|

|

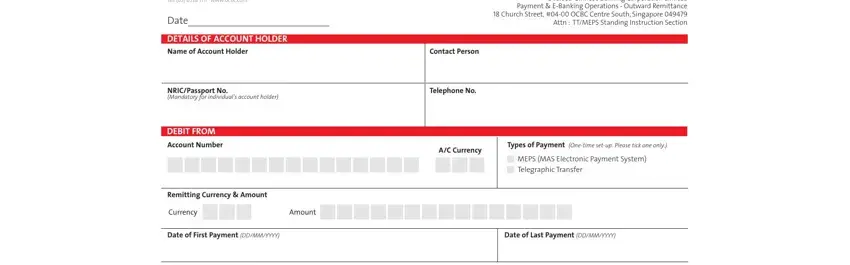

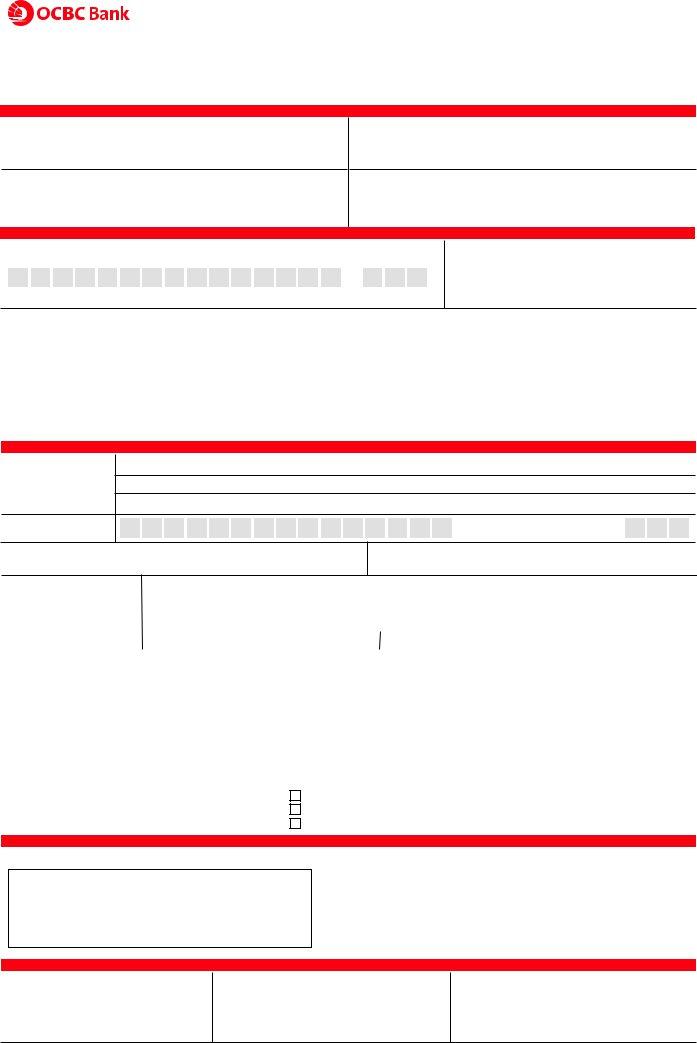

NEW STANDING INSTRUCTION APPLICATION FORM |

|

Oversea-Chinese Banking Corporation Limited |

FOR TELEGRAPHIC TRANSFER AND MEPS |

|

Please mail completed documents to: |

|

65 Chulia Street OCBC Centre Singapore 049513 |

|

Oversea-Chinese Banking Corporation Limited |

|

Tel: (65) 6538 1111 www.ocbc.com |

|

|

Payment & E-Banking Operations - Outward Remittance |

|

Date____________________________ |

18 Church Street, #04-00 OCBC Centre South, Singapore 049479 |

|

Attn : TT/MEPS Standing Instruction Section |

DETAILS OF ACCOUNT HOLDER

Name of Account Holder

NRIC/Passport No.

(Mandatory for individual’s account holder)

Contact Person

Telephone No.

DEBIT FROM

Account Number

A/C Currency

Types of Payment (One-time set-up. Please tick one only.)

MEPS (MAS Electronic Payment System) Telegraphic Transfer

Remitting Currency & Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency |

|

|

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of First Payment (DD/MM/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Last Payment (DD/MM/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

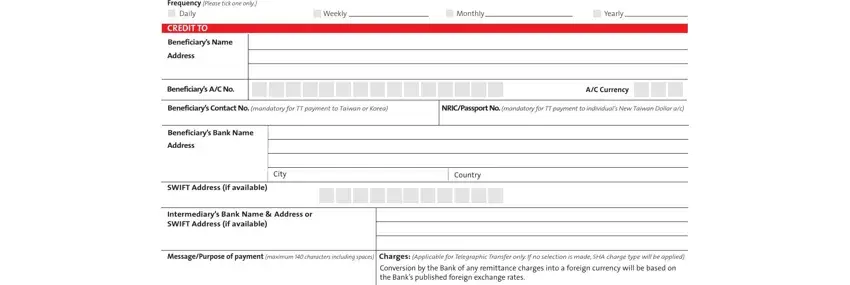

Frequency (Please tick one only.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daily |

|

|

Weekly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yearly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT TO

Beneficiary’s Name

Address

Beneficiary’s A/C No.

