragraph is amended by replacing the fifty-dollar ($50) cancellation fee with a twenty-five dollar ($25) cancellation fee; and, to include the following: The right to cancel this Contract within the first sixty (60) days from the original Contract Purchase Date and receive a one hundred percent (100%) refund of the Total Contract Price when no Claim has been made is exclusive to the original Purchaser and is not transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

Alaska: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may cancel this Contract by mailing written notice to You at Your last known address, stating the reason for cancellation and the effective date, at least five (5) days before the cancellation effective date. We may cancel this Contract only for the following reasons:

(a)You fail to pay the Total Contract Price; (b) You are convicted of a crime having as one of its necessary elements an act increasing a hazard covered by this Contract;

(c)Discovery of fraud or a material misrepresentation made by You or Your representative in obtaining this Contract, or pursuing a Claim under this Contract; (d) Discovery of a grossly negligent act or omission by You that substantially increases the hazards covered by this Contract; (e) Physical changes in the Vehicle covered by this Contract that result in the Vehicle becoming ineligible for coverage under this Contract; or (f) A substantial breach of duties by You related to the Vehicle. Written notice of cancellation is not required if the Contract cancellation is due to reasons described in (a) or (c) above.

Refund Calculation paragraph is amended by replacing the fifty-dollar ($50) cancellation fee with a cancellation fee of fifty dollars ($50) or seven and one-half percent (7.5%) of the unearned Total Contract Price, based on months or miles remaining, whichever is less; and, to include the following: The right to cancel this Contract within the first sixty (60) days from the original Contract Purchase Date and receive a one hundred percent (100%) refund of the Total Contract Price when no Claim has been made is exclusive to the original Purchaser and is not transferrable. A ten percent (10%) penalty per month shall be added to a refund if it is not made within forty-five (45) days of return of this Contract to Us.

Arizona: IMPORTANT INFORMATION section, item 6) is amended to include the following: Nothing in this section prevents, limits, or waives Your rights to file a complaint against Us, Pablo Creek Services, Inc., or seek remedy available thereto, with the Arizona Department of Insurance.

WHAT IS NOT COVERED section, item 2b) is deleted in its entirety and replaced with the following: Any Breakdown that existed prior to the Contract Purchase Date unless such conditions were known or should reasonably have been known by Us or the Seller, or reported after the expiration of this Contract, or occurred following a change of Vehicle ownership where the Contract was not transferred in accordance with the HOW TO TRANSFER THIS CONTRACT section.

INELIGIBLE VEHICLES section, item 1) is amended to include the following: In the event a Contract is issued on this type of ineligible vehicle, this Contract is valid and covered Breakdowns would be covered.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: We may not cancel or void this Contract or any provisions of this Contract due to (1) Our acts or omissions in failing to provide correct information or to perform services or repairs in a timely, competent, and workmanlike manner, (2) A Breakdown that existed prior to the Contract Purchase Date, (3) prior use or unlawful acts relating to the Vehicle, (4) Our misrepresentation, and (5) ineligibility of the Vehicle for coverage under the program.

Refund Calculation paragraph is amended by replacing the fifty-dollar ($50) cancellation fee with a cancellation fee of either ten percent (10%) of the Total Contract Price, which is the gross amount paid for this Contract, or fifty dollars ($50), whichever is less. The cancellation fee will not exceed ten percent (10%) of the gross amount paid for this Contract.

Arkansas: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: We may cancel this Contract by mailing written notice to You at Your last known address, stating the reason for the cancellation and the effective date within fifteen (15) days of the cancellation effective date.

Refund Calculation paragraph is amended to include the following: The right to cancel this Contract within the first sixty (60) days from the original Contract Purchase Date and receive a one hundred percent (100%) refund of the Total Contract Price when no Claim has been made is exclusive to the original Purchaser and is not transferrable.

ARBITRATION section is deleted in its entirety as Arbitration does not apply in the state of Arkansas.

