Number of things can be quicker than preparing documentation making use of the PDF editor. There isn't much you have to do to enhance the oh ust sales tax document - just abide by these steps in the following order:

Step 1: The first task is to pick the orange "Get Form Now" button.

Step 2: The file editing page is now available. It's possible to add text or edit present data.

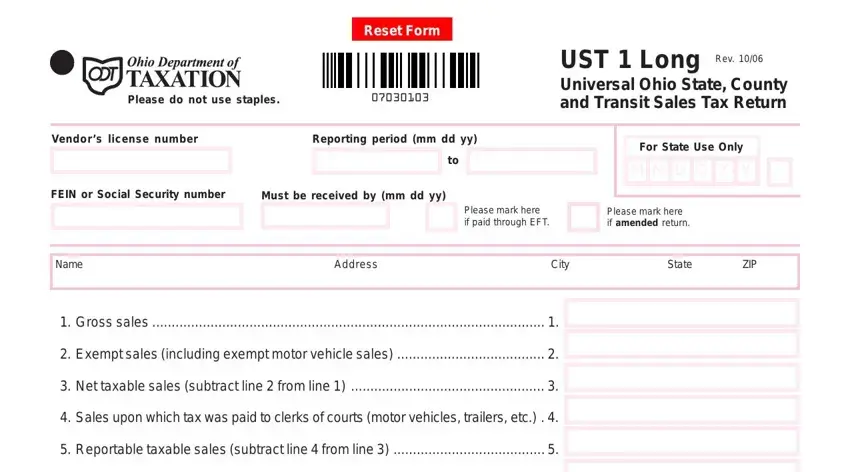

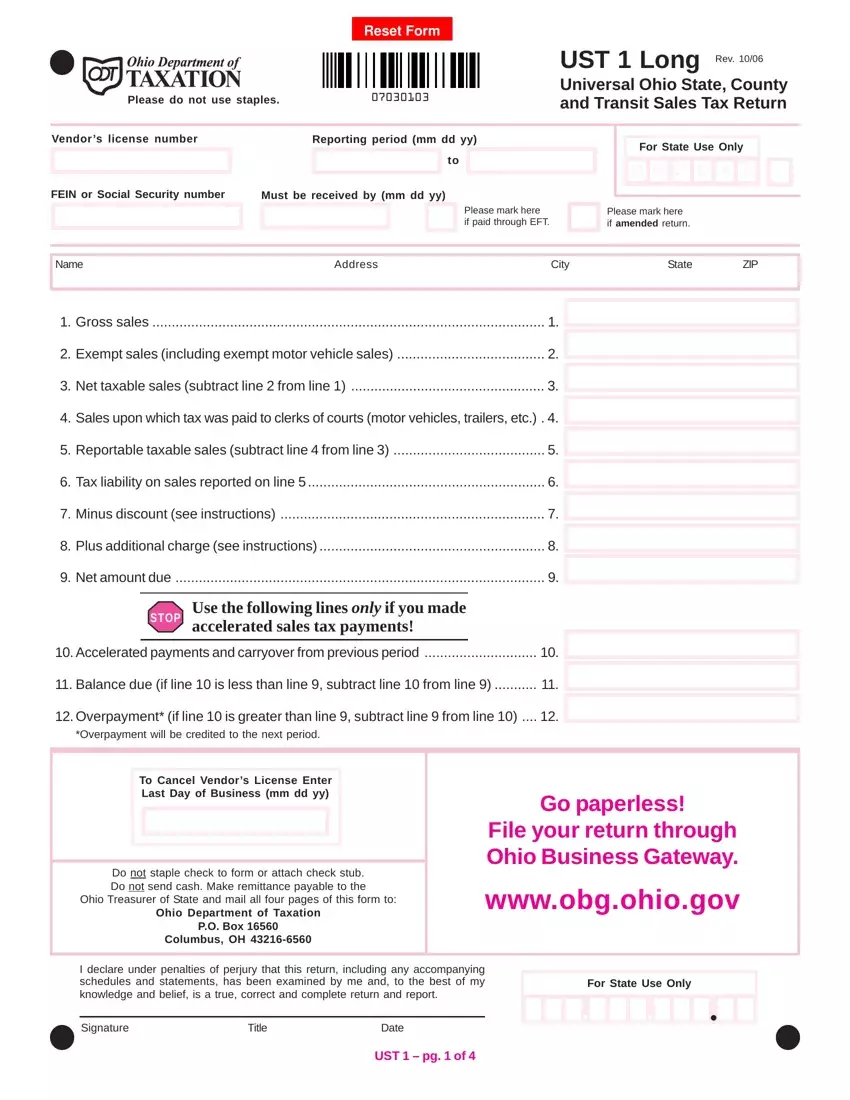