Beneficiary’s Contact No. (mandatory for TT payment to Taiwan or Korea)

NRIC/Passport No. (mandatory for TT payment to individual’s New Taiwan Dollar a/c)

Beneficiary’s Bank Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SWIFT Address (if available) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermediary’s Bank Name & Address or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SWIFT Address (if available) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Message/Purpose of payment (maximum 140 characters including spaces) |

Charges: (Applicable for Telegraphic Transfer only. If no selection is made, SHA charge type will be applied) |

|

|

|

|

|

|

|

|

|

Conversion by the Bank of any remittance charges into a foreign currency will be based on |

|

|

|

|

|

|

|

|

|

the Bank’s published foreign exchange rates. |

|

|

|

|

|

|

|

|

|

|

|

SHA – Local charges to be paid by Account Holder,overseas charges to be paid by Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

OUR– All local & overseas charges to be paid by Account Holder |

(mandatory for THB payment to Thailand and for all payments to India) |

|

|

BEN – All local & overseas charges to be paid by Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

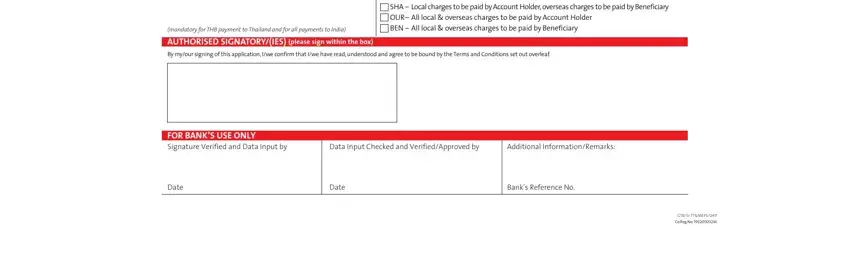

AUTHORISED SIGNATORY/(IES) (please sign within the box)

By my/our signing of this application, I/we confirm that I/we have read, understood and agree to be bound by the Terms and Conditions set out overleaf.

FOR BANK’S USE ONLY

Signature Verified and Data Input by

Data Input Checked and Verified/Approved by

Additional Information/Remarks:

GTB/SI-TT&MEPS/0411

Co.Reg.No: 193200032W

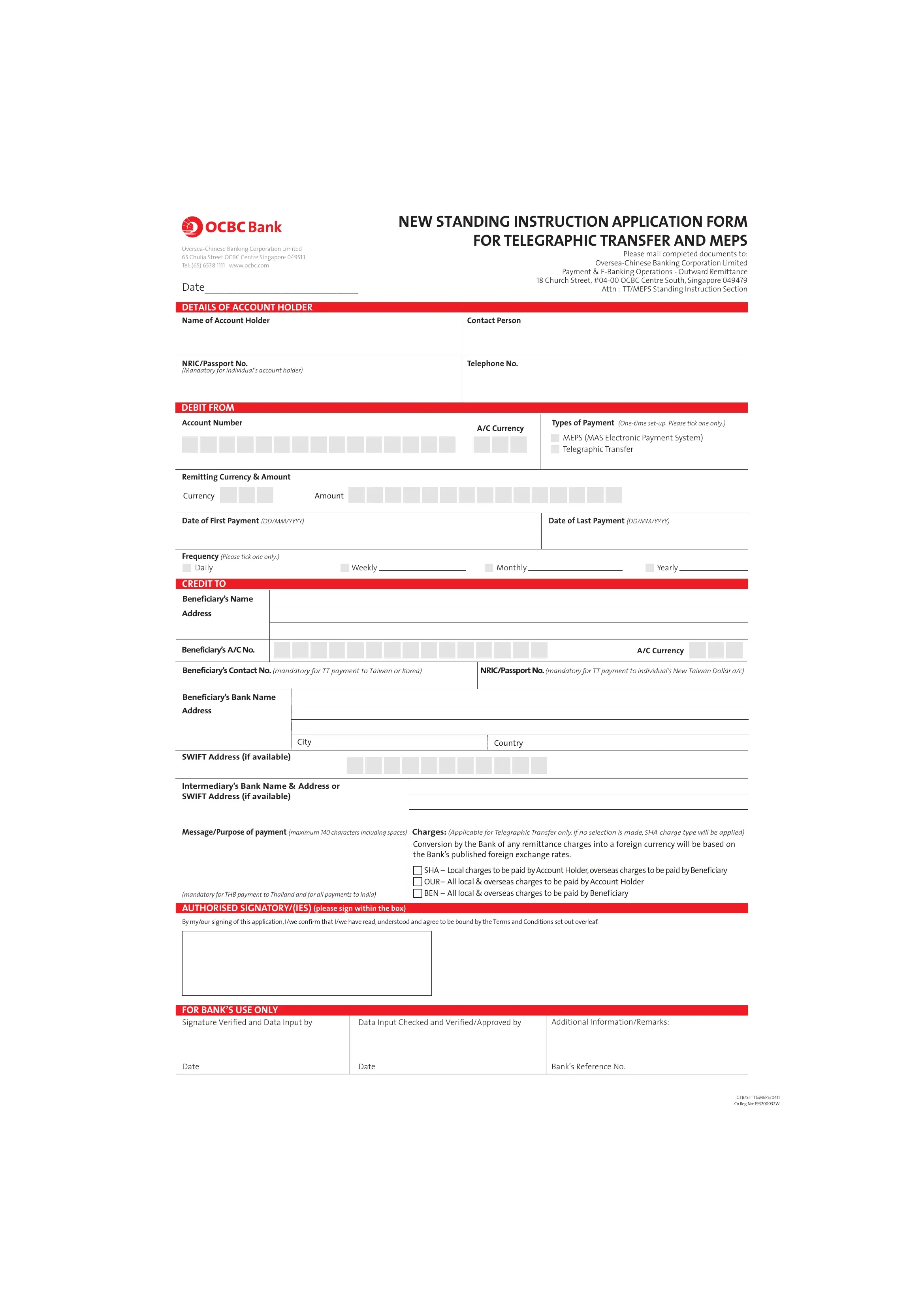

HOW TO COMPLETE THE APPLICATION FORM

Please complete the form using BLOCK LETTERS. If there are more boxes in a line than you need, leave the extra boxes blank.

In order to avoid any delay in processing, it is best that you provide all information requested in the application form. The table below indicates what information is Mandatory (which means you must provide) and what is Conditional/Optional (which means you must provide only when your application needs to meet certain criteria or when the information is available).

|

Mandatory |

Conditional/ |

|

Optional |

|

|

|

|

|

DETAILS OF ACCOUNT HOLDER |

|

1. |

Name of Account Holder. |

✔ |

|

|

|

|

|

2. |

NRIC/Passport No.: This is only required for individual account holder. |

✔ |

|

3. |

Contact Person / Telephone No: This is the name and telephone number to contact for this application. |

✔ |

|

|

|

|

|

DEBIT FROM

4. |

Account Number: Indicate your OCBC account number for debiting of the SI charges, payment and its relevant charges. |

✔ |

|

|

|

|

|

5. |

Types of Payment: Indicate the payment type for this standing instruction. |

|

|

|

MEPS - Singapore Dollar payment to beneficiary's account with a bank located in Singapore |

✔ |

|

|

|

|

|

Telegraphic Transfer - i. Payment to beneficiary's account with a bank located outside of Singapore or |

|

|

|

ii. Foreign currency (ie non-SGD) payment to beneficiary's account with a bank in Singapore |

|

|

|

|

|

|

6. |

Payment Currency & Amount: The currency and amount to be paid to the beneficiary. |

✔ |

|

|

|

|

|

7. |

Date of first payment: The date first payment takes effect. |

✔ |

|

8. |

Date of last payment: The date of final payment for this SI. |

✔ |

|

|

|

|

|

9. |

Frequency: The payment will be effected and recurring : |

|

|

|

Daily - means every business day in a week. |

|

|

|

Weekly - means once a week. Please indicate the day of the week, eg every Tuesday |

|

|

|

Monthly - means once every month. Please indicate the day of the month, eg 15th day of every month |

|

|

|

Yearly - means once annually. Please indicate the month and day, eg every January 15th |

✔ |

|

|

Note: |

|

|

|

Business day is in accordance to Singapore calendar. |

|

|

|

Whenever a payment is due on a Saturday, Sunday or Public Holiday, the payment will be effected on the next business day. |

|

|

|

|

|

|

CREDIT TO

10. |

Beneficiary's Name : Name of individual/organisation which will be paid. |

✔ |

|

|

|

|

|

|

11. |

Beneficiary's Account No: Account number of the individual/organisation which will be paid. |

✔ |

|

|

Please provide IBAN (International Bank Account Number) of the account when making payment to Europe. |

|

|

|

|

|

|

|

|

12. |

Beneficiary's Address: Address, if available, of individual/organisation which will be paid. |

|

✔ |

|

|

|

|

|

13. |

Beneficiary's Contact Number: This is the telephone contact number of the Beneficiary and is required when making payment |

|

✔ |

|

to Taiwan or Korea. |

|

|

|

|

|

|

|

|

|

|

14. |

Passport / IC No: This is the Passport or Identification Card Number of the Person you wish to remit the New Taiwan Dollar (NTD) |

|

✔ |

|

|

|

|

to in Taiwan. |

|

|

|

15. |

Beneficiary's Bank Name : Full Beneficiary's Bank Name. |

✔ |

|

|

|

Note: For Internal Funds Transfer, please indicate OCBC Bank or Oversea-Chinese Banking Corporation Limited. |

|

|

|

|

|

16. |

Beneficiary's Bank Address: Full address of Beneficiary's Bank, including city and country of location. |

✔ |

|

|

|

|

|

|

17. |

Swift Address : If you have provided a SWIFT Address of the Beneficiary Bank, it will take precedence over the Beneficiary's Bank |

|

✔ |

|

Name and Address provided. |

|

|

|

|

|

|

|

|

|

18. |

Intermediary's Bank Name and Address or SWIFT Address: If you have provided a SWIFT Address for the Intermediary Bank, |

|

✔ |

|

it will take precedence over the Intermediary's Bank Name and Address provided. |

|

|

|

|

|

|

|

|

19. |

Message/Purpose of Payment: This refers to payment details which will be made known to the beneficiary. It is mandatory for: |

|

|

|

|

a) All payments to India |

|

|

|

|

b) THB payment to Thailand. Please provide description for : |

✔ |

|

|

i) goods and services purchased, together with the invoice number quoted as purpose of payment |

|

|

|

|

ii) purpose of payment, if it is not for purchase of goods and services |

|

|

|

|

|

|

|

|

20. |

Charges (applicable for Telegraphic Transfer only): Please select ONE option on how you want the charges to be applied. If there |

✔ |

|

|

|

is no selection made, local charges will be borne by the Account Holder and overseas charges will be borne by the Beneficiary. |

|

|

|

|

|

|

|

|

|

|

ACCOUNT HOLDER'S SIGNATURE

21. To be signed by the authorised signatory/ies per account mandate. |

✔ |

|

|

|

|

TERMS AND CONDITIONS

I/We understand that the Bank accepts the standing instructions (the “Standing Instructions”) upon the following terms and conditions:- 1. The Bank is not obliged to effect payment if the relevant debit account is not sufficiently in credit to meet the payment;

2. On the date of effecting payment under a payment order the Bank reserves the right to determine the priority of such payment order against cheques presented or any other existing arrangements made with the Bank;

3. The Bank may at any time refuse to effect any payment under these Standing Instructions without prior notice to me/us if the Bank has been advised by the relevant beneficiary/beneficiaries that no further payment is required or if any payment was returned unpaid;

4. The Bank may terminate these Standing Instructions at any time without providing any reason therefor by giving notice to me/us in writing;

5. Any request by me/us to cancel or amend these Standing Instructions must be received by the Bank at least five business days before the next payment is due and subject to such conditions as the Bank may impose;

6. These Standing Instructions will remain effective notwithstanding my/our death, bankruptcy, liquidation, winding up or incapacity until actual notice thereof is received by the Bank.

7. The Bank shall not be liable for any losses, damages and expenses that I/we may suffer or incur as a result of the Bank carrying out the instructions; 8. All charges if converted into another currency, are performed at the Bank’s published foreign exchange rate;

9. The Bank shall not incur any liability by reason of any delay, refusal or omission to make any of the payments under the Standing Instructions or to follow any instructions;

10. Where applicable, my/our instructions shall be carried out by the Bank and acted upon by the agent or correspondent subject to the rules and procedures of the place where or through which they are to be executed.The Bank (including the agent or correspondent) may refuse to execute the instructions if in their opinion they are contrary to any applicable law, rule or other regulatory requirement;

11. The Bank shall not be liable for any loss, damage or expense suffered or incurred by me/us arising from any delay in or inability to effect the transfer owing to any event beyond the Bank’s control or through no fault of the Bank. The Bank shall not be liable for any errors, delay or default of any agent or correspondent used to effect the transfer;

12. Where applicable, the Bank may disclose to the agent or correspondent, such information relating to me/us or the beneficiary as the Bank may think fit and I/we irrevocably consent and authorise such disclosure by the Bank; and

13. To comply with MAS Notice 626 – Prevention of Money Laundering and Countering the Financing of Terrorism, with effect from 1 July 2007, all wire transfer messages would need to include the Applicant’s name, account number and address/unique identification number.

GTB/SI-TT&MEPS/0411

Co.Reg.No: 193200032W