Colorado: INSURANCE STATEMENT section, first sentence is deleted in its entirety and replaced with the following: Our obligations under this Contract are guaranteed

by a reimbursement insurance policy issued by First Colonial Insurance Company, Policy Number: PCSVRCO1.

Connecticut: IMPORTANT INFORMATION section is amended as follows: Item 1) is amended to include the following: Contact information for Pablo Creek Services, Inc.

is as follows: P.O. Box 40525 Jacksonville, FL 32203-0525; (888) 251-6441.

Item 6) is amended to include the following: Unresolved complaints may be addressed to the State of Connecticut, Insurance Department P.O. Box 816, Hartford, CT

06142-0816, Attention: Consumer Affairs. If the warranty period is less than one year, the coverage is automatically extended if the product is being repaired when the warranty expires.

HOW TO CANCEL THIS CONTRACT section, By You paragraph is amended to include the following: You may cancel this Contract if the Vehicle is returned or sold, lost, stolen or destroyed. If the Vehicle is lost, stolen, or destroyed the odometer reading is not required for cancellation.

Florida: IMPORTANT INFORMATION section, item 6) is amended to include the following: The Total Contract Price charged for this Contract is not subject to regulation by the FL OIR.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We cannot cancel this Contract except:

1.If there has been material misrepresentation or fraud at time of sale of the Contract;

2.If You have failed to maintain the Vehicle as prescribed by the manufacturer;

3.If the odometer has been tampered with or disabled and You have failed to repair the odometer; or

4.For non-payment of Total Contract Price by You, in which case We will provide You notice of cancellation by certified mail.

Refund Calculation paragraph is amended to replace the fifty-dollar ($50) cancellation fee with a cancellation fee of either five percent (5%) of the gross premium paid by You or fifty dollars ($50), whichever is less.

HOW TO TRANSFER THIS CONTRACT section is deleted in its entirety and replaced with the following:

You may transfer this Contract to a private party, provided that:

FP4073-ML |

1 of 8 |

(01/19) Rev. (05/20) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2020 Allstate |

|

1)This Contract has not been previously transferred;

2)The Vehicle has not been sold or traded to or through any automobile dealer, auto broker, auto auction or financial institution;

3)The Total Contract Price has been paid in full;

4)You provide the new owner all records confirming that maintenance has been completed pursuant to the Contract terms; and

5)You submit a completed transfer request form to Us within thirty (30) days of an ownership change. You must include:

a)An odometer statement for the Vehicle, and

b)A forty-dollar ($40) transfer fee.

6)To transfer this Contract please go to allstateextendedvehiclecare.com to obtain a transfer form, or You may contact Us for assistance. Georgia: WHAT IS NOT COVERED section is amended as follows:

Item 2) a) is revised to remove “sludge”.

Item 2) b) is deleted in its entirety and replaced with the following: A Breakdown known to You or reasonably should be known to You that existed prior to the Contract Purchase Date, or any Breakdown reported after the expiration of the Contract.

Item 2) e) is deleted in its entirety and replaced with the following: Any Breakdown that occurs after any alterations have been made to Your Vehicle by You or with Your knowledge (whether before or after the Contract Purchase Date), or if You are using or have used Your Vehicle in a manner not recommended by the manufacturer, including but not limited to: the failure of any custom or add-on part, trailer hitches, engine modifications, offset rims, frame or suspension lowering.

Item 2) f) is deleted in its entirety and replaced with the following: Repair costs or expenses if the odometer of the Vehicle has broken or becomes inoperable or unreliable for any reason and odometer repairs were not made immediately at the time of failure, or if the odometer has been tampered with, disconnected, or altered in any way while owned by You.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may not cancel this Contract except for material misrepresentation or fraud at time of sale or non-payment of Total Contract Price. Written notice of cancellation will be mailed to You at least ten (10) days prior to the cancellation of this Contract for non-payment of the Total Contract Price. At least thirty (30) days written notice of cancellation will be mailed to You for all other reasons. Cancellation will comply with Section 33-24-44 of the Georgia Code.

