Dealing with PDF forms online is certainly simple with our PDF editor. You can fill out va gov vaforms medical pdf vha 10 10hs pdf here and use many other options we provide. To keep our tool on the cutting edge of practicality, we strive to implement user-driven capabilities and improvements on a regular basis. We're always grateful for any suggestions - join us in revolutionizing how we work with PDF forms. In case you are seeking to get going, here is what it's going to take:

Step 1: Just hit the "Get Form Button" at the top of this site to start up our pdf editing tool. Here you'll find everything that is necessary to fill out your file.

Step 2: The tool will give you the ability to change the majority of PDF files in various ways. Enhance it by adding any text, correct what is already in the PDF, and add a signature - all within several mouse clicks!

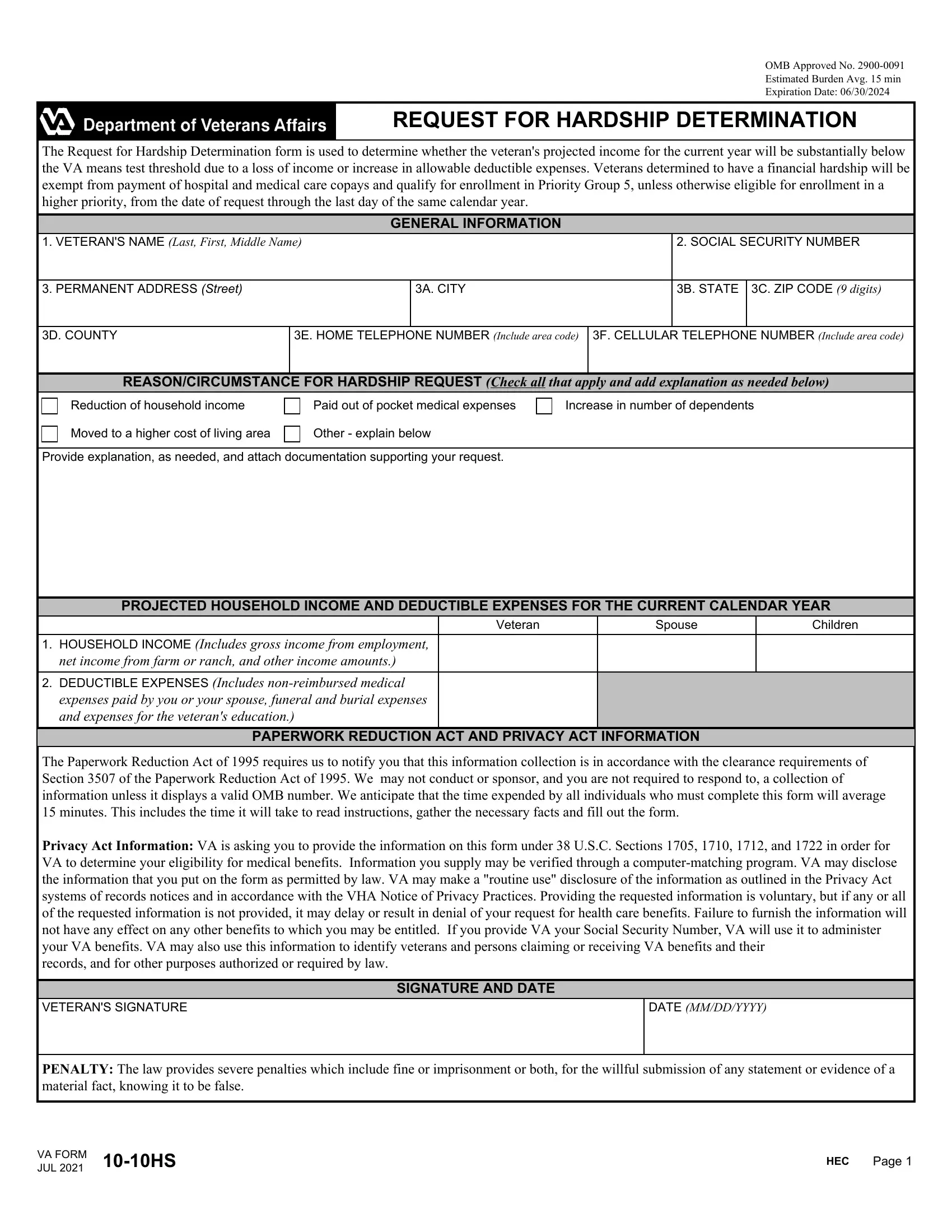

This form will require particular details to be typed in, hence make sure to take your time to enter what's required:

