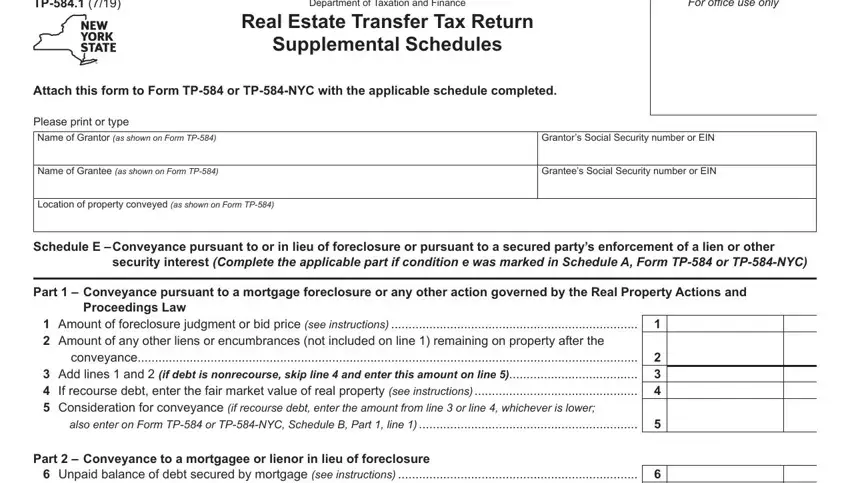

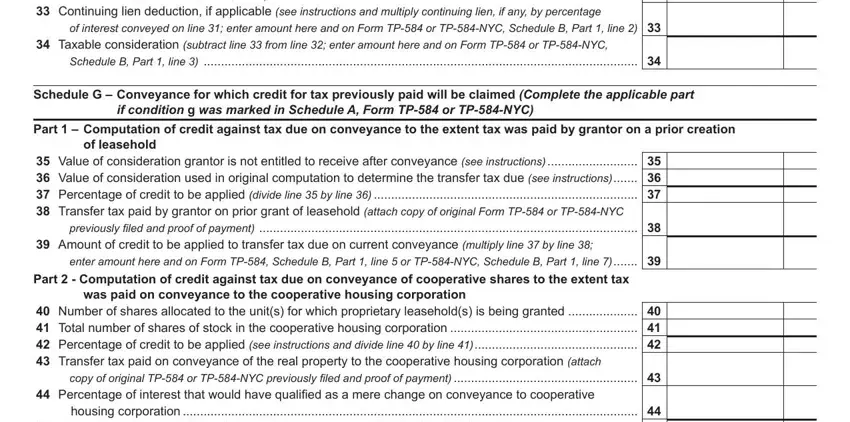

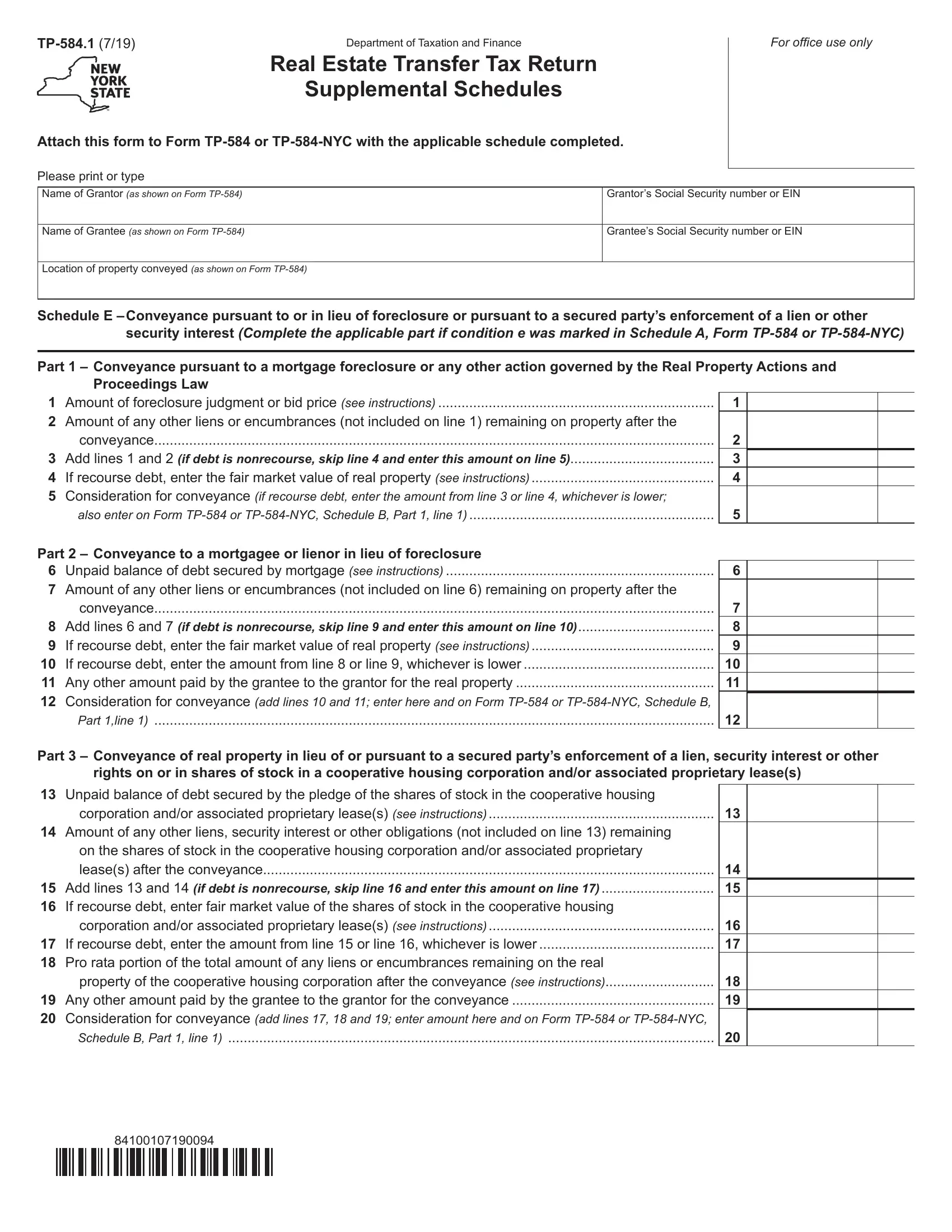

Purpose of Form TP-584.1

This form must be completed and filed with Form TP-584 or TP-584-NYC for all conveyances that are pursuant to or in lieu of foreclosure or any other action governed by the Real Property Actions and Proceedings Law and for conveyances pursuant to a secured party’s enforcement of a lien or other security interest, except for such conveyances where part of the debt is recourse and part of the debt is nonrecourse (see Schedule E), for conveyances that consist in whole or in part of a mere change of identity or form of ownership or organization (see Schedule F), and for conveyances for which a credit will be claimed for tax previously paid (see Schedule G).

Specific instructions

Schedule E

For purposes of Schedule E, continuing liens are liens or encumbrances that after the conveyance, remain either on the real property, the shares of stock in the cooperative housing corporation and/or proprietary lease(s) or the ownership interest in the entity, depending on whether the conveyance is the type described in Part 1, 2, 3, or 4 of Schedule E.

Pursuant to section 575.11(a)(2)(ii) of the real estate transfer tax regulations, a debt is recourse debt to the extent that, as of the date of conveyance, the grantor or a person related to the grantor, including any guarantor, bears the economic risk of loss for the debt beyond any loss attributable to the value of the property securing the debt.

A grantee is related to the mortgagee or lienor to the extent that the mere change of identity or form of ownership exemption, as provided in Tax Law section 1405(b)(6) would apply to a conveyance by the mortgagee or lienor to the grantee.

Where the grantee is the mortgagee or lienor, as in the type of conveyances described in Parts 1 and 2 or the secured party, as in the type of conveyances described in Parts 3 and 4, or its agent, nominee or an entity wholly owned by such mortgagee, lienor or secured party, Schedule E may be used only if the debt, including continuing liens, is either all recourse or all nonrecourse. If the debt is not either all recourse or all nonrecourse, do not use Schedule E. Attach a separate schedule setting forth the method of computation.

