We've used the endeavours of our best programmers to create the PDF editor you can apply. Our software will enable you to fill in the ides notice of change document without trouble and don’t waste valuable time. What you need to do is keep up with the following easy rules.

Step 1: The first step should be to click on the orange "Get Form Now" button.

Step 2: When you have accessed your ides notice of change edit page, you will notice all actions it is possible to undertake concerning your file at the upper menu.

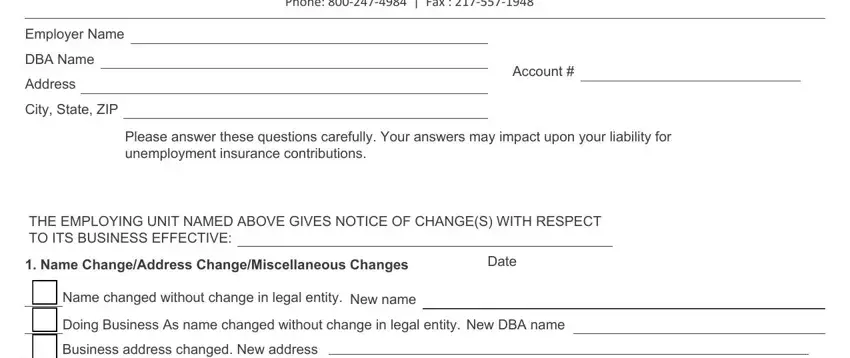

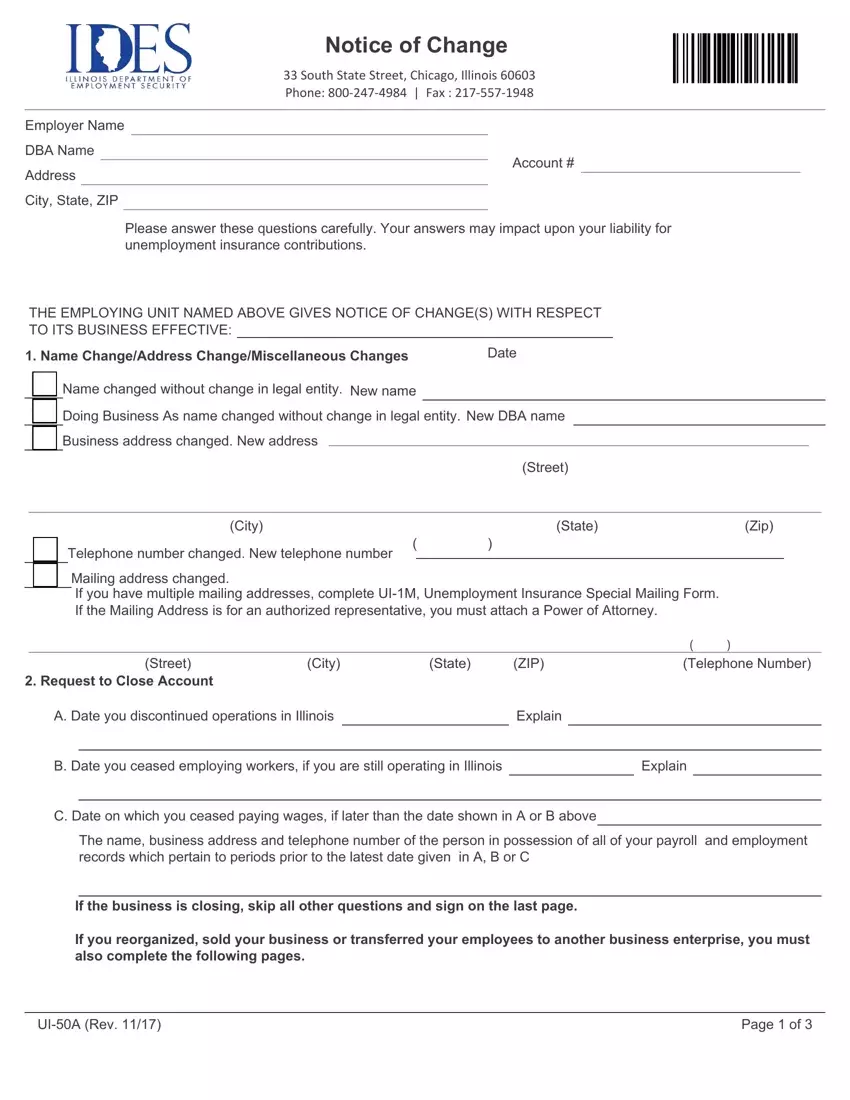

Create the ides notice of change PDF and type in the content for every single section:

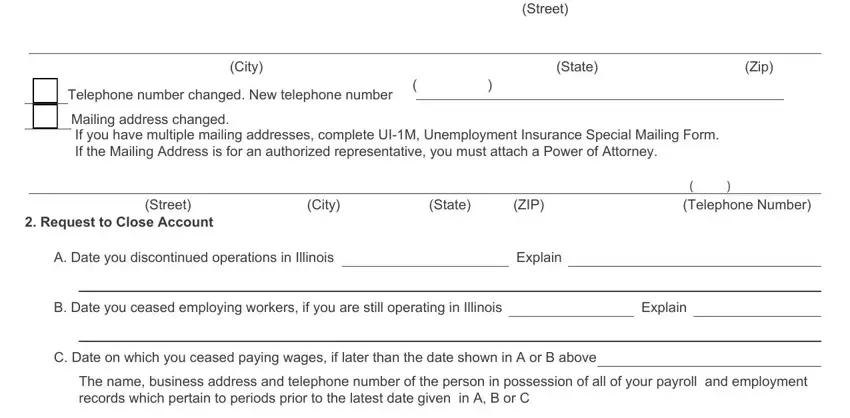

Type in the requested particulars in the segment Street, Telephone number changed New, City, State, Zip, Mailing address changed If you, Request to Close Account, Street, City, State ZIP, A Date you discontinued operations, Explain, Telephone Number, B Date you ceased employing, and Explain.

