Filling out documents along with our PDF editor is more straightforward when compared with anything. To modify tutti frutti job application near me the form, there is nothing you should do - basically adhere to the actions below:

Step 1: Press the "Get Form Now" button to get started on.

Step 2: Once you have entered your tutti frutti job application near me edit page, you will notice all actions it is possible to use with regards to your file at the top menu.

To fill in the tutti frutti job application near me PDF, provide the content for all of the sections:

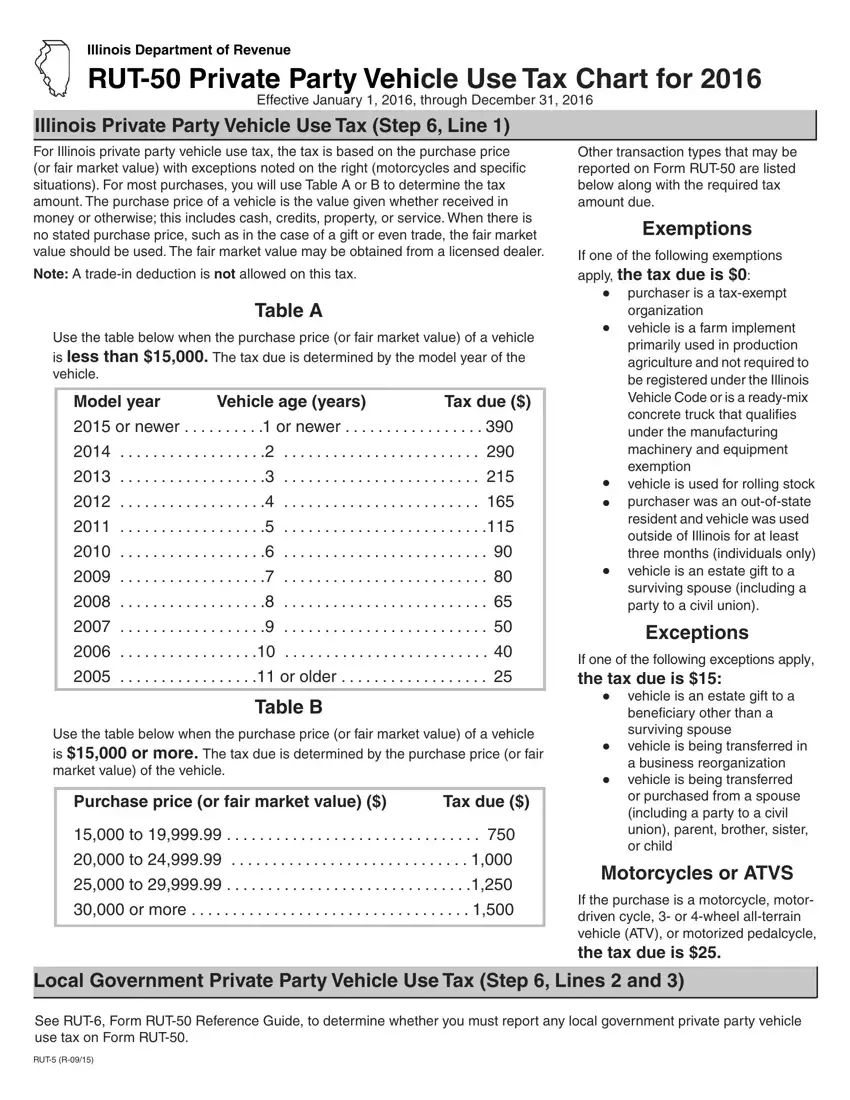

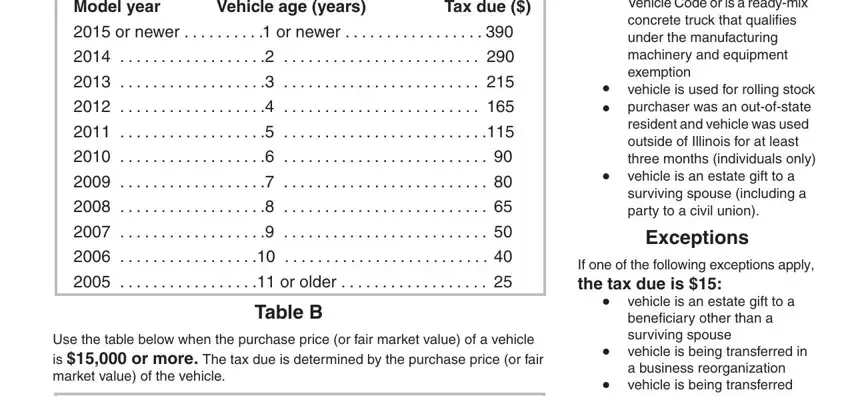

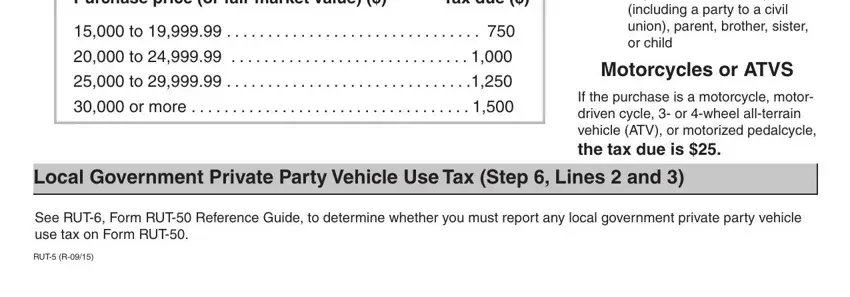

Make sure you write down the necessary data in the Purchase price or fair market, Tax due, or more, vehicle is an estate gift to a, Motorcycles or ATVS, If the purchase is a motorcycle, Local Government Private Party, See RUT Form RUT Reference Guide, and RUT R space.

Step 3: As you click the Done button, your finished document is simply transferable to any of your gadgets. Or alternatively, you will be able to send it via mail.

Step 4: Just be sure to get as many duplicates of your form as you can to prevent potential misunderstandings.