Part 1

Line 1 – If real property is being conveyed pursuant to a mortgage foreclosure or any other action governed by the Real Property Actions and Proceedings Law and the grantee is the mortgagee or lienor, its agent, nominee or an entity wholly owned by the mortgagee or lienor, enter the amount of judgment of foreclosure or the bid price, whichever is higher. The amount of judgment of foreclosure includes any interest accrued through the date of transfer.

If the grantee is a person unrelated to the mortgagee or lienor, regardless whether the debt is recourse or nonrecourse, enter the bid price.

If the grantee is an entity partially owned by the mortgagee or lienor and partially owned by a person unrelated to the mortgagee or lienor, enter the sum of (1) the

amount of judgment of foreclosure or the bid price, whichever is higher, multiplied by the percentage that represents the mortgagee’s or lienor’s beneficial interest in

the grantee and (2) the bid price multiplied by the percentage that represents the unrelated person’s beneficial interest in the grantee.

For this computation, the grantee is deemed to be the party who ultimately acquires the real property as a result of a mortgage foreclosure sale.

Example: X, a mortgagee, has the highest bid at a foreclosure sale. X assigns the bid to an unrelated third party, Z, who ultimately acquires the property. Z is the grantee. The consideration for the conveyance of the real property is the bid price paid by Z to the referee.

Line 2 – Enter the amount of any continuing liens. Do not include the amount of any liens or encumbrances included on line 1.

Line 3 – Add lines 1 and 2. If debt is nonrecourse or if the grantee is a person unrelated to the mortgagee or lienor, skip line 4 and enter the line 3 amount on line 5.

Line 4 – Where the debt is recourse debt and the grantee is the mortgagee or lienor, its agent, nominee or an entity wholly owned by the mortgagee or lienor, enter the fair market value of the real property.

Where the grantee is an entity partially owned by the mortgagee or lienor

and partially owned by a person unrelated to the mortgagee or lienor, if the percentage that represents the mortgagee’s or lienor’s beneficial interest in the

grantee multiplied by the sum of the higher of the judgment of foreclosure or bid price and any continuing liens, exceeds the fair market value of the real property multiplied by such mortgagee’s or lienor’s percentage, enter the sum of (1) the

fair market value of the real property multiplied by the percentage that represents the mortgagee’s or lienor’s beneficial interest in the grantee, and (2) the bid price

plus continuing liens multiplied by the percentage that represents the unrelated person’s ownership interest in the grantee.

Line 5 – If debt is recourse, enter line 3 or line 4, whichever is lower. If debt is nonrecourse or if the grantee is a person unrelated to the mortgagee or lienor,

enter the amount from line 3. This is the amount of consideration to be entered on Form TP-584 or TP-584-NYC, Schedule B, Part 1, line 1.

Attach a copy of the referee’s report of sale, if available.

Part 2

Line 6 – If real property is being conveyed to a mortgagee or lienor, or its agent, nominee or an entity wholly owned by the mortgagee or lienor, in lieu of an action

to foreclose a mortgage or lien, enter the unpaid balance of the debt secured by the mortgage or lien. The unpaid balance of the debt includes the principal, interest and other accruals secured by the mortgage or lien.

Line 7 – Enter the amount of any continuing liens. Do not include the amount of any liens or encumbrances included on line 6.

Line 8 – Add lines 6 and 7. If debt is nonrecourse, skip line 9 and enter the line 8 amount on line 10.

Line 9 – Where the debt is recourse, and the grantee is the mortgagee or lienor, its agent, nominee or an entity wholly owned by the mortgagee or lienor, enter the fair market value of the real property.

Line 10 – If debt is recourse, enter the amount from line 8 or line 9, whichever is lower. If debt is nonrecourse, enter the amount from line 8.

Line 11 – Enter any other amount paid by the grantee to the grantor for the real property.

Line 12 – Add lines 10 and 11. This the amount of consideration to be entered on

Form TP-584 or TP-584-NYC, Schedule B, Part 1, line 1.