Enter the content requested by the software to create the file.

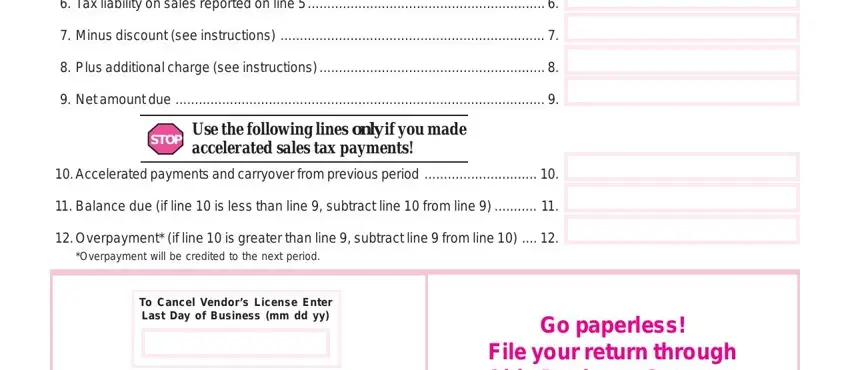

Type in the necessary data in the space Tax liability on sales reported, Minus discount see instructions, Plus additional charge see, Net amount due, STOP, Use the following lines only if, Accelerated payments and, Balance due if line is less than, Overpayment if line is greater, Overpayment will be credited to, To Cancel Vendors License Enter, and Go paperless File your return.