Refund Calculation paragraph is amended to replace the fifty-dollar ($50) cancellation fee with an administrative fee of 10% of the pro-rata refund amount or fifty dollars ($50), whichever is less, if the Contract is cancelled by You.

Limited Rights of Finance Company paragraph is deleted in its entirety and replaced with the following: If this Contract is financed, the Finance Company named on the first page of this Contract has the right to receive any portion of the cancellation refund amounts. The Finance Company has the right to cancel this Contract in the event of non-payment due to repossession or total loss of the vehicle.

ARBITRATION section is deleted in its entirety as Arbitration does not apply in Georgia. Hawaii: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: If We cancel the Contract, notice of such cancellation will be delivered to You by registered mail five (5) days prior to cancellation. The notice of cancellation will state the reason for cancellation and will include any reimbursement required. The cancellation will be effective as of the date of termination as stated in the notice of cancellation. If cancellation is due to non-payment of the Total Contract Price, material misrepresentation, or a substantial breach of duties under the Contract, such notice will not be required.

Refund Calculation paragraph is amended to include the following: A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

Idaho: INSURANCE STATEMENT section is amended to include the following: Coverage afforded under this Contract is not guaranteed by the Idaho Insurance Guarantee Association.

Illinois: HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph is amended to replace the fifty-dollar ($50) cancellation fee with a cancellation fee of either ten percent (10%) of the Total Contract Price or fifty dollars ($50), whichever is less.

Indiana: IMPORTANT INFORMATION section, item 6) is amended to include the following: Your proof of payment to the Seller for this Contract shall be considered proof of payment to First Colonial Insurance Company, which guarantees Our obligations to You, providing such insurance was in effect at the time You purchased this Contract. This Contract is not insurance and is not subject to Indiana insurance law.

Iowa: IMPORTANT INFORMATION section, item 6) is amended to include the following: Iowa residents only may contact the Iowa Insurance Commissioner at the following

address: Iowa Insurance Division, Two Ruan Center, 601 Locust Street, 4th Floor, Des Moines, Iowa 50309-3738.

HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph is amended to include the following: The right to cancel this Contract within the first sixty

(60)days and receive a one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser. A ten percent (10%) penalty per month shall be added to a refund that is not made within thirty (30) days of return of this Contract to Us. If You cancel the Contract, written notice of such cancellation will be mailed to You within fifteen (15) days of the date of cancellation.

Louisiana: IMPORTANT INFORMATION section is amended as follows:

Item 4) is amended to include the following: This Contract is not regulated by the Department of Insurance.

Item 6) is amended to include the following: Any concerns or complaints regarding this Contract may be directed to the attorney general. HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: After sixty (60) days, We cannot cancel this Contract except:

1.If there has been a material misrepresentation or fraud at the time of sale of the Contract;

2.If You failed to maintain the motor Vehicle as prescribed by the manufacturer;

3.For a substantial breach of duties by You related to the Vehicle or its use; or

4.For non-payment of the Total Contract Price by You, in which case We will provide You notice of cancellation by certified mail.

We will mail You written notice of cancellation at least fifteen (15) days prior to cancellation stating the effective date of cancellation and the reason for the cancellation. Prior notice of cancellation will not be mailed if cancellation is due to numbers 1, 3 or 4 above.

Refund Calculation paragraph is amended to include the following: The right to cancel this Contract within the first sixty (60) days from the original Contract Purchase Date and receive a one hundred percent (100%) refund of the Total Contract Price when no Claim has been made is exclusive to the original Purchaser and is not transferrable. A ten percent (10%) penalty per month shall be added to a refund if it is not made within forty-five (45) days of return of this Contract to Us.

