This PDF editor was built to be as straightforward as possible. Since you try out the following steps, the procedure for creating the 26 1802a document will undoubtedly be easy.

Step 1: Get the button "Get Form Here" and then click it.

Step 2: When you get into our 26 1802a editing page, there'll be lots of the options you can undertake about your template at the top menu.

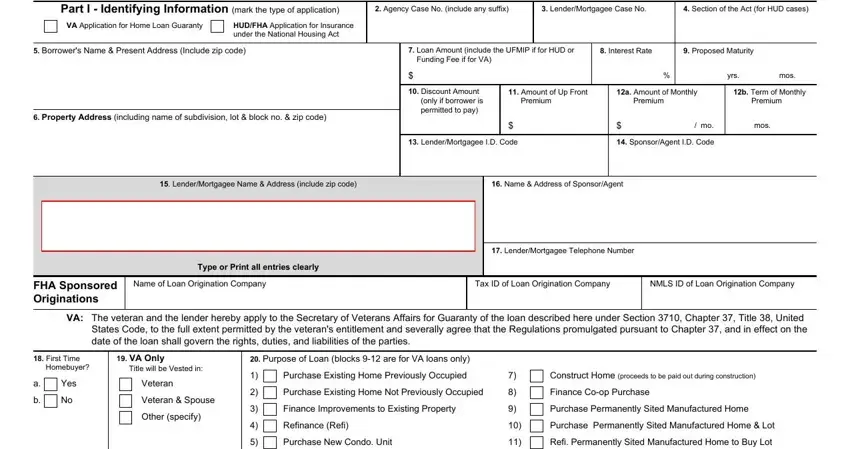

Complete all of the following sections to create the document:

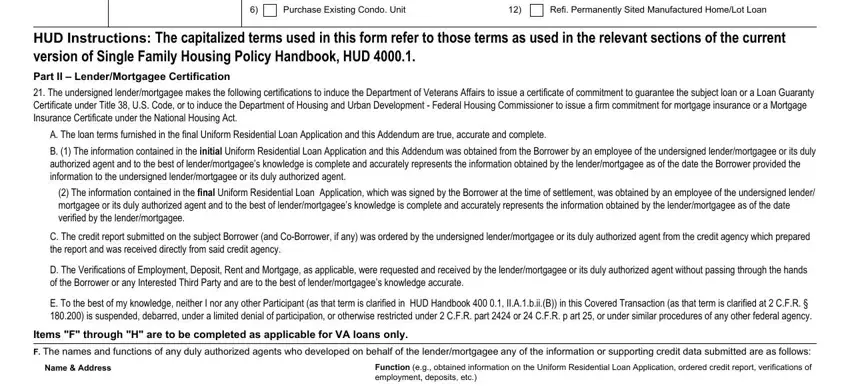

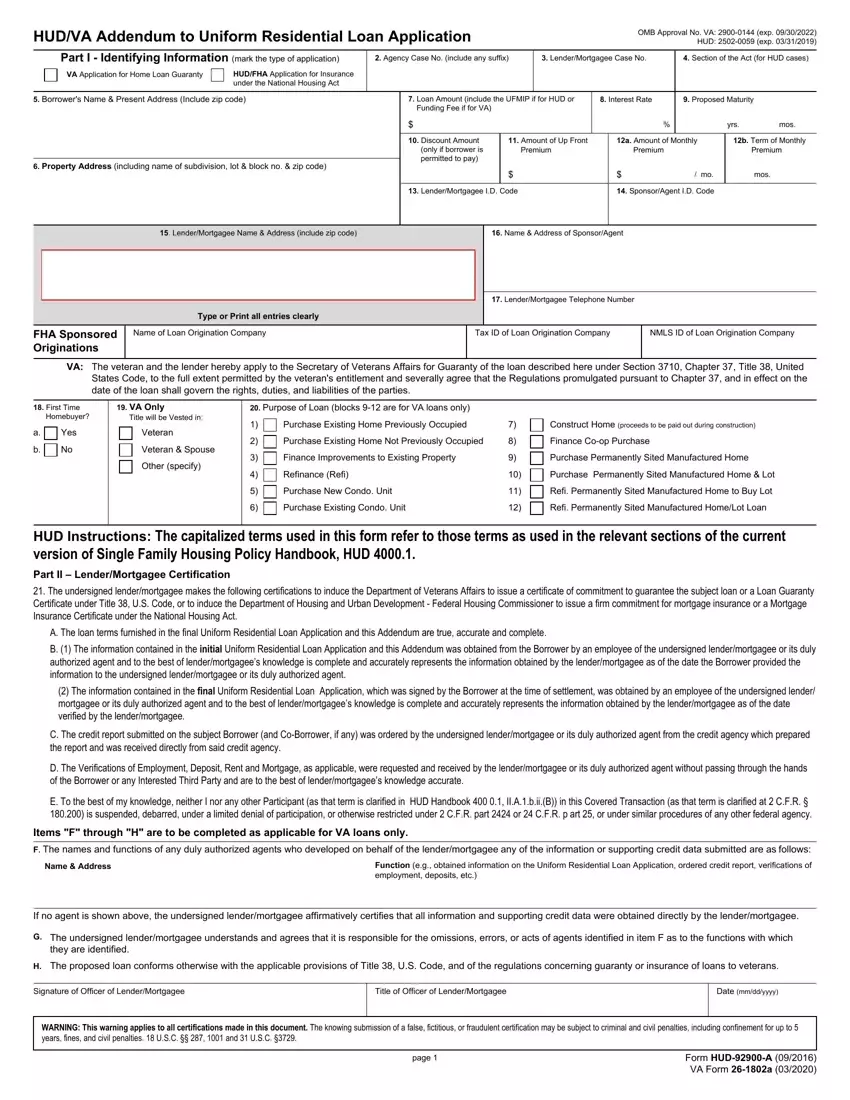

The application will require you to complete the Purchase Existing Condo Unit, Refi Permanently Sited, HUD Instructions The capitalized, A The loan terms furnished in the, B The information contained in, The information contained in the, C The credit report submitted on, D The Verifications of Employment, E To the best of my knowledge, Items F through H are to be, F The names and functions of any, Name Address, and Function eg obtained information field.

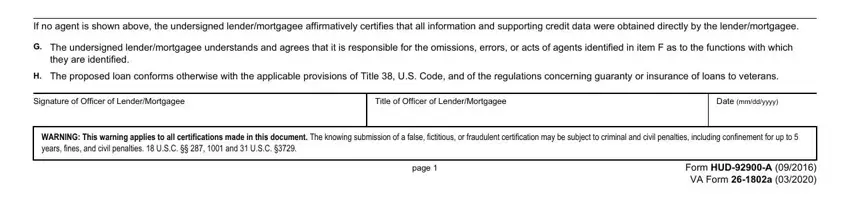

Determine the relevant particulars in the If no agent is shown above the, G The undersigned lendermortgagee, they are identified, H The proposed loan conforms, Signature of Officer of, Title of Officer of LenderMortgagee, Date mmddyyyy, WARNING This warning applies to, page, and Form HUDA VA Form a section.

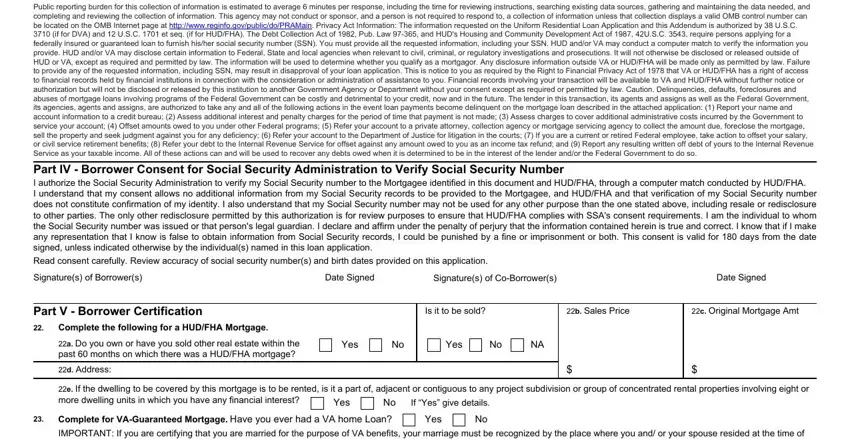

Within the box Part III Notices to Borrowers, Part IV Borrower Consent for, Signatures of Borrowers, Date Signed, Signatures of CoBorrowers, Date Signed, Part V Borrower Certification, Complete the following for a, Is it to be sold, b Sales Price, c Original Mortgage Amt, a Do you own or have you sold, Yes, Yes, and d Address, list the rights and responsibilities of the parties.

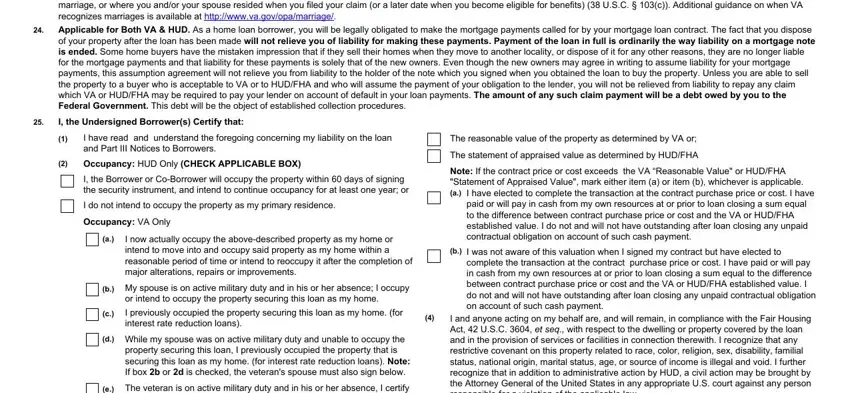

End by looking at the next sections and typing in the suitable data: Yes Complete for VAGuaranteed, I the Undersigned Borrowers, I have read and understand the, Occupancy HUD Only CHECK, I the Borrower or CoBorrower will, I do not intend to occupy the, Occupancy VA Only, I now actually occupy the, b My spouse is on active military, or intend to occupy the property, I previously occupied the property, d While my spouse was on active, property securing this loan I, e The veteran is on active, and The reasonable value of the.

Step 3: Press the button "Done". Your PDF form is available to be transferred. You will be able download it to your laptop or send it by email.

Step 4: It is safer to prepare copies of the file. You can rest easy that we won't reveal or see your details.

(do) builder or seller involved in this transaction.

(do) builder or seller involved in this transaction.