You'll find nothing troublesome in relation to filling out the filing for unemployment in illinois after you open our tool. By taking these simple steps, you will get the prepared PDF in the minimum period possible.

Step 1: This page includes an orange button that says "Get Form Now". Click it.

Step 2: Right now, it is possible to alter the filing for unemployment in illinois. This multifunctional toolbar will let you add, remove, transform, highlight, as well as perform other commands to the text and fields within the document.

In order to fill out the file, provide the information the software will require you to for each of the following segments:

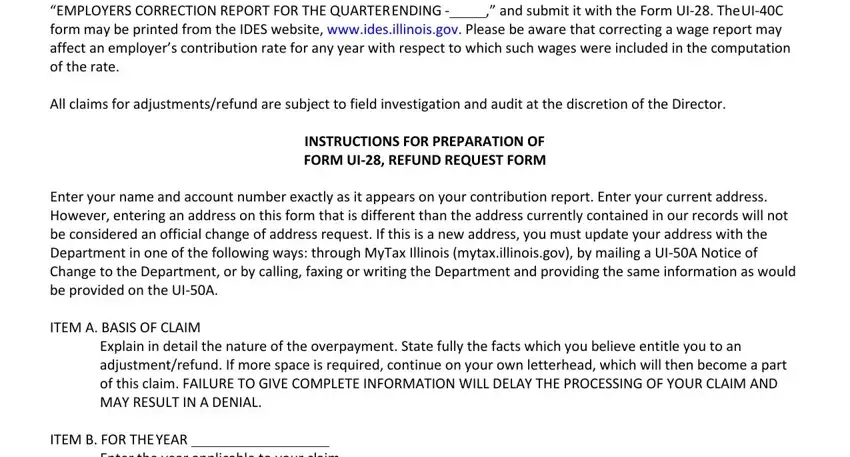

In the A separate form UI Refund Request, All claims for adjustmentsrefund, INSTRUCTIONS FOR PREPARATION OF, Enter your name and account number, ITEM A BASIS OF CLAIM, Explain in detail the nature of, ITEM B FOR THE YEAR, and Enter the year applicable to your field, put in writing your details.

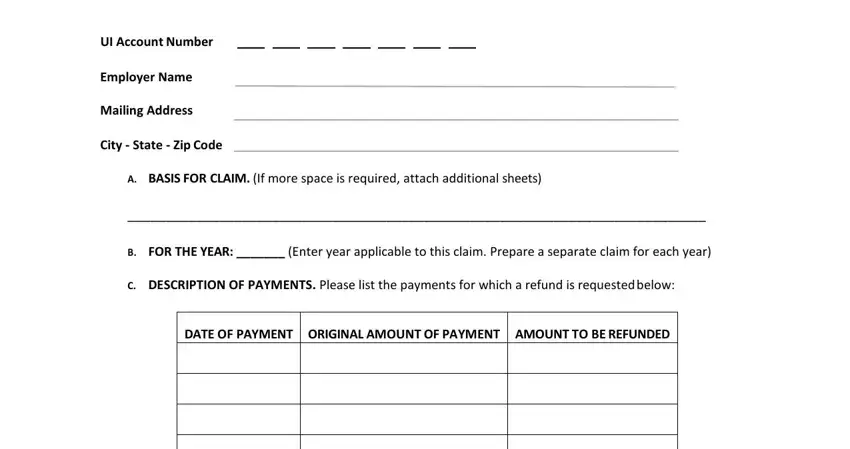

Within the section referring to UI Account Number, Employer Name, Mailing Address, City State Zip Code, A BASIS FOR CLAIM If more space is, B FOR THE YEAR Enter year, C DESCRIPTION OF PAYMENTS Please, and DATE OF PAYMENT ORIGINAL AMOUNT OF, you should put down some expected information.

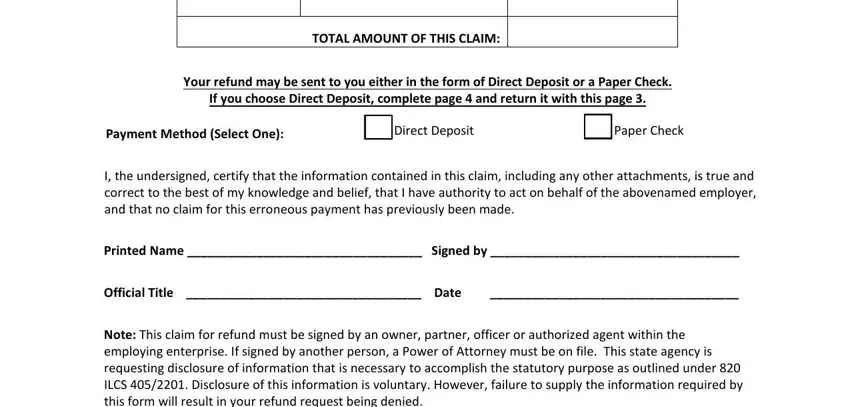

The TOTAL AMOUNT OF THIS CLAIM, Your refund may be sent to you, Payment Method Select One, Direct Deposit, Paper Check, I the undersigned certify that the, Printed Name Signed by, Official Title Date, and Note This claim for refund must be section is the place to place the rights and obligations of each party.

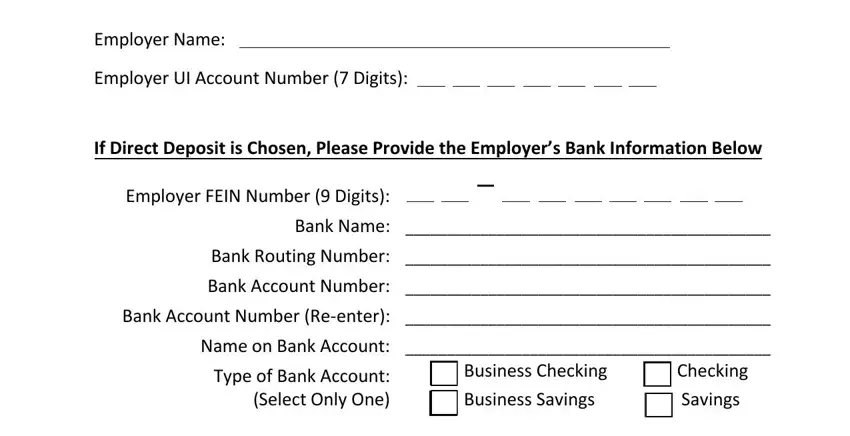

Finalize by analyzing the next areas and completing them accordingly: Employer Name, Employer UI Account Number Digits, If Direct Deposit is Chosen Please, Employer FEIN Number Digits, Bank Name, Bank Routing Number, Bank Account Number, Bank Account Number Reenter, Name on Bank Account, Type of Bank Account Select Only, Business Checking Business Savings, and Checking Savings.

Step 3: Once you have clicked the Done button, your document is going to be readily available upload to any electronic device or email address you identify.

Step 4: Make as much as two or three copies of the file to stay clear of any sort of possible issues.