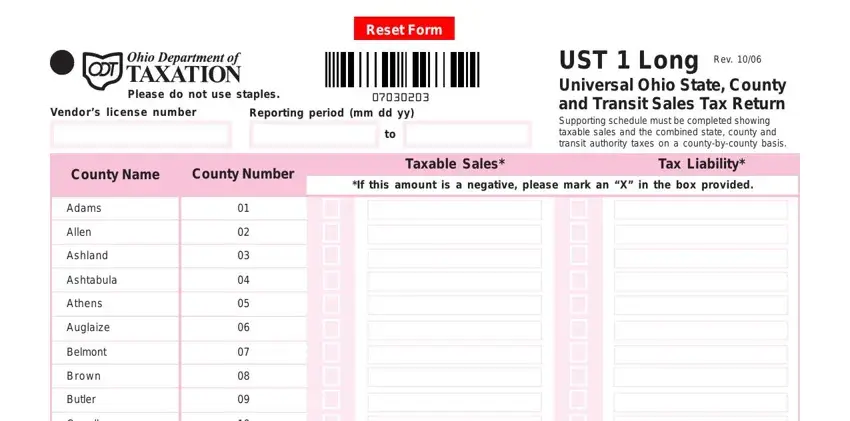

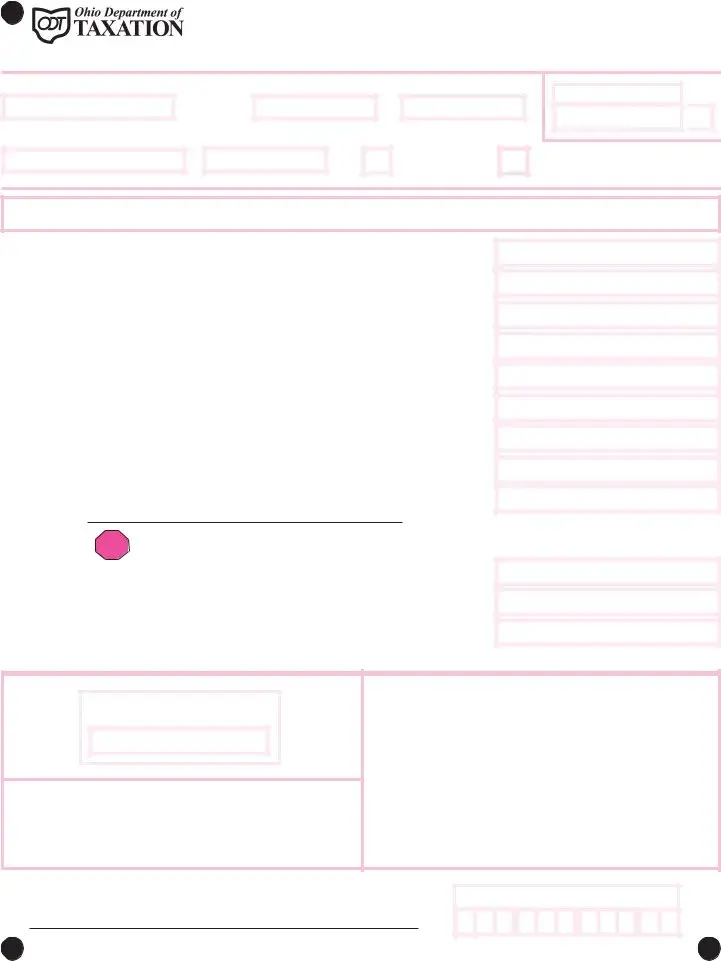

Make sure you point out the necessary particulars from the Please do not use staples, Vendors license number, Reporting period mm dd yy, Rev, UST Long Universal Ohio State, County Name, County Number, Taxable Sales, Tax Liability, If this amount is a negative, Adams, Allen, Ashland, Ashtabula, and Athens segment.

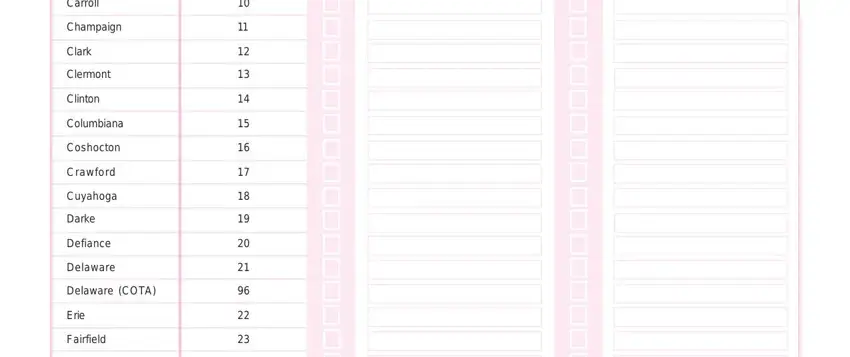

Within the paragraph Carroll, Champaign, Clark, Clermont, Clinton, Columbiana, Coshocton, Crawford, Cuyahoga, Darke, Defiance, Delaware, Delaware COTA, Erie, and Fairfield, write down the rights and responsibilities of the parties.

Fill in the file by reviewing the next sections: Fairfield COTA, Fayette, Franklin, Fulton, Gallia, Geauga, Greene, Guernsey, Hamilton, Page subtotal, and UST pg of.

Step 3: When you pick the Done button, your ready document is readily exportable to any of your gadgets. Or, you can easily deliver it by means of email.

Step 4: Generate copies of your form - it may help you remain away from forthcoming worries. And don't worry - we are not meant to display or read your information.

M

M  D

D  D

D  Y

Y  Y

Y