Our best web developers worked hard to create the PDF editor we're happy to deliver to you. Our software allows you to effortlessly fill in department veterans affairs of forms and saves valuable time. You only need to try out this particular instruction.

Step 1: Choose the button "Get Form Here" on this webpage and select it.

Step 2: You can now modify the department veterans affairs of forms. The multifunctional toolbar makes it possible to include, remove, modify, and highlight text as well as undertake many other commands.

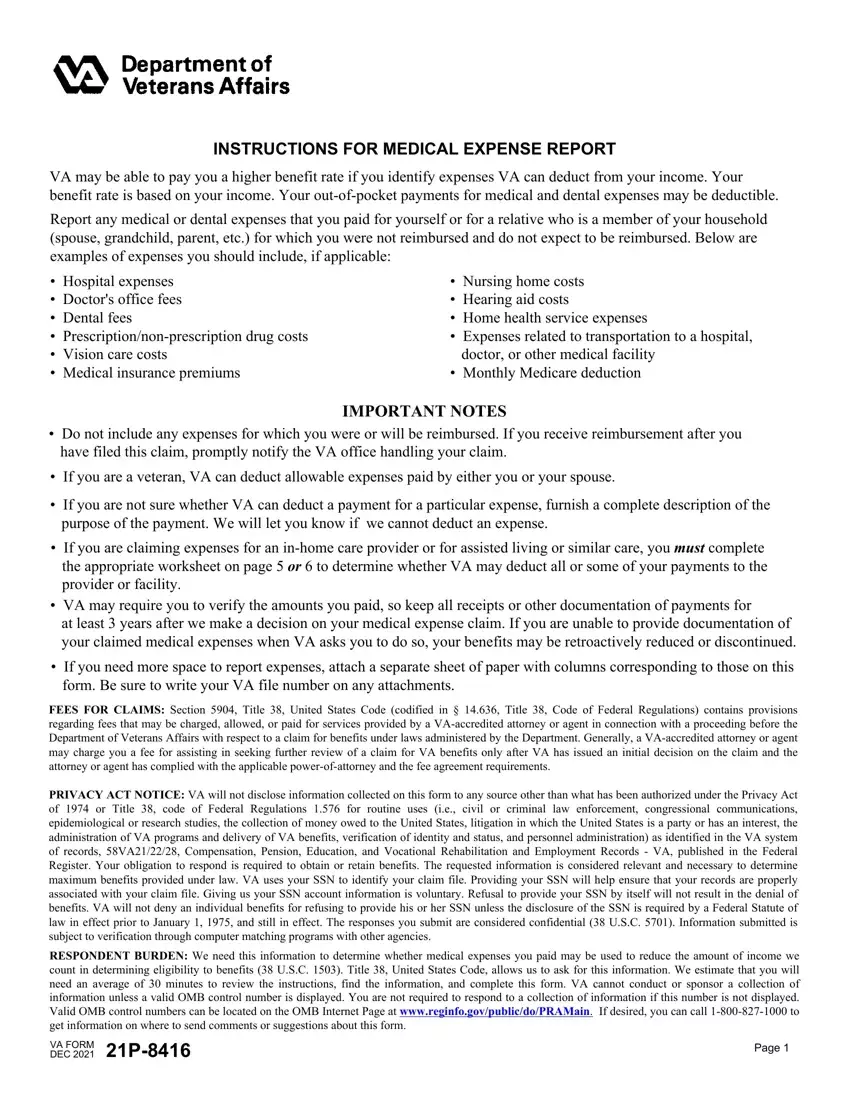

Feel free to type in the next details to complete the department veterans affairs of forms PDF:

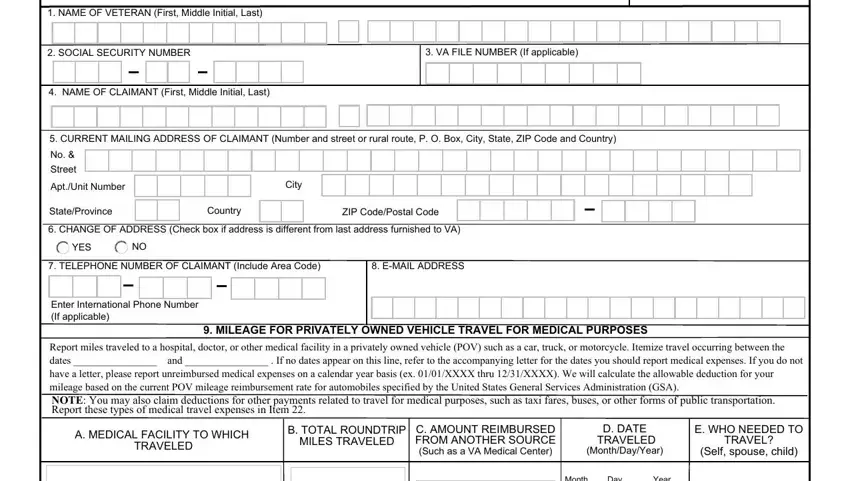

Make sure you submit the NAME OF VETERAN First Middle, SOCIAL SECURITY NUMBER, VA FILE NUMBER If applicable, NAME OF CLAIMANT First Middle, CURRENT MAILING ADDRESS OF, No Street, AptUnit Number, City, StateProvince, Country, ZIP CodePostal Code, CHANGE OF ADDRESS Check box if, YES, TELEPHONE NUMBER OF CLAIMANT, and EMAIL ADDRESS field with the expected details.

