Filling in united wholesale broker agreement is simple. Our team designed our PDF software to make it simple to operate and assist you to complete any PDF online. Here are a few steps that you need to adhere to:

Step 1: Click the orange "Get Form Now" button on the following website page.

Step 2: So, you are on the form editing page. You may add content, edit existing details, highlight certain words or phrases, place crosses or checks, insert images, sign the document, erase unrequired fields, etc.

For every single part, prepare the content demanded by the software.

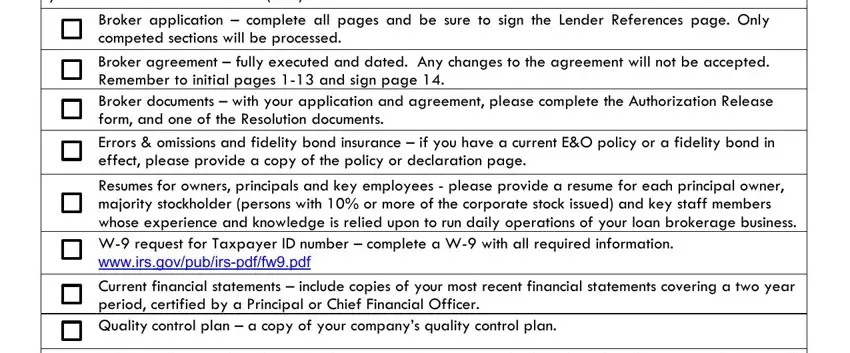

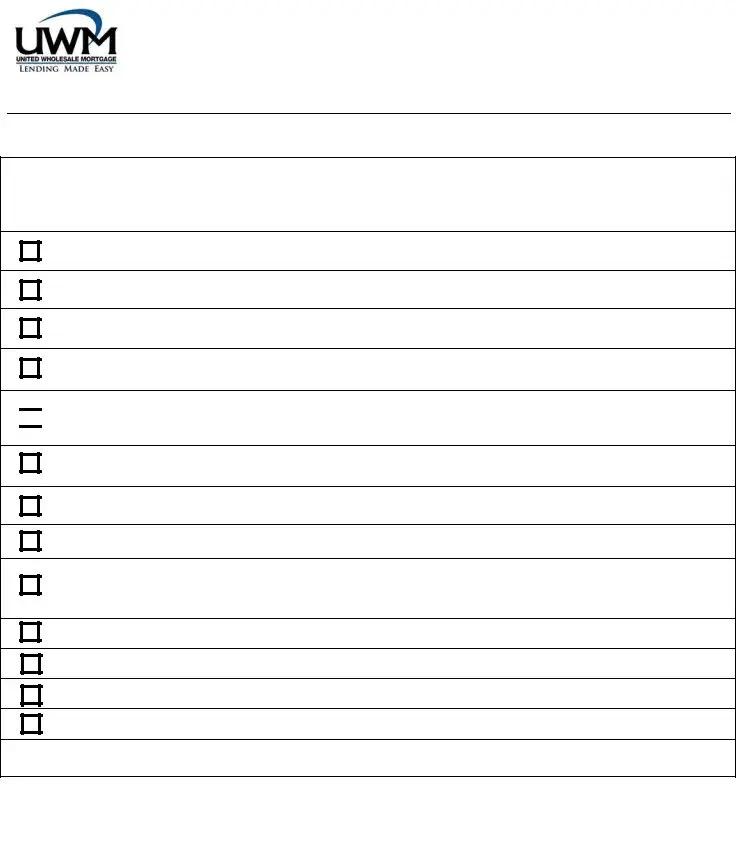

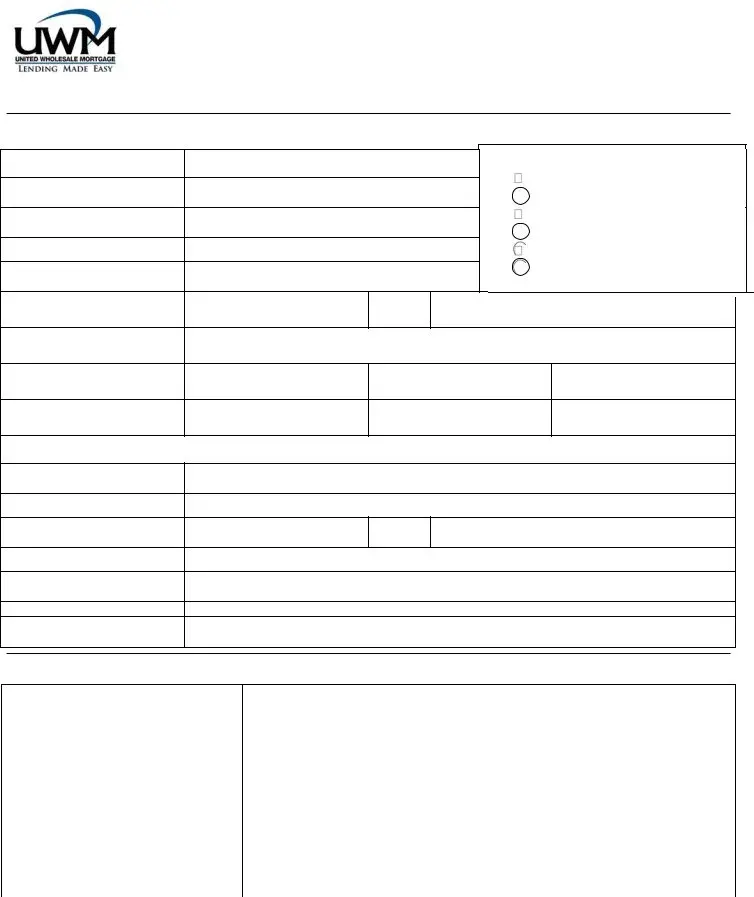

The application will require you to prepare the Complete and sign your Broker, Broker application complete all, Broker agreement fully executed, Remember to initial pages and, and Articles of box.

