At the heart of navigating the evolution or cessation of a business in Kentucky lies the comprehensive UI-21 form, a critical document forged by the Commonwealth of Kentucky's Workforce Development Cabinet, Department of Employment Services. This form serves as a pivotal tool for reporting any changes in ownership or the discontinuation of a business, either in part or in its entirety. It meticulously gathers details from the date and nature of the ownership change to the specifics surrounding the type of ownership and the reasons prompting these shifts. By dissecting the varied components—ranging from the entirety transfer to the nuanced division of business assets and liabilities—it lays a structured pathway for ensuring that the transfer or cessation process adheres to the state’s legislative framework. Beyond the operational changes, the UI-21 form delves into the allocation of resources and liabilities of the predecessor's reserve account to the successor, underpinned by Kentucky Revised Statute 341.540, illustrating a balance of continuity and financial responsibility amidst transitions. The rigorous requirement for comprehensive completion and signing off by involved parties highlights the form’s critical role in not just reporting but effectively managing the implications of business ownership changes on employment and contribution obligations within Kentucky. As a linchpin in the administrative process, the UI-21 form embodies an essential procedure for businesses navigating the complex landscape of ownership transition or cessation, ensuring legal compliance and the smooth transition of obligations in the ever-evolving business environment.

| Question | Answer |

|---|---|

| Form Name | Form Ui 21 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Transferor, acquirers, Transferee, UI-21 |

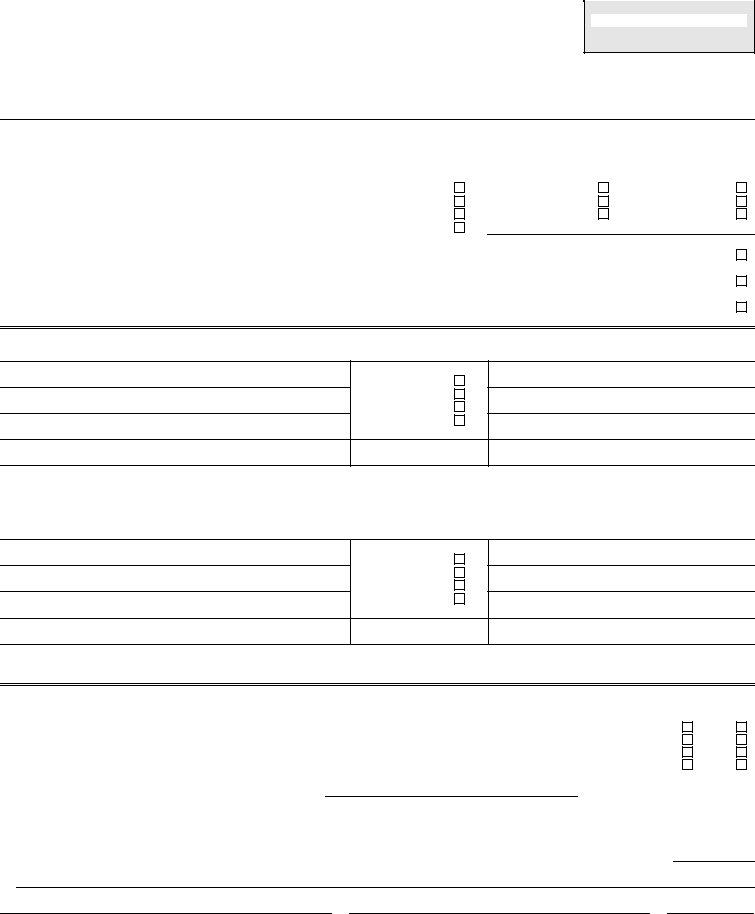

COMMONWEALTH OF KENTUCKY |

|

(Rev. 10/93) |

WORKFORCE DEVELOPMENT CABINET |

DEPARTMENT FOR EMPLOYMENT SERVICES |

|

|

DIVISION OF UNEMPLOYMENT INSURANCE |

FRANKFORT, KY 40621

(502)

NO ACTION WILL BE TAKEN AND THE FORM RETURNED IF NOT PROPERLY COMPLETED AND SIGNED.

REPORT OF CHANGE IN OWNERSHIP OR DISCONTINUANCE OF BUSINESS IN WHOLE OR PART

PART 1 ENTER DATE OF CHANGE & STATUS OF OWNERSHIP PRIOR TO CHANGE

DATE OF TRANSFER/CLOSING |

EMPLOYER NO. |

FEDERAL NO. |

Names of Owner/s or Officer/s |

Phone ( |

) |

TYPE OF OWNERSHIP |

|

|

|

Proprietorship |

|

|

|

Partnership |

|

|

|

Corporation |

|

|

|

Other (Explain) |

|

|

|

|

Trade or Business Name & Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REASON FOR CHANGE |

|

Sold |

Leased |

Quit |

Lease Reverted |

Ky. Job Completed. |

Other (Explain) |

TYPE OF CHANGE

Closed, No Successor................................................