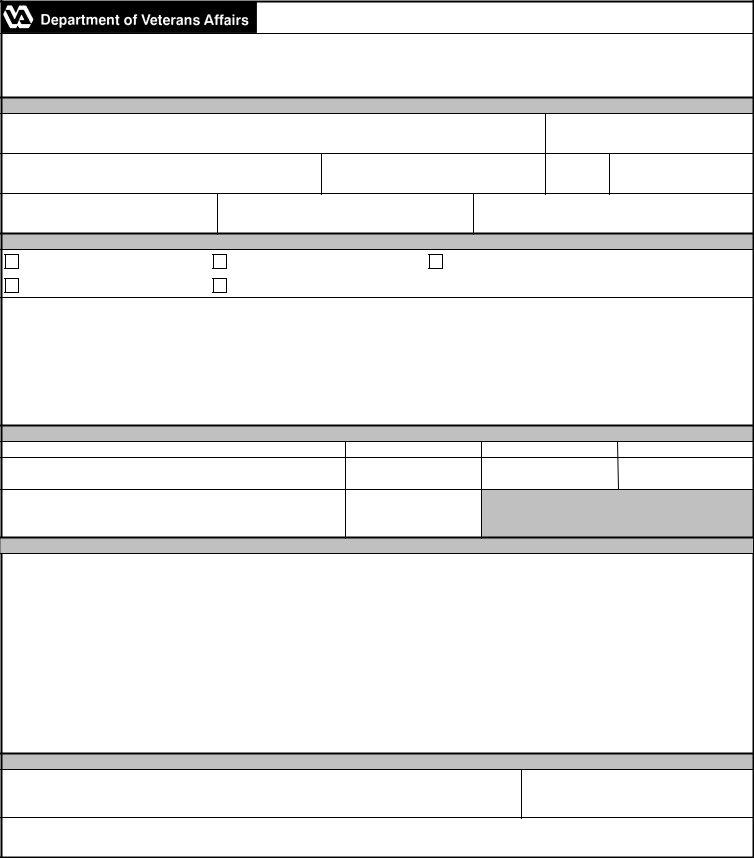

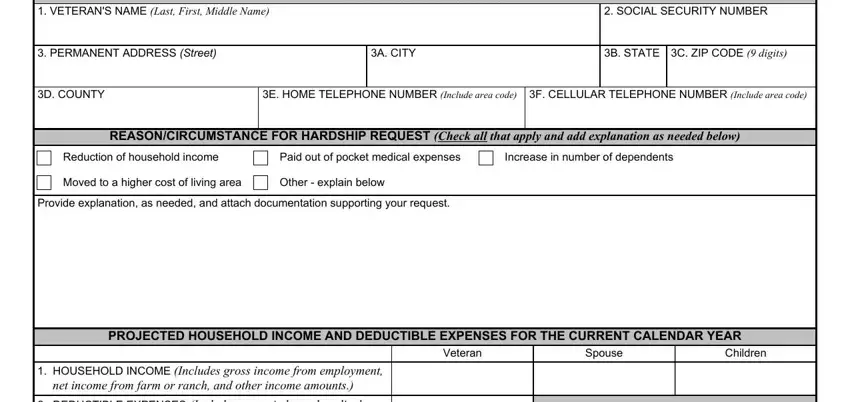

1. The va gov vaforms medical pdf vha 10 10hs pdf involves particular information to be typed in. Make certain the following blank fields are filled out:

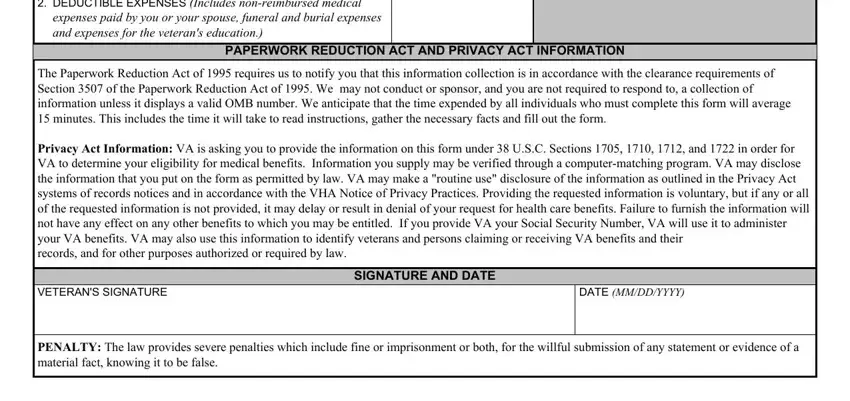

2. Once your current task is complete, take the next step – fill out all of these fields - DEDUCTIBLE EXPENSES Includes, expenses paid by you or your, PAPERWORK REDUCTION ACT AND, The Paperwork Reduction Act of, VETERANS SIGNATURE, DATE MMDDYYYY, SIGNATURE AND DATE, and PENALTY The law provides severe with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