FP4073-ML |

2 of 8 |

(01/19) Rev. (05/20) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2020 Allstate |

|

Maine: HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph is deleted in its entirety and replaced with the following: If this Contract is cancelled within the first sixty (60) days from the Contract Purchase Date, We or the Seller will refund You one hundred percent (100%) of the Total Contract Price and any sales tax refund required pursuant to state law. The right to cancel this Contract within the first sixty (60) days and receive a one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser and is not transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five

(45)days of return of this Contract to Us. If this Contract is cancelled after the first sixty (60) days from the Contract Purchase Date, We or the Seller will refund You a pro-rated amount of the Total Contract Price, based on the lesser of the months or miles remaining, less an administrative fee of fifty dollars ($50) or ten percent (10%) of the Total Contract Price, whichever is less. If We cancel this Contract for any reason other than non-payment of the Total Contract Price, We or the Seller will refund You one hundred percent (100%) of the Total Contract Price, and We will mail a written notice to Your last known address at least fifteen (15) days prior to the cancellation effective date, stating the reason for cancellation and the cancellation effective date. All refunds will be paid to the Finance Company, if any; otherwise, the refund will be paid to You.

Maryland: IMPORTANT INFORMATION section is amended as follows: Item 6) is amended to include the following: Should we fail to perform the services under this Contract, this Contract is extended automatically and will not terminate until the services are provided in accordance with the terms of this Contract.

INELIGIBLE VEHICLES section, item 7) is deleted in its entirety and replaced with the following: Any vehicle that was reconstructed from salvage, declared a total loss, declared a lemon, or if the original manufacturer’s warranty is no longer in effect for any reason.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We cannot cancel this Contract except:

1.If there has been a material misrepresentation or fraud at the time of sale of the Contract;

2.If there is a matter or issue related to the risk that constitutes a threat to public safety;

3.If there is a change in the condition of the risk that results in an increase in the hazard insured against;

4.For non-payment of premium; or

5.Due to the revocation or suspension of the driver’s license or motor vehicle registration of the named insured or covered driver under the policy and for reasons related to the driving record of the named insured or covered driver.

Refund Calculation paragraph is amended to delete the fifty-dollar ($50) cancellation fee; and, to include the following: The right to cancel this Contract within the first sixty (60) days and receive a one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser and is non-transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

Limited Rights of Finance Company paragraph, first sentence is deleted in its entirety and replaced with the following: If Your Contract is financed, the insurer shall return any gross unearned premiums that are due under the insurance contract, computed pro rata, and excluding any expense constant, administrative fee not to exceed fifty dollars ($50), or any nonrefundable charge filed with and approved by the Commissioner.

HOW TO TRANSFER THIS CONTRACT section, item 5) b) is amended to delete the fifty-dollar ($50) transfer fee. ARBITRATION section is deleted in its entirety as Arbitration does not apply in Maryland.

Massachusetts: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may cancel this Contract for material misrepresentation, fraud, non-payment of Total Contract Price, a substantial breach of duties by You related to the Vehicle or its use, or if We find the Vehicle to be ineligible for coverage under the INELIGIBLE VEHICLES section.

Refund Calculation paragraph is amended to include the following: A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

Minnesota: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: Written notice of such cancellation will be mailed to You within fifteen (15) days of the date of cancellation and will state the effective date and the reason for cancellation; five (5) days written notice will be mailed to You for cancellation due to non-payment of premium, material misrepresentation or substantial breach of duties by You.

Refund Calculation paragraph is amended to include the following: A ten percent (10%) penalty per month shall be added to a refund that is not paid or credited within forty-five (45) days after return of this Contract to Us.

Mississippi: INSURANCE STATEMENT section, first sentence is deleted in its entirety and replaced with the following: This Contract is not supported by a manufacturer or distributor; however, Our obligations under this Contract are guaranteed by a reimbursement insurance policy issued by First Colonial Insurance Company, a member of the Allstate family of companies.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may not cancel this Contract except:

1.For non-payment of the Total Contract Price by You;

2.Discovery of fraud or material misrepresentation by You; or

3.A substantial breach of duties by You related to the Vehicle or its use.