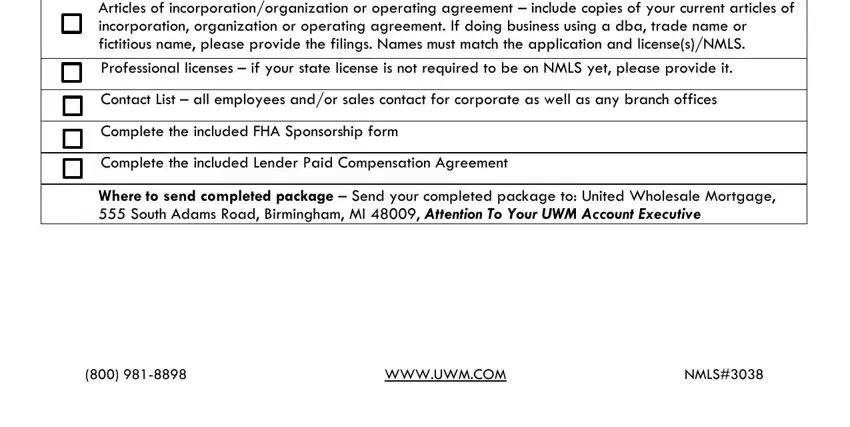

You'll be required to write down the data to let the application fill out the part Articles of, Contact List all employees andor, Complete the included FHA, Complete the included Lender Paid, Where to send completed package, WWWUWMCOM, and NMLS.

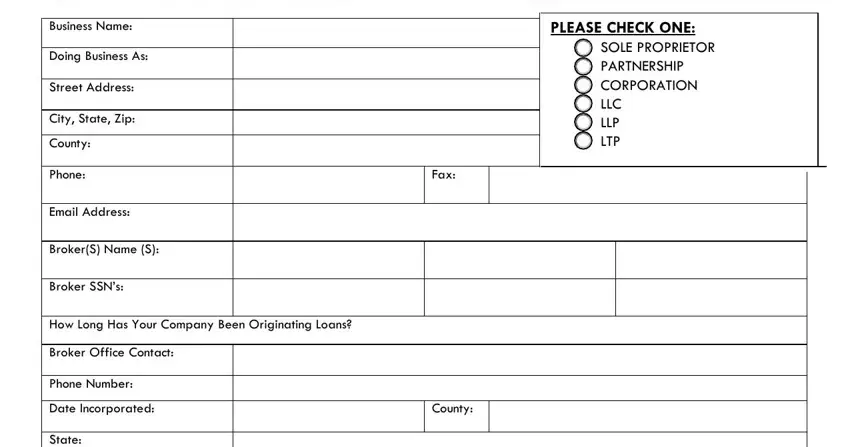

You will have to identify the rights and obligations of both sides in part PLEASE CHECK ONE, SOLE PROPRIETOR PARTNERSHIP, Fax, County, Business Name, Doing Business As, Street Address, City State Zip County, Phone, Email Address, BrokerS Name S, Broker SSNs, How Long Has Your Company Been, Phone Number Date Incorporated, and State Federal ID Number.

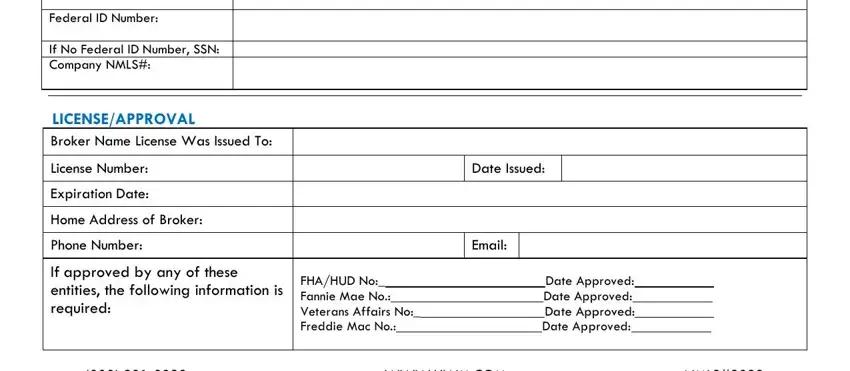

Fill out the template by taking a look at the following areas: State Federal ID Number, If No Federal ID Number SSN, LICENSEAPPROVAL Broker Name, If approved by any of these, Date Issued, Email, FHAHUD No Fannie Mae No Veterans, Date Approved Date Approved Date, WWWUWMCOM, and NMLS.

Step 3: Select the "Done" button. Now, it is possible to transfer the PDF document - upload it to your device or forward it by means of electronic mail.

Step 4: Try to generate as many duplicates of your form as possible to avoid potential misunderstandings.

majority stockholder (persons with 10% or more of the corporate stock issued) and key staff members whose experience and knowledge is relied upon to run daily operations of your loan brokerage business.

majority stockholder (persons with 10% or more of the corporate stock issued) and key staff members whose experience and knowledge is relied upon to run daily operations of your loan brokerage business.

SOLE PROPRIETOR

SOLE PROPRIETOR PARTNERSHIP

PARTNERSHIP CORPORATION

CORPORATION LLC

LLC LLP

LLP LTP

LTP