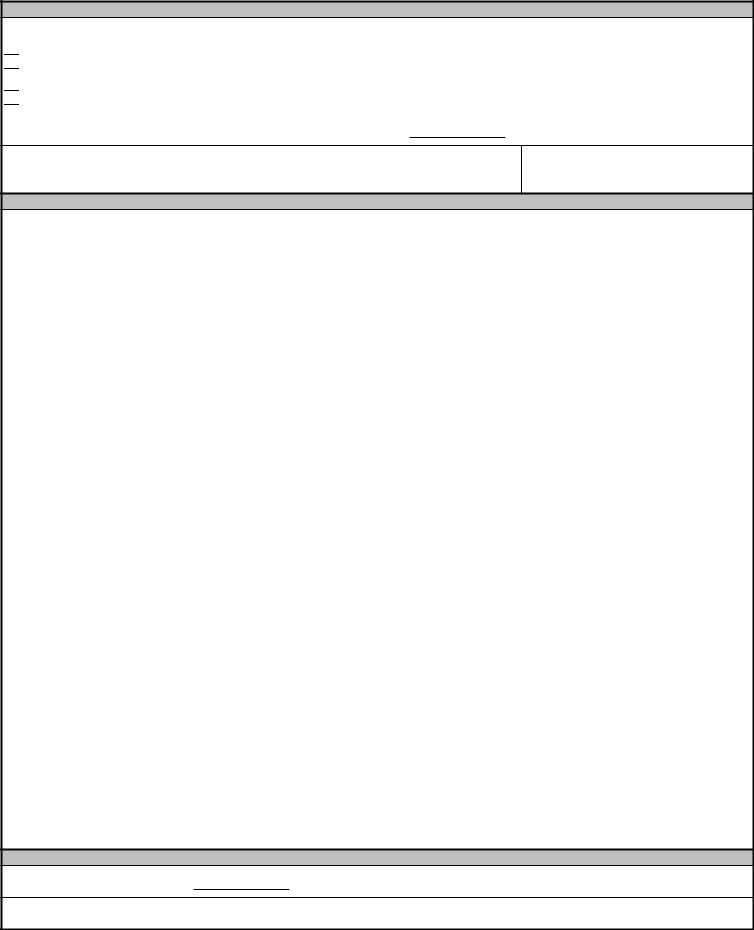

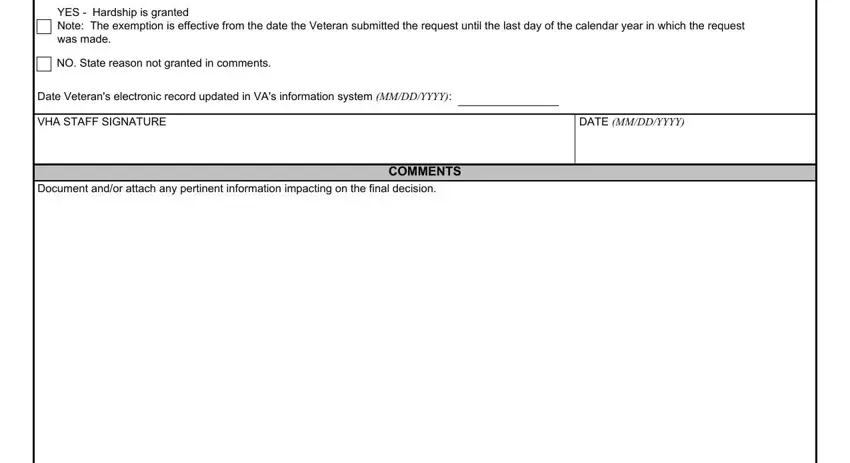

3. In this specific stage, check out YES Hardship is granted Note The, NO State reason not granted in, Date Veterans electronic record, VHA STAFF SIGNATURE, DATE MMDDYYYY, Document andor attach any, and COMMENTS. These have to be taken care of with greatest attention to detail.

Many people often make errors while completing YES Hardship is granted Note The in this area. Ensure you revise whatever you enter here.

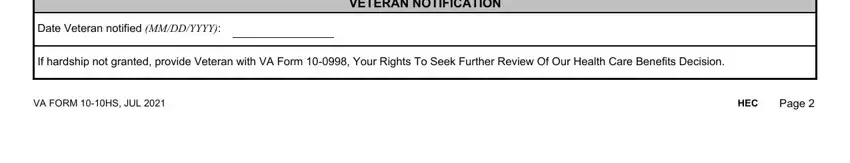

4. All set to start working on this next part! Here you will get all of these Date Veteran notified MMDDYYYY, VETERAN NOTIFICATION, If hardship not granted provide, VA FORM HS JUL, HEC, and Page fields to fill out.

Step 3: Spell-check the details you have typed into the blanks and then press the "Done" button. Grab your va gov vaforms medical pdf vha 10 10hs pdf the instant you sign up for a 7-day free trial. Instantly get access to the form from your personal account, along with any modifications and changes all preserved! FormsPal ensures your data privacy by having a protected method that never records or distributes any personal information used in the file. Be confident knowing your paperwork are kept confidential whenever you work with our service!