Refund Calculation paragraph is deleted in its entirety and replaced with the following: If this Contract is cancelled within the first sixty (60) days and no Claim has been paid, the Seller will refund You one hundred percent (100%) of the Total Contract Price. If You cancel this Contract after the first sixty (60) days from the Contract Purchase Date, or if a Claim has been paid, the Seller will refund You a pro-rated amount of the Total Contract Price, based on the lesser of the months or miles remaining, less a cancellation fee not to exceed ten percent (10%) of the Total Contract Price or fifty dollars ($50), whichever is less. If We cancel this Contract and no Claim has been paid, the Seller will refund You one hundred percent (100%) of the Total Contract Price. All refunds will be paid to You or credited to Your account. The right to cancel this Contract within the first sixty (60) days and receive a one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser and is not transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

ARBITRATION section is deleted in its entirety as Arbitration does not apply in Mississippi. Missouri: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is amended to include the following: If We cancel the Contract, notice of such cancellation will be delivered to You by registered mail within forty-five (45) days of the cancellation effective date.

Refund Calculation paragraph is amended to include the following: The right to cancel this Contract within the first sixty (60) days and receive a one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser and is non-transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within thirty (30) days of return of this Contract to Us.

FP4073-ML |

3 of 8 |

(01/19) Rev. (05/20) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2020 Allstate |

|

Nebraska: ARBITRATION section is deleted in its entirety and replaced with the following: Any Claim or dispute in any way related to this Contract, by a person covered under this Contract against Us or Us against a person covered under this Contract, may be resolved by arbitration only upon mutual consent of the parties. Arbitration pursuant to this provision shall be subject to the following:

a)no arbitrator shall have the authority to award punitive damages or attorney’s fees;

b)neither party shall be entitled to arbitrate any claims or disputes in a representative capacity or as a member of a class; and

c)no arbitrator shall have the authority, without the mutual consent of the parties, to consolidate claims or disputes in arbitration. Nevada: CONTRACT TERM section is amended to include the following: This Contract is non-renewable.

INELIGIBLE VEHICLES section, item 7) is deleted in its entirety and replaced with the following: Any vehicle that was reconstructed from salvage; declared a total loss; or declared a lemon. This Contract may not be initially issued to any vehicle described in the INELIGIBLE VEHICLES section of this Contract. However, the INELIGIBLE VEHICLES section does not apply if the manufacturer’s warranty on Your Vehicle is cancelled at some time during the term of this Contract once the Contract has already been issued to You.

WHAT IS NOT COVERED section is amended as follows:

Item 2) k) is amended to include the following: If the manufacturer’s warranty on Your Vehicle becomes void for any reason during the term of this Contract, We will not automatically suspend or void all coverage. We will not provide any coverage that would have otherwise been provided under the manufacturer’s warranty. However, We will continue to provide any other coverage under this Contract, unless such coverage is otherwise excluded by the terms of this Contract.

Item 3) a) is deleted in its entirety and replaced with the following: Any Breakdown resulting from neglect, abuse or misuse of Your Vehicle, or failure to protect Your

Vehicle from further damage when any Breakdown has occurred, or any Breakdown that arises out of Your use of Your Vehicle in a manner not recommended by the manufacturer. However, this Contract will continue to cover any Breakdown that is not related to the non-manufacturer-recommended uses of Your Vehicle, unless such coverage is otherwise excluded by the terms of this Contract.

HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may cancel this Contract during the first sixty-nine (69) days from the Contract Purchase Date for any reason. No Contract that has been in effect for at least seventy (70) days will be cancelled by Us before the expiration of the agreed term or one (1) year after the Contract Purchase Date, whichever occurs first, except on any of the following grounds:

1.Your failure to pay an amount when due;

2.You are convicted of a crime that results in an increase in the service required under the Contract;

3.Discovery of fraud or material misrepresentation by You in obtaining the Contract or in presenting a Claim for service thereunder; or

4.Discovery of either of the following if it occurred after the Contract Purchase Date and substantially and materially increased the service required under the Contract: a. An act or omission by You; or b. Your violation of any condition of the Contract.