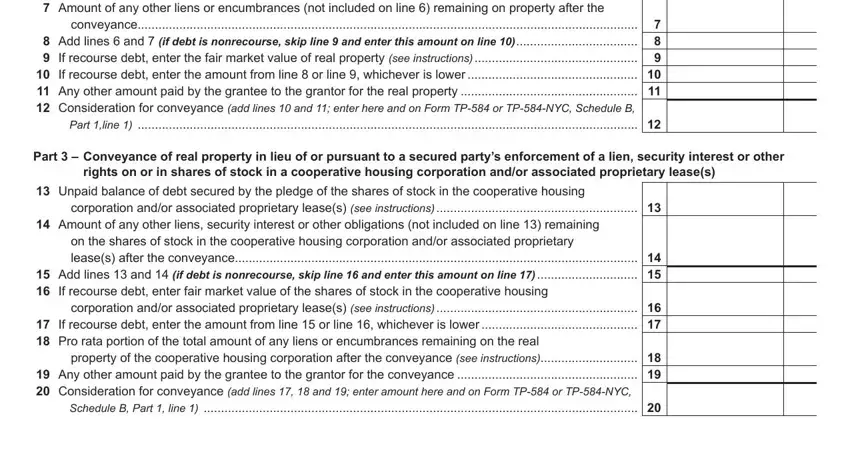

Part 3

Line 13 – Where the conveyance is to a secured party, or its agent, nominee or an entity owned by the secured party, who is enforcing a lien, security interest or other rights on or in shares of stock in a cooperative housing corporation and/or associated proprietary lease(s), enter the unpaid balance of the debt secured by the pledge of the shares of stock in the cooperative housing corporation and/or associated proprietary lease(s). The unpaid balance of the debt includes the principal, interest and other accruals secured by the pledge of the shares and/or associated proprietary lease(s).

Line 14 – Enter the amount of any continuing liens, security interests or other obligations remaining on the shares of stock in the cooperative housing corporation and/or associated proprietary lease(s) after the conveyance. Do not include the amount of any liens, security interests or other obligations included on line 13.

Line 15 – Add lines 13 and 14. If debt is nonrecourse, skip line 16 and enter the line 15 amount on line 17.

Line 16 – Where the debt is recourse and the grantee is the secured party, or its agent, nominee or an entity wholly owned by the secured party, who is enforcing a lien, security interest or other rights on or in shares of stock in a cooperative housing corporation and/or associated proprietary lease(s), enter the fair market value of the shares of stock in the cooperative housing corporation and/or associated proprietary lease(s).

Line 17 – If debt is recourse, enter the amount from line 15 or line 16, whichever is lower. If debt is nonrecourse, enter the amount from line 15.

Line 18 – If the conveyance is the original conveyance of shares of stock in a cooperative housing corporation by the cooperative corporation or cooperative plan sponsor, or the subsequent conveyance of stock in a cooperative housing corporation for a unit other than an individual residential unit, enter the pro rata portion of the total amount of any liens or encumbrances that remain on the real property of the cooperative housing corporation after the conveyance. The pro rata portion is determined by multiplying the total unpaid principal of the mortgage by a fraction, the numerator of which is the number of shares of stock in the cooperative housing corporation being conveyed in connection with the transfer of the proprietary lease(s) and the denominator is the total number of shares of stock in the cooperative housing corporation.

Line 19 – Enter any other amount paid by the grantee to the grantor for the conveyance.

Line 20 – Add lines 17, 18 and 19. This is the amount of consideration to be entered on Form TP-584 or TP-584-NYC, Schedule B, Part 1, line 1.