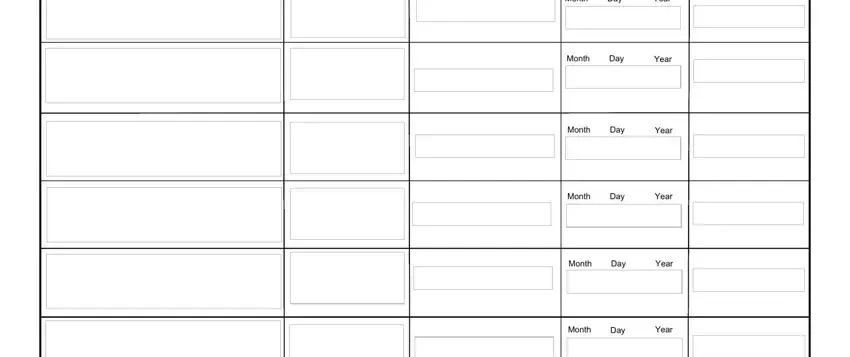

The program will request for more details with a purpose to automatically fill out the section Month, Day, Year, Month, Day, Year, Month, Day, Year, Month, Day, Year, Month, Day, and Year.

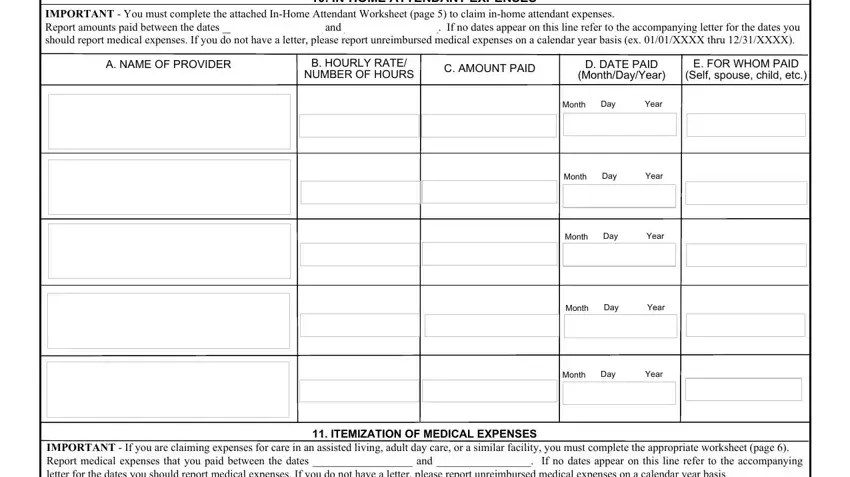

The IMPORTANT You must complete the, INHOME ATTENDANT EXPENSES, A NAME OF PROVIDER, B HOURLY RATE NUMBER OF HOURS, C AMOUNT PAID, D DATE PAID MonthDayYear, E FOR WHOM PAID Self spouse child, Month, Day, Year, Month, Day, Year, Month, and Day area is where all parties can describe their rights and obligations.

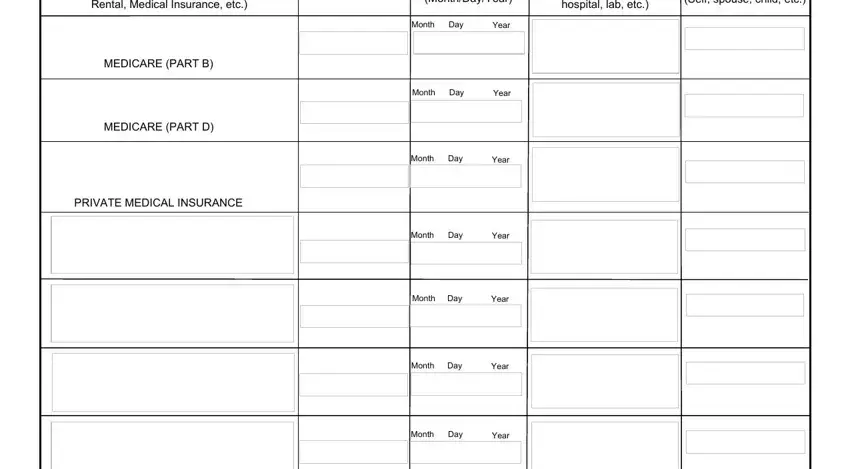

Finish the template by taking a look at all of these sections: A MEDICAL EXPENSE Physician or, C DATE PAID MonthDayYear, D NAME OF PROVIDER Name of doctor, E FOR WHOM PAID Self spouse child, MEDICARE PART B, MEDICARE PART D, PRIVATE MEDICAL INSURANCE, Month, Day, Year, Month, Day, Year, Month, and Day.

Step 3: Press the "Done" button. Now it's possible to transfer the PDF file to your electronic device. In addition, you can forward it through electronic mail.

Step 4: Prepare no less than a few copies of your file to keep away from all of the forthcoming challenges.