5.A material change in the nature or extent of the required service or repair which occurs after the effective date of the service contract and which causes the required service or repair to be substantially and materially increased beyond that contemplated at the time that the service contract was issued or sold.

If We cancel the Contract, notice of such cancellation will be delivered to You by registered mail fifteen (15) days prior to cancellation.

Refund Calculation paragraph is amended by replacing the fifty-dollar ($50) cancellation fee with a twenty-five dollar ($25) cancellation fee; and, to include the following: If We cancel this Contract and a Claim has been paid, the Seller will refund You a pro-rated amount of the Total Contract Price, based on the lesser of the months or miles remaining. The right to cancel this Contract within the first sixty (60) days and receive and one hundred percent (100%) refund of the Total Contract Price is exclusive to the original Purchaser and is non-transferrable. A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us. No Claims paid on Your Contract will ever be deducted from any refund issued pursuant to this Contract in Nevada.

HOW TO TRANSFER THIS CONTRACT section, item 5) b) is amended to replace the fifty-dollar ($50) transfer fee with a transfer fee of twenty-five dollars ($25).

Limited Rights of Finance Company paragraph is amended to include the following: No cancellation will become effective until at least fifteen (15) days after the notice of cancellation is mailed to You.

INSURANCE STATEMENT section is amended to include the following: If You are not satisfied with the manner in which We are handling a Claim, You may contact the Nevada Insurance Commissioner at (888) 872-3234.

New Hampshire: IMPORTANT INFORMATION section, item 6) is amended to include the following: If You have any questions or complaints regarding this Contract, You may contact Us by mail or by phone. Refer to the front of this Contract for Our address and toll-free number. In the event You do not receive satisfaction under this Contract, You may contact the New Hampshire Insurance Department at the following address: 21 Fruit Street, Suite 14, Concord, New Hampshire 03301, 1-800-852- 3416.

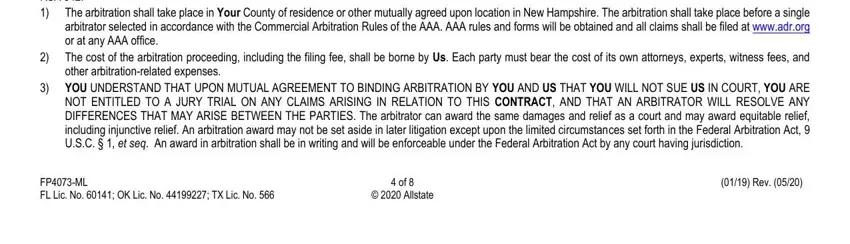

ARBITRATION section is deleted in its entirety and replaced with the following: It is understood and agreed that the transaction evidenced by this Contract takes place in and substantially affects interstate commerce. Arbitration shall only be required upon mutual agreement by Us and You to submit any controversy or claim arising out of or relating to this Contract, or a breach hereof, to binding arbitration at the time of such controversy or claim. Upon such agreement, disputes between the parties are subject to binding arbitration, including disputes concerning the arbitrability of disputes, disputes related to the making or administration of this Contract, disputes regarding recovery of any Claim or refund under this Contract, and disputes arising out of or relating in any way to the sale or marketing of this Contract. In the first instance, the parties agree to attempt to resolve any dispute through informal negotiation. The parties agree to contact each other about a dispute before initiating any legal action. If the parties agree to binding arbitration to resolve any dispute, such arbitration will be conducted under the Commercial Arbitration Rules of the American Arbitration Association (AAA) in effect at the time the dispute arises. All preliminary issues of arbitrability of any dispute will be decided by the arbitrator. All arbitration shall be subject to New Hampshire RSA 542.

1)The arbitration shall take place in Your County of residence or other mutually agreed upon location in New Hampshire. The arbitration shall take place before a single arbitrator selected in accordance with the Commercial Arbitration Rules of the AAA. AAA rules and forms will be obtained and all claims shall be filed at www.adr.org or at any AAA office.

2)The cost of the arbitration proceeding, including the filing fee, shall be borne by Us. Each party must bear the cost of its own attorneys, experts, witness fees, and other arbitration-related expenses.