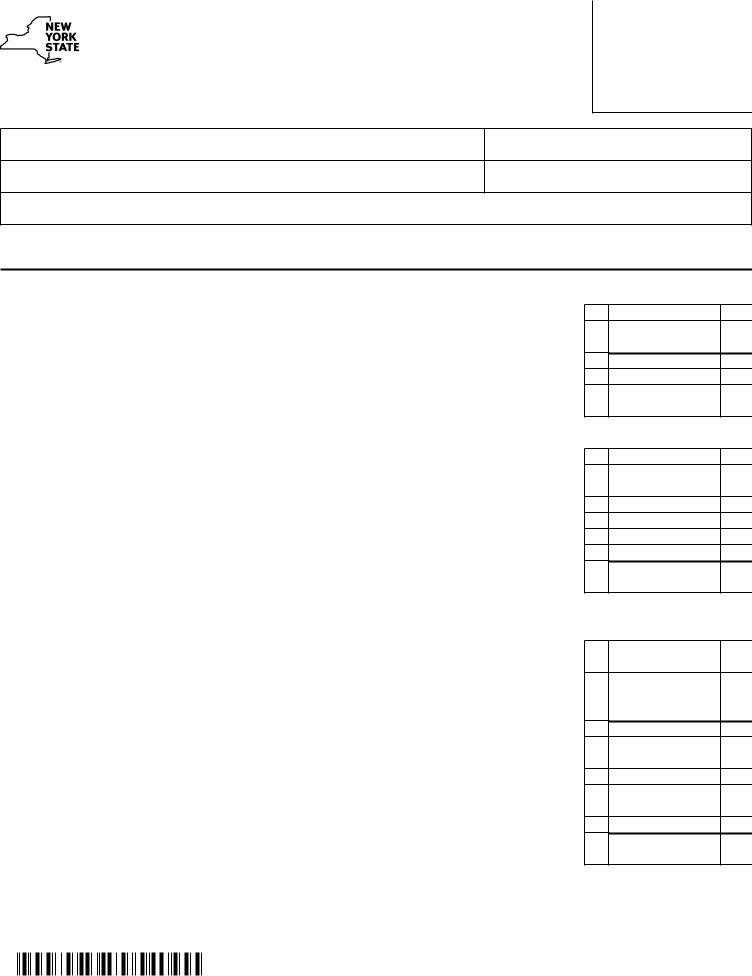

Part 4

Line 21 – If the conveyance is to a secured party, or its agent, nominee or an entity owned by the secured party, who is enforcing a lien, security interest or other rights on or in shares of stock, partnership interests or other instruments (i.e., the transfer or acquisition of a controlling interest in an entity with an interest in real property), enter the unpaid balance of the debt secured by the pledge of the ownership interest in the entity. The unpaid balance of the debt includes the principal, interest and other accruals secured by the pledge of the ownership interest.

Line 22 – Enter the amount of any other liens, security interests or other obligation remaining on the ownership interest in the entity after the conveyance. Do not include the amount of any liens, security interests or other obligations included on line 21.

Line 23 – Enter the amount of any liens or encumbrances remaining on the real property of the entity multiplied by the percentage in the entity being transferred or acquired.

Line 24 – Enter the amount of any other debt or obligation of the entity multiplied by the percentage in the entity being transferred or acquired. Do not include the amount of any other debt or obligation of the entity included on line 23.

Line 25 – Enter any other amount paid by the grantee to the grantor for the conveyance.

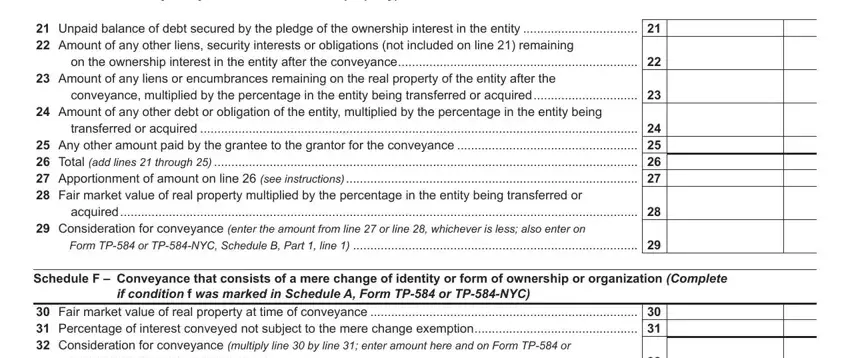

Line 27 – Enter the apportionment of line 26 to the interest in real property owned by the entity. The apportionment is determined by multiplying line 26 by

a fraction, the numerator of which is the fair market value of the real property located in New York State that is owned by the entity and the denominator is the

fair market value of all assets owned by the entity.