It is straightforward to complete the montana unemployment ui 5 fillable form. Our software was created to be enable you to fill in any form swiftly. These are the four actions to take:

Step 1: Seek out the button "Get Form Here" and select it.

Step 2: At the moment, you may alter the montana unemployment ui 5 fillable form. The multifunctional toolbar will let you add, erase, change, highlight, and also perform many other commands to the text and areas inside the document.

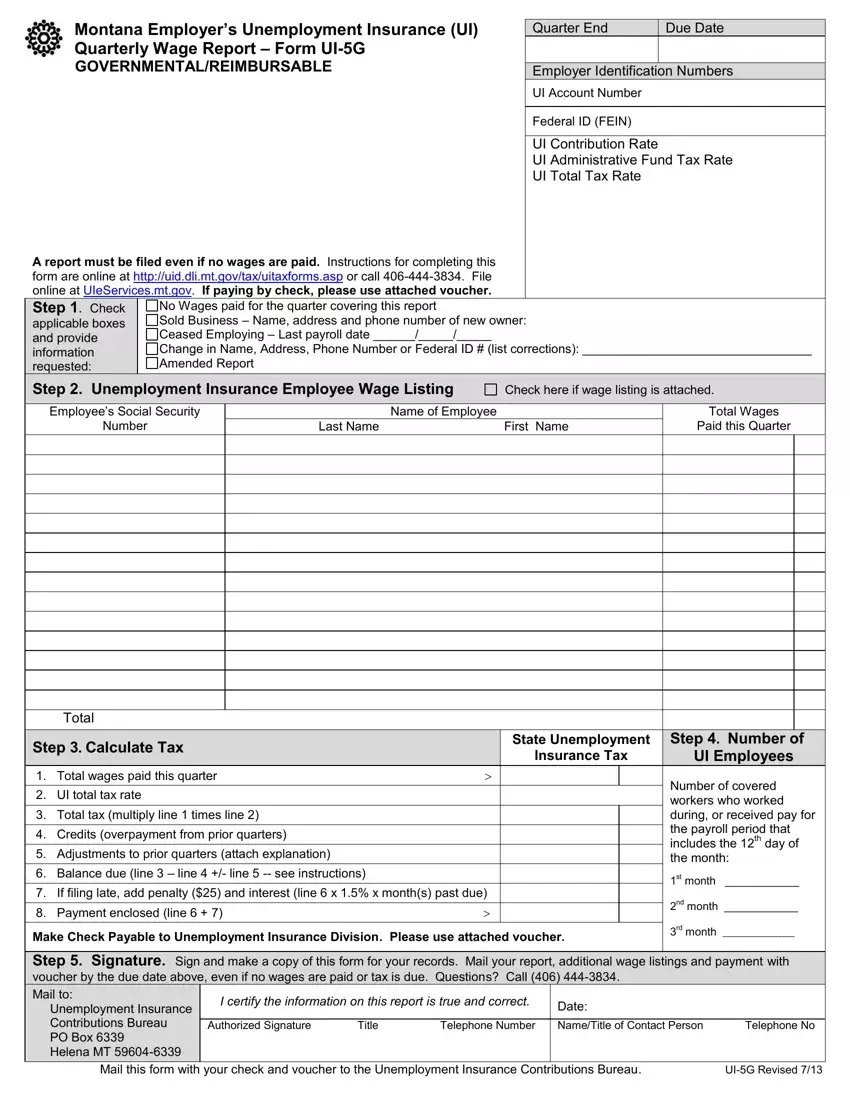

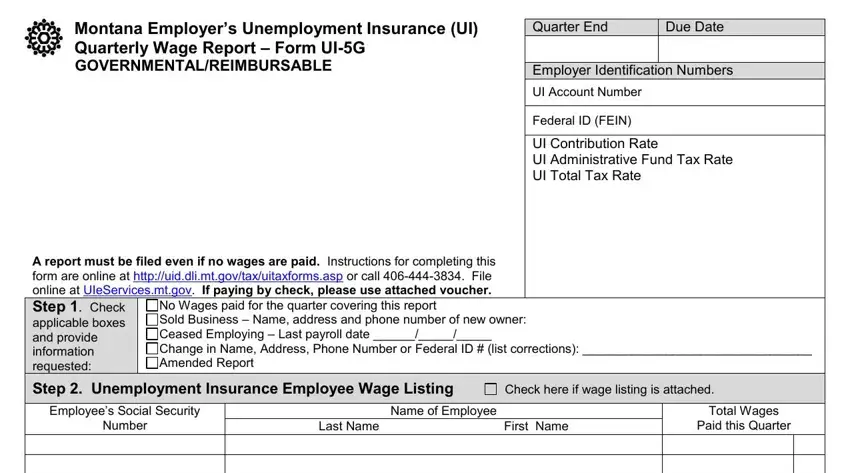

For every single section, add the data requested by the platform.

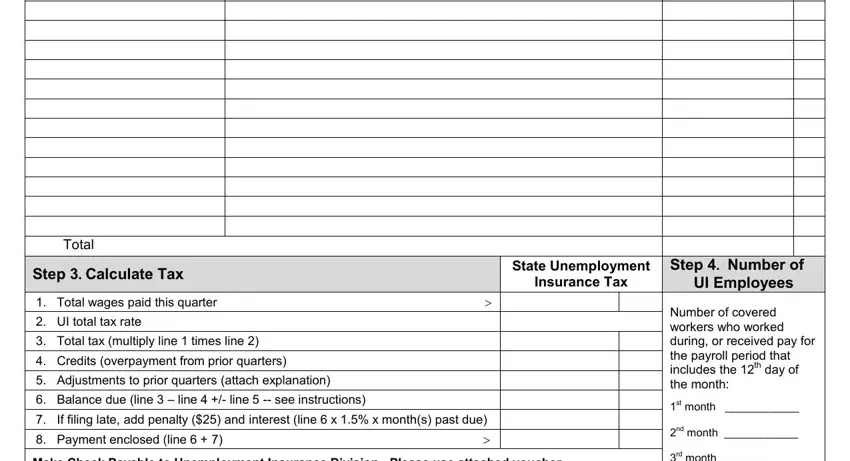

Indicate the data in Total, Step Calculate Tax, State Unemployment Insurance Tax, Step Number of UI Employees, Total wages paid this quarter, UI total tax rate, Total tax multiply line times, Credits overpayment from prior, Adjustments to prior quarters, Balance due line line line, Payment enclosed line, Make Check Payable to Unemployment, Number of covered workers who, st month, and nd month.

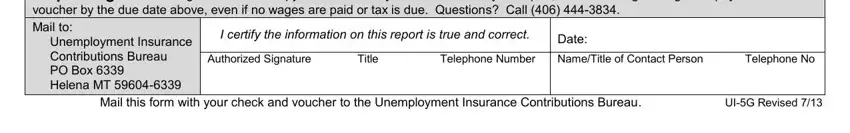

Make sure you point out the fundamental details within the Step Signature Sign and make a, I certify the information on this, Authorized Signature Title, NameTitle of Contact Person, Date, and Mail this form with your check and field.

Step 3: At the time you select the Done button, the ready document is readily exportable to every of your gadgets. Or alternatively, you may send it by means of email.

Step 4: Try to make as many copies of the file as you can to prevent potential misunderstandings.