Should you want to fill out u1 form election, there's no need to install any kind of applications - just try using our online tool. FormsPal is dedicated to giving you the perfect experience with our tool by constantly releasing new features and upgrades. Our editor is now a lot more intuitive thanks to the newest updates! At this point, working with PDF files is simpler and faster than ever before. For anyone who is seeking to start, this is what you will need to do:

Step 1: Click the orange "Get Form" button above. It is going to open up our editor so that you can begin filling out your form.

Step 2: With the help of this handy PDF editing tool, it is easy to do more than merely complete forms. Edit away and make your documents appear perfect with customized text incorporated, or fine-tune the original content to perfection - all comes along with an ability to incorporate your personal photos and sign the document off.

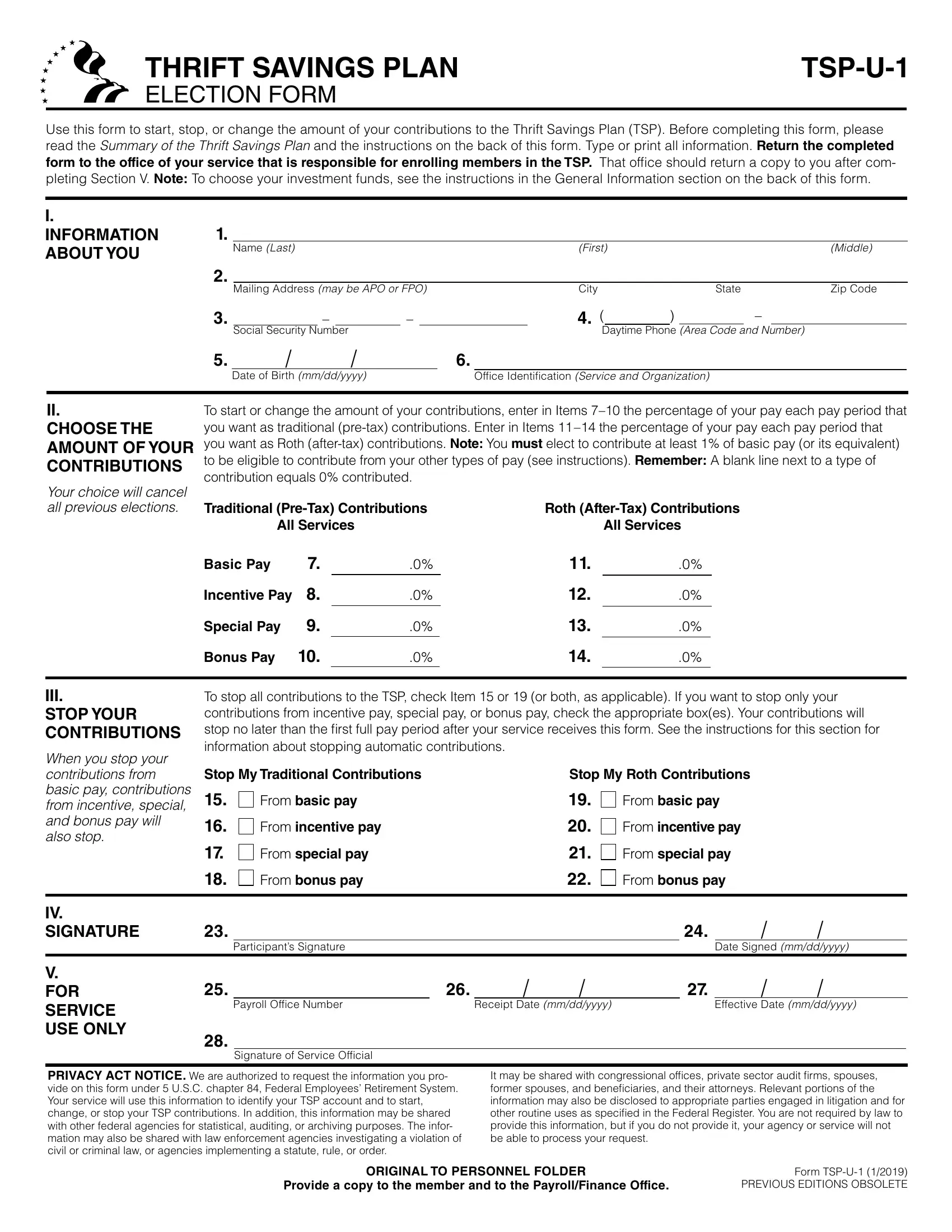

When it comes to blanks of this precise form, this is what you should do:

1. When filling in the u1 form election, be certain to include all important fields within the relevant area. This will help to speed up the work, allowing for your information to be processed promptly and accurately.

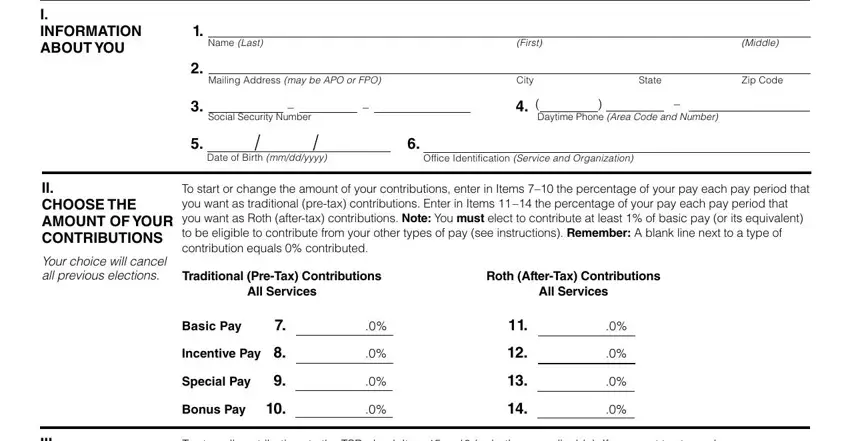

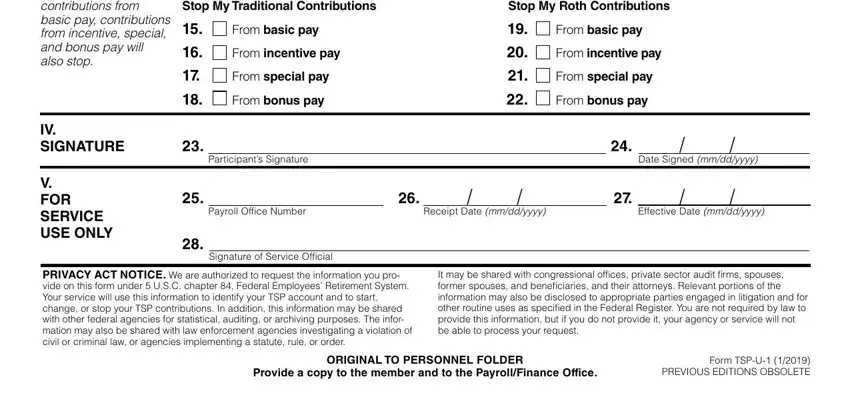

2. After filling out the previous step, go on to the next part and fill out all required particulars in these fields - When you stop your contributions, IV SIGNATURE, V FOR SERVICE USE ONLY, Stop My Traditional Contributions, Stop My Roth Contributions, From basic pay, From incentive pay, From special pay, From bonus pay, Participants Signature, Payroll Office Number, Receipt Date mmddyyyy, Signature of Service Official, From basic pay, and From incentive pay.

Those who use this PDF generally make errors when filling out V FOR SERVICE USE ONLY in this part. You should definitely read twice whatever you type in here.

Step 3: Right after proofreading the filled out blanks, hit "Done" and you are good to go! After registering a7-day free trial account at FormsPal, it will be possible to download u1 form election or send it via email promptly. The PDF form will also be readily accessible via your personal cabinet with all of your modifications. At FormsPal, we do our utmost to make sure that all your information is stored secure.