3)YOU UNDERSTAND THAT UPON MUTUAL AGREEMENT TO BINDING ARBITRATION BY YOU AND US THAT YOU WILL NOT SUE US IN COURT, YOU ARE NOT ENTITLED TO A JURY TRIAL ON ANY CLAIMS ARISING IN RELATION TO THIS CONTRACT, AND THAT AN ARBITRATOR WILL RESOLVE ANY DIFFERENCES THAT MAY ARISE BETWEEN THE PARTIES. The arbitrator can award the same damages and relief as a court and may award equitable relief, including injunctive relief. An arbitration award may not be set aside in later litigation except upon the limited circumstances set forth in the Federal Arbitration Act, 9 U.S.C. § 1, et seq. An award in arbitration shall be in writing and will be enforceable under the Federal Arbitration Act by any court having jurisdiction.

FP4073-ML |

4 of 8 |

(01/19) Rev. (05/20) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2020 Allstate |

|

4)CLASS ACTION WAIVER: You agree not to participate as a representative or member of any class of claimants proceeding against Us in a judicial forum or in an arbitral forum (including any class action, representative action, consolidated action or private attorney general action). The arbitrator may not consolidate more than one person’s claims, and may not otherwise preside over any form of a class or representative proceeding or claims.

5)All limitations periods that would otherwise be applicable shall apply to any arbitration proceedings.

If any portion of this provision is deemed invalid or unenforceable, the remaining portions of this provision shall nevertheless remain valid and in force. If there is a conflict or inconsistency between this provision and other provisions of this Contract, this provision shall govern. This provision shall be governed by the Federal Arbitration Act.

New Jersey: HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph is amended to include the following: A ten percent (10%) penalty per month shall be added to a refund that is not made within forty-five (45) days of return of this Contract to Us.

New Mexico: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may cancel this Contract during the first sixty-nine (69) days from the Contract Purchase Date for any reason. No Contract that has been in effect for at least seventy (70) days will be cancelled by Us before the expiration of the agreed term or one (1) year after the Contract Purchase Date, whichever occurs first, except on any of the following grounds:

1.Your failure to pay an amount when due;

2.You are convicted of a crime that results in an increase in the service required under the Contract;

3.Discovery of fraud or material misrepresentation by You in obtaining the Contract or in presenting a Claim for service thereunder; or

4.Discovery of either of the following if it occurred after the Contract Purchase Date and substantially and materially increased the service required under the Contract:

a.An act or omission by You; or

b.Your violation of any condition of the Contract.

If We cancel the Contract, notice of such cancellation will be delivered to You by registered mail fifteen (15) days prior to cancellation. The notice of cancellation will state the reason for cancellation and will include any reimbursement required. The cancellation will be effective as of the date of termination as stated in the notice of cancellation.

Refund Calculation paragraph is revised to delete the fifty-dollar ($50) cancellation fee; and, to include the following: The right to cancel this Contract within the first sixty

(60)days is not transferable and applies only to the original Purchaser. A ten percent (10%) penalty per month shall be added to a refund that is not made within thirty (30) days of return of this Contract to Us.

INSURANCE STATEMENT section is amended to include the following: Superintendent of Insurance at 1-855-427-5674. In the event that You accordance with the terms and conditions contained in this Contract.

If You have any concerns regarding the handling of Your claim, You may contact the Office of experience a Breakdown, We will pay for or reimburse You for the Authorized Amount, in

New York: HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph is amended to include the following: A ten percent (10%) penalty per month shall be added to a refund if it is not made within thirty (30) days of return of this Contract to Us.

By Us paragraph is amended to include the following: We shall mail a written notice to You at Your last known address contained in Our records at least fifteen (15) days prior to cancellation by Us. The notice shall state the effective date of the cancellation and the reason for the cancellation. Written notice is not required if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation, or a substantial breach of duties by You relating to the Vehicle.

North Carolina: HOW TO CANCEL THIS CONTRACT section is amended as follows:

By Us paragraph is deleted in its entirety and replaced with the following: We may only cancel this Contract for non-payment of premium or for a direct violation of the Contract by You.

Refund Calculation paragraph is amended by replacing the fifty-dollar ($50) cancellation fee with a cancellation fee of twenty-five dollars ($25) or ten percent (10%) of the pro-rata refund amount, whichever is less.

Oklahoma: IMPORTANT INFORMATION section, item 6) is amended to include the following: Oklahoma service warranty statutes do not apply to commercial use references in service warranty contracts.

INSURANCE STATEMENT section is amended to include the following: Coverage afforded under this Contract is not guaranteed by the Oklahoma Insurance Guaranty Association.

HOW TO CANCEL THIS CONTRACT section, Refund Calculation paragraph, second sentence is deleted in its entirety and replaced with the following: If this Contract is cancelled after the first sixty (60) days from the Contract Purchase Date, or if a Claim was made within the first sixty (60) days, You will receive a refund of ninety percent (90%) of the unearned pro rata Total Contract Price.

ARBITRATION section is deleted in its entirety and replaced with the following: It is understood and agreed that the transaction evidenced by this Contract takes place in and substantially affects interstate commerce. All disputes between the parties are subject to arbitration, including disputes concerning the arbitrability of disputes, disputes related to the making or administration of this Contract, disputes regarding recovery of any Claim or refund under this Contract, and disputes arising out of or relating in any way to the sale or marketing of this Contract. In the first instance, the parties agree to attempt to resolve any dispute through informal negotiation. The parties agree to contact each other about a dispute before initiating any legal action. If the parties are unable to resolve any dispute through informal negotiations, the parties agree to submit all disputes to arbitration under the Commercial Arbitration Rules of the American Arbitration Association (AAA) in effect at the time the dispute arises. All preliminary issues of arbitrability of any dispute will be decided by the arbitrator.

1)The arbitration shall take place in Your County of residence unless another location is mutually agreed upon by the parties. The arbitration shall take place before a single arbitrator selected in accordance with the Commercial Arbitration Rules of the AAA. AAA rules and forms will be obtained and all claims shall be filed at www.adr.org or at any AAA office.

2)The cost of the arbitration proceeding, including the filing fee, shall be borne by Us. Each party must bear the cost of its own attorneys, experts, witness fees, and other arbitration-related expenses.

3)It is understood and agreed that, while arbitration is mandatory, the outcome of any arbitration shall be non-binding on the parties, and either party shall, following arbitration, have the right to reject the arbitration award and bring suit in district court. The parties acknowledge that they are waiving their right to seek remedies in court, including the right to a jury trial, prior to the outcome of arbitration. YOU UNDERSTAND THAT YOU ARE AGREEING THAT IF A DISPUTE ARISES BETWEEN YOU AND US AND AN ARBITRATION OUTCOME HAS NOT YET BEEN REACHED, YOU WILL NOT SUE US IN COURT, YOU ARE NOT ENTITLED TO A JURY TRIAL ON ANY CLAIMS ARISING IN RELATION TO THIS CONTRACT, AND THAT AN ARBITRATOR WILL ATTEMPT TO RESOLVE ANY DIFFERENCES THAT MAY ARISE BETWEEN YOU AND US. The arbitrator can award the same damages and relief as a court and may award equitable relief, including injunctive relief. An award in arbitration shall be in writing and will be enforceable under the Federal Arbitration Act by any court having jurisdiction.

4)CLASS ACTION WAIVER: You agree not to participate as a representative or member of any class of claimants proceeding against Us in a judicial forum or in an arbitral forum (including any class action, representative action, consolidated action or private attorney general action). The arbitrator may not consolidate more than one person’s claims, and may not otherwise preside over any form of a class or representative proceeding or claims.

FP4073-ML |

5 of 8 |

(01/19) Rev. (05/20) |

FL Lic. No. 60141; OK Lic. No. 44199227; TX Lic. No. 566 |

© 2020 Allstate |

|