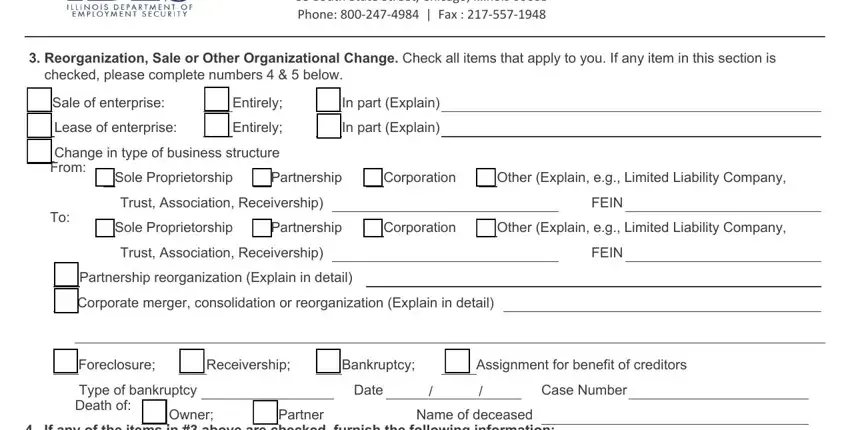

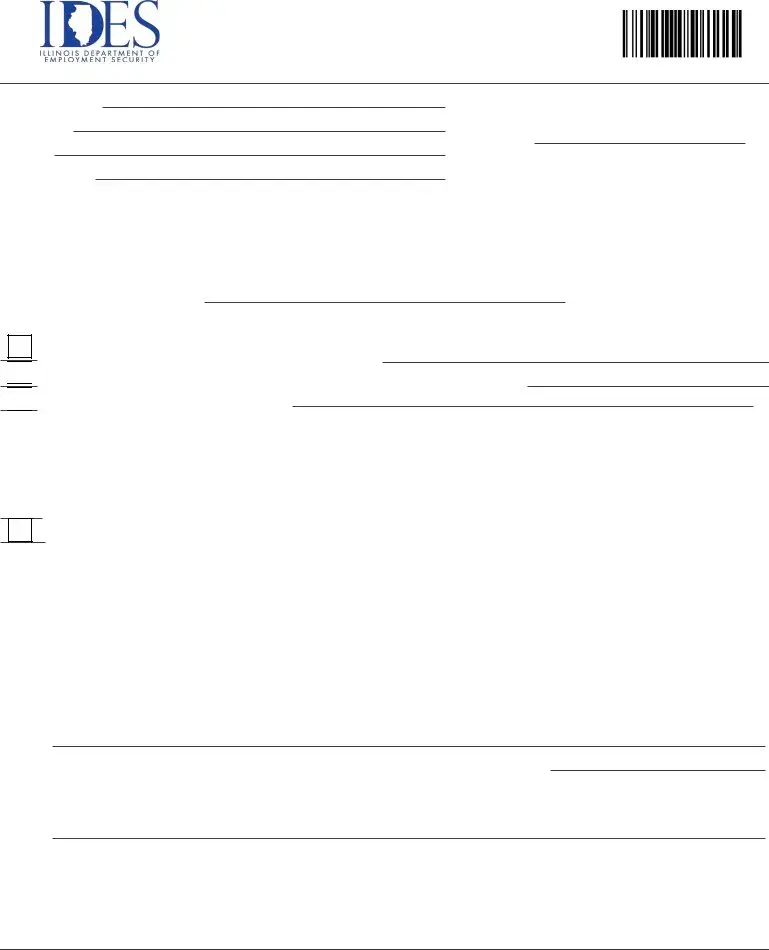

Type in the important data as you are on the South State Street Chicago, Reorganization Sale or Other, checked please complete numbers, Sale of enterprise, Lease of enterprise, Entirely, Entirely, In part Explain, In part Explain, Change in type of business, Sole Proprietorship, Partnership, Corporation, Other Explain eg Limited Liability, and Trust Association Receivership field.

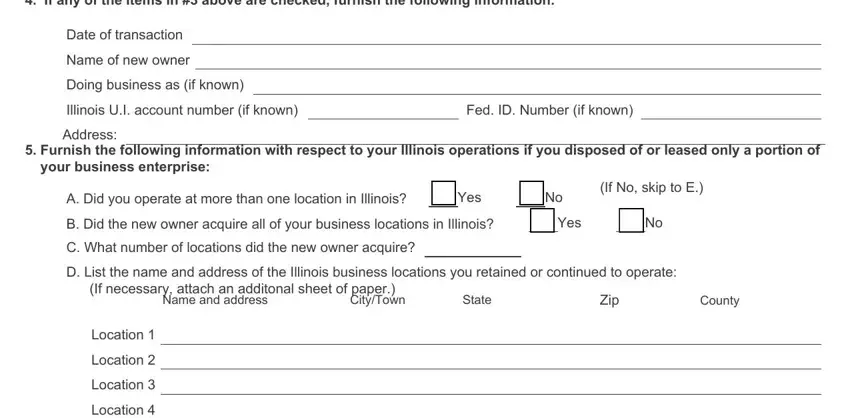

The Partner If any of the items in, Date of transaction, Name of new owner, Doing business as if known, Illinois UI account number if known, Fed ID Number if known, Address, Furnish the following information, your business enterprise, A Did you operate at more than one, Yes, B Did the new owner acquire all of, C What number of locations did the, Yes, and If No skip to E area is where all sides can place their rights and obligations.

Finish by checking all these areas and preparing them accordingly: Location, Location, Location, UIA Rev, and Page of.

Step 3: The moment you hit the Done button, your finalized document is easily transferable to any kind of of your devices. Or alternatively, you will be able to send it via email.

Step 4: To protect yourself from any kind of hassles later on, try to have as much as two or three duplicates of your document.

Doing Business As name changed without change in legal entity. New DBA name

Doing Business As name changed without change in legal entity. New DBA name

Business address changed. New address

Business address changed. New address