(Omit Parts 2, 3 & 4)

Transferred in Entirety (ALL KY OPERATIONS)...

(Complete Part 2 - Both Parties Must Sign)

Transferred in Part.....................................................

(Complete Parts 2, 3 & 4 - Both Parties Must Sign)

PART 2 |

ENTER DATA FOR NEW OWNERSHIP |

EMPLOYER NO. |

FEDERAL NO. |

Name, Address & S.S. # of Owner/s, Officer/s or Member/s

TYPE OF OWNERSHIP

Proprietorship

Partnership

Corporation

Other (Explain)

TRADE OR BUSINESS NAME, ADDRESS & ZIP CODE

Location of Business in Kentucky (Street, City, Zip Code) |

Phone ( |

) |

Principal Activity |

Principal Product |

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 3 |

ENTER DATA FOR RETAINED PORTION |

|

EMPLOYER NO. |

FEDERAL NO. |

|

Name, Address & S.S. # of Owner/s, Officer/s or Member/s

TYPE OF OWNERSHIP

Proprietorship

Partnership

Corporation

Other (Explain)

TRADE OR BUSINESS NAME, ADDRESS & ZIP CODE

Location of Business in Kentucky (Street, City, Zip Code) Phone ( )Principal ActivityPrincipal Product

PART 4 TRANSFERS IN PART ONLY - ENTER EMPLOYMENT DATA FOR TRANSFERRED PORTION & % OF RESERVE ACCOUNT TO BE TRANSFERRED

20 |

Weeks of employment of at least one or more workers in either the year of the transfer or in the preceding calendar year. |

YES |

20 |

Weeks of employment of at least 10 or more workers in either the year of the transfer or in the preceding calendar year. |

YES |

$1500 Quarterly payroll in either the year of the transfer or in the preceding calendar year. |

YES |

|

$20,000 Quarterly payroll in either the year of the transfer or in the preceding calendar year. |

YES |

|

Predecessor’s date of first employment for transferred portion.

The Transferor (Predecessor) and the Transferee (Successor in part) Hereby agree to the Transfer of |

% |

|

of the Resources and Liabilities of the Transferor’s Reserve Account. (KRS 341.540) |

|

|

NO NO NO NO

Percentage of reserve transferred must be based on payroll or number of employees transferred. Please indicate which basis has been used.

Signature & Title of Transferor or Disposing Employer Shown in Part 1 (Owner or Officer)

Signature & Title of Transferee or |

Date |

Acquiring Employer Shown in Part 2 |

|

(Owner or Officer) |

|

341.540 Reserve accounts of successive employing

(2)The liability for delinquent contributions and interest imposed upon the successor or acquirer by subsection (1) of this section shall be secondary to the liability of the predecessor or predecessors, and if the delinquency has been reduced to judgment, the order of execution on such judgment shall be as follows:

(a)Against the assets, both real and personal, of the predecessor or predecessors;

(b)Against the assets, both real and personal, of the business acquired; and

(c)Against the assets, both real and personal, of the successor or acquirer.

(3)Notwithstanding the provisions of subsection (1), any employing unit which succeeds to or acquires a segregable and identifiable portion of the organization, trade or business from a subject employer, and who is, or by reason of the succession or acquisition becomes, a subject employer, shall assume the position of an employer with respect to the resources and liabilities of the reserve account in proportion to the percentage of the payroll or employees assignable to the transferred portion. In calculating the transferred portion, the secretary shall utilize the last four (4) calendar quarters, preceding the date of succession or acquisition, for workers employed by the successor subsequent to that date. The taxable payroll, benefit charges and the potential benefit charges shall likewise be assumed by the successors or acquirers in interest in a like proportion.

(4)(a) The contribution rate of a successor or acquirer employing unit, whether in whole or in part, which was a subject employer prior to such succession or acquisition, shall not be affected by the transfer of the reserve account for the remainder of the rate year in which such succession or acquisition occurred.

(b)The contribution rate of a successor or acquirer employing unit, either in whole or in part, which was not a subject employer prior to such succession or acquisition, shall be, for the calendar year in which such succession or acquisition occurred, the same rate as that of its predecessor.

(c)The contribution rate for a successor or acquirer employing unit, which was not a subject employer prior to the simultaneous succession to or acquisition of two (2) or more predecessor reserve accounts, either in whole or in part, shall be the rate determined in accordance with the provisions of KRS 341.270, by combining the reserve accounts succeeded to or acquired as they existed as of the computation date for determining rates for the calendar year in which such succession or acquisition occurred.

(d)The contribution rate of a successor or acquirer employing unit which succeeds to or acquires, either in whole or in part, a predecessor’s reserve account after a computation date but prior to the beginning of the calendar year immediately following such computation date shall be the rate determined, in accordance with KRS 341.270, be effecting the transfer of such reserve account as of the computation date immediately preceding the date of